Which means that forex in circulation has declined much less when in comparison with Rs 2000 notes deposits in banks (85% of Rs 1.8 lakh crore Rs 1.5 lakh crore). It has declined from Rs 34.78 lakh crore as on 19 Could 2023 to Rs 34.08 lakh crore as on 9 2023, a decline of solely round Rs 70,000 crore.

Had your entire Rs 1.5 lakh crore/ 85% of Rs 1.8 lakh crore had been deposited and never exchanged, the CIC ought to have declined much more implying that this might end in not solely a financial institution deposit enhance but in addition a lift for reimbursement of loans and consumption.

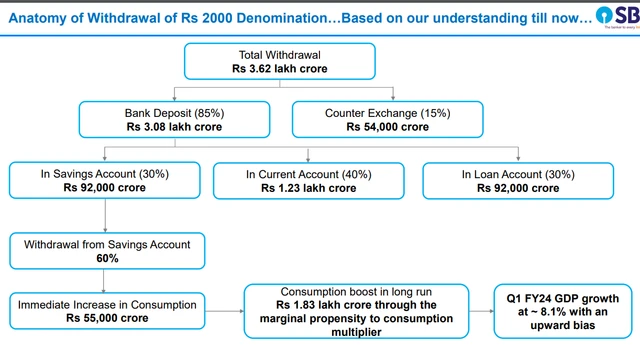

“As per our estimate consumption demand could also be frontloaded by Rs 55,000 crore. With the financial institution word remaining a authorized tender, in contrast to demonetisation, consumption may see a lift. Although, RBI requested clients to deposit or trade the Rs 2,000 notes, however it’s anticipated that high-value quantities may transfer to high-value spends resembling gold/jewelry, high-end client durables like AC, cellphones and so on, and actual property,” the SBI report stated.

• Money on supply: Individuals have additionally began ordering objects on-line with the cash-on-delivery possibility. It’s reported that just about 75% of Zomato’s customers choosing cash-on-delivery have been paying with Rs 2,000 notes. Ecommerce, meals and on-line grocery segments are more likely to witness a rise in clients choosing money on supply.

Gold jewellery gross sales rose by 10-20% when RBI introduced the withdrawal of the Rs 2000 notes whereas individuals stepped up purchases of day by day necessities, and even premium branded items.

“Within the major housing market (residence gross sales), there can be minimal affect of the Rs 2,000 word withdrawal. That is largely as a result of most new launches within the current previous years have been by branded builders preferring their money registers clear and clear. Use of money transactions or black cash on the entire had diminished within the major market since DeMo in 2016. This transfer is, in actual fact, a transparent indicator that the federal government needs to additional tighten the noose on unaccounted cash. It is going to convey extra transparency to the resale market. There’s a small risk that we may even see some improve in land offers involving this denomination,” stated Prashant Thakur, Sr. Director & Head – Analysis, ANAROCK Group.

)

“Contemplating the MPC of this Rs 55,000 crore at 0.7, we imagine that the Non-public Ultimate Consumption Expenditure (PFCE) would possibly improve by Rs 1.83 lakh crore by way of the multiplier impact. Contemplating that ratio of PFCE to GDP at fixed costs is round 58 per cent, we might anticipate Q1 FY24 GDP progress at 8.1 per cent with an upward bias because of the affect of this Rs 2,000 word withdrawal occasion. This reinforces our projection that FY24 GDP might be increased than 6.5 per cent, per the RBI estimate,” the report stated.