[ad_1]

Earlier in November, new Shopper Worth Index (CPI) knowledge was launched, revealing that inflation had dropped on a year-over-year foundation from 8.2% in September to 7.7% in October. That is welcomed information. Don’t get me mistaken, 7.7% inflation remains to be unacceptably excessive, and nobody must be cheering but. However the truth that the year-over-year inflation charge has fallen 4 months in a row is an efficient signal, and I imagine it’ll fall even additional. I ran some numbers and imagine it’s very seemingly that inflation has peaked and can decline (albeit slowly) all through 2023.

There are a number of causes for why inflation has seemingly peaked: Fed motion, supply-side fixes, and the “base impact.” I’ll rapidly contact on the primary two, however I’m excited to share my analysis on the bottom impact, so be certain to examine that out.

Fed Motion

As everyone knows, the Federal Reserve has been elevating its Federal Funds Price for many of 2022 in an effort to cut back inflation. Inflation is commonly described as “an excessive amount of cash chasing too few items,” and by elevating rates of interest, the Fed targets the “an excessive amount of cash” a part of the equation.

Elevating rates of interest makes it dearer to borrow cash. When borrowing is dearer, folks are likely to spend much less (in any other case referred to as decreasing demand). Much less demand removes cash from circulation within the economic system and helps to tamp down inflation.

The factor is—this takes time. It’s not as if the Fed raises charges and abruptly, folks cease shopping for issues. The discount in demand takes time, and rate of interest hikes should not absolutely felt within the economic system for a number of months. So it’s very seemingly that we’re solely now starting to really feel the impression of rate of interest hikes. And for the reason that Fed has indicated they intend to maintain elevating charges, we’ll seemingly really feel the impression of decrease demand within the economic system for the foreseeable future, serving to to tame inflation.

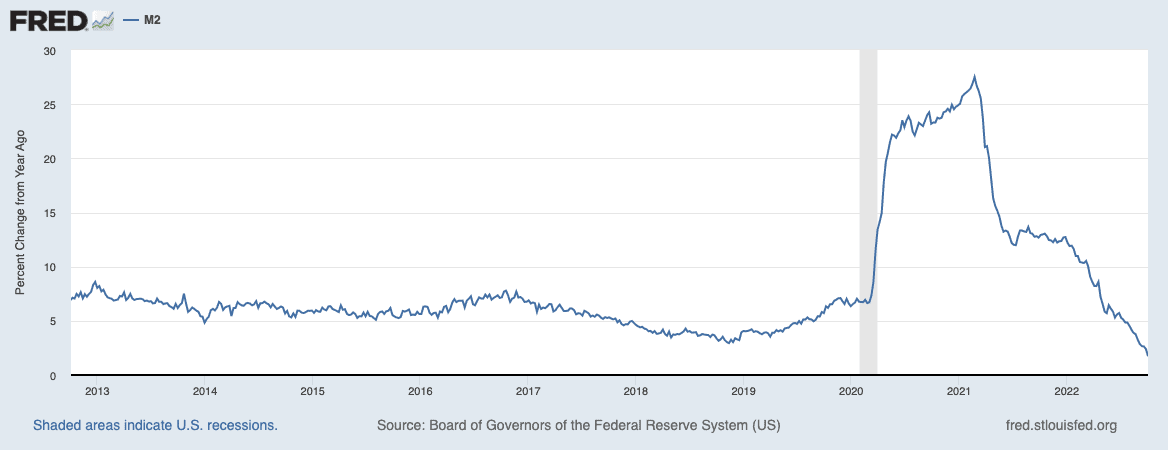

It’s additionally value mentioning that the fast will increase in cash printing have stopped. Under is a graph that reveals the year-over-year change in M2 financial provide within the U.S. As you may see, after a wild experience the previous couple of years, annual will increase in cash provide are again to regular charges and the bottom they’ve been in 10 years.

Provide-Facet Fixes

Whereas the Fed is attacking the “an excessive amount of cash” a part of the inflation drawback, there has additionally been a extra silent contributor to inflation: supply-side shock. That is the “too few items” a part of the “an excessive amount of cash chasing too few items” equation. When there’s not sufficient stuff to purchase, costs go up.

Provide-side points arose from Covid when manufacturing was restricted throughout the globe. There have been simply fewer merchandise made, and that causes inflation. The U.S. and many of the world resumed manufacturing step by step all through 2021, however China, which manufactures a ton of products for the U.S., has been a lot slower to ramp again up. This has constrained provide and helped inflation keep stubbornly excessive. That is beginning to change, although, and manufacturing is ramping up now, which ought to assist curve the supply-side points.

The second essential subject that prompted supply-side points was the Russian invasion of Ukraine. Russia is a serious exporter of meals and power, and western sanctions have lower these items off from many of the world. Moreover, Ukrainian exports, significantly wheat and grain, are having a tough time hitting the market. This has additional constrained world provide chains and pushed up inflation.

Whereas the conflict in Ukraine is sadly nonetheless raging and sanctions nonetheless exist, the world is adapting to the brand new actuality. This implies different suppliers of products usually provided by Russia will step up manufacturing and assist stabilize {the marketplace}. This might assist inflation cool as effectively.

The Base Impact

Whereas the Fed’s actions and supply-side fixes ought to assist cool inflation, there’s one more reason why you must anticipate to see inflation numbers come down within the coming 12 months: the bottom impact. Examine this out.

We speak about inflation in the USA on a year-over-year (YoY) foundation. When the current knowledge mentioned inflation was at 7.7%, what it’s actually saying is costs went up within the U.S. by 7.7% between October 2021 and October 2022.

Due to this, it doesn’t simply matter what costs are in the present day. It additionally issues what costs had been a 12 months in the past as a result of we’re evaluating the 2. After we evaluate excessive costs this 12 months to low costs final 12 months, the distinction seems enormous, and that’s what’s been taking place for many of 2022. After we evaluate excessive costs this 12 months to low costs final 12 months, the distinction seems smaller, which is what’s beginning to occur. This is named the bottom impact. It issues what knowledge you’re evaluating in the present day’s numbers to.

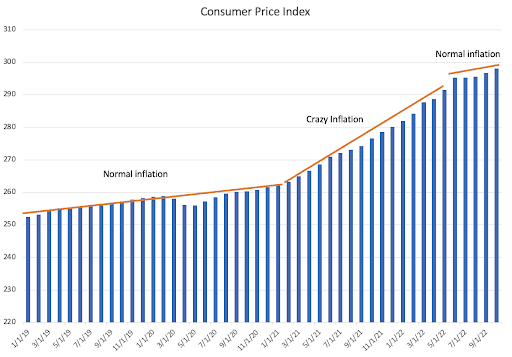

Simply try this chart. Keep in mind, throughout the starting of the pandemic, inflation was fairly regular. In reality, we had deflation for a couple of months! Issues didn’t actually begin to go loopy till the center of 2021. So for the primary half of this 12 months, we’ve been evaluating excessive 2022 costs to comparatively decrease 2021 costs, which makes the distinction (YoY change) look actually excessive. Within the second half of 2022, we’re evaluating excessive 2022 costs to already-high 2021 costs, which makes the distinction look smaller.

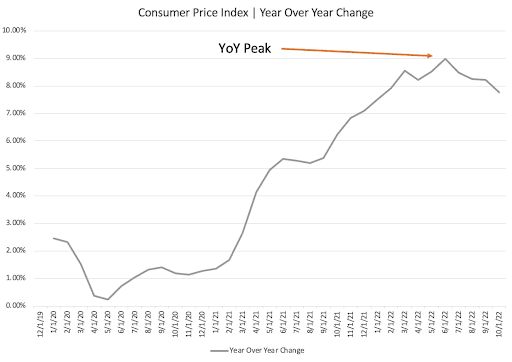

For that reason, inflation on a YoY foundation (which is what the Fed cares about and the way we usually consider inflation within the U.S.) peaked again in June and has fallen for 4 straight months.

That is prone to proceed, and I anticipate YoY inflation to say no slowly however significantly in 2023. Why? As a result of I did the mathematics!

In the latest CPI report, costs rose 0.44% month-over-month from September 2022 to October 2022. That’s fairly excessive, but YoY inflation nonetheless fell. That’s the bottom impact in motion!

If we proceed to see costs go at the same month-to-month charge for the subsequent 12 months, we are going to see inflation fall to someplace round 5.5% subsequent 12 months. Once more, the identical month-to-month will increase, however year-over-year inflation goes down. And if costs begin to enhance at a slower charge, we may see inflation come down much more.

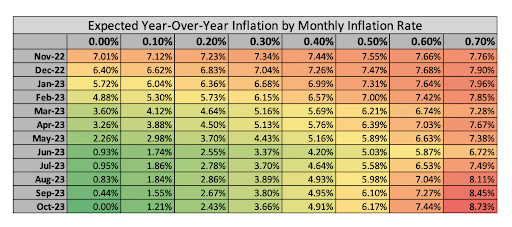

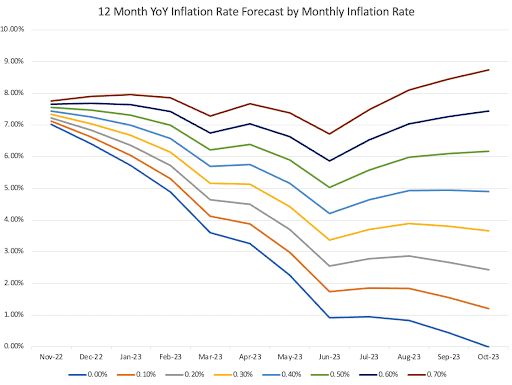

Take a look at this colourful chart I made. Throughout the highest, you see potential eventualities for month-to-month worth will increase from 0% to 0.7%. Every row represents a forecast for YoY inflation by month for the subsequent 12 months. As you may see, the one means inflation begins to return up YoY is that if month-to-month worth will increase speed up to 0.7% (bear in mind, we’re at 0.44% now).

Conclusion

Personally, I believe it’s unlikely that we see month-to-month inflation enhance until there may be some huge, unexpected geopolitical shock once more. As a substitute, I believe it’s fairly seemingly we are going to see month-to-month inflation charges lower, maybe to someplace between 0.2% and 0.4%. If that occurs, we are able to anticipate the inflation charge to be between 2.5-4% in 2023. Nonetheless not the place the Fed desires us to be (round 2%), however means higher than the place we’re in the present day! So long as the month-to-month charge of worth will increase stays near the place it’s been the final 4 months, inflation ought to come down.

None of that is to say that the Fed will cease elevating charges quickly (they’re not). But it surely ought to provide some reduction to Individuals who’re struggling to maintain up with inflation. If this pattern continues, it must also give us a clearer image of after we can anticipate regular inflation, which can assist us forecast when charge hikes may cease and when financial circumstances turn into extra predictable.

In fact, one thing unexpected may change this trajection. But when the established order continues, we must always see inflation come down. Let’s all hope that’s true. It’s the perfect factor that would occur to the U.S. economic system.

On The Market is offered by Fundrise

Fundrise is revolutionizing the way you spend money on actual property.

With direct-access to high-quality actual property investments, Fundrise permits you to construct, handle, and develop a portfolio on the contact of a button. Combining innovation with experience, Fundrise maximizes your long-term return potential and has rapidly turn into America’s largest direct-to-investor actual property investing platform.

Study extra about Fundrise

Word By BiggerPockets: These are opinions written by the creator and don’t essentially characterize the opinions of BiggerPockets.

[ad_2]

Source link