[ad_1]

We’re getting a extra lifelike replace on the startup funding panorama in India, and as is true elsewhere, all of the figures are in crimson within the South Asian market.

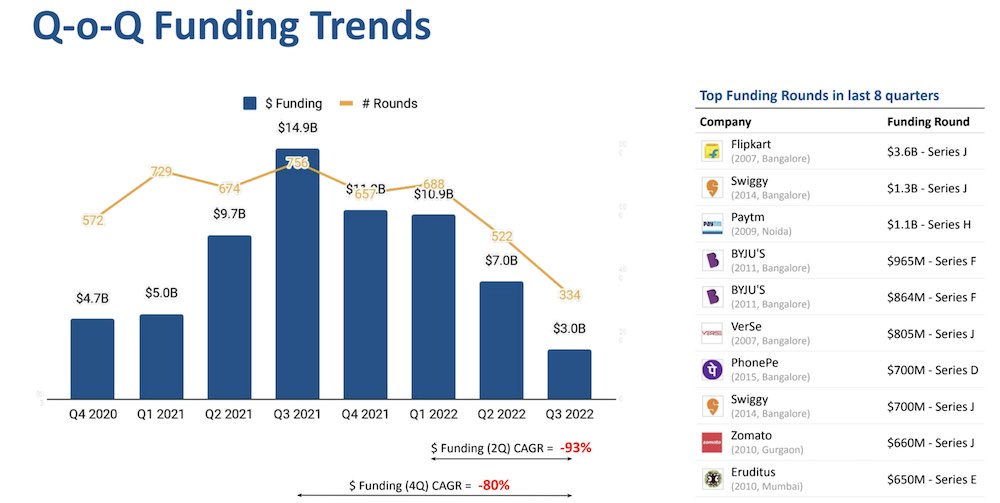

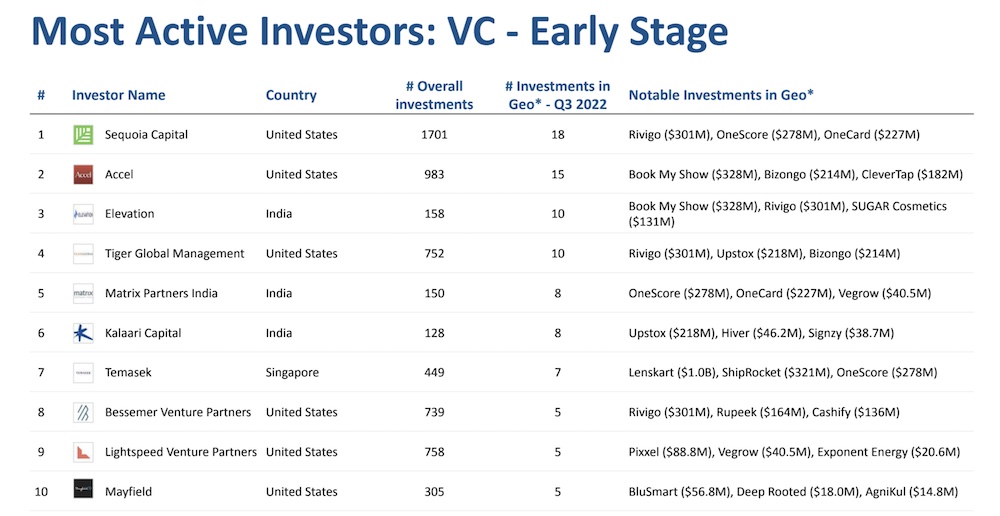

Indian startups raised $3 billion within the quarter that resulted in September, down 57% from the earlier quarter and 80% year-over-year, market intelligence platform Tracxn mentioned in a report Tuesday. The figures are outstanding for a lot of causes, the obvious being that startups are discovering it troublesome to boost capital at a time when most high tier funds in India — Sequoia India and Southeast Asia, Lightspeed Enterprise Companions, Accel, Elevation Capital, Matrix Companions India — have raised file giant funds this 12 months.

Second, the funding crunch seems to be extra acute in India. Globally, funding was down 53% year-on-year and 33% quarter-on-quarter, in accordance with knowledge compiled by Crunchbase.

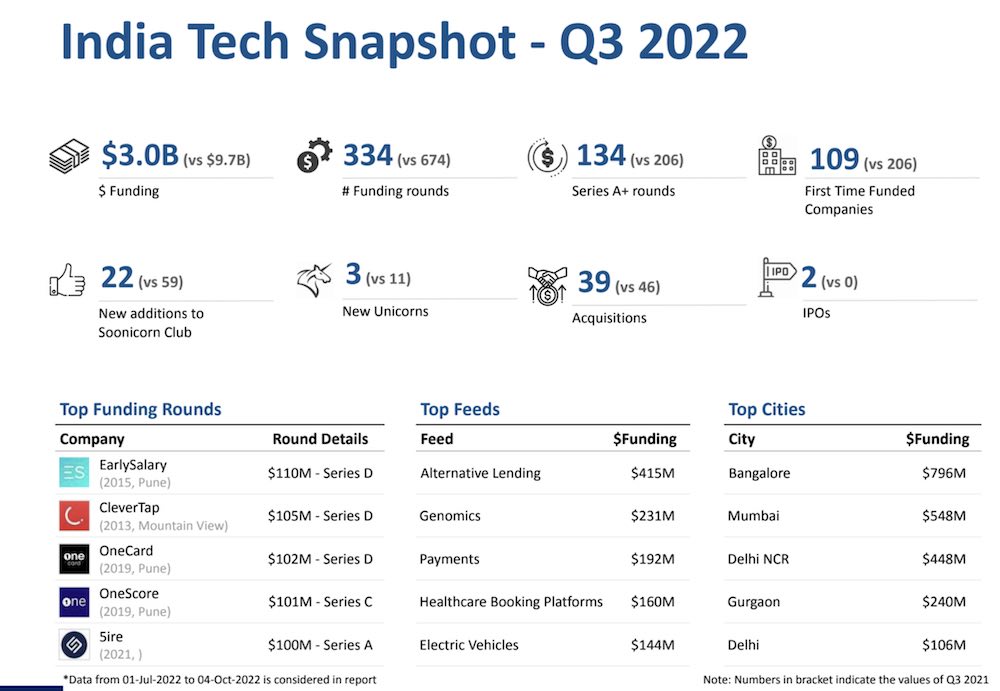

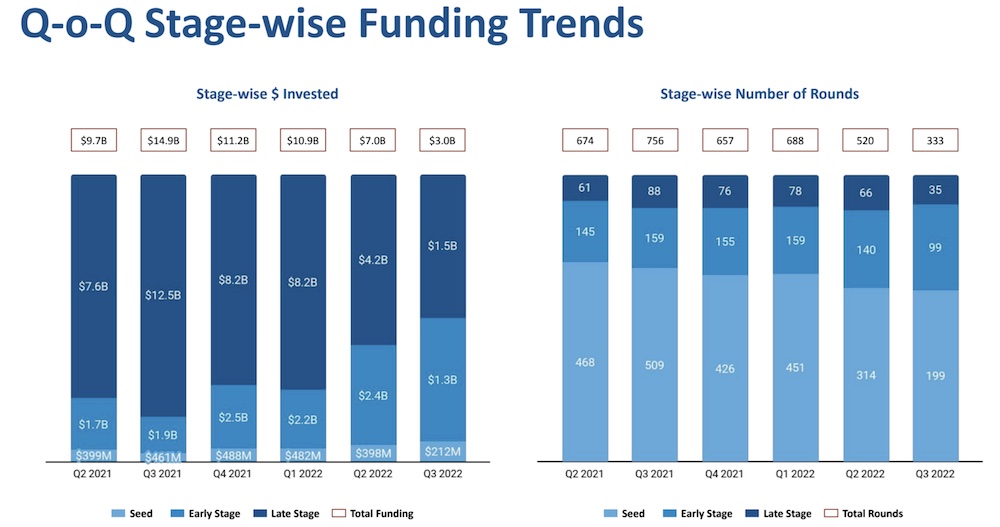

In Q3, the Indian startup ecosystem undertook 334 funding rounds, down from 674 in Q3 2021. The verify sizes are additionally more and more getting smaller for startups throughout all funding levels. Late stage startups that raised capital secured $42 million in funding on a mean, down over 70% from $142 million throughout the identical interval final 12 months, Tracxn mentioned.

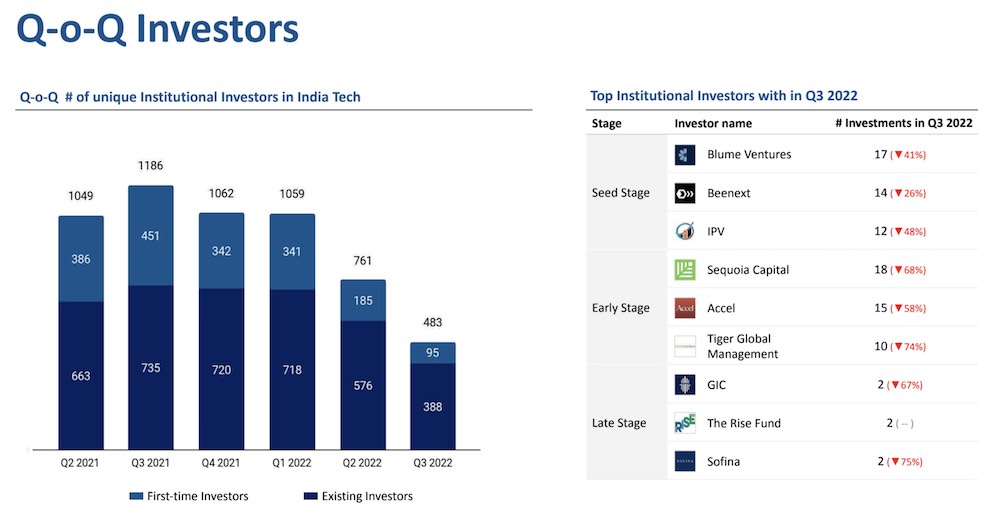

Traders globally have change into cautious in current months as market reverses many of the beneficial properties from the 13-year-long bull cycle. In consequence, startups are more and more discovering it troublesome to boost new rounds of funding at a valuation increased than that of the earlier spherical. Due diligence, which largely went out of vogue final 12 months, has made a robust return as most offers are taking weeks, if not longer, for analysis.

Masayoshi Son, founding father of SoftBank, which deployed over $3 billion in India final 12 months, warned in August that the funding winter might proceed for longer as a result of some unicorn founders are unwilling to just accept decrease valuations.

It doesn’t seem that issues can be enhancing anytime quickly. Byju’s, India’s most respected startup, has postponed its plans to file to go public this 12 months. Finances resort chain Oyo, as soon as valued at $10 billion, is seeking to listing early subsequent 12 months however its largest backer has minimize its valuation to $2.7 billion.

“India is presently experiencing a funding slowdown which is predicted to proceed for the subsequent 12-18 months and the consequences of the funding slowdown are anticipated to accentuate going ahead,” mentioned Neha Singh, co-founder of Tracxn, which on a separate word has simply filed for an IPO.

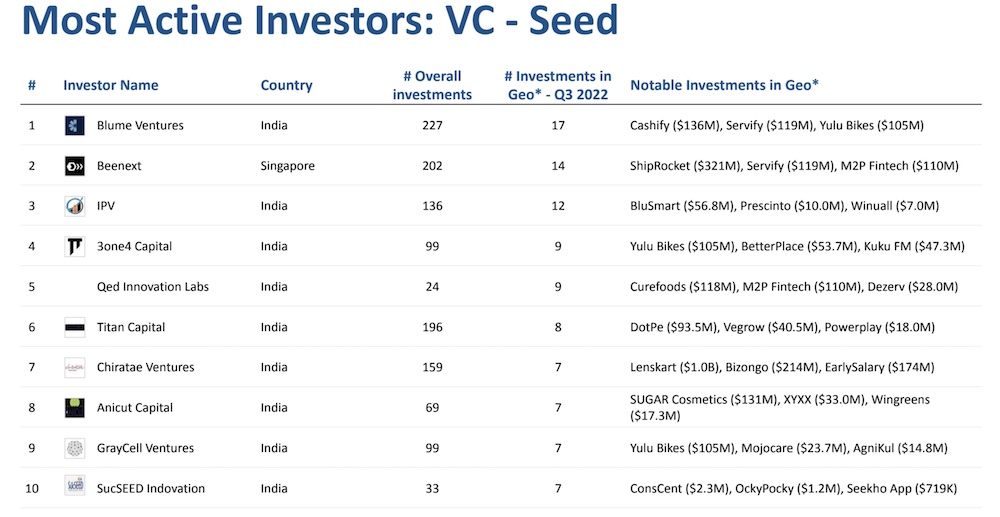

Some charts and different attention-grabbing stats from the report:

[ad_2]

Source link