[ad_1]

Historically, constructing homeowners have relied on a mixture of surveyors, architects, and engineers to develop blueprints and detailed plans to know their buildings and their usable house, integrating little or no expertise into the method. Built-in Initiatives Trade (IPX) combines 3D scans with software-enhanced insights to allow actual property homeowners to develop correct digital depictions of buildings that present an unprecedented degree of element at a fraction of the associated fee and time. This spatial intelligence is effective not just for constructing homeowners and design professionals to do issues like develop renovation plans, supplies provisioning and planning, and use house effectively however it’s more and more changing into extra crucial for understanding environmental footprint. The corporate has partnered with main 3D scanning firms like Matterport and Sitescape FARO to supply worldwide protection for constructing homeowners; presently IPX can serve 6 buildings per day. With this extra funding, the corporate plans to increase capability to 60 buildings per day.

AlleyWatch caught up with Built-in Initiatives Founder and CEO Jose Cruz Jr to study extra in regards to the enterprise, the corporate’s strategic plans, latest spherical of funding, and far, way more…

Who had been your traders and the way a lot did you increase?

This was a $3M spherical in seed funding. The seed spherical is led by 186 Ventures with participation from Founder Collective, Connexa Capital, and 4 Acres Capital, together with investments from main actual property executives and institutional landlords together with The Fallon Firm, Atlantic Administration, JLL, and Newmark.

Inform us in regards to the services or products that Built-in Initiatives presents.

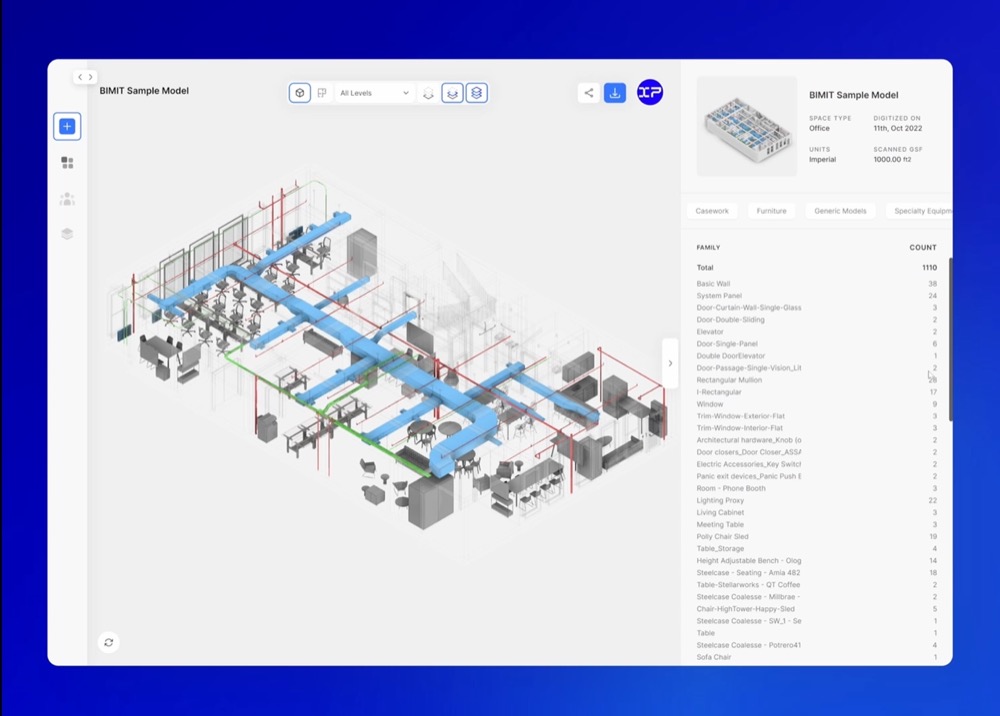

Built-in Initiatives Trade (IPX) is a digitization platform for constructing homeowners and design professionals. By means of IPX, prospects can convey their constructing on-line—with unprecedented accuracy—by requesting a 3D seize of their constructing.

This on-demand digitization service presents customers varied advantages that span throughout a constructing’s lifecycle from acquisitions, to design, to procurement, to services, and advertising and marketing. On IPX, customers can immediately view, share, obtain, report, and quantify their house from any browser.

What impressed the beginning of Built-in Initiatives?

All through my profession, I’ve had the possibility to sit down throughout completely different sides of the actual property desk:

All through my profession, I’ve had the possibility to sit down throughout completely different sides of the actual property desk:

First, as an architect, then as a development supervisor, and later as an Proprietor’s Consultant. Whereas engaged on completely different sides of the desk, it turned painfully clear that we had been constructing with dangerous constructing info. This precipitated costly errors within the areas that we constructed: from the budgets we didn’t hit, to the renovation timelines.

Tangentially, there’s been a wave of proptech constructed during the last decade centered on software program—however no innovation on the hands-on companies that it takes to seize good info on buildings.

IPX sits on the intersection of software program and progressive companies.

How is Built-in Initiatives completely different?

We’re within the enterprise of changing atoms to bits—precisely. This implies IPX is a digital proxy for filth, brick, and mortar. By definition, software program alone can’t remedy the problem of precisely measuring a bodily house. We’d like a mixture of companies and software program. In the identical means Amazon has an interface from which you’ll order your shampoo and, within the background, there’s a whole success course of devoted to transferring that shampoo from level A to level B. In the identical means, IPX serves as an interface from which homeowners can digitize their constructing by mobilizing a whole success course of to finally convey their buildings on-line.

What market does Built-in Initiatives goal and the way large is it?

Our market: present buildings. It turns on the market are about 1.6 billion distinctive buildings the world over. For context, there are nearly as many buildings as there are complete web sites (as of 2022).

Current buildings are public enemy primary, contributing greater than 40 % of world CO2 emissions—they usually additionally characterize the most important asset class on this planet. In cities like New York, buildings characterize a good greater CO2 ratio, upwards of 70 %.

To curb this, constructing homeowners have essentially the most direct company to enhance their very own bodily property—whereas additionally eliminating CO2 from the atmosphere. However they’ll’t do it alone. They want the assistance of others.

So whereas constructing homeowners characterize our core buyer phase, we’re constructing companies for architects, engineers, product firms, and public companies additionally working to facilitate the advance of buildings.

What’s your enterprise mannequin?

Our enterprise mannequin is on-demand. It’s centered round worth transparency, timeliness, and standardization.

As constructing homeowners have to 3D scan their buildings—we’re a 10X extra reasonably priced different versus them having to pay a mixture of surveyors, architects, and engineers to easily doc their constructing.

How are you making ready for a possible financial slowdown?

If COVID taught us something as a enterprise, it taught us to not underestimate how rapidly issues can change. In these moments of uncertainty, money is oxygen.

Each CEO have to be taking a multi-faceted strategy to the looming financial slowdown:

- Create a money runway for a number of months of uncertainty. Even for those who’re rising and worthwhile now, assume the quantity of labor might lower as a consequence of an affect in your prospects.

- Discuss to your prospects. It’s doubtless they’re feeling pains within the financial slowdown and might have you to regulate to their wants.

- Stay lean. For a traditionally bootstrapped firm like us, doing lots with a bit of is a part of our DNA. That being mentioned, for firms used to lavish perks and easily throwing our bodies at an issue—there’ll doubtless be a impolite awakening.

What was the funding course of like?

Earlier than going by way of the fundraising course of, I promised myself that earlier than elevating a single penny from traders, we, the Built-in Initiatives workforce, would first show to ourselves a few of the enterprise fundamentals:

- That individuals actually need our companies

- That individuals would actually pay us

- That individuals have a recurring want

- That the issue is sufficiently big to go world

That we are able to function with excessive sufficient margins to sustainable scale with out a lot capital.

In our case, it took about 5 years to search out the fitting mixtures of levers. It seems, while you determine these levers out earlier than elevating—the fundraising course of takes care of itself. Our seed spherical took about three months from begin to end. On this financial atmosphere, I’d say that could be a large success.

What are the largest challenges that you just confronted whereas elevating capital?

As a founder, you need to develop relationships with traders early.

Don’t wait to get intros to traders and lenders till the second you want it. Wanting again, that is one thing I might have performed significantly better. You by no means need to meet somebody for the primary time and ask them for cash, it isn’t a very good look. Maybe we might have closed even sooner had I developed relationships forward of our increase.

Fortunately, we had been producing worthwhile income forward of our seed increase. This meant, even when we failed to boost capital, we had been already creating our personal money runway. This necessary truth allowed me to sleep at evening in the course of the fundraising course of.

What elements about your enterprise led your traders to put in writing the verify?

Backside line: we’ve constructed a worthwhile, scalable enterprise in a big, new market with repeat prospects.

Our bootstrapped workforce has paid shut consideration to the unit economics of our operations, discovering methods to systemize at each flip, and including worth to our prospects—out of necessity.

What recommendation are you able to supply firms in New York that would not have a recent injection of capital within the financial institution?

A money injection will merely spotlight the nice and dangerous a couple of enterprise. Elevating cash received’t remedy any of your core challenges.

From my expertise, it’s higher to rejoice a buyer paying you $1, and reinvesting 70 % of that greenback, than celebrating a money injection from traders.

The place do you see the corporate going now over the close to time period?

Our complete focus is increasing IPX’s present digitization capability from 6 to 60 buildings a day.

With a plethora of commuting choices within the metropolis, how do you sometimes get to work every day?

Our operation is totally distant given our companies are round the clock. We’ve constructed a decentralized workforce spanning eight time zones.

Personally, it actually is determined by the day. I’m an introvert residing in New York Metropolis. Naturally, I favor an remoted atmosphere to carry out my greatest work, however I prefer to be inside the motion to expertise our landlord prospects’ ache factors.

For the sake of the workforce, particular initiatives, and purchasers, nothing beats in-person work periods. I discover myself taking the subway to the Chelsea neighborhood in Manhattan. It tends to be a central spot to satisfy purchasers and workforce members.

You’re seconds away from signing up for the most well liked listing in Tech!

Enroll in the present day

[ad_2]

Source link