[ad_1]

by jessefelder

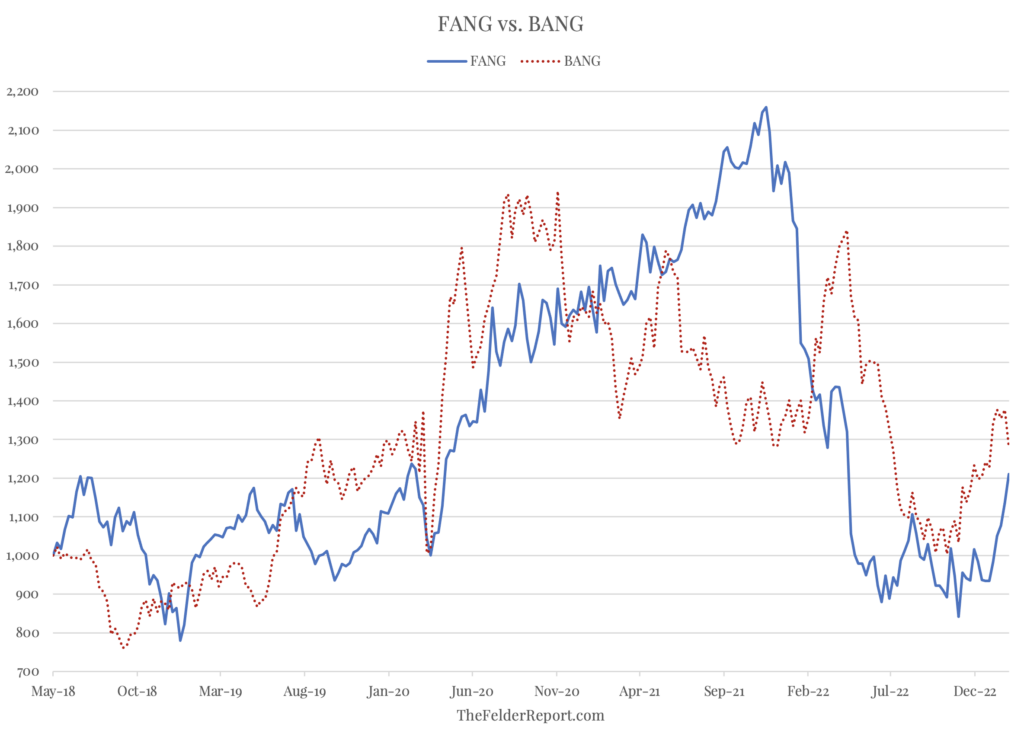

Virtually 5 years in the past I wrote a weblog submit titled, “BANG: Why The Gold Miners Might Quickly Make FANG Look Tame.” A reader just lately reached out to ask if I might submit an replace so right here it’s. The chart under plots two customized indexes: FANG (META, AMZN, NFLX, GOOG) versus BANG (GOLD, AEM, NEM). Clearly, there was some backwards and forwards between the 2 with the BANG shares taking the lead and holding it over the previous yr or so. Frankly, I’m shocked they haven’t executed higher however extra on that in a bit. As for the FANG shares, it’s fairly exceptional to see them generate primarily zero return as a gaggle since mid-2018, even after their robust runup to start out the yr.

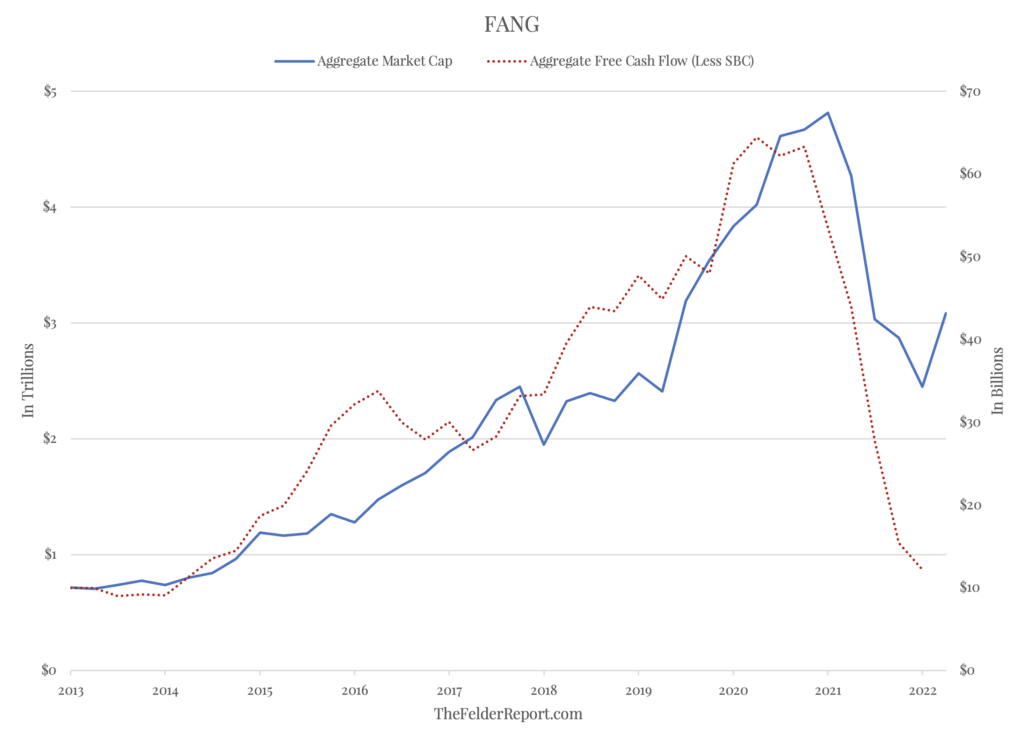

What has pushed the poor efficiency in these perennial inventory market favorites previous to this yr is the truth that their combination free money circulation has fallen greater than 80% from its peak a few years in the past again to a stage not seen in nearly a decade. This compares to only a 35% decline of their combination market cap. Clearly, buyers piling into these shares immediately are betting the businesses could make the transition from hyper-growth to hyper-efficiency and quickly reverse this plunge in profitability.

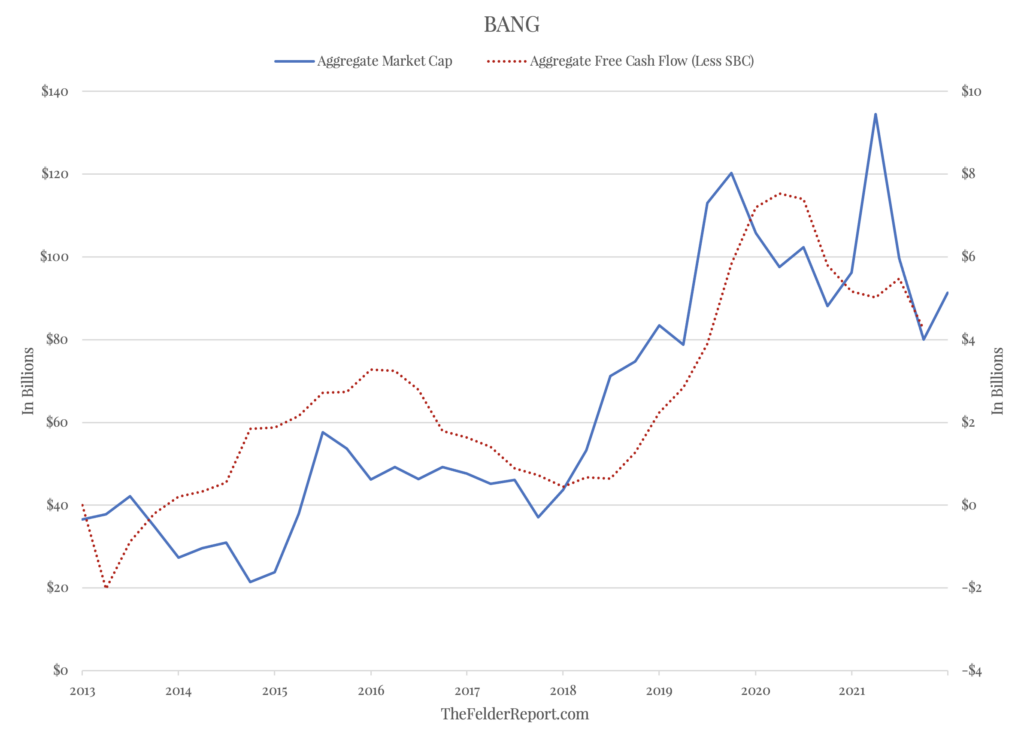

The scenario for the BANG shares, nonetheless broadly ignored by buyers, could be very completely different. Free money circulation has soared greater than four-fold since I first wrote about them. The rise in combination market cap has been far much less. The results of all of that is that the BANG shares have outperformed the FANG shares even whereas they’ve gotten considerably cheaper and the latter have gotten considerably costlier relative to their respective tendencies in free money circulation.

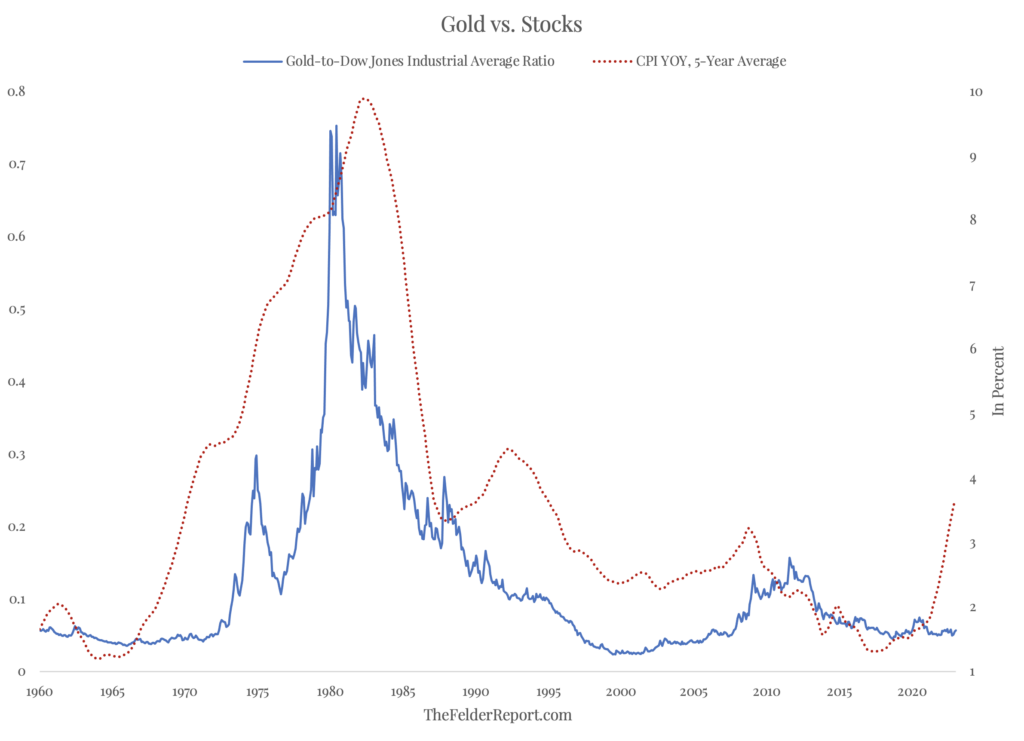

It’s most likely essential to notice, although, that the key driver of each free money circulation tendencies and valuations for all of those shares going ahead would be the path of inflation. If the return of inflation proves to be secular reasonably than cyclical, BANG shares’ current outperformance is probably going solely the start of a a lot greater pattern. Traders, nevertheless, nonetheless look like betting on the concept inflation is merely a cyclical phenomenon. Time will inform.

[ad_2]

Source link