The S&P 500 (SP500) on Friday slumped to its third straight weekly loss, falling 0.20% to three,844.82 factors for the ultimate full buying and selling week of the 12 months.

Sentiment has been dampened by worries over the way forward for rate of interest hikes by the Federal Reserve. Financial information launched by way of the week pointed to a nonetheless strong economic system and tight labor market that’s solely now starting to indicate some indicators of cooling as a result of central financial institution’s aggressive fee hikes.

Traders additionally parsed a shock hawkish transfer by the Financial institution of Japan (BoJ) within the type of an sudden widening of its yield-curve management. The BoJ was one of many previous few international central banks that had clung on to extremely unfastened financial coverage.

Hopes of a year-end rally, or a so-called “Santa Claus” rally, have been dashed, as market individuals are coming to grips with a grim actuality that may in all probability see continued tightening of coverage by the Fed within the wake of stubbornly excessive inflation. Many are making ready for a recession.

Earnings information additionally took among the highlight this week, with shoe big Nike (NKE) and chipmaker Micron Know-how (MU) probably the most high-profile corporations that reported outcomes. Traders cheered Nike’s numbers. However, Micron’s forecast and plans to chop jobs disenchanted.

With Monday being a vacation for Christmas, many merchants are already on trip for the long-weekend.

On the financial entrance, the ultimate measure of Q3 GDP development was revised greater to three.2% versus the anticipated 2.9%. Moreover, the variety of People submitting for preliminary jobless claims got here in decrease than anticipated. Each units of information signaled a strong economic system and resilient labor market.

However, November private consumption expenditure got here in cooler than anticipated, whereas core PCE – the Fed’s most popular inflation gauge – rose consistent with expectations.

The Convention Board’s studying of U.S. shopper confidence and the College of Michigan’s gauge of U.S. shopper sentiment each improved.

The SPDR S&P 500 Belief ETF (NYSEARCA:SPY) on Friday slipped 0.09% for the week alongside the benchmark index. The ETF is -19.38% YTD.

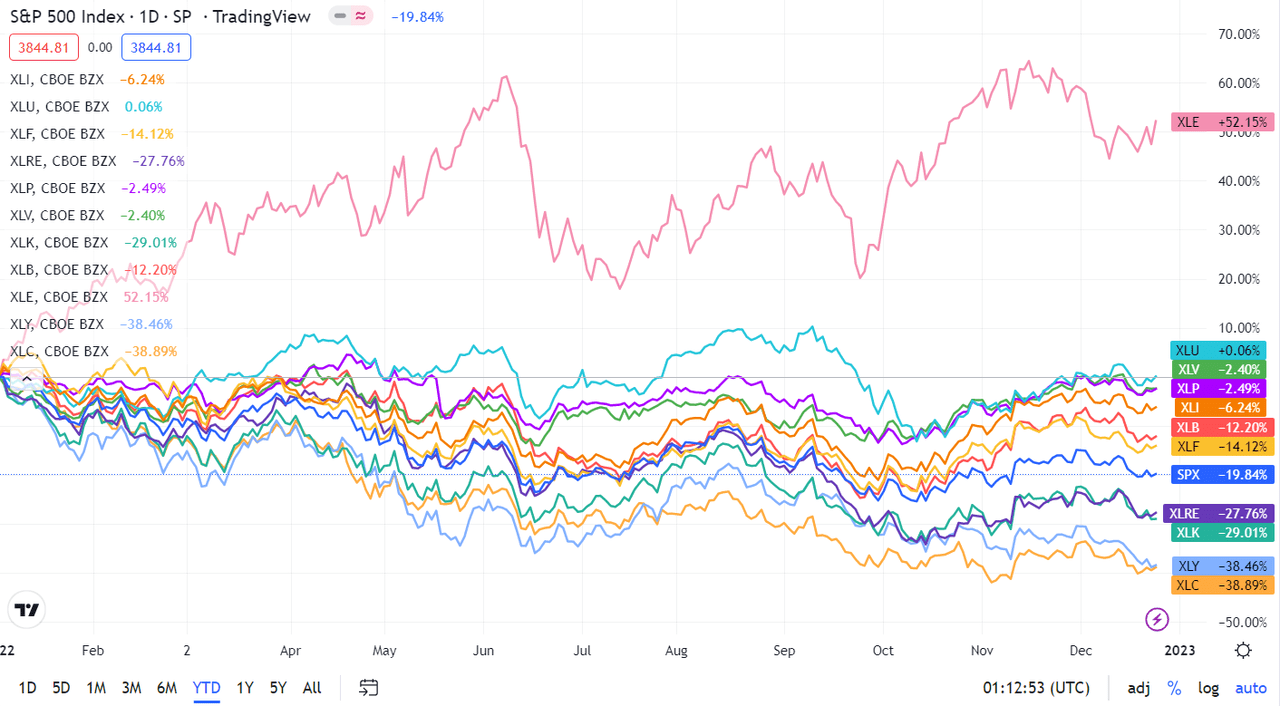

Of the 11 S&P 500 (SP500) sectors, six ended the week within the inexperienced, led by Power. Among the many 5 losers, Client Discretionary retreated probably the most.

See under a breakdown of the weekly efficiency of the sectors in addition to their accompanying SPDR Choose Sector ETFs from Dec. 16 near Dec. 23 shut:

#1: Power +4.38%, and the Power Choose Sector SPDR ETF (XLE) +3.20%.

#2: Utilities +1.42%, and the Utilities Choose Sector SPDR ETF (XLU) +0.61%.

#3: Financials +1.40%, and the Monetary Choose Sector SPDR ETF (XLF) +0.74%.

#4: Client Staples +1.00%, and the Client Staples Choose Sector SPDR ETF (XLP) +0.43%.

#5: Well being Care +0.81%, and the Well being Care Choose Sector SPDR ETF (XLV) +0.42%.

#6: Industrials +0.76%, and the Industrial Choose Sector SPDR ETF (XLI) +0.30%.

#7: Actual Property -0.01%, and the Actual Property Choose Sector SPDR ETF (XLRE) -1.12%.

#8: Supplies -0.10%, and the Supplies Choose Sector SPDR ETF (XLB) -0.71%.

#9: Communication Providers -0.40%, and the Communication Providers Choose Sector SPDR Fund (XLC) -0.52%.

#10: Data Know-how -2.04%, and the Know-how Choose Sector SPDR ETF (XLK) -2.26%.

#11: Client Discretionary -3.10%, and the Client Discretionary Choose Sector SPDR ETF (XLY) -3.35%.

Under is a chart of the 11 sectors’ YTD efficiency and the way they fared in opposition to the S&P 500. For buyers trying into the way forward for what’s taking place, check out the Looking for Alpha Catalyst Watch to see subsequent week’s breakdown of actionable occasions that stand out.