jetcityimage

In early March of this 12 months, issues raged a few banking disaster that had begun. The concern was that it may trigger a domino impact, with one banking failure ensuing within the failure of extra corporations. Plenty of banks did fall throughout this time, largely these with excessive quantities of uninsured deposits and ones that had a substantial amount of publicity to a few of the riskiest corporations on the market. However as I’ve been stating since then, it appears as if the market threw the infant out with the bathwater. Many monetary establishments noticed steep declines within the value of their shares. This occurred even when the declines weren’t warranted.

Since then, issues have died down. However most of the monetary establishments that noticed their share costs collapse haven’t staged a full restoration. One such instance will be seen by taking a look at funding and banking large The Charles Schwab Company (NYSE:SCHW). From its closing share value on the finish of February, which was about two weeks earlier than the underside fell out, till shares hit their 52-week low, the worth of the inventory plummeted 41.9%. Since then, we’ve got seen a pleasant restoration. However even with that restoration, shares are down 28.4%. Beforehand, I noticed this as a shopping for alternative. I do not personal a number of the inventory, nevertheless it is likely one of the 8 totally different holdings that I at present personal. Having mentioned that, I do acknowledge that my stance on the corporate ought to change based mostly on what knowledge turns into out there. Happily for traders, administration simply revealed some extra outcomes. And whereas the corporate has proven some weak point in some respects in comparison with final 12 months, the general monetary image for the corporate could be very stable.

Nonetheless a wonderful prospect

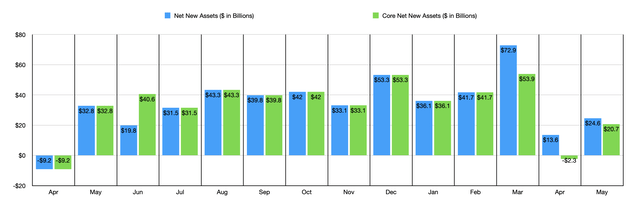

Simply the opposite day, the administration crew at Charles Schwab revealed some monetary knowledge protecting the month of Could. Whereas I do not consider it is necessary to go over every particular person knowledge level, there are some which might be extremely vital to cowl. For starters, the one which I believe is most vital, is the worth of web new belongings that comes onto the corporate’s platform. For the month, this quantity totaled $24.6 billion. Though this represents a decline in comparison with the $32.8 billion that the corporate skilled the identical month final 12 months, it did characterize a close to doubling in comparison with the $13.6 billion recorded for April.

Creator – Monetary Knowledge

There’s one other means to have a look at this explicit metric. The choice model of this metric is known as core web new belongings. This strips out vital one-time occasions, corresponding to these involving acquisitions or divestitures, or massive contracts that expire or are gained by the corporate. By this lens, the image seems even higher. For the month of Could, core web new belongings got here in at $20.7 billion. This compares to the $2.3 billion outflow skilled just one month earlier.

Creator – Monetary Knowledge

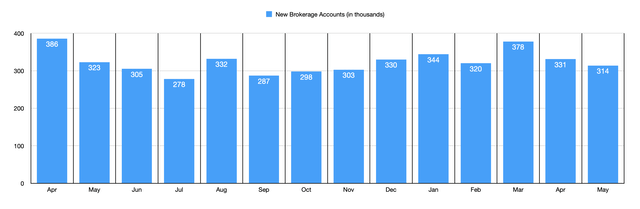

There are, clearly, different vital metrics that we should always contact on. One other one which I place a excessive quantity of worth in includes the brokerage account actions of the agency. The primary metric that pops to thoughts is known as the brand new brokerage accounts. These are new accounts with the corporate’s brokerage arm which might be opened up throughout the month. In Could, this quantity got here in at 314,000. This was down from the 331,000 reported one month earlier and in contrast poorly relative to the 323,000 reported the identical month final 12 months. However you will need to understand that it’s nonetheless nicely inside the historic common for the enterprise. Over the previous 12 months, there have been 5 months the place the variety of new brokerage accounts was decrease than what the corporate reported for final month.

Creator – Monetary Knowledge

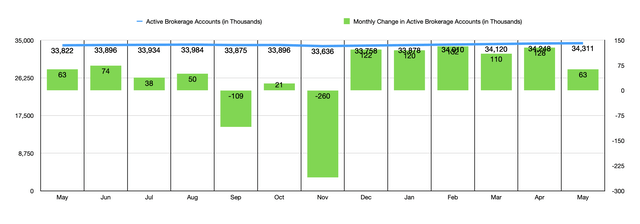

There’s a distinction between the variety of new brokerage accounts and the variety of energetic brokerage accounts. Not each account that finally ends up being opened is used regularly or is used in any respect. Throughout the month, the corporate recorded 34.31 million energetic brokerage accounts. That was 63,000 larger than the 34.25 million reported one month earlier. Over the previous 12 months, Charles Schwab has seen this quantity bounce round fairly a bit from month to month. The very best month throughout this time was February of this 12 months when the corporate noticed 132,000 extra energetic brokerage accounts in comparison with what it reported for January. The worst month was in November of final 12 months. In comparison with October, the corporate reported a decline of 260,000 energetic brokerage accounts. So to see this quantity are available in constructive in any respect, significantly throughout such troublesome instances, and when contemplating that it matches with the corporate reported the identical time final 12 months, is a constructive.

Creator – Monetary Knowledge

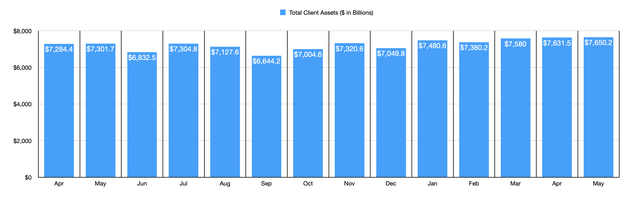

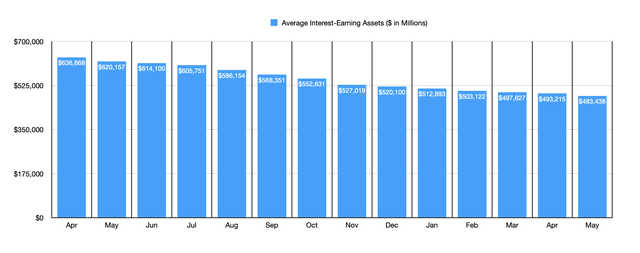

As a result of engaging market returns and continued web new belongings, the corporate has seen the whole worth of its shopper belongings develop for the third consecutive month. In Could, this quantity got here in at $7.65 trillion. That is up from $7.38 trillion reported for February of this 12 months. To say that the whole lot was nice for the enterprise. Common curiosity incomes belongings for the corporate continues to drop. In actual fact, this metric has declined every month for over a 12 months now. Again in April of final 12 months, for example, it totaled $636.7 billion. By April of this 12 months, it had declined to $493.2 billion. And final month, it got here in at $483.4 billion. The decline in curiosity incomes belongings on its books, mixed with a ‘quickly compressed’ NIM (web curiosity margin) ought to end in income coming in between 10% and 11% decrease than with the corporate skilled within the second quarter of the 2022 fiscal 12 months. Analysts had been forecasting a decline of about 6.4%.

Creator – Monetary Knowledge

For these questioning, the NIM is being compressed partially due to sure account balances, together with borrowings and retail CDs, that carry with them larger rates of interest than the corporate would usually should pay. The CFO of the corporate, Peter Crawford, said that the corporate plans to repay sure borrowings which might be weighing down on it earlier than the top of the 2024 fiscal 12 months. That’s definitely unappealing. Nevertheless it’s not the top of the world.

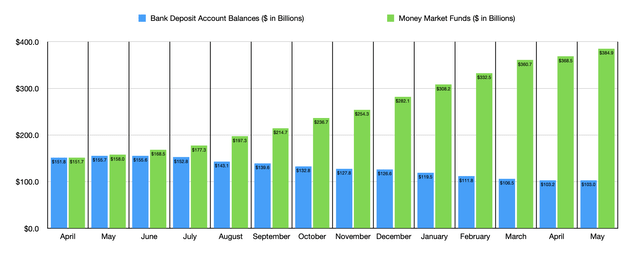

There’s yet another factor that I want to contact on. A part of the corporate’s asset downside is that total financial institution deposit balances have been on the decline as nicely. With larger rates of interest, depositors are in search of extra engaging yields. And that has served as a draw on just about the whole monetary business. In the case of Charles Schwab, the ache has been palpable. Again in Could of final 12 months, for example, the corporate had $155.7 billion of financial institution deposits. That quantity has declined each month since then, and now totals $103 billion. The excellent news is that the declines on this entrance are slowing materially. The drop from April to Could, for example, was solely about $200 million. On the identical time, the corporate is seeing a pleasant influx of capital into its cash market funds. These skilled an all-time excessive final month of $384.9 billion. That represents a pleasant enchancment over the $368.5 billion reported for April. And it’s considerably larger than the $158 billion the corporate had one 12 months in the past.

Creator – Monetary Knowledge

Takeaway

It will be disingenuous for me to take a seat right here and inform you that the whole lot goes implausible for Charles Schwab and its shareholders. Due to present financial circumstances and issues over the banking business, the corporate has confronted some ache. The excellent news is that it continues to develop its core operations and, in the long term, the bigger quantity of belongings on its books will in the end create extra worth for its traders. It will take a while. However given what the long-term outlook is, I’ve no downside preserving the corporate rated a ‘sturdy purchase’ for now.