SeanPavonePhoto

Korea fund historical past and previous efficiency

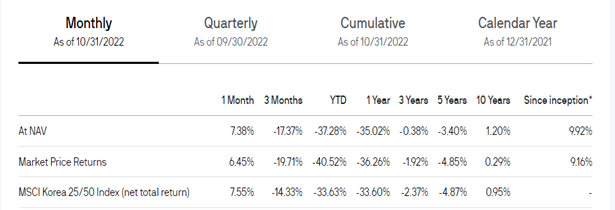

The Korea Fund (NYSE:KF) historical past goes again a long time; nevertheless, it has been a very long time because it could possibly be considered profitable. The since-inception returns figures are boosted from increased returns achieved approach again greater than a decade in the past. Absolute returns have been poor within the final decade, barely in optimistic territory.

That in itself doesn’t lead me to provide the Korea Fund a miss. Markets can typically transfer in decade lengthy tendencies. As an illustration, the primary decade of the 2000s noticed rising markets do comparatively properly. The 2020s may see a repeat now that valuations in markets like South Korea have turn out to be compelling.

Because the efficiency numbers counsel beneath, I wouldn’t anticipate the fund to deviate considerably from the benchmark they observe. The holdings are pretty just like the iShares MSCI South Korea Capped ETF (EWY).

thekoreafund.com

With the Korea Fund although, now we have the potential for the low cost to NAV to contract. Its previous efficiency historical past is affordable in a relative sense. This makes it engaging sufficient to beat the upper expense ratio of 1.1% that comes with it.

If over the subsequent couple of years, the fund underperforms its benchmark, well-cushioning the draw back danger can be the power to tender 25% your shares at very close to the NAV. That’s a way that may allow you to bridge the present giant worth hole between the share value and NAV. I’ll talk about this side additional down within the article.

Korean inventory market crash and may it recuperate in 2023?

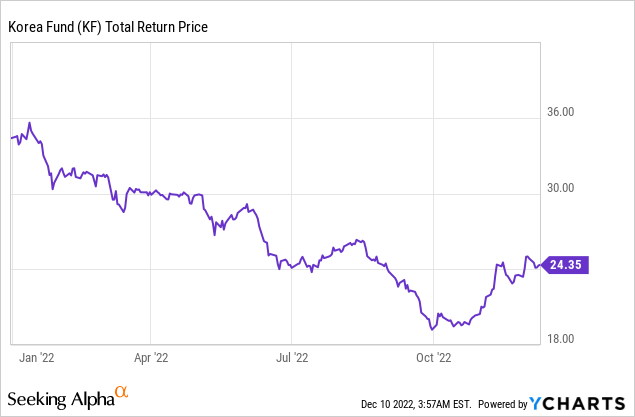

Up till late October a minimum of, inventory markets like South Korea (which might be delicate to information surrounding China’s zero Covid insurance policies), had been amongst the toughest hit in 2022.

The next components have acted as headwinds for distinguished listed South Korean firms this 12 months.

- Provide bottlenecks, particularly chip sector hurting them economically the place they’ve important auto and electronics outputs.

- Covid disruptions on home consumption.

- Softening international demand.

- Rising enter costs, general inflation and rates of interest.

During the last couple of months, now we have seen China stress-free Covid restrictions. South Korea was already loosening Covid restrictions a lot earlier within the 12 months, however strict measures within the first few months of 2022 had held the financial system again. This bodes properly for the above headwinds to fade away all through 2023. Inflationary pressures stand probability of subsiding in 2023.

I acknowledge that a part of this has already been factored in by the sizeable bounce in inventory markets like South Korea’s because the backside in late September. Taking into account, nevertheless, the magnitude of underperformance seen lately, mixed with extraordinarily low valuations, we’re seemingly nonetheless early on this optimistic re-rating pattern. The numerous weaking of the Korean gained in 2022 may help them ultimately arrest an export hunch they’re in.

Korean inventory market valuations

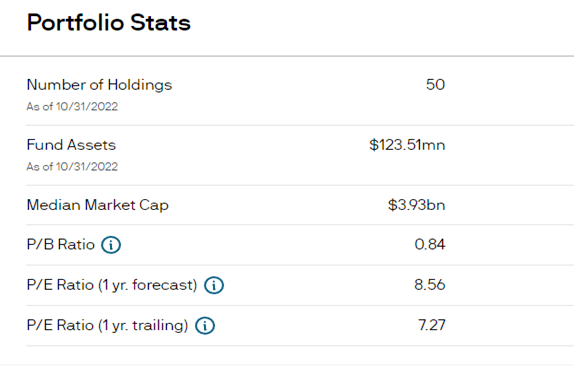

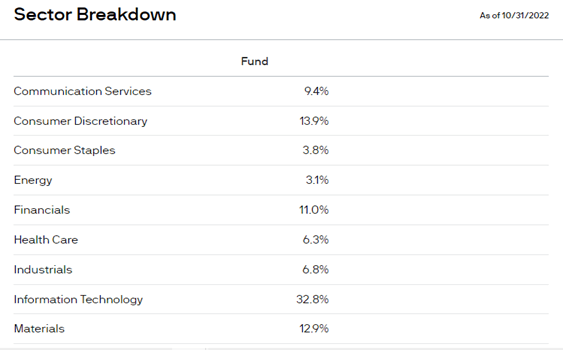

Beneath are some valuation statistics of the Korea Fund. The headwinds to Korean shares that I discussed earlier should result in some shorter-term stress on firm earnings. Even when we take the forecasted P/E ratio although, shares nonetheless look exceptionally low cost. Value to ebook ratios of underneath one are additionally traditionally very low cost.

thekoreafund.com

The market additionally appears to standout as low cost when evaluating throughout Asia.

Korean shares are a significant factor of the MSCI Rising Markets Index representing round 12%. EM equities are poised to be on international traders’ radar once more now that the narrative round China’s Covid insurance policies has shifted notably within the final couple of months.

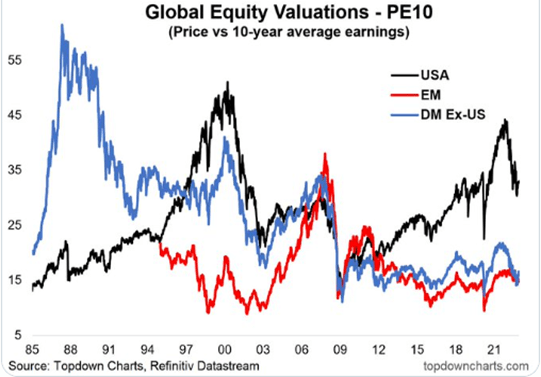

This global equity valuations twitter thread from earlier this month is an effective dialogue on the temptation for international traders to now need to chubby EM from a valuation perspective.

topdowncharts.com

Rising market shares generally is a main long-term winner of the 2020s

The chart simply above exhibits how EM markets outperformed within the early 2000s, and this additionally coincided with very sturdy returns for the Korea Fund again then. Are we about to see a repeat of this expertise?

The hole between the valuation line of EM versus USA shares nonetheless appears extraordinarily vast – not in contrast to the way it appeared within the early 2000s. Traditionally, we are able to level to many events of markets shifting in decade lengthy tendencies.

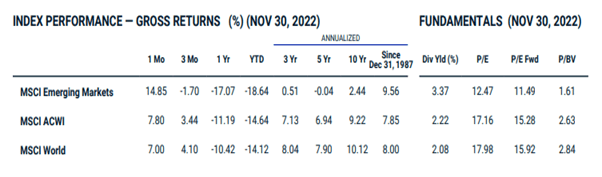

After we study the efficiency of the MSCI Rising Markets Index, we are able to see how within the final decade EM has not been the place to be.

msci.com

But after we have a look at ahead P/E ratios within the above desk, nowadays we get to probably enter EM equities at much more favorable valuations. Breaking that down additional as I famous earlier, the Korea Fund has a ahead P/E ratio of 9 occasions, so thus represents one of many least expensive nations inside the EM Index.

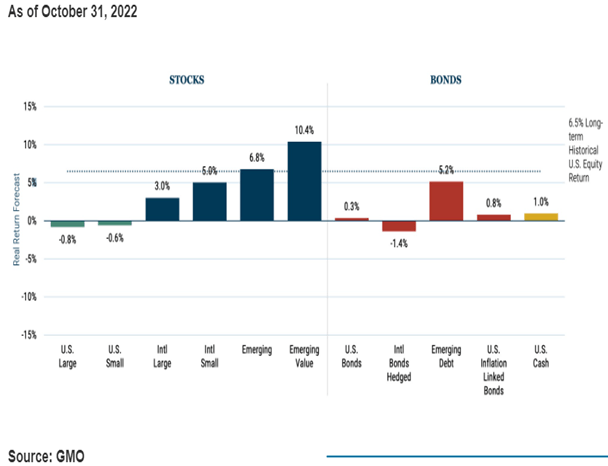

For what it’s definitely worth the typically a lot mentioned 7-year asset class forecast from GMO additionally suggest the 2020s would possibly find yourself being the last decade for EM equities. Observe that the beneath desk is expressed as actual return forecasts.

GMO

A Korean Fund run by a worth oriented fund supervisor ought to imply we’re looking in the best pockets of worth throughout international markets nowadays.

Shareholder activism tendencies for the Korean inventory market and the Korea fund itself

One honest criticism and argument towards investing within the Korean inventory market surrounds company governance historical past and therapy of minority shareholders. It isn’t unusual for affordable shares to stay low cost or be labeled “worth traps” as a result of majority shareholders for instance run “lazy” steadiness sheets and don’t take care of smaller shareholders.

The next article on shareholder activism tendencies in South Korea explains a number of the historic issues. Importantly nevertheless, it additionally discusses clear structural modifications in laws there that are leading to an growing variety of activism campaigns as a way to unlock worth.

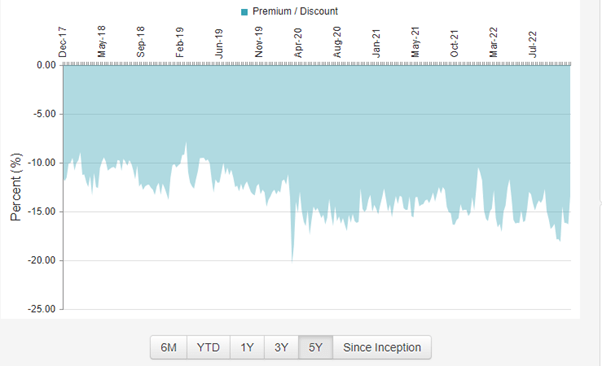

Turning again to the Korea Fund particularly, as proven beneath the low cost to NAV has hovered across the 15% mark during the last couple of years.

closed-end fund join

Some distinguished shareholders of the fund embody Metropolis of London, Lazard, and 1607 Capital Companions. They know the closed-end fund sector properly and can be eager to make sure the low cost contracts reasonably than proceed to widen. Additional down on the shareholder checklist with albeit a lot smaller holdings are Saba Capital Administration and Bulldog traders, two notable activists within the CEF area.

Such a backdrop has seemingly performed a task within the Korea Fund asserting in 2020 a scheme to make a young provide for 25% of shares, if the fund underperforms within the three years main as much as 2024. Moreover, the announcement notes that the scheme resets and applies thereafter on every third-year anniversary of September 30, 2024.

While they’ve a share buyback in place, the quantities they’ve purchased have been minuscule within the final couple of years. I wouldn’t be stunned if extra stress is positioned on the board for them to get extra energetic in executing the buyback on market, which might be optimistic for the shares.

Is Samsung inventory to purchase for 2023?

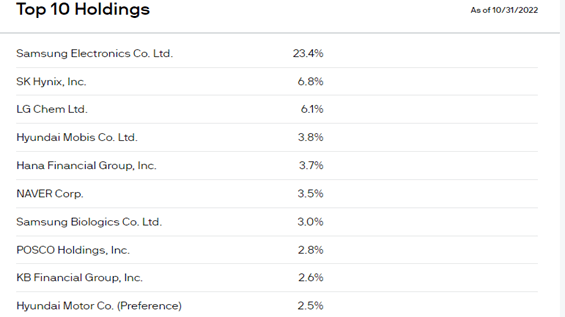

When many traders consider the inventory market in South Korea, Samsung Electronics (OTCPK:SSNLF, OTCPK:SSNNF), would fairly rightly be on the forefront of their thoughts. Given the Korea Fund has an enormous weight within the inventory (23%), the corporate deserves a minimum of a short dialogue of it by itself.

The bears on the inventory might cite seemingly slowing international progress outlook to weigh on them by means of most of 2023. The corporate nevertheless lately stated it sees gentle on the finish of the tunnel, and that chip demand might recuperate in late 2023.

That may appear a great distance off to some, however Samsung is such a high quality firm over the long run I might not get overly fixated on brief time period timing about when the shares might backside out. We all know that inventory markets are a discounting mechanism, so now may properly be the time to place for a restoration. Samsung’s PE ratio and forecast PE ratio for 2023 are fairly just like that of the general Korean inventory market and the Korea Fund top-down statistics.

Korea fund prime holdings

thekoreafund.com thekoreafund.com

Dangers of the Korea Fund

The principle danger I see is solely if a lot of the globe slips into a chronic recession in 2023. The Korean financial system and its inventory market are fairly delicate to this as it’s an export-led financial system with key hyperlinks to the world’s largest buying and selling companions. China as I’ve mentioned is essential on this regard and though I’ve talked about current developments have been promising, a excessive stage of uncertainty nonetheless stays.

On a fund stage the small fund measurement is way from supreme. Each by way of leading to decrease liquidity, but additionally this implies the expense ratio can be onerous to scale back sooner or later.

Conclusion

The Korea Fund has already had a major bounce from the lows of a few months in the past, however I might argue we’re comparatively early on in a longer-term optimistic re-rating. The current short-term enchancment is warranted given the backdrop of China’s easing of Covid restrictions and the way vital commerce with China is.

We’re nonetheless left with exceptionally low cost valuations and the newest bounce within the share value is trying like a catalyst for 2023. I plan on taking an extended place quickly and see it as an environment friendly fund to build up for publicity to the Korean inventory market.

While being cautious of the market being labeled as a little bit of a worth entice, the tendencies in shareholder activism tilt the chances additional in your favor right here. I’m referring to the activism tendencies within the Korean inventory market as an entire that I mentioned earlier. I additionally see the potential for activism stress on the Korea fund itself to be a optimistic share value catalyst.

Editor’s Observe: This text was submitted as a part of Looking for Alpha’s High 2023 Decide competitors, which runs by means of December 25. This competitors is open to all customers and contributors; click on right here to seek out out extra and submit your article at this time!