katleho Seisa/E+ through Getty Photographs

Introduction

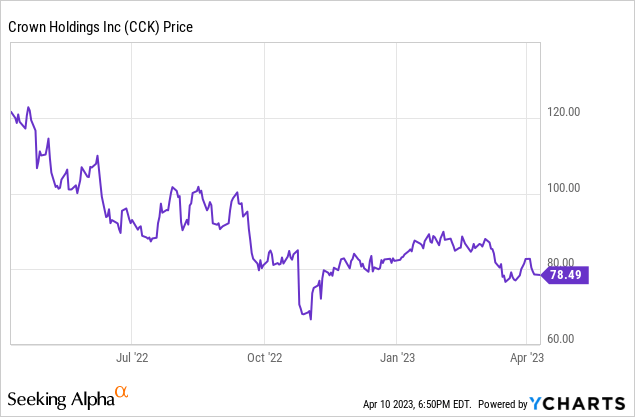

Crown Holdings (NYSE:CCK) is a big producer of aluminum beverage cans. Your complete sector has been hit arduous because the manufacturing capability enlargement wasn’t absorbed as quick as anticipated. The expansion investments ought to now be accomplished and this 12 months would be the final 12 months the place Crown Holdings has to spend a considerable amount of money on its progress initiatives. The corporate has guided for a forty five% capex discount in 2024 and that can enable the market to appreciate Crown Holdings is a money cow in disguise.

2022 was okay, 2023 will likely be a lot better

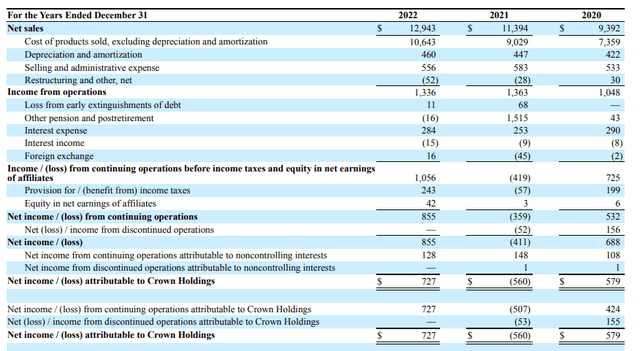

Crown Holdings reported a complete income of slightly below $13B in 2022 and because the firm was unable to move via all value will increase to its prospects, the working earnings decreased by about 2% to $1.34B. That is primarily attributable to a 18% enhance within the COGS as many of the different bills remained fairly secure and even barely decreased once more.

Crown Holdings Investor Relations

Whereas the curiosity bills elevated once more, Crown’s pre-tax earnings results of $1.06B and web earnings of $855M was fairly first rate. You’ll be able to’t actually examine it to the $411M web loss recorded in 2021 as the corporate recorded a $1.52B non-recurring cost but it surely compares fairly effectively to the $688M in reported web earnings in 2020.

After deducting the $128M of web earnings attributable to non-controlling pursuits, the online earnings attributable to Crown’s personal shareholders was $727M which equates an EPS of $6.01.

As Crown may very well be seen as an ‘industrial’ participant with comparatively low sustaining capex (this doesn’t imply the sustaining capex is minimal, but it surely does imply that when a brand new plant has been constructed, this sunk value will likely be depreciated whereas the continuing upkeep capital expenditures are considerably decrease than the depreciation bills), I feel the money circulate results of Crown is not less than equally and maybe even extra essential than the earnings assertion.

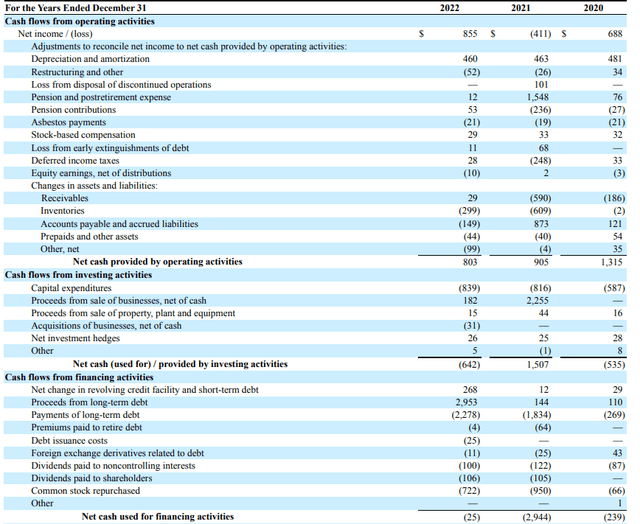

The reported working money circulate in 2022 was roughly $803M. This features a web capex funding of roughly $570M but it surely additionally excludes the $100M in money funds to non-controlling shareholders. This implies the underlying working money circulate was roughly $1.27B.

The overall capex was simply $839M leading to a web free money circulate of $430M which is roughly $3.5/share.

Crown Holdings Investor Relations

Take note the reported capex remains to be nearly 100% increased than the depreciation and amortization bills and the full capex ought to begin to drop this 12 months as many of the progress investments have now been accomplished. On the FY 2022 convention name, Crown’s administration commented the full capex will drop to simply round $500M from 2024 on. Whereas that’s nonetheless barely increased than the present depreciation bills it’s going to enable ‘the market’ to see a a lot increased reported free money circulate consequence.

Which means if I’d use a complete capex of $500M going ahead (I anticipate this to be round $400M in sustaining capex and $100M in miscellaneous progress and enchancment initiatives), the underlying free money circulate results of Crown Holdings could be round $770M in 2022. That is in extra of $6/share.

However there’s extra.

In 2023, Crown Holdings expects its gross sales volumes to extend by a mid-single digit proportion and this, together with increased costs, ought to lead to a considerable income enhance and a 8-12% EBITDA enhance.

That will be fairly spectacular. The adjusted EBITDA in 2022 got here in at $1.74B and a ten% enhance (the midpoint of the steering vary) would peg the anticipated 2023 EBITDA at $1.9B. The corporate additionally talked about it expects a free money circulate results of $500M after taking $900M in capex into consideration this 12 months. This additionally means the online free money circulate consequence will enhance in direction of $900M in 2024 when the full capex degree decreases farther from $900M to $500M. So even in my most conservative state of affairs and after taking the affect of non-controlling pursuits into consideration, I nonetheless anticipate a web free money circulate results of $6.50 per share in 2024 (excluding modifications within the working capital place). This consists of smaller progress investments and I estimate the underlying sustaining free money circulate to be nearer to $7.5/share utilizing the present share rely of 120M shares excellent.

Funding thesis

Surprisingly, Crown Holdings is catching as much as Ball Company (BALL). The income of each firms is sort of comparable and Crown’s EBITDA in 2022 got here fairly near Ball’s adjusted EBITDA. As of the tip of 2022, Crown had about $550M in money and $7B in web debt leading to a complete enterprise worth of roughly $16B for an EV/EBITDA a number of of simply round 8.5. As we are able to count on Crown Holdings to additional scale back its web debt in direction of $6B by the tip of 2024 whereas the EBITDA ought to enhance to in extra of $2B, I now anticipate Crown Holdings to commerce at an EBITDA a number of of simply 7.5 by the tip of subsequent 12 months whereas the debt ratio ought to lower to simply below 3.

The mix of all these parts makes Crown Holdings a purchase and I will likely be trying to set up an extended place quickly. I’ve written put choices on Crown up to now (and attributable to a liquidity crunch in my portfolio I bought my lengthy place and changed that with within the cash put choices) and can doubtless proceed to take action.