dk_photos

Earnings of Bridgewater Bancshares, Inc. (NASDAQ:BWB) will likely decline this 12 months on account of stress on the web curiosity margin. I’m anticipating the corporate to report earnings of $1.35 per share for 2023, down 22% year-over-year. In comparison with my final report on the corporate, I’ve lowered my earnings estimate as a result of I’ve slashed my internet curiosity margin estimate. The year-end goal value suggests a small upside from the present market value. Therefore, I’m downgrading Bridgewater Bancshares inventory to a Maintain ranking.

Additional Mortgage Development Deceleration Anticipated

Bridgewater Bancshares’ mortgage development slid to three.2% within the first quarter from 5.6% within the fourth quarter of 2022. The administration expects additional slowdown because it talked about within the earnings presentation that it’s anticipating a high-single-digit to low-double-digit mortgage development in 2023. This goal appears cheap as a result of the deposit e-book is beneath stress because of the Fed’s financial tightening. Bridgewater Bancshares’ deposit e-book dipped by 0.2% over the last quarter, although not the entire discount was attributable to the financial tightening. The administration talked about within the convention name that the deposits additionally declined due to seasonal outflows. The administration additionally talked about that it was selective about lending in the course of the first quarter in order to raised align mortgage development with the funding outlook. Because of this technique, I’m anticipating the stress on the deposit facet to proceed to have an effect on mortgage development within the upcoming quarters.

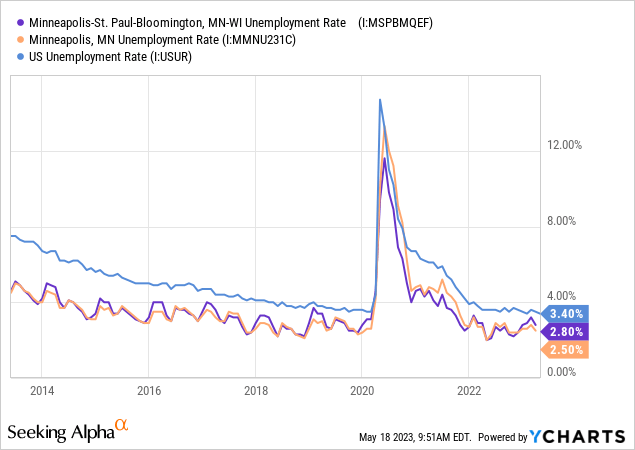

On the plus facet, regional financial elements bode nicely for mortgage development. Bridgewater Bancshares operates within the twin cities (Minneapolis and Saint Paul) space of Minnesota. This area has traditionally loved a really low unemployment price in comparison with the nationwide common, as proven beneath.

Because of the robust native job markets, I’m optimistic about development in Bridgewater Bancshares’ primary focus space of multifamily real-estate loans.

Contemplating these elements, I’m anticipating the mortgage portfolio to develop by 9.5% and the deposit e-book to extend by 4.4% in 2023. The next desk exhibits my stability sheet estimates.

| Monetary Place | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Internet Loans | 1,640 | 1,884 | 2,282 | 2,770 | 3,512 | 3,847 |

| Development of Internet Loans | 23.7% | 14.9% | 21.1% | 21.4% | 26.8% | 9.5% |

| Different Incomes Belongings | 257 | 293 | 393 | 441 | 550 | 569 |

| Deposits | 1,561 | 1,823 | 2,502 | 2,946 | 3,417 | 3,567 |

| Borrowings and Sub-Debt | 182 | 174 | 142 | 135 | 477 | 771 |

| Widespread fairness | 221 | 245 | 265 | 313 | 328 | 363 |

| Ebook Worth Per Share ($) | 7.5 | 8.2 | 9.1 | 10.8 | 11.4 | 12.7 |

| Tangible BVPS ($) | 7.4 | 8.0 | 9.0 | 10.7 | 11.3 | 12.6 |

| Supply: SEC Filings, Earnings Releases, Creator’s Estimates (In USD million until in any other case specified) | ||||||

Additional Stress on the Internet Curiosity Margin Forward

Bridgewater Bancshares’ internet curiosity margin plunged by 44 foundation factors within the first quarter of 2023, which was worse than my expectations. Additional, the deposit combine continued to deteriorate within the first quarter as deposits migrated from non-interest-bearing accounts into interest-bearing accounts. The proportion of non-interest-bearing deposits in complete deposits dropped to 21.8% by the tip of March 2023 from 25.9% on the finish of December 2022.

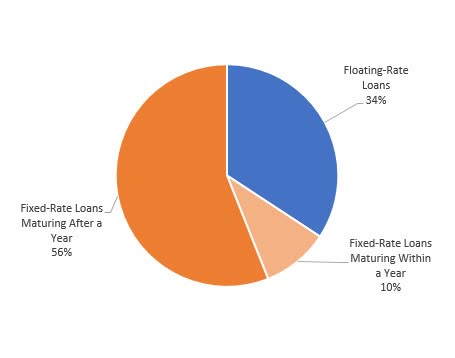

The opposite facet of the stability sheet can also be not favorably positioned for a rising price surroundings. A majority of the loans is not going to reprice this 12 months, as will be seen within the mortgage combine chart beneath.

1Q 2023 10-Q Submitting

Furthermore, Bridgewater Bancshares has a large securities portfolio with a median period of 5.3 years. Subsequently, solely a small portion of this portfolio will be anticipated to reprice this 12 months. Securities made up 13% of complete incomes property on the finish of March 2023.

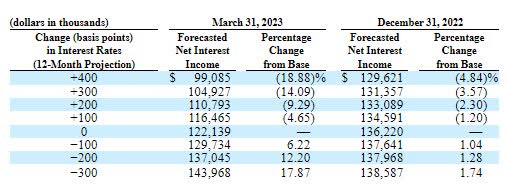

The outcomes of the administration’s price sensitivity evaluation given within the 10-Q submitting present {that a} 200-basis factors hike in charges might lower the web curiosity revenue by 9.29% over twelve months.

1Q 2023 10-Q Submitting

I’m anticipating an additional 25 foundation level hike within the fed funds price in June. For the second half of this 12 months, I’m anticipating rates of interest to stay unchanged. Contemplating these elements, I am anticipating the margin to say no by a cumulative ten foundation factors within the second and third quarters earlier than stabilizing within the fourth quarter of 2023. In comparison with my final report on the corporate, I’ve lowered my internet curiosity margin estimate partly due to the primary quarter’s disappointing efficiency. Additional, the deposit combine has already worsened greater than I anticipated, which has compelled me to scale back my estimate.

Anticipating Earnings to Plunge by 22%

The stress on the margin will play a key function in an earnings decline this 12 months. Then again, mortgage development will assist earnings. Additional, expense management efforts will assist the earnings. Bills fell in the course of the first quarter because the administration tightened management on its discretionary spending, in accordance with particulars given within the convention name.

Total, I’m anticipating Bridgewater Bancshares to report earnings of $1.35 per share for 2023, down 22% year-over-year. The next desk exhibits my revenue assertion estimates.

| Revenue Assertion | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Internet curiosity revenue | 65 | 74 | 88 | 110 | 130 | 114 |

| Provision for mortgage losses | 4 | 3 | 13 | 5 | 8 | 9 |

| Non-interest revenue | 3 | 4 | 6 | 5 | 6 | 8 |

| Non-interest expense | 32 | 37 | 45 | 48 | 57 | 56 |

| Internet revenue – Widespread Sh. | 27 | 31 | 27 | 45 | 49 | 38 |

| EPS – Diluted ($) | 0.91 | 1.05 | 0.93 | 1.54 | 1.72 | 1.35 |

| Supply: SEC Filings, Earnings Releases, Creator’s Estimates (In USD million until in any other case specified) | ||||||

In comparison with my final report on the corporate, I’ve lowered my earnings estimate largely as a result of I’ve slashed my internet curiosity margin estimate.

Dangers aren’t a Trigger for Concern

The administration took concrete steps to scale back its uninsured deposits in the course of the first quarter of 2023, which makes me assured concerning the firm’s skill to outlive any deposit run on the financial institution. On account of these measures, uninsured deposits dropped to 24% of complete deposits by the tip of March 2023 from 38% of complete deposits on the finish of December 2022, as talked about within the presentation. These uninsured deposits quantity to $818 million and are comfortably lined by the corporate’s out there liquidity of $1.9 billion.

The opposite main supply of danger, i.e. unrealized mark-to-market losses on Accessible-for-Sale (“AFS”) securities, can also be not worrisome. Unrealized losses on AFS securities had been 10.6% of stockholders’ fairness as of the tip of March 2023, which isn’t too excessive. The market capitalization has already dropped by 37% for the reason that begin of the banking sector disaster on March 8, 2023. Subsequently, the market has included greater than the danger from these unrealized losses.

Downgrading to a Maintain Score

Beforehand I used to be utilizing the historic common price-to-tangible e-book (“P/TB”) and price-to-earnings (“P/E”) multiples to worth Bridgewater Bancshares, which gave the corporate a really excessive truthful worth. I’ve now determined to worth BWB utilizing peer-average multiples due to the present banking disaster. It is because, in my view, banks will proceed to commerce beneath their historic averages till the scenario within the banking sector normalizes and the systemic riskiness declines.

Friends are buying and selling at a median P/TB ratio of 0.80 and a median P/E ratio of 6.3, as proven beneath.

| BWB | CIVB | BLFY | FISI | FLIC | SMMF | Peer Common | |

| P/E (“fwd”) | 6.83 | 5.27 | NM | 5.48 | 9.25 | 5.24 | 6.31 |

| P/B (“ttm”) | 0.75 | 0.72 | 0.60 | 0.64 | 0.66 | 0.69 | 0.66 |

| P/TB (“ttm”) | 0.75 | 1.17 | 0.59 | 0.76 | 0.65 | 0.84 | 0.80 |

| Supply: In search of Alpha | |||||||

Multiplying the typical P/TB a number of with the forecast tangible e-book worth per share of $12.6 provides a goal value of $10.1 for the tip of 2023. This value goal implies a 13.2% upside from the Might 19 closing value. The next desk exhibits the sensitivity of the goal value to the P/TB ratio.

| P/TB A number of | 0.60x | 0.70x | 0.80x | 0.90x | 1.00x |

| TBVPS – Dec 2023 ($) | 12.6 | 12.6 | 12.6 | 12.6 | 12.6 |

| Goal Worth ($) | 7.6 | 8.9 | 10.1 | 11.4 | 12.7 |

| Market Worth ($) | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 |

| Upside/(Draw back) | (15.0)% | (0.9)% | 13.2% | 27.3% | 41.4% |

| Supply: Creator’s Estimates |

Multiplying the typical P/E a number of with the forecast earnings per share of $1.35 provides a goal value of $8.5 for the tip of 2023. This value goal implies a 5.2% draw back from the Might 19 closing value. The next desk exhibits the sensitivity of the goal value to the P/E ratio.

| P/E A number of | 4.3x | 5.3x | 6.3x | 7.3x | 8.3x |

| EPS 2023 ($) | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 |

| Goal Worth ($) | 5.8 | 7.1 | 8.5 | 9.8 | 11.2 |

| Market Worth ($) | 9.0 | 9.0 | 9.0 | 9.0 | 9.0 |

| Upside/(Draw back) | (35.3)% | (20.2)% | (5.2)% | 9.8% | 24.8% |

| Supply: Creator’s Estimates |

Equally weighting the goal costs from the 2 valuation strategies provides a mixed goal value of $9.3, which suggests a 4.0% upside from the present market value. My up to date goal value is way beneath my earlier goal value which was primarily based on historic multiples. Subsequently, I’m downgrading Bridgewater Bancshares to a Maintain ranking from my earlier ranking of Purchase.