DNY59

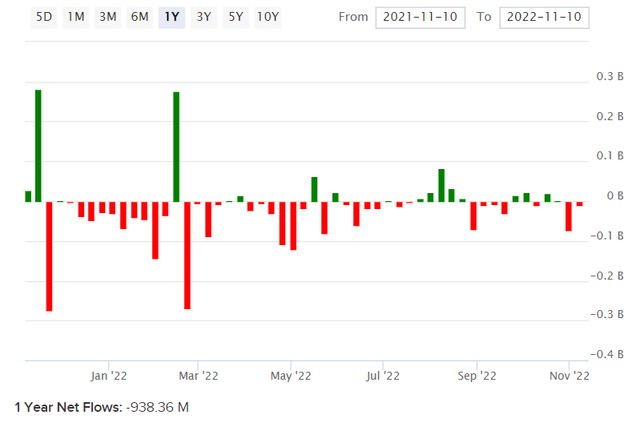

Invesco S&P 500 Excessive Beta ETF (NYSEARCA:NYSEARCA:SPHB) is an exchange-traded fund whose funding mandate includes investing in accord with its chosen benchmark index, the S&P 500 Excessive Beta Index. That is an attention-grabbing technique which permits traders to get entry to a unstable (by design) ETF which is constructed on a portfolio of U.S. shares that exhibit higher worth volatility than the broader U.S. fairness indices. The fund had 100 holdings precisely as of November 10, 2022, with web property underneath administration of about $410 million and a complete expense ratio of 0.25%. This follows detrimental web fund flows over the previous yr of about -$938 million, which is smart in a down market.

ETFDB.com

Nonetheless, regardless of the massive outflows SPHB has fallen by “solely” -15.06% year-to-date, on the time of writing, as in comparison with the S&P 500 U.S. fairness index’s fall of -16.71%. The out-performance is modest, however any out-performance in any respect is stunning given the numerous outflows and high-beta technique.

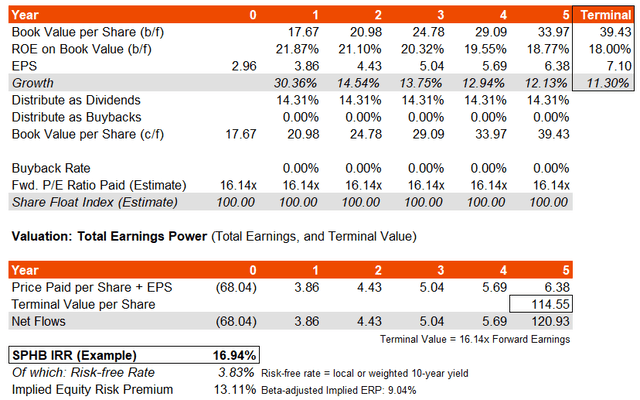

Valuing SPHB inherently seems like an odd activity, given the volatility-oriented technique as in comparison with a bottom-up, value-oriented strategy. Nonetheless, valuing ETFs offers a helpful perspective irrespective of the technique. The fund’s benchmark’s most up-to-date factsheet as of October 31, 2022 displays trailing and ahead worth/earnings ratios of 21.04x and 16.14x, respectively, with a worth/e book ratio of three.53x. That means a ahead return on fairness of 21.87% and a ahead earnings yield of 6.20%. Each these figures are sturdy.

Assuming a comparatively secure return on fairness round 20% over the following a number of years, and a secure price of dividend distributions of about 14% (based mostly on the above information), my primary mannequin would indicate 19-21% common earnings progress, which compares to Morningstar’s forecast of 18.15% on common for SPHB’s portfolio over the following 3-5 years. In an effort to carry this into stability with the forecast common earnings progress, I’ll assume that the underlying portfolio return on fairness steadily falls to 18% by yr six. The implied IRR remains to be giant at virtually 17% (see under).

Writer’s Calculations

The historic beta of the fund is 1.45x, which isn’t really particularly excessive. My mannequin, with a risk-free price of three.83% at current (that’s, the prevailing U.S. 10-year yield) would indicate an underlying fairness danger premium of 13.11%. On a beta-adjusted foundation that’s nonetheless 9.04%, which is way greater than a good vary of 4.2-5.5% for U.S. equities. SPHB appears to be like like it’s undervalued. Sure, it could be extra unstable/dangerous, however the underlying portfolio affords sturdy returns even adjusted for danger ranges. The earnings a number of can be comparatively tame at about 16x ahead earnings.

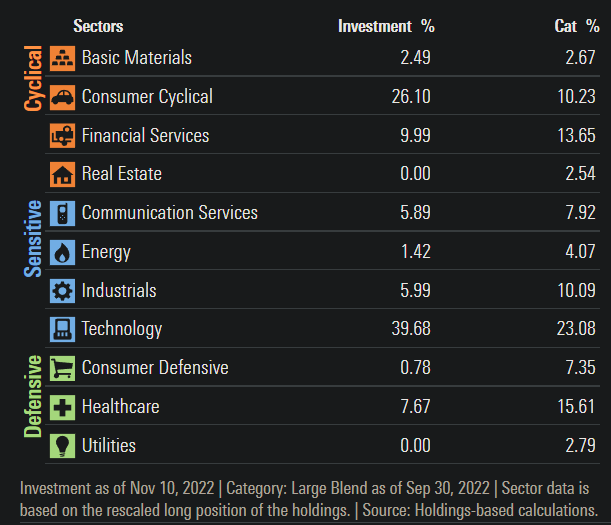

Keep in mind that the fund is uncovered primarily to expertise (40%) and cyclical client (26%) shares. This makes the fund much more spectacular given latest out-performance, and likewise possible makes SPHB well-positioned at current.

Morningstar.com

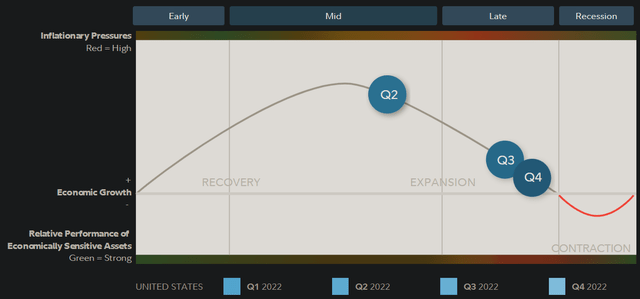

That’s as a result of, as per Constancy analysis, the USA is probably going heading right into a contractionary interval in its current enterprise cycle (as of This fall 2022).

Constancy.com

That makes high-beta fairness funds well-positioned, as a result of markets have a tendency to guide the true financial system. Ought to progress and inflation fall, rates of interest will possible additionally start to show (albeit steadily). If fairness markets can get forward of the financial system by 6-12 months, ideally by about 12 months, then SPHB could be very a lot more likely to out-perform, as the typical recession lasts circa 10 months.

Whereas SPHB is an unconventional ETF technique, I just like the simplicity and the portfolio composition. With 100 holdings, the fund isn’t too concentrated both, with the most important positions nonetheless safely representing lower than 2% of the fund every. SPHB is a powerful guess for these bullish on the financial system past 12 months from now.