[ad_1]

It’s the massive Tesla query: Are you a bull or a bear?

The inventory fell greater than 10% final week.

The corporate slashed costs on its electrical autos (EVs), and now not too long ago raised costs on its luxurious fashions (Mannequin S and Mannequin X).

However ARK Make investments’s Cathie Wooden simply introduced her new TSLA worth goal: $2,000 by 2027 — 10X.

So what’s our outlook for the world’s largest EV maker? [See it here: 1:15]

One factor is definite.

On this world of Alexa units, ChatGPT, self-driving semitrucks, and robo-taxis— synthetic intelligence and automation are usually not simply the long run.

It’s the current. And the funding potential is HUGE.

There’s not only one path to positive aspects. There are various.

That’s why we’re sharing considered one of our high exchange-traded funds (ETFs) you should buy in the present day.

However if you would like extra direct publicity, I’m recommending a brand new inventory for the autonomous car revolution within the subsequent version of our Strategic Fortunes e-newsletter. Should you’re not a subscriber, discover out how one can get the inventory ticker right here.

In At this time’s Video:

Amber Lancaster and I are masking:

- Tech Information: Autonomous vehicles. How self-driving expertise is accelerating in the present day. [5:00]

- Demo This: Tradesmith helps us observe shares in our portfolios with commerce stops. Watch this evaluation on Tesla (Nasdaq: TSLA). [13:40]

- World of Crypto: Are cryptocurrency and blockchain expertise too sophisticated to be mainstream? [14:50] And for crypto rookies: The place must you open an account to begin buying and selling? [27:00]

- Mega Development: Inside 10 years, a brand new report says autonomous vehicles will likely be mainstream. [27:30]

- Funding Alternative: We advocate this ETF if you wish to faucet into the AI and robotics pattern! [29:50]

(Or learn the transcript right here.)

What Do You Assume About Tesla?

Should you’re into EVs like we’re, are you bullish or bearish concerning the inventory? Tell us!

Ship us an electronic mail at BanyanEdge@BanyanHill.com.

See you quickly,

Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

My chat with Ian yesterday on The Banyan Edge Podcast acquired me pondering.

China actually is screwed.

And it’s not one thing that may be mounted with small tweaks to authorities coverage. As I stated, the nation misplaced 850,000 individuals final yr. The United Nations’ projections present China’s inhabitants shrinking by 100 million to 200 million by 2050, which is lower than 30 years from now.

That’s the equal of a rustic the dimensions of Mexico simply … disappearing.

Not solely is their inhabitants shrinking, however those who stay are getting older. The common age of a China citizen in 2050 is projected to be over 50, up from about 38 in the present day.

I touched on what this implies for China’s labor market with Ian within the podcast. (Spoiler alert: It means a large funding in robotics automation and synthetic intelligence.)

However in the present day, I’m extra within the implications for shopper spending.

Should you’re Apple, Nike or Starbucks, China’s progress market is over. Over the following 30 years, you’ll have fewer and fewer individuals to promote iPhones, Air Jordans or frappuccinos to.

How do you intend for one thing like that? How do you justify constructing workplace buildings or residences, and even primary infrastructure like colleges or roads … if there will likely be fewer individuals utilizing it yr after yr?

Extra essentially, how do you develop your financial system?

The brief reply is: you don’t.

Take into account the case of China’s neighbor, Japan.

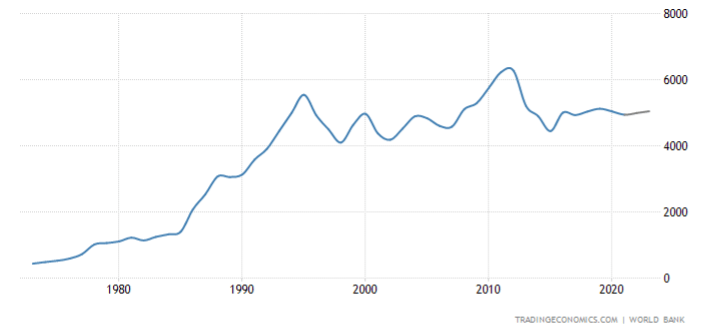

Japan’s Actual GDP In U.S. {Dollars}

Japan hasn’t had significant or sustained financial progress because the mid-Nineties. Japan’s financial system has been stagnant since Invoice Clinton was nonetheless in his first presidential time period and Pals was in its second season.

As for the “why,” inform me if this sounds acquainted. Japan had an enormous actual property constructing spree that went bust simply as Japan’s inhabitants began to quickly age within the Nineties. (Due partly to Japan’s excessive residing requirements, the inhabitants didn’t truly begin to decline till 2008.)

When you’re in your 50s, you in all probability already personal the most important and most costly home you’ll ever personal, and also you’ve already crammed it stuffed with furnishings and home equipment. You’ve already purchased all of the issues that folks have a tendency to purchase on credit score, and also you’ve shifted your focus to saving for retirement.

At this time, Japan is estimated to have over 10 million deserted homes. These are properties that the house owners gave up on making an attempt to promote as a result of the patrons merely don’t exist. They had been by no means born.

In fact, each disaster is a chance. And China’s shrinkage will probably be offset by progress in India and different rising markets with youthful populations.

We’re already seeing firms transfer with their toes. As I discussed in Saturday’s Weekly Recap, Apple simply opened its first shops in India. You’ll be able to guess there will likely be extra coming.

So in case you loved Ian and Amber’s video on the huge autonomous car pattern (and how one can spend money on it), ensure you tune in to tomorrow’s Banyan Edge for an additional nice funding alternative.

Charles Mizrahi goes to indicate you learn how to discover 200%+ winners like one of many shares in his microcap portfolio.

And that’s just the start…

As a result of he says one choice can flip right into a billion-dollar transfer for a corporation. And it could actually change your life perpetually.

Charles instructed me:

I’ve discovered the one firm I’m satisfied will likely be making the following billion-dollar transfer.

It’s a small power firm — and the CEO has made a daring choice that now permits his firm to generate as much as 5X more cash from their power than others can get from theirs.

And the kicker?

It’s buying and selling for lower than $5 a share.

I’m sharing all the main points in my new occasion — “The Subsequent Billion-Greenback Transfer.”

I simply completed watching it and belief me … you do not need to overlook this. Click on right here to observe it now (and see learn how to unlock that $5 inventory earlier than it strikes larger.)

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link