[ad_1]

The place merchants see a inventory ticker, I see an actual enterprise.

They spend numerous time attempting to determine which approach the inventory market will zig or zag.

I’ve discovered a a lot less complicated technique to become profitable within the inventory market.

All it requires is 4th-grade math expertise and a common thought of the enterprise you’re investing in.

In as we speak’s replace, I’m going to point out you precisely what I’m speaking about with an actual reside instance.

It’s a drug firm we added to the portfolio that Mr. Market priced at $0 per share!

Once we took pencil to paper, our valuation got here out to as a lot as $10 per share.

We added the inventory to the portfolio and fairly quickly after realized we had been flawed.

The inventory was price far more than $10 per share.

Click on on my good-looking face to see what I’m speaking about.

I assure, you’re going to love how this story ends.

(Click on right here to observe the video.)

Or you possibly can learn the transcript right here.

This is only one instance of the straightforward layup alternatives we’re seeing as we speak.

As a result of regardless of the inventory market shifting larger this yr, we’re STILL discovering a number of high quality companies buying and selling for cut price costs.

And that’s why, about six months in the past I began a $1 million portfolio … to see precisely why and how one can make investments, click on right here.

Regards,

Charles Mizrahi

Founder, Alpha Investor

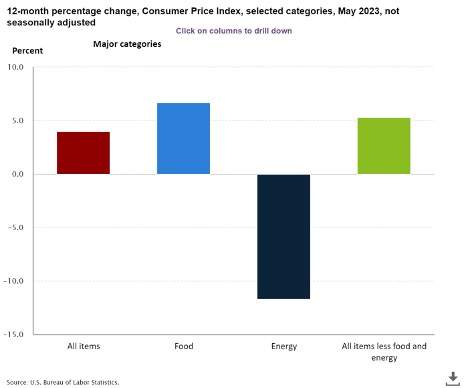

Shopper worth inflation fell to its lowest ranges in two years final month, dropping to only 4%. That’s an enormous drop from the 5% we noticed the month earlier than.

So even when inflation continues to be nicely above the Federal Reserve’s 2% goal, it seems to be like inflation is trending decrease, proper?

Not so quick.

A significant driver of Might’s inflation swoon was the 12% drop in power costs. Now, I’m as glad as the following man to spend much less cash filling up my fuel tank.

However power costs are wildly unstable, and something that may drop 12% in a month can simply as simply spike 12%.

Let’s not overlook that our personal Charles Mizrahi and Adam O’Dell each count on power costs to go sharply larger over the following a number of months.

Stripping out meals and power costs, core inflation continues to be clocking in at 5.3%. However that’s not all.

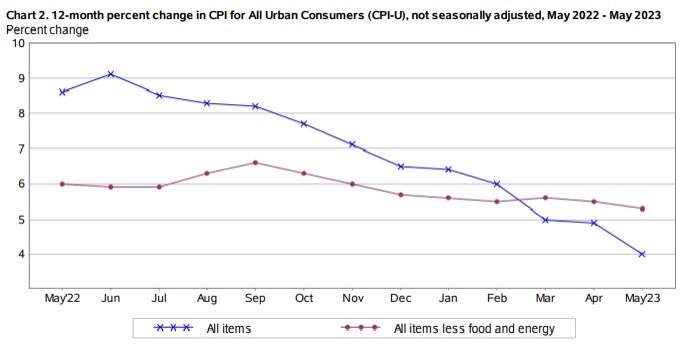

Not solely is core inflation larger, it’s additionally stubbornly refusing to pattern decrease.

On the chart under, you possibly can see the headline inflation quantity (blue line) trending sharply decrease over the previous yr. However the core inflation charge (purple line) has been hovering within the mid-5% vary all yr.

Once more, I’m glad to see any progress in any respect on inflation. However we’re not more likely to see core inflation drop decrease till one in every of two issues occur:

- We get a recession that massively reduces demand.

- We get a productiveness enhance that permits us to provide extra with much less.

I consider we’ll finally get each. However regardless, the funding play right here is simple sufficient.

In a recession, companies search for methods to chop prices and produce extra with much less. And synthetic intelligence and automation applied sciences are the plain approach to try this. Company America is already doing it, and the pressures of a recession will solely speed up it.

Nevertheless it’s vital to be nimble out there, and take cues when funding alternatives are plain. Watch Charles Mizrahi’s new video for particulars about his “inevitable wealth” shares.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link