[ad_1]

Evidently, the downturn hasn’t soured buyers on the journey {industry}. Journey reserving startup Hopper right this moment introduced that it closed a $96 million follow-on funding from Capital One, bringing the corporate’s whole raised to $740 million. The contemporary money will probably be put towards a number of efforts, CEO and co-founder Frederic Lalonde mentioned in a press launch, together with supporting Hopper’s new social commerce initiatives.

As part of the funding, Hopper says it’s extending its partnership with Capital One (which led Hopper’s Sequence F) to create new journey merchandise geared toward Capital One clients. Hopper’s tech already powers Capital One Journey and Premier Assortment, Capital One’s market of motels and resorts unique to Capital One Enterprise X cardholders. It’s a secure wager that comparable experiences alongside that vein are forthcoming.

“With Hopper, we’ve got discovered a associate who can’t solely match that tempo, however assist us proceed to problem the established order and take a differentiated strategy to constructing a world-class journey model,” Capital One managing VP Matt Knise mentioned in assertion. “By way of this strategic partnership, we’re well-positioned to adapt to a quickly altering journey surroundings and create industry-leading options for our clients alongside their journey journey.”

Based by Frederic Lalonde and Joost Ouwerkerk in 2007, Hopper spent six years in stealth constructing what it claimed on the time was the “world’s largest structured database of journey data.” The corporate’s web-crawling tech ingested blogs, photo-sharing websites and different sources of details about locales and tagged them to a geolocation in an enormous place database. However after Hopper’s public debut in 2014, the corporate’s management determined to pivot to cell and dedicate engineering sources to flight prediction, constructing a software that constantly displays airline costs and sends worth change alerts by way of push notification.

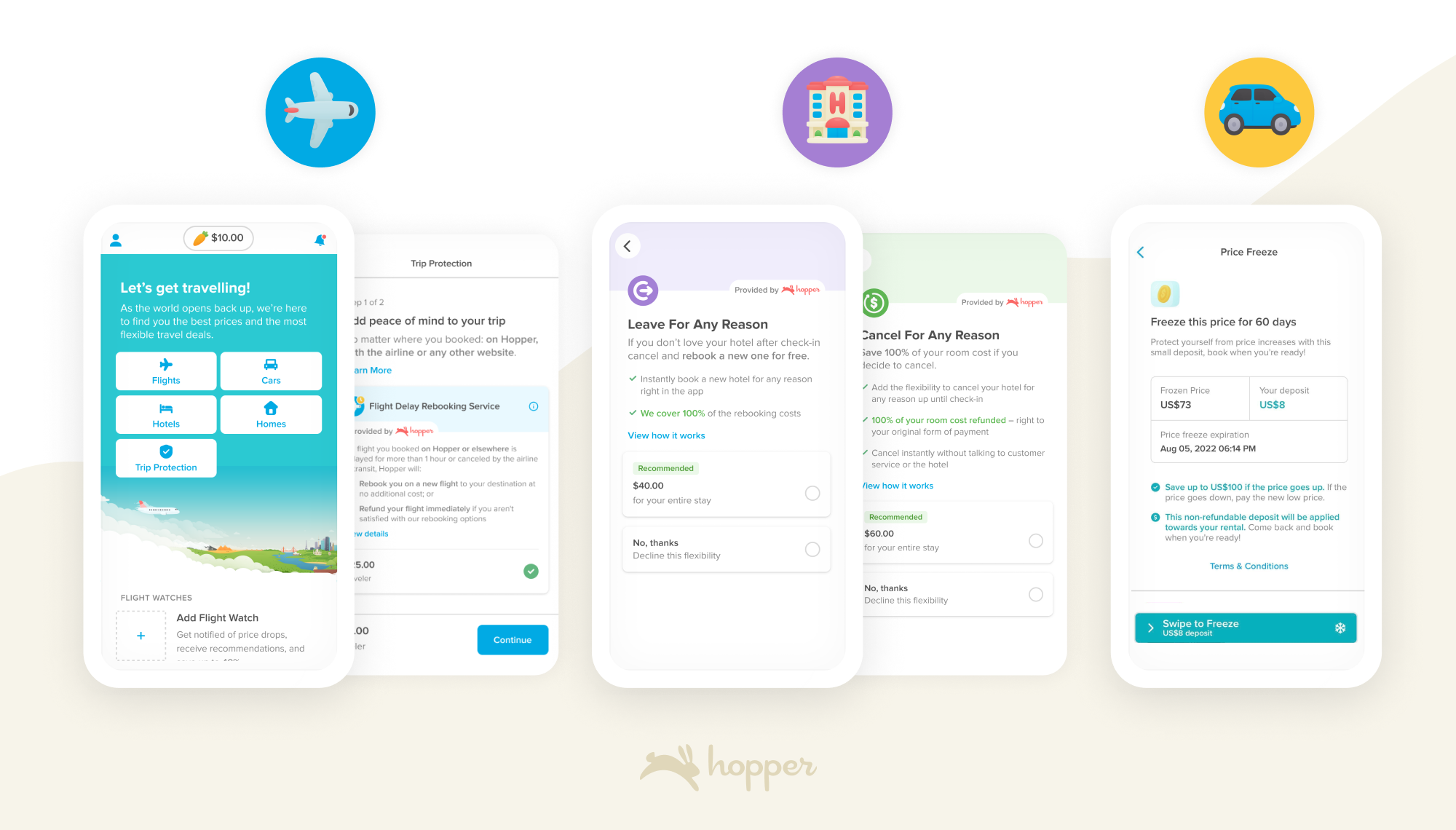

Picture Credit: Hopper

Since then, Hopper has advanced into one of many largest journey apps in North America, with over 80 million downloads and gross sales of flights, motels, houses and rental automobiles on the platform set to exceed $4.5 billion this yr. Hopper differentiates itself from rival journey companies (e.g. Travelocity) with options corresponding to airfare worth freezes, “cancel for any purpose” and flight disruption ensures, the previous of which the corporate says represents about 40% of its whole app income.

Final yr, Hopper ventured into the business-to-business market with the launch of Hopper Cloud, a partnership program that permits journey suppliers together with Kayak, Marriott and Journey.com to resell Hopper’s fintech and journey company merchandise by means of a white-label portal. Hopper claims that Cloud has seen a speedy uptake, now comprising greater than 40% of Hopper’s enterprise; Lalonde claims that Hopper Cloud is on monitor to make extra in 2022 than all of Hopper did in final yr.

On the buyer facet, this spring, Hopper shifted its focus to in-app promotions, reductions and gross sales occasions. Social commerce is the corporate’s subsequent huge push, anchored by options like referrals, share-to-earn, group shopping for and day by day present, which reward customers for with reductions on journey purchases for launching the app and fascinating in sharing with pals.

“Worldwide customers comprised lower than 3% of gross sales final yr however now comprise over 20% of gross sales,” Hopper president Dakota Smith famous to TechCrunch in an e-mail, attributing the expansion partly to the corporate’s renewed social focus. “The app is rapidly internationalizing.”

Hopper was final valued at $5 billion, TechCrunch reported in early February; a supply accustomed to the matter says it’s elevated since then. The 1,500-employee-strong firm — which has an estimated 11.2% of the third-party air journey market within the U.S. — plans to ultimately go public.

[ad_2]

Source link