Cindy Ord

Qurate Retail (NASDAQ:QRTEA) is a John Malone-backed Holdco that owns distinguished legacy video and on-line streaming commerce manufacturers similar to QVC and HSN. It additionally owns belongings, together with Cornerstone Manufacturers (CBI), Zulily, and different minor price and fairness methodology stakes. The corporate serves 13.2 million distinctive prospects throughout its legacy community enterprise and produced $12.1B in annual gross sales.

The retail inventory was transformed from a Liberty Media monitoring inventory to an asset-backed inventory in 2018. The worth has since plummeted by 95% to a mere 95 cents. This out-of-favor safety piqued my curiosity on account of its severely depressed worth, its surprisingly loyal core-customer base, a protracted historical past of producing money, large leverage ($8.5B TEV vs. $360 million market cap) with spread-out maturities, and doubtlessly transient operational points notably impacted by the Rocky Mount hearth together with related important non-recurring bills. Buying and selling at 1/3 of 2021 FCF, my pondering was that if the corporate’s earnings can return to a normalized degree even after accounting for some attrition from a slowly dying enterprise, the fairness might re-rate to a a number of as little as 3-5x FCF, or I might obtain candy dividend payouts value greater than the market cap, resulting in a candy multi-bagger.

Sounds nice, does not it!?

The first challenge with Qurate’s turnaround plan, named Undertaking Athens, is its dependence on administration’s capacity to execute flawlessly whereas coping with important leverage. For this system to achieve success, buyer counts and ARPUs might want to stabilize over a number of years, margins should return to not less than their pre-2022 ranges, and dealing capital must be managed impeccably. If a number of of those situations usually are not happy, money won’t seemingly be out there for fairness holders. I consider that the market is right to cost the inventory for chapter within the not-too-distant future. There’s simply an excessive amount of danger of a everlasting danger of capital and thus no margin of security. I like to recommend that buyers keep away from this worth entice except it constitutes a negligible portion of their portfolio. Nonetheless, there could also be different alternatives out there inside its advanced capital construction, such because the 2024 or 2025 senior secured bonds, for these desirous about distressed debt conditions.

How is QVC/HSN nonetheless round!?

As a proud millennial, I had no concept that QVC generated billions of {dollars} in income, not to mention nonetheless round as a viable enterprise earlier than the inventory appeared on my radar. To my shock, the QVC and HSN manufacturers are nonetheless comparatively thriving, and collectively they type the Qurate Retail Group, which occurs to be essentially the most important participant in video and on-line streaming commerce in North America. After digging additional, I found that QVC’s resilience is attributed to 2 sturdy aggressive benefits.

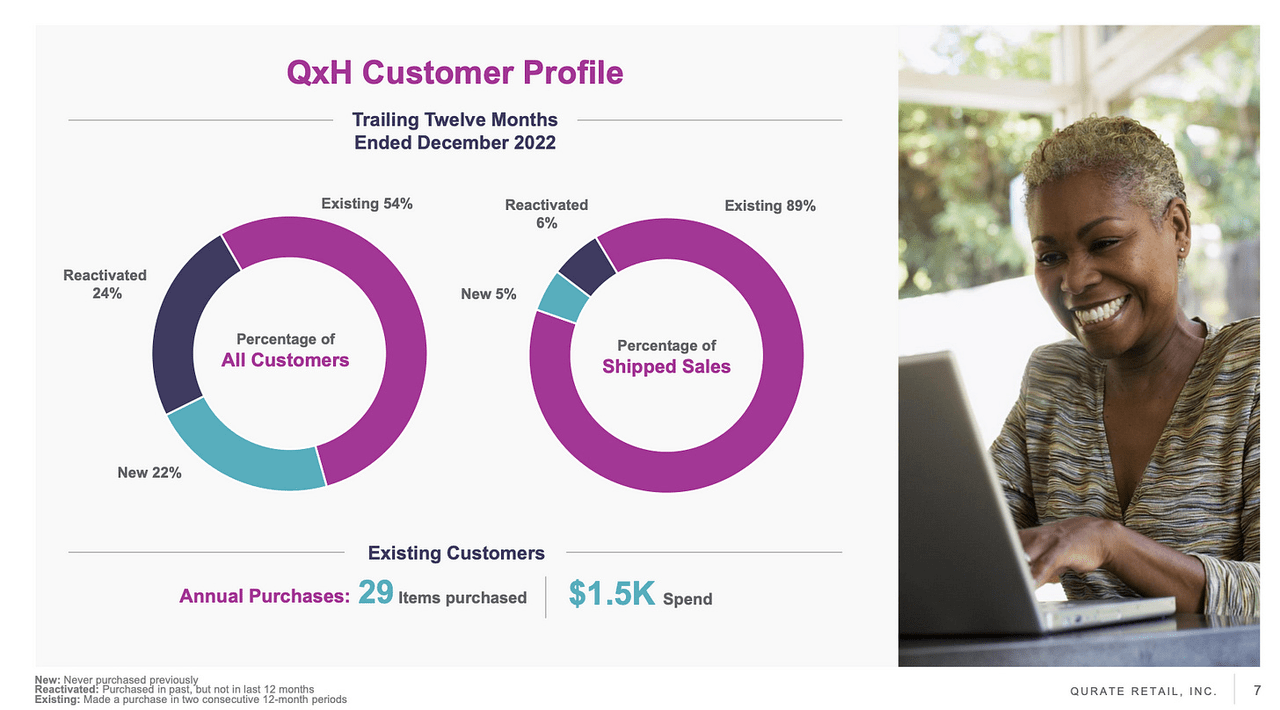

This autumn 2022 Investor Deck (QRTEA IR)

The primary is a powerful model moat that it has cultivated inside a selected demographic section. QVC and HSN have a devoted cohort of long-standing prospects who’ve demonstrated unwavering loyalty to the model over time. Roughly half of the present 8.8 million QxH (QVC US) prospects in america, who spend a mean of $1.5k per 12 months, account for round 90% of the gross sales. Furthermore, a good smaller subset of consumers, comprising 1.8 million tremendous customers, representing a mere 17% of the shopper base, is liable for roughly 70% of the income generated by QxH. Qurate cultivated this loyalty by its television personalities, who’ve cultivated deep connections and belief with audiences. These viewers are sometimes girls between the ages of 35 and 65 with appreciable discretionary spending energy. This purchaser focus makes the enterprise a cash printer when prospects are happy. Nonetheless, it will also be a double-edged sword, as any misstep by the corporate might unravel its working leverage in a rush.

The second benefit is the low-cost nature of its large operational scale, eliminating the necessity to keep a bodily retailer presence (other than CBI). This enterprise mannequin reduces costly capital expenditures that opponents could need to spend money on working a large-scale bodily retailer footprint. This function permits the corporate to handle stock ranges at its centralized warehouses effectively. It additionally permits for extra flexibility as it could actually reply rapidly to altering developments and calls for by adjusting programming schedules and product combine. This attribute alone does not confer a particular edge since e-commerce corporations possess comparable asset-light traits. Nonetheless, when mixed with model energy, it creates a strong synergy that leads to robust returns on tangible capital (ROTC). Qurate Retail Group, as an example, achieved ROTC ranges of over 60% earlier than 2022.

Qurate’s Publish-COVID Hangover

All through 2020, Qurate’s enterprise thrived on account of client habits, pushed by pandemic-induced restrictions, which resulted in a heightened attraction to the platform. This translated to notable year-over-year income progress of 5.3%, a considerable enchancment from the earlier 12 months’s damaging 4.3%. Moreover, money circulate efficiency was much more spectacular, surging by over 100% to achieve a staggering $2.2 billion, after progress stalled the 12 months prior.

Nonetheless, fortunes began to vary for the worst in 2021 as prices skyrocketed and substantial operational efficiencies plagued the enterprise. Based on CEO David Rawlinson, the provision chain and distribution system proved to be costly and fragile when in comparison with these of opponents, and administration confronted challenges in dealing with it. For instance, cancellations of scheduled trans-pacific vessels and delays at US ports of as much as 45 days led to considerably delayed receipts of buy orders. Moreover, the tragic hearth at Rocky Mount, the corporate’s second-largest success middle, additional exacerbated the operational inefficiencies, leading to important setbacks.

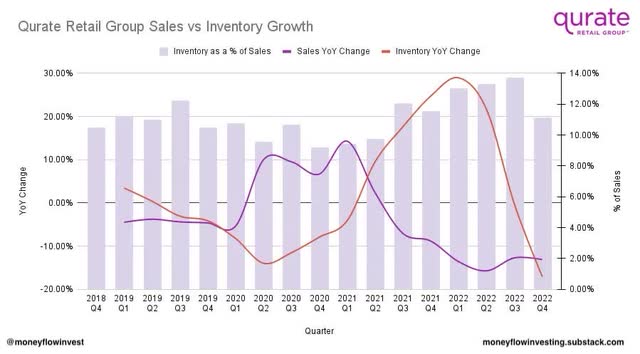

Qurate Retail Quarterly Gross sales Progress vs. Stock Progress (10-Ks/Creator)

The impact was an inflection level for stock ranges in Q2 2021 as the provision chain eased, and beforehand delayed buy orders have been lastly coming by simply as demand cratered. Consequently, prices have been uncontrolled, and stock as a % of gross sales rocketed from 9.73% to a Q3 2022 peak of 13.74%. Qurate skilled a major setback with the lack of its Rocky Mount facility, which constituted a lack of between 20-30% of its best stock storage and processing capability. This, in flip, resulted in extra prices similar to detention and demurrage, additional exacerbating the monetary implications of the warehouse’s closure. Consequently, the corporate needed to resort to leasing roughly 1,000 trailers to handle the surplus stock. Furthermore, the emergence of inflationary headwinds precipitated a surge in bills, together with transportation and freight prices, in addition to labor wage hikes stemming from labor shortages. Collectively, these developments compounded Qurate’s monetary challenges, including to the complexity of the state of affairs.

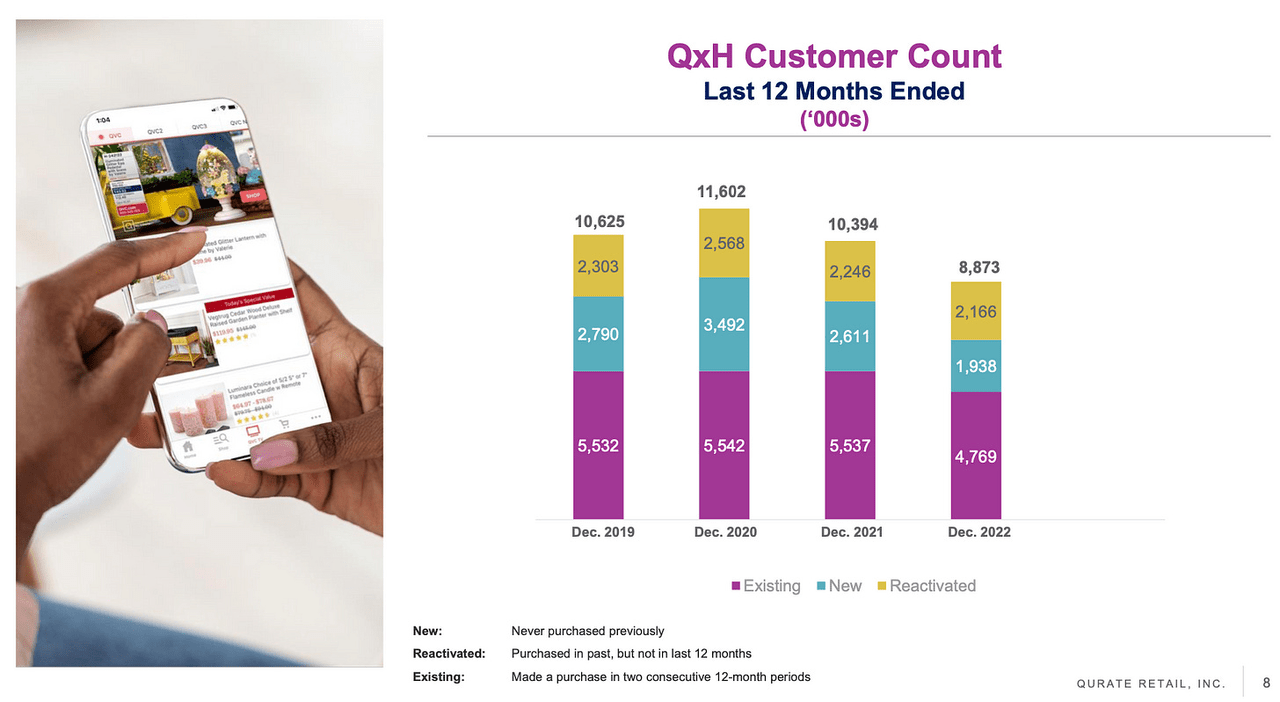

Whereas Qurate battled these fires (fairly actually), buyer counts suffered tremendously. There are a number of causes for this. First, the secular decline led to by cord-cutting additional accelerated throughout the pandemic and continues right now. The variety of paying households declined by 27% from 2018 to 2022. Second, fickle consumers, who had little attachment to the model and have been flush with money from stimulus checks and restricted choices to spend the cash throughout COVID, left.

This autumn 2022 Investor Deck (QRTEA IR)

Moreover, a portion of its loyal buyer base churned. Poor operational execution in opposition to a deteriorating macroeconomic backdrop led to pervasive buyer expertise points that eroded belief. For instance, the stock disruptions significantly impacted As we speak’s Particular Worth (TSV) offers, that are the main target of buyer engagement and sometimes account for 20-25% of gross sales. At one level, 3/4ths of the deliberate TSVs have been shifted to regulate for lack of product availability. Administration additionally acknowledged {that a} lack of self-discipline precipitated buyer pricing confusion. The a number of pricing tier construction it had between TSVs and different gross sales campaigns in the end eroded the shopper worth notion of the TSVs. Ultimately, QxH buyer rely fell 23.5% from the covid peak in 2020 and 16.5% from 2019, a secure pre-covid baseline 12 months.

Undertaking Athens: Is it Sufficient to Revive the Inventory?

5-Pillar Technique for Undertaking Athens (June 2022 Investor Day)

Through the June 2022 investor occasion, the CEO unveiled Undertaking Athens, the corporate’s multi-year 5-pillar turnaround technique to re-establish income progress, margin enlargement, and incremental money circulate era. Its main objective is to bolster self-discipline from the highest all the way down to reverse or mitigate the problems that eviscerated money circulate and investor confidence. The initiatives embrace deliberately reinvigorating buyer relationships, assuaging pricing confusion, decreasing direct and oblique prices, returning Zulily to profitability, sustaining CBI’s momentum, and prudently investing in on-line streaming. Administration believes there is a chance for an incremental $300-$600 million in Adjusted OIBDA and a $300-$500 million free money circulate run charge beginning in 2024.

Some good progress has already been made that may enhance margins and dealing capital. For instance, stock ranges are down 27% from June 2022 and stock as a % of gross sales is now solely barely above its 10.5% pre-Q2 2021 common. Consequently, margins ought to enhance as heavy discounting tapers off. Adjustments in accounts payables must be much less of a headwind to money circulate for the subsequent couple of years because the enterprise labored off $450 million off the stability sheet final 12 months together with $150-$200 million in covid-era stock purchases.

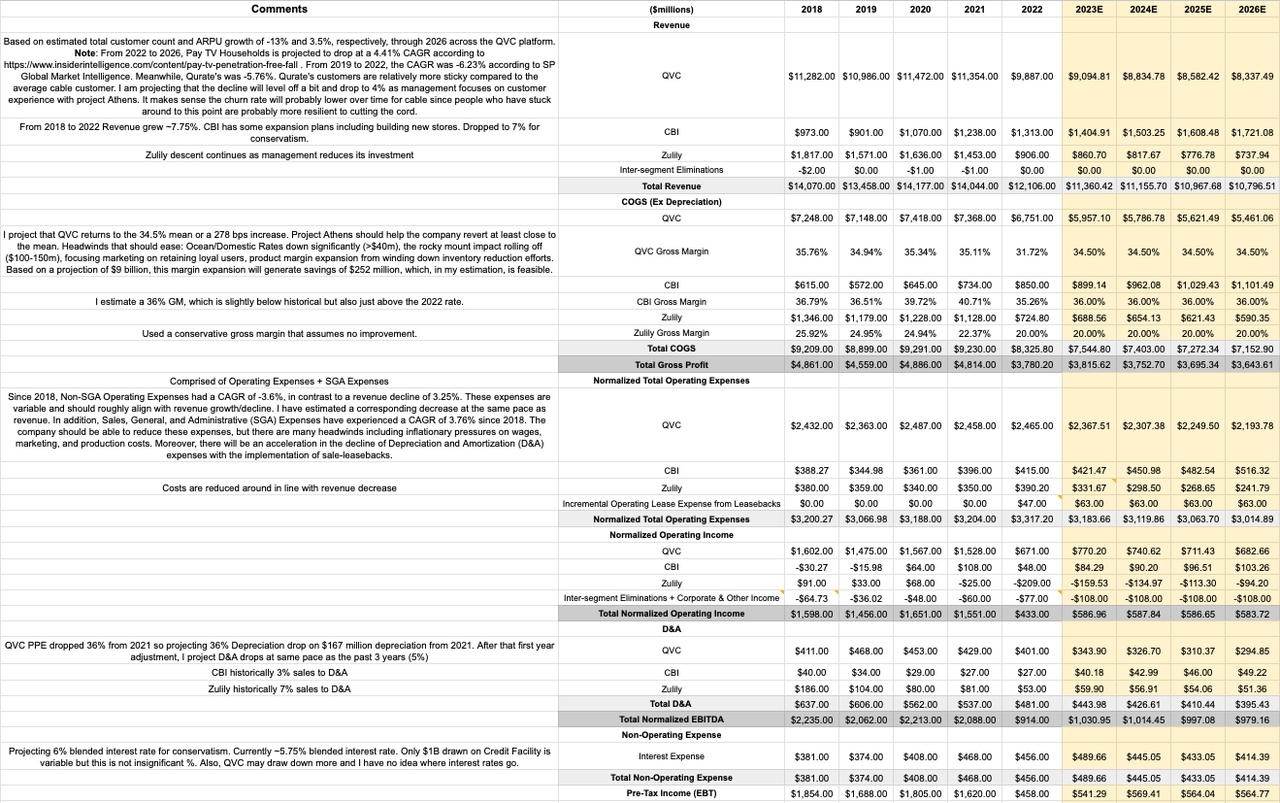

For my part, it’s cheap to consider that QVC’s gross margin will roughly revert to the imply by Undertaking Athens and the easing of macro situations. Increasing the gross margin from a 5-year low of 31.72% to a mean of 34.5% is a 2.78% distinction or $252 million incremental price financial savings on $9.094B in gross sales (see feedback under). Working bills will even lower however at a slower tempo than income on account of working deleveraging.

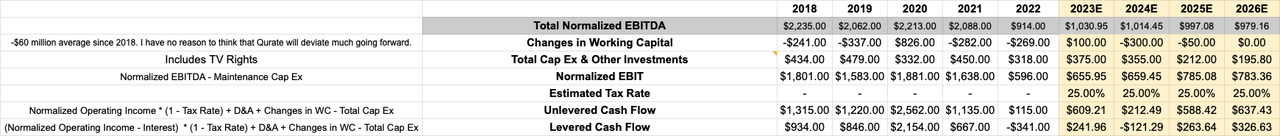

QRTEA P/L Mannequin by 2026 (Creator/10-Ks)

QRTEA Money Circulate Mannequin by 2026 (Creator/10-Ks)

Regardless of the enhancements from Undertaking Athens, there’s not sufficient margin of security for an fairness holder to sleep properly at evening and be assured the fairness will not go to 0. Earlier than 2021, the annual curiosity funds of $460-480 million have been tolerable, provided that the enterprise persistently generated an unlevered free money circulate of $1.2-$2 billion. From my perspective, Qurate’s unlevered future earnings potential is weakened to underneath $700 million on account of a lowered buyer base, margin discount from working deleveraging, Zulily’s cash-sucking enterprise additional deteriorating, an extra ~$60 million in working lease funds ensuing from sale-leasebacks, and ongoing inflationary prices.

The enterprise carries a debt burden of $8.1 billion, with a blended rate of interest of ~5.75%, together with $1.2 billion in 8% most popular inventory and $6.9 billion in higher-ranking debt securities, of which $2.5 billion will mature by 2026. With ~$1.2 billion in extra money and ~$700 million in cumulative free money flows by 2026, administration might allocate your complete $1.9 billion from money flows to repay bondholders. On this situation, administration must be able to addressing not less than a few of the $600 million hole with some monetary maneuvering, similar to liquidating extra PPE by extra sale-leasebacks or promoting stakes in its companies. It might additionally lengthen maturities or roll over debt, particularly if the leverage ratio improves and collectors have extra confidence. Nonetheless, as an investor whose precedence is to keep away from everlasting capital loss, I’m not keen to depend on the credit score market as a white knight to offer liquidity.

Finally, there are three main issues for shareholders. Firstly, all money flows are directed towards bondholders and never fairness holders. Though Undertaking Athens is anticipated to reinforce the enterprise’s monetary standing, the immense debt burden implies that just about all money flows will proceed to be paid to collectors. Secondly, even when Qurate stays afloat over the subsequent 4 years, the outlook past 2026 is notably worse, given the enterprise’s declining money flows and substantial debt and tax liabilities of $4.7 billion by 2030 (which must be barely offset by not less than $400-$500 million in DTAs). Lastly, success is essentially predicated on administration’s capability to execute their methods with distinctive precision and for exogenous components to not develop into setbacks as they did in 2022. If a number of variables, together with an unexpectedly excessive charge of buyer attrition, a failure to revive gross margins to the historic imply, a slower-than-anticipated decline in working bills, or suboptimal administration of working capital, deteriorate past expectations, money flows and due to this fact the flexibility to pay again money owed or keep covenants efficiently will likely be adversely impacted.

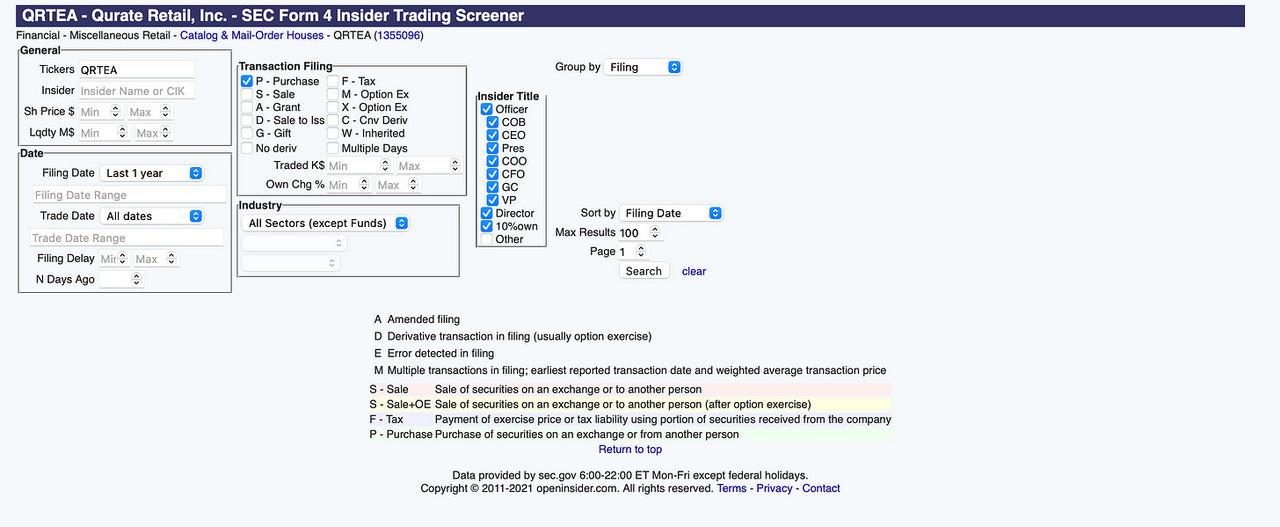

Radio Silence from Insiders

Qurate Retail Insider Purchases (openinsider.com)

On the finish of the day, if insiders had confidence that this was a house run deal, you’ll suppose insiders could be doing every little thing they may to purchase up shares. The truth is that there have been 0 open market purchases. The one signal of optimism is that Malone elected to alternate all of his B shares for A shares at $14 as a substitute of receiving money in 2021. Nonetheless, I’d take this with a grain of salt since it’s believable that this was merely one other of his tax-saving methods, which he’s famously identified for, to keep away from capital beneficial properties taxes.

How Qurate can Extend its Lifespan

The chief staff might make some decisive capital allocation strikes to shore up Qurate’s financials, lower its leverage, and lengthen its lifespan. First, it could actually shut down and liquidate the unprofitable Zulily. This may enhance working earnings by $100 to $200 million yearly. Even when administration can get the enterprise again to interrupt even in such a fiercely aggressive market, it’s nonetheless diverting useful consideration away from its struggling core enterprise. Discovering an acquirer or promoting off a few of Zulily’s belongings could be a bonus. Secondly, it might unload the dear CBI belongings and immediately repay a portion of its high-interest debt. If a purchaser is keen to pay a a number of of 7-9x CBI’s working earnings energy, which I estimate is roughly $100 million, the corporate’s capitalized worth might vary from $700 million to $900 million. Then, it might tender the 8% preferreds or redeem the remaining $792 million 8%+ yielding LI LLC Senior Debentures and offset many of the misplaced earnings.

Conclusion

Qurate Retail Group’s inventory could seem to worth buyers to be a tempting funding alternative given its anemic valuation, latest non-recurring prices, loyal buyer base, and lengthy historical past of producing money. The corporate’s operational scale and resilient television streaming enterprise mannequin have enabled it to thrive for many years. Nonetheless, the corporate’s excessive leverage and dependence on administration’s flawless execution of the Undertaking Athens turnaround plan make the fairness dangerous. I agree with Kingdom Capital’s evaluation to give attention to the high-yielding bonds quite than the inventory, particularly if yields proceed to develop.

Editor’s Be aware: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.