[ad_1]

Shares for the Lengthy Run is considered one of my favourite books. In the event you had been to ask me what the one most universally held perception in all of investing is, I’d say it’s that “shares are one of the best ways to construct wealth”. I don’t disagree. In any case the most important fund I handle is a protracted solely US shares fund!

However I don’t essentially agree both.

US shares are the STARTING POINT and the most important allocation for each funding portfolio. They usually possible ought to be as they’re the world’s largest inventory market at 60% of the overall (10 instances bigger than #2 Japan, which is astonishing).

US shares have compounded at 10% ceaselessly, and the loopy math behind that’s if you happen to maintain them for 25 years, you 10x your cash, and after 50 years you 100x your cash.

$10,000 plunked down on the age of 20 would develop to $1,000,000 in retirement. Badass!

So it’s pure that once we poll investors on Twitter that US shares are essentially the most universally held funding class.

However shares can go a painfully very long time with flat efficiency, in addition to nauseating bear markets. They usually can undergo painfully lengthy durations underperforming different property too.

So what if there may be one other manner? What if you happen to can construct wealth and personal zero US shares?

Blasphemy!

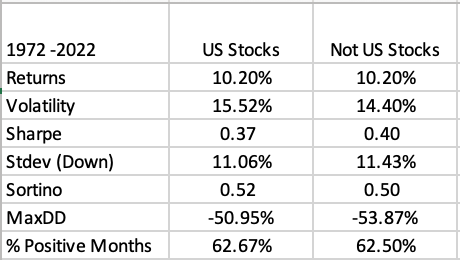

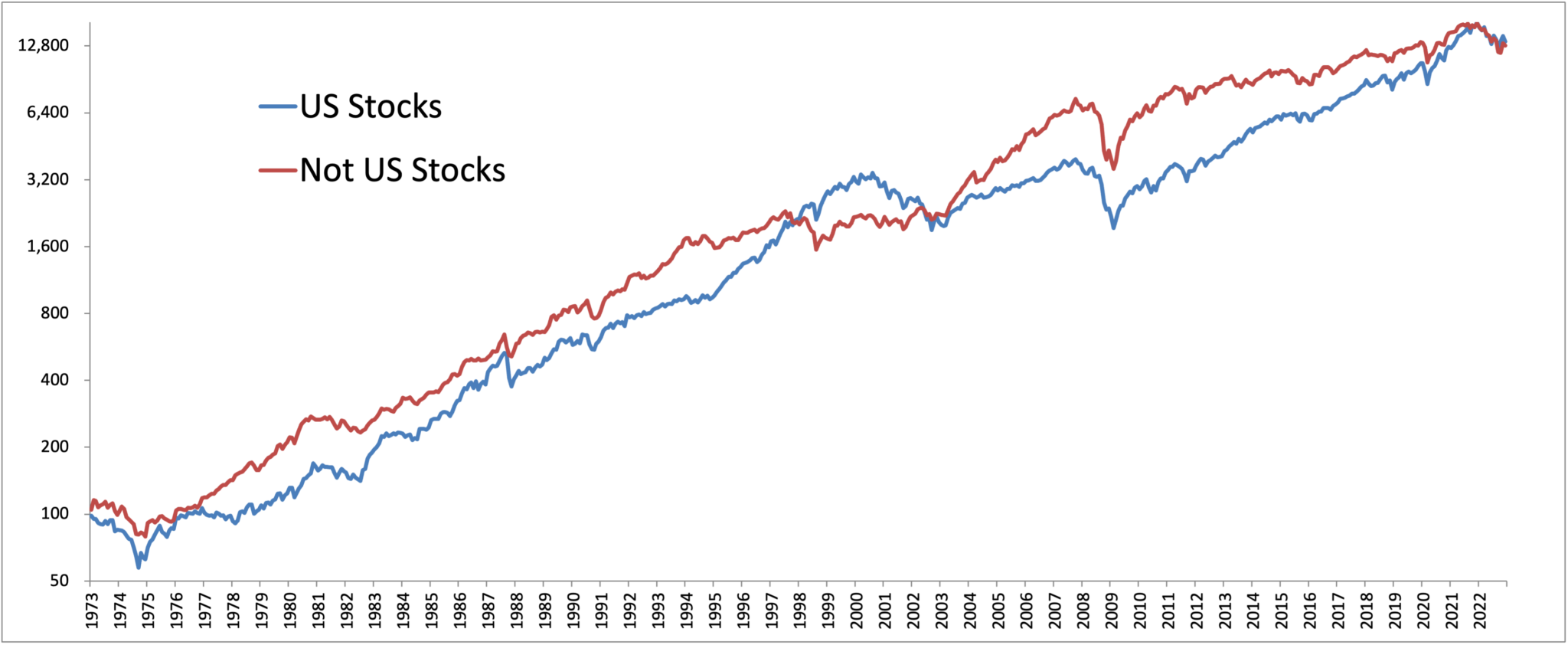

I had a bit enjoyable over espresso this morning with our asset class backtester. Beneath are some stats for US shares, in addition to an allocation I’ll name “Not US Shares”. I restricted it to market cap weighted property, it took about 10 minutes to provide you with. The chances don’t actually matter, I’m simply attempting to make some extent. The stats throughout the board are close to similar!

(The allocation consists of REITs, ex-US shares, company bonds, US and overseas bonds, and gold.)

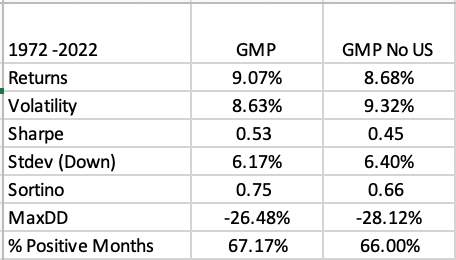

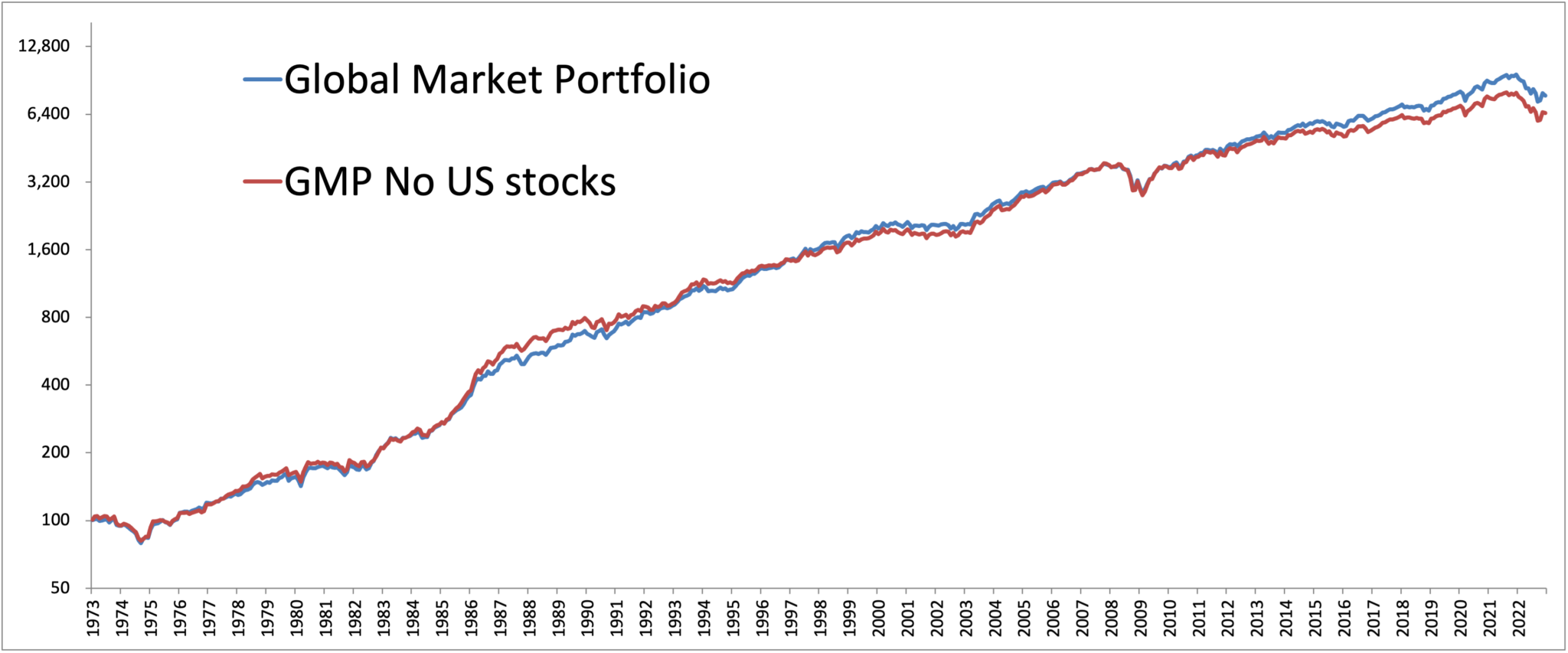

Right here’s one other actual world instance. Most individuals don’t ONLY personal US shares. So they could personal a 60/40 portfolio, or maybe a world market portfolio of all property.

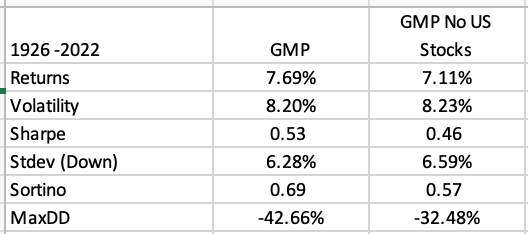

So let’s evaluate these if you happen to take US shares out altogether and change them with ex-US shares.

Right here is the GMP at the moment, and held constantly again in time.

Voila! Not optimum, however nonetheless completely wonderful.

And in actuality, my perception is that issues like taxes and costs shall be extra essential than the precise percentages of what you personal…

these outcomes are constant all the way in which again to 1926 too…

(Outcomes for international 40/40 are related…)

The entire level is that it’s a must to personal SOMETHING. For a lot of People, it’s a home, however my level is that it actually doesn’t matter a lot what you particularly personal because the mindset of BEING THE OWNER.

Now, if you happen to actually needed to have some enjoyable and have a look at one thing that actually strikes the needle, you could possibly use methods like lively administration (gasp, pattern?) or issue tilts (gasp, worth and momentum)….

Personally, I imagine that may get you greater returns with decrease volatility and drawdown with these additions, all of the whereas together with NO US shares, and might direct you to our outdated Trinity Portfolio white paper…

[ad_2]

Source link