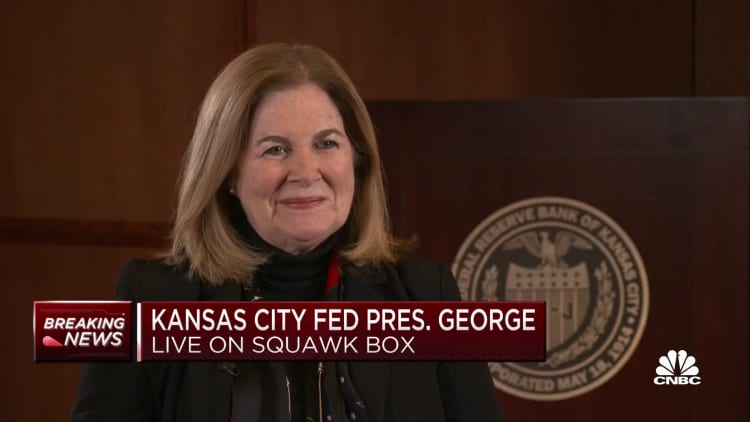

As her 40-year central banking profession involves a detailed, Kansas Metropolis Federal Reserve President Esther George is advising her colleagues to remain powerful of their efforts to stamp out runaway inflation.

George stated Thursday that she thinks the Fed ought to elevate its benchmark borrowing price above 5% and preserve it there till there are substantial indicators that costs are stabilizing.

associated investing information

“Holding that till we get proof that inflation is definitely coming down is actually the message we’re making an attempt to place on the market,” she advised CNBC’s Steve Liesman throughout a “Squawk Field” interview. “I will be over 5% and I see staying there for a while, once more till we get the sign that inflation is actually convincingly beginning to fall again towards our 2% aim.”

On the December Fed assembly, the rate-setting Federal Open Market Committee voted to boost the fed funds price half a proportion level to a variety of 4.25%-4.5%.

Assembly minutes launched Wednesday indicated that members see no likelihood of any price cuts in 2023, and so they expressed concern over whether or not the general public mistakenly may view the step down in price hikes, from a string of 4 straight three-quarter level strikes, as a softening in coverage.

Requested whether or not her view is that the funds price ought to maintain above 5% into 2024, George replied, “It’s for me.” That assertion comes a day after Minneapolis Fed President Neel Kashkari wrote that he thinks the funds price ought to rise to five.4% and will go even larger if inflation does not come down.

In earlier feedback, George has stated the tighter financial coverage is anticipated to tamp down demand and gradual financial system, presumably sufficient to create a recession. She stated in her remarks to CNBC that she does not see that as inevitable, however quite as a risk.

“I am not forecasting a recession,” she stated. “However I am fairly reasonable that if you see below-trend development and the concept our instrument goes to work on demand, bringing that down, it does not go away a number of margin there. Any shock may come, any danger to the outlook may ship the financial system in that path. So it is not my forecast, however I do perceive that bringing demand down creates that form of risk.”

George is leaving the Fed this month as she hit the obligatory retirement age of 65. She has been the Kansas Metropolis president for greater than 11 years and has served there for greater than 40 years.

No alternative has been named. George was an FOMC voter in 2022; her alternative is not going to vote till 2025.