[ad_1]

Let’s face it, Seattle isn’t about to land itself on any hottest lists of reasonably priced locations to take a position any time quickly. However an absence of bargains doesn’t imply that there aren’t alternatives available. For individuals who personal Seattle property or discover a appropriate funding on this space, properties entice excessive common rents and alternatives for constant returns and appreciation. With single-family properties having fun with comparable returns to the inventory market with out the identical stage of volatility, secure “Tier 1” markets like Seattle might be a lovely choice in your portfolio.

Late final yr, Redfin reported that Seattle was the fastest-cooling market within the U.S. As an already costly metropolis to purchase into, the additional warmth available in the market turned out to be unsustainable as rates of interest and inflation started to chew on giant mortgages. The excellent news is that extra bargaining energy was lastly obtainable to those who do have the capital to get into the Emerald Metropolis.

So does it make sense to attempt to spend money on Seattle in 2023? BiggerPockets has teamed up with Belong to deliver you a snapshot of the Seattle rental market. Belong is a contemporary various to property administration corporations that’s humanizing the rental expertise and making it simpler for particular person householders to handle actual property investments in standard cities like Seattle and San Francisco.

Solely you already know your monetary state of affairs and what you possibly can tackle, so this report is designed to help your analysis with a sign of common rents and the present state of the rental market in Seattle, together with:

- Are Seattle’s cooling actual property costs sufficient to decrease the obstacles to entry?

- How does the median worth of properties in Seattle examine to comparable Tier 1 cities?

- What sort of rental revenue can I count on from a property in Seattle?

- When is the perfect time to record a Seattle rental to attain the very best charge?

- Will the tech downturn have an effect on actual property in Seattle? What are the opposite macroeconomic elements to contemplate?

Are Seattle’s Cooling Actual Property Costs Sufficient to Decrease the Boundaries to Entry?

Like most Tier 1 markets, investing in Seattle might be difficult attributable to excessive entry prices, particularly for these needing a mortgage. That is why the market is cooling, with debt costing twice as a lot as lately. A worth discount in a sizzling space ought to be a trigger for celebration for would-be buyers, however not on this occasion. Even a 5% drop in costs isn’t going to make the world extra reasonably priced if you’ll want to take out a mortgage at a 6% – 7% rate of interest.

Moreover, demand exceeds provide, making Seattle a vendor’s market with low stock. Owners with good fastened rates of interest are unlikely to promote except vital.

How Do Median Costs in Seattle Evaluate to Different Tier 1 Cities?

In response to realtor.com, the Median Itemizing Residence Worth in Seattle is $780,000, with the Median Sale Worth of $750,000. Most properties are promoting for near ask, indicating a vendor’s market.

If you happen to have a look at different Tier 1 west coast cities like San Francisco, the Median Itemizing Residence Worth is $1.3M, some $520k larger than Seattle.

Though Seattle might not provide a fast revenue, it’s a viable choice for buyers who can’t afford different Tier 1 cities. With secure renter demand and long-term development potential, proudly owning a house in Seattle might be worthwhile, however much less so for short-term money circulation.

What Form of Rental Revenue Can I Anticipate in Seattle?

The ROI and money circulation of a Seattle property will depend on mortgage bills, appreciation, and tax advantages. Regardless of current fluctuations because of the pandemic, Seattle properties have usually appreciated very properly over time.

In response to NeighborhoodScout, Seattle actual property has appreciated by 137% over the previous 10 years, with a median annual dwelling appreciation charge of between 5.69% and 9.02%, inserting Seattle within the 10% for appreciation within the U.S.

With rates of interest nonetheless climbing on the time of publication and a few areas hotter than others when it comes to demand, you will have to run a brand new money circulation evaluation on any rental property or potential buy to get an correct view of your ROI. Beneath we’ve compiled some averages throughout the Seattle metro space to get an understanding of what you may count on to see.

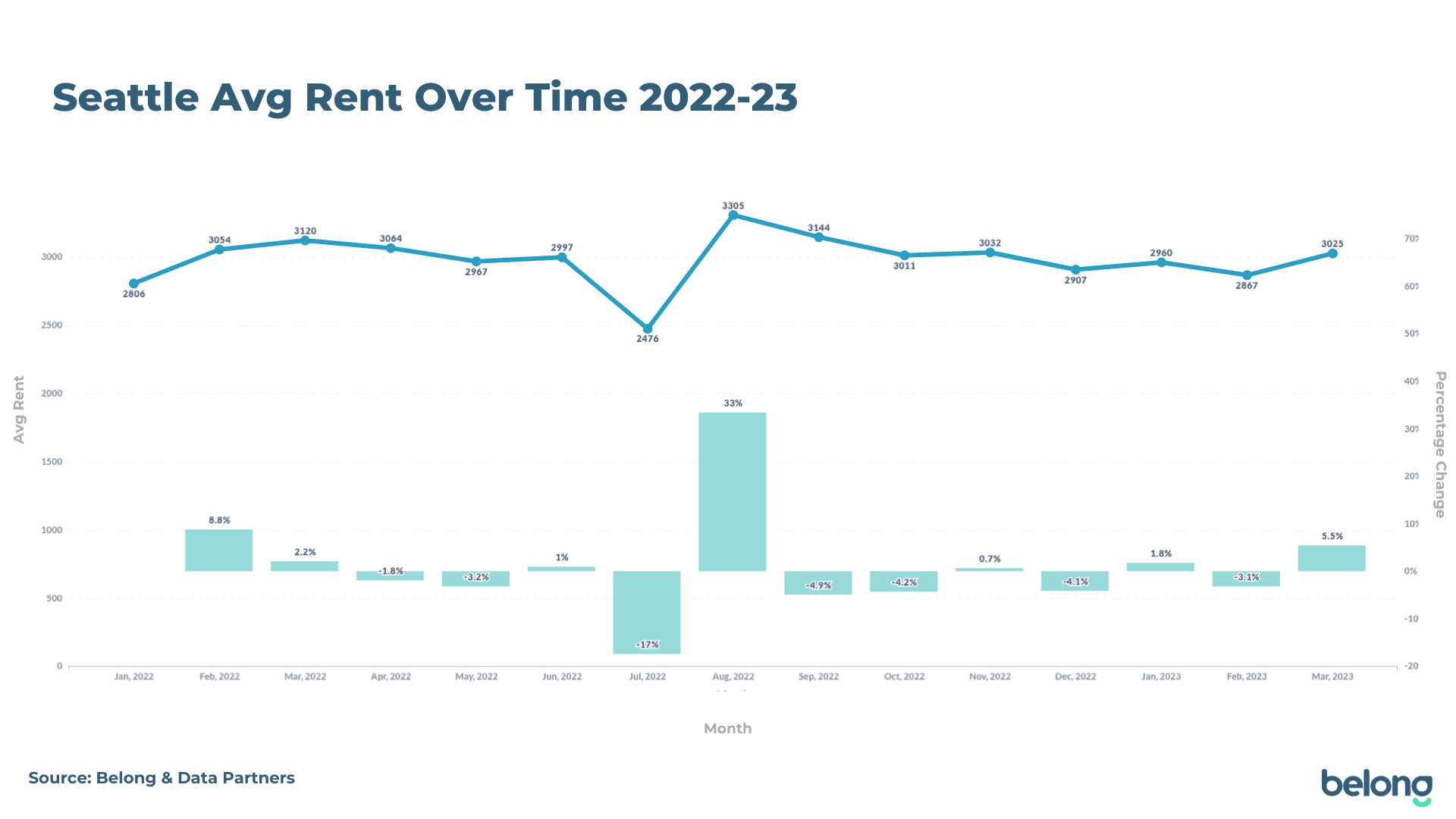

Belong, who companions with house owners of single-family properties, flats, and condos, has seen common rental charges between $2,476-$3,305/month for the Seattle market during the last 12 months.

How does this examine to different Tier 1 markets? San Francisco once more, single-family properties and condos on the Belong Bay Space community lease for a median of $3,754. When you think about that the common worth of a house in S.F. is round $520,000 larger than in Seattle, it highlights the favorable cap charges and potential for a powerful return on funding. Within the Bay Space, you’ll be hard-pressed to discover a neighborhood with SFHs that common for lower than 1,000,000 {dollars}, whereas Seattle nonetheless has cheaper entry factors across the $500k – $600k mark.

In response to Belong associate, Zumper, median rents are up 6.2% YoY in March 2023, trending up from final month. The breakdown by housing sort is:

- Studio: $1,477 (+14% YoY)

- 1-Bed room: $2,021 (+7% YoY)

- 2-Bed room: $2,795 (+4% YoY)

- 3-Bed room: $3,330 (+0% YoY)

- 4-Bed room: $3,700 (+6% YoY)

In response to the most recent U.S. Census information for This autumn 2022, rental emptiness charges within the Seattle/Tacoma/Bellevue space are sitting at 4.7%, down from 5.7% in Q1. That is according to neighboring cities of Portland/Vancouver/Hillsboro, with a emptiness charge of 4.8%, down from a excessive 6.1% in Q1.

When is the Greatest Time to Checklist a Seattle Rental?

Like most cities alongside the west coast, Seattle rental costs are seasonal. Because the chaos of the pandemic cools off, we’re seeing a return to peaks and troughs of seasonal pricing that weren’t skilled in the course of the up-and-up lease climbs.

Whereas Seattle is known for its rain, it’s additionally famed for its unbelievable out of doors life-style and walkability, which sees a peak in demand throughout summer time when there’s loads of sunshine and blue skies. Seattle enjoys the identical peak in rental pricing round August that we witness in different Tier 1 markets throughout California. In actual fact, August is the perfect time to draw prime greenback in your property in Seattle, based on Belong information (pictured under), with the common lease peaking at $3305. Seattle can also be dwelling to many fascinating faculty districts, so bigger household leases in these areas entice sizzling competitors and rents within the lead-up to Semester 1 in September.

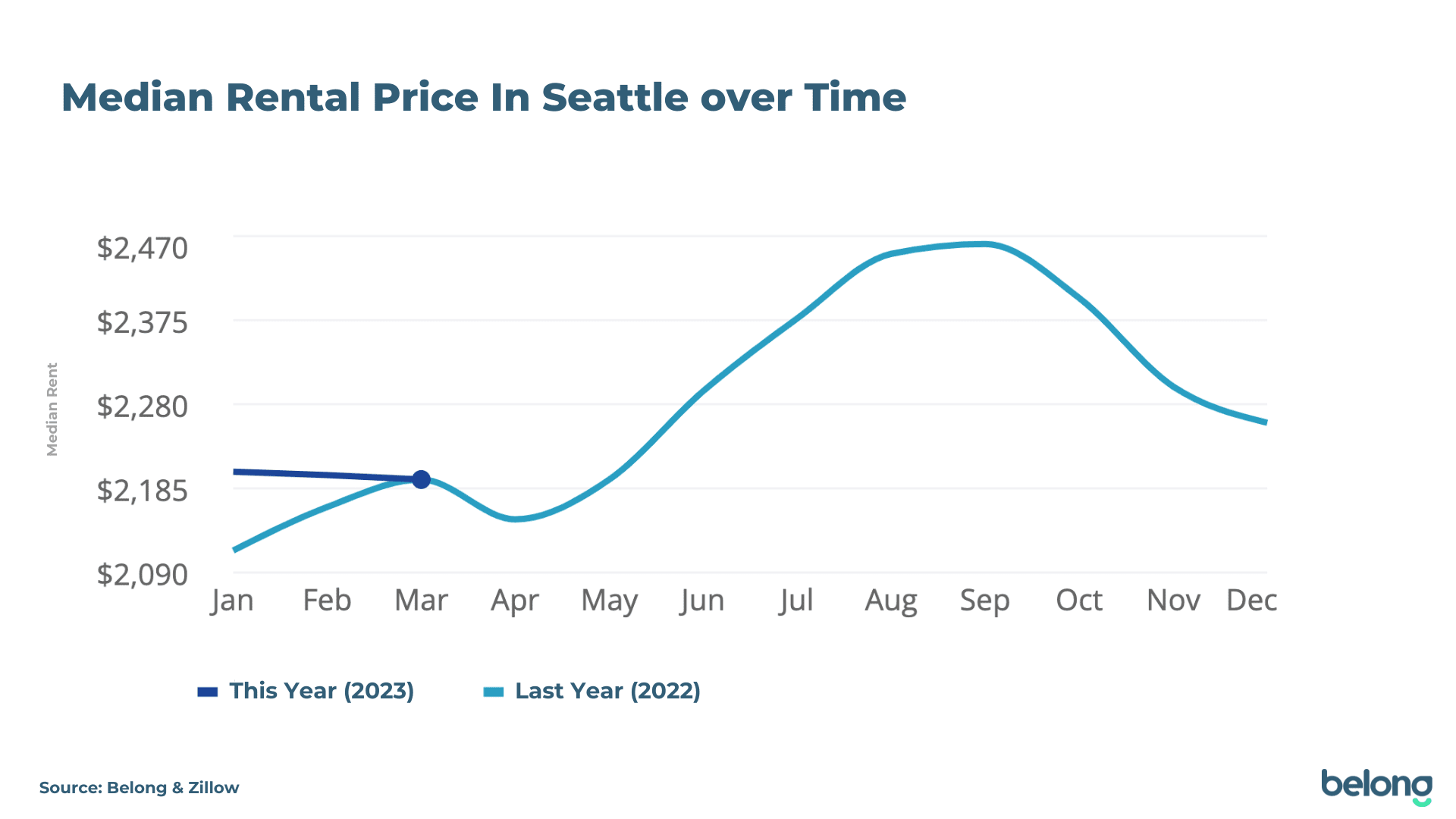

Evaluating Belong’s information to a wider information supply akin to Zillow (which incorporates multifamily and flats of their numbers), their market developments present the identical peak in Summer time, with common rents peaking between $2,450-$2,461 within the August/September interval.

That’s to not say that buyers renting out a Seattle dwelling in winter will take an enormous hit. At the same time as the common charge dips seasonally, Belong householders nonetheless get a median month-to-month charge of $2,500-$3,000 throughout low months like December.

March can also be a powerful month for rents, and if this pattern continues, rents will stay secure earlier than peaking in August. If you happen to plan to enter the market, you will have time to organize and profit from larger costs in a number of months.

What are the Different Macroeconomic Elements to Think about?

Rates of interest apart, what different macro elements ought to be thought of earlier than investing within the Seattle metro space?

The Seattle metro is:

- One of many prime 5 cities for family revenue.

- A metropolis with a low unemployment charge however is experiencing nervousness round layoffs.

- Being hit tougher by inflation, with charges larger than the nationwide common.

- Nonetheless experiencing low charges of mortgage delinquency and foreclosures.

- Investing in transportation to shut gaps and enhance accessibility.

Seattle is an prosperous space, with residents incomes a median family revenue of $105,391, based on the most recent Census information. This ranks the town fourth among the many 100 largest metro areas within the U.S.

That is largely fuelled by a profitable job market. If you happen to have a look at the Redmond space, median revenue jumps to $147,006—unsurprisingly, given it’s the place Microsoft is headquartered. It’s arduous to take a look at macro elements influencing the Seattle actual property market with out discussing the present tech downturn. May {industry} layoffs put strain on householders or result in distressed stock available on the market?

Microsoft, Amazon, Meta, Salesforce, and Google have all made employment cuts affecting Washington-based workforces. In actual fact, Seattle is claimed to have a few of the highest layoff nervousness. However whereas tech has pushed a lot of Seattle’s development lately, the native economic system isn’t susceptible to this {industry} alone.

U.S. Information just lately examined the Seattle unemployment developments and located that the speed of unemployment in Seattle is decrease than the nationwide common and that the speed of foreclosures stays low. Only one.5% of mortgages are reported to be delinquent within the metro space, and 0.1% have lively foreclosures filings.

The Financial and Income Forecast Council launched their March 2023 outcomes, stating that whereas the general unemployment charge started to rise sooner than anticipated in 2022, employment additionally elevated by 16,300 in November and December—3,800 greater than forecasted. Additionally they famous that client worth inflation within the Seattle metro space continued to exceed the nationwide common within the yr ending in February 2023, including to the price of residing strain for residents.

For current landlords, this excessive inflation, layoff nervousness, and uncertainty available in the market might trigger staff within the {industry} to postpone making an attempt to purchase a house and lease for longer. Seattle is already dwelling to extra renters than owner-occupiers, sitting at 55% renter-occupied within the final Census. For these searching for an in, these layoffs haven’t but created a flood of distressed housing inventory available on the market. That will change if financial circumstances worsen, nevertheless it’s price noting that the tech {industry} usually employs expert staff and offers beneficiant exit packages, which softens the blow to the native economic system.

One other notable issue is transportation. The SoundTransit system growth will see improved accessibility throughout Seattle, impacting the worth of native actual property because it turns into simpler for folks to get into the town. Investing in actual property in these areas (akin to Lynnwood, Shoreline, Everett, and Marysville, for instance) earlier than the transit system is accomplished might present a decrease entry level with a possibility for larger lease and residential appreciation over time as entry to facilities improves. ??

How Actual Property Traders Can Hold a Pulse on the Seattle Rental Market

Whether or not you’re new to the true property investing sport, coping with a problematic property administration firm, or burnt out on self-managing your rental dwelling, BiggerPockets, and Belong may help.

From ebooks to podcasts, BiggerPockets presents academic sources for each stage of actual property funding expertise and technique. With regards to managing your private home, Belong shouldn’t be a property administration firm however a residential community providing industry-leading companies to each householders and their residents.

From not charging hidden charges for the necessities to industry-first fintech options to handle your money circulation extra successfully, to guaranteeing lease, Belong will associate with you to make proudly owning a rental property price it. And also you’ll by no means must raise a finger. Study extra and discover out if your private home is eligible (even if you happen to’re mid-lease!) right here!

This text is introduced by Belong

Personal a rental property? Say goodbye to property administration and hiya to Belong. Belong brings end-to-end dwelling administration companies to your fingertips.

Get pleasure from assured rental funds, vetted residents who love your private home the best way you do, 24/7 help for you and your residents, revolutionary money circulation options, an industry-leading cellular app, and maximized rental worth.

With Belong, you possibly can create long-term wealth whereas incomes passive revenue.

Notice By BiggerPockets: These are opinions written by the creator and don’t essentially characterize the opinions of BiggerPockets.

[ad_2]

Source link