Hero Photos Inc

Introduction

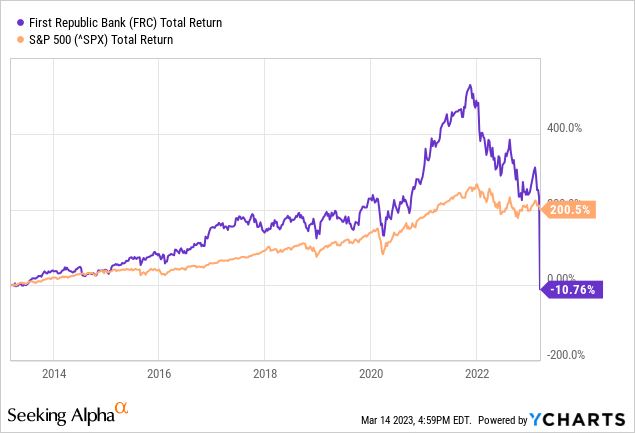

With a number of financial institution shares down considerably, buyers could be questioning if it is a shopping for alternative of a lifetime. I seized this chance and acquired giant positions in First Republic (NYSE:FRC), Comerica (CMA), Charles Schwab (SCHW), Western Alliance Bancorporation (WAL), PacWest Bancorp (PACW) and First Basis (FFWM).

These financials all skilled sharp declines whereas their fundamentals have been sturdy. What was notably notable was the sharp decline of First Republic, which fell 80% from its peak. The financial institution has sturdy fundamentals as a result of it serves excessive internet price prospects with 0% internet mortgage charge-offs.

In my article I give 4 the reason why I like First Republic, and earlier than that I give some insights into the market scenario.

What Occurred To The Markets

Silvergate, Silicon Valley, and Signature, all main banks with publicity to cryptocurrencies, have been shut down by regulators principally as a result of giant losses on gross sales of its securities portfolio.

The regional banking sector is down considerably, and it began final week with issues at Silicon Valley financial institution. SVB Monetary is Silicon Valley’s holding firm, a financial institution that focuses on financing start-up tech corporations. Its inventory worth crashed 60% this week, for good cause. The corporate is in monetary hassle now that it has introduced a proposal to lift money and put the corporate up on the market.

On March 8, SVB Monetary introduced the sale of its available-for-sale securities portfolio and offered about $21 billion in authorities bonds and different monetary merchandise. This can lead to an after-tax lack of $1.8 billion for the primary quarter of 2023. Obtainable-for-sale securities are usually not offered till the corporate has an urging want for money.

To keep away from doable panic promoting, the financial institution introduced that it deliberate to supply $1.25 billion of widespread inventory and $500 million of deposit shares. As well as, Normal Atlantic will buy $500 million of widespread inventory in a separate non-public transaction on the worth of the general public providing. The overall worth of this capital transaction is as a lot as $2.25 billion, and the corporate will use the web proceeds for “normal company functions.” The overall quantity of $2.25 billion is important as a result of its market capitalization was solely $16 billion (14%).

CEO Greg Becker calmly addressed the inventory markets, however issues turned out very in a different way. Depositors have been shocked and pulled their cash out of the Silicon Valley financial institution. Buyers have been additionally shocked and the inventory worth fell 60%.

Enterprise capital buyers similar to Founders Fund (Peter Thiel), Union Sq., Tribe Capital and Founders Collective have suggested their portfolio corporations to position their money elsewhere. The CEO of Y Combinator, Garry Tan, has additionally warned his community of start-ups that the solvency danger is actual and that they too ought to cut back their publicity to the financial institution.

Whereas Silicon Valley Financial institution was struggling as a result of rising rates of interest and stagnant VC funding, the monetary issues primarily come up within the financial institution run, many companies and people have been taking their money out of the financial institution.

The withdrawal of deposits is disastrous for banks as a result of they function collateral for loans. The Federal Deposit Insurance coverage Corp. took over Silicon Valley Financial institution and it entered receivership after SVB Monetary was shut down by California regulators. What I’m notably involved about is that the expansion in innovation will decline, as a result of Silicon Valley was the primary financial institution for reinforcing start-ups. This complete situation jogs my memory of the 2008 monetary disaster.

As soon as Of A Lifetime Shopping for Alternative

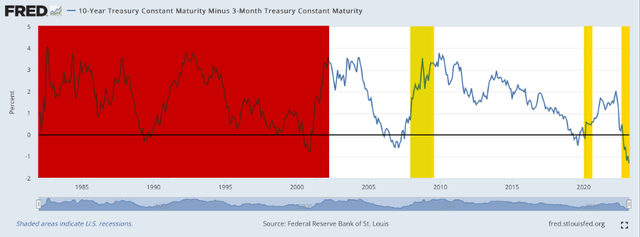

I’m not stunned that Silicon Valley financial institution is presently in hassle. In an earlier article, I pointed to a doable recession. When the yield curve inverts, it causes a decline within the fairness market, and financial institution shares are notably susceptible. I see that as a robust contrarian shopping for alternative, which traditionally happens about as soon as each 10 years. Now, lower than 4 years after the COVID disaster, this chance presents itself once more.

I’ve highlighted the -20% or extra peak-to-trough moments of the SPDR S&P Regional Banking ETF (KRE) in yellow within the yield curve chart. Sadly, I don’t have information previous to 2000. Within the picture beneath, we see that the ETF enters the bear market after the yield curve inverted. This isn’t outstanding as a result of the yield curve inverts when short-term rates of interest are increased than long-term rates of interest.

Yield Curve Marked For Peak-Trough of the SPDR S&P Regional Banking ETF (FRED and creator’s personal visualization)

The inverted yield curve often solely happens as soon as each 10 years, so we’re fortunate to see this coming, as the costs of many financial institution shares are presently favorable for my part. I’ve 4 the reason why I believe First Republic particularly is a gorgeous inventory funding.

Purpose 1: Further funding from JPMorgan and the FED

First Republic has plummeted from its all-time excessive of $210 in November 2021 to $40 now. On Monday, the inventory offered for $19 per share. Buyers are clearly panicking and questioning if First Republic is the following financial institution to be shut down by regulators.

We all know First Republic is a stable financial institution with rich and creditworthy prospects, which additionally makes it a bit dangerous due to the big uninsured quantity of depositors. Greater than $140 billion of its deposits are in accounts that exceed the restrict for federal deposit insurance coverage.

First Republic obtained a brand new facility from JPMorgan (JPM) and JPMorgan gave First Republic entry to $70 billion in funds. The Federal Reserve additionally supplied the financial institution further funding capability beneath its $25 billion Financial institution Time period Funding Program in change for high-quality collateral similar to Treasuries.

The extra liquidity enhance of $70 billion is anticipated to cowl greater than 40% of complete deposits of $176 billion. That signifies that lots of depositors must withdraw their cash earlier than issues come up, which I do not suppose will occur.

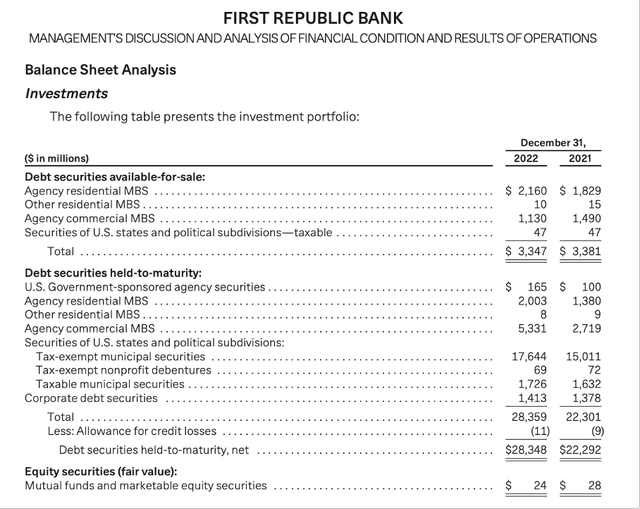

The issues at SVB Monetary stemmed from giant unrealized losses within the funding securities portfolio. First Republic confirmed some attention-grabbing information on funding securities and the available-for-sale portfolio in its This fall 2022 outcomes:

The overall mixed funding securities portfolio (consisting of available-for-sale, held-to-maturity and fairness securities, excluding any ACL) represented 15% and 14% of complete property at December 31, 2022 and 2021, respectively.

The weighted common length of the available-for-sale portfolio was 4.4 and three.9 years at December 31, 2022 and 2021, respectively. The weighted common length of the held-to-maturity portfolio was 10.8 and 10.6 years at December 31, 2022 and 2021, respectively.

When contrasted to SVB Financials’ portfolio allocation of 57%, the mixed 15% of funding securities is a pittance. This reduces the potential of struggling important unrealized losses because of falling bond costs.

First Republic Financial institution Stability Sheet Evaluation (First Republic Investor Relations)

Purpose 2: Low publicity to unrealized losses as a % of complete fairness

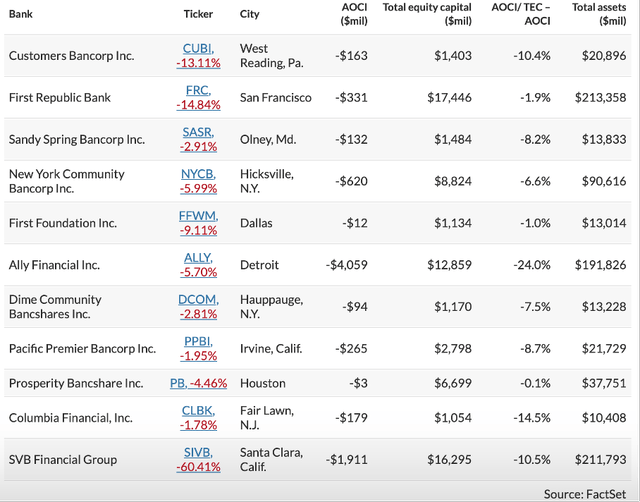

The markets are in mayhem as buyers flee the market out of worry of financial institution runs. Western Alliance Bancorporation fell 21%, PacWest 51% and First Basis 32%. These banks have the identical purple flags as Silicon Valley Financial institution; they’ve a big publicity to unrealized securities losses as a % of complete fairness.

One method to get perception into the danger publicity of sure regional banks is to divide the detrimental AOCI by the financial institution’s complete fairness minus AOCI (by including the unrealized losses on AFS securities again to complete fairness). FactSet supplied the listing of 10 regional banks with related purple flags to SVB Monetary.

AOCI/TEC-AOCI (FactSet and MarketWatch)

We see that Ally Monetary’s (ALLY) AOCI decline of -24% is the biggest on the listing. This might put Ally at nice danger, as I wrote in an article earlier this month.

The listing above reveals that First Republic didn’t report important AOCI losses relative to its complete fairness minus AOCI, this is because of the truth that solely 15% of its property encompass its complete mixed portfolio of funding securities.

Buyers ought to understand, nonetheless, that it is a snapshot of the established order. The yield curve remains to be deep within the purple, so banks are doubtless nonetheless susceptible to further unrealized losses.

Purpose 3: The influence of unrealized losses on capital ratios

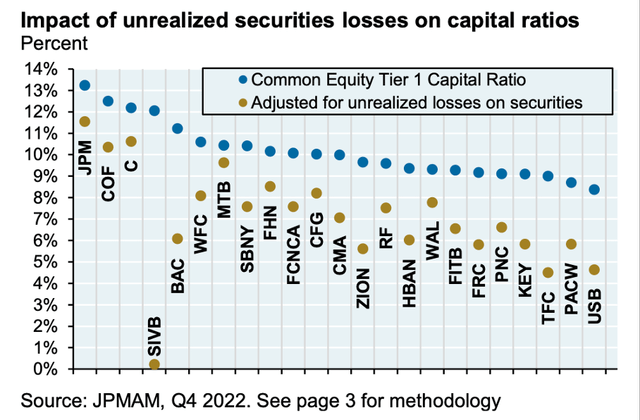

JPMorgan got here out with an evaluation of SVB Monetary’s influence on the banking system and the way different banks could be affected. It supplied us a chart exhibiting the widespread fairness tier 1 capital ratio adjusted for unrealized losses on securities.

JPMorgan gave clear ideas on the primary explanation for Silicon Valley Financial institution’s monetary issues:

Between This fall 2019 and Q1 2022, deposits at US banks rose by $5.4 trillion and as a result of weak mortgage demand, solely ~15% was lent out; the remaining was invested in securities or saved as money. Banks designate these securities as being “available-for-sale” (AFS) or in “hold-to-maturity” (HTM) portfolios as an alternative. SIVB relied extensively on HTM therapy for its rising securities portfolio: since 2019, its AFS ebook grew from $14 to $27 bn whereas its HTM ebook grew from $14 to $99 bn. Promoting HTM securities is difficult, because it ends in bigger components of the portfolio being all of a sudden marked to market, which may in flip then consequence within the want for a capital elevate.

What clearly stands out within the chart beneath is that the widespread inventory tier 1 capital ratio, adjusted for SVB Monetary’s unrealized losses, is about 0%.

And what I am notably happy about is that First Republic continues to keep up a robust 6% tier 1 capital ratio, as projected by JPMorgan.

Some sturdy phrases from the corporate’s CEO Michael J. Roffler:

First Republic’s capital and liquidity positions are very sturdy, and its capital stays nicely above the regulatory threshold for well-capitalized banks.

Influence on unrealized losses on capital ratios (JPMorgan )

Purpose 4: First Republic is a much less dangerous financial institution

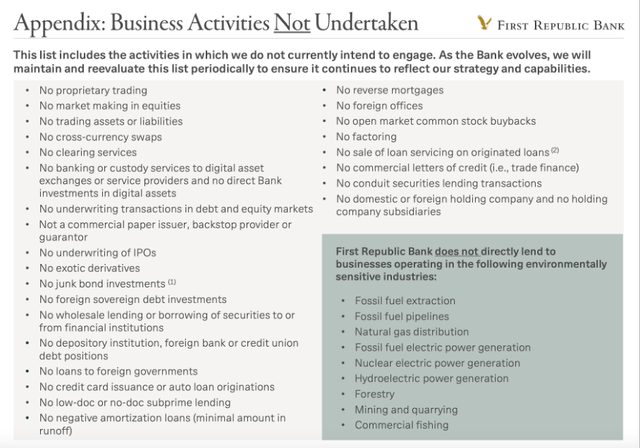

I additionally suppose its enterprise actions are much less dangerous than these of different banks. The financial institution provides us “Not Undertaken Enterprise Actions” in its fourth quarter 2022 investor presentation.

First Republic doesn’t commerce in unique derivatives, spend money on junk bonds, doesn’t subject bank cards or auto loans, and has no detrimental amortization loans. Due to this fact, the financial institution’s operational danger is lower than that of different banks for my part.

First Republic Fourth Quarter Earnings (Enterprise actions not undertaken)

Key Takeaway

The sharp decline within the regional banking sector presents a primary alternative to purchase regional financial institution shares cheaply, however just for buyers who can deal with the sturdy worth volatility.

First Republic is a regional financial institution with prosperous prospects, and with mortgage write-offs of solely 0%, its collectors seem creditworthy. However as a result of many deposits are uninsured, there’s a danger that depositors might take cash out of First Republic. JPMorgan supplied the financial institution $70 billion in liquidity, and the Fed supplied further funds beneath its Financial institution Time period Funding Program. So I do not suppose many depositors will take cash out of the financial institution because of the additional liquidity enhance. And since its portfolio of funding securities accounts for under 15% of its complete property, I do not count on it to undergo enormous losses if depositors flee. FactSet additionally supplies perception into the danger publicity of 10 regional banks. First Republic got here out sturdy from this evaluation, with just one.9% AOCI/TEC-AOCI. Trying forward, JPMorgan got here out with an evaluation that confirmed us the dramatic results of SVB’s Monetary’s CET1 capital ratio. The CET1 capital ratio for First Republic is anticipated to be sturdy at 6%. Furthermore, First Republic’s danger administration is favorable as a result of the financial institution doesn’t spend money on unique derivatives, doesn’t spend money on junk bonds, doesn’t subject bank cards or auto loans, and has no detrimental compensation loans. I see this as a singular alternative, however just for the courageous. I’ve diversified my danger into 6 shares, as talked about within the introduction. Due to this fact, I do not thoughts if one of many banks whose shares I personal closes, as I consider the extraordinarily low costs of those shares provide me a positive danger/reward. Let’s hope for the most effective.