Natee127/iStock by way of Getty Photographs

A Fast Take On Semrush Holdings

Semrush Holdings (NYSE:SEMR) reported its Q1 2023 monetary outcomes on Could 8, 2023, beating income estimates however lacking EPS estimates.

The agency operates a SaaS platform that permits companies to execute and handle their on-line advertising and marketing efforts.

With downward macroeconomic pressures and administration showing to prioritize decreased working spending and guiding to decrease topline income development, I’m Impartial [Hold] on Semrush for the close to time period.

Semrush Overview

Boston, Massachusetts-based Semrush was based to create an built-in SaaS system ‘offering corporations complete and actionable insights to drive visitors on-line.’

Administration is headed by co-founder and CEO Oleg Shchegolev, who beforehand obtained a Grasp’s of Science in Pc Science from St. Petersburg State Polytechnic College.

The corporate’s major choices embody:

-

search engine marketing

-

Promoting

-

Content material Advertising and marketing

-

Social Media

-

Market Analysis

The corporate pursues clients primarily by on-line promoting, together with paid promoting, social media, digital public relations, SEO and owned media.

The agency tracks over a number of hundred million domains, billions of key phrases, and trillions of backlinks and URLs.

Semrush’s Market & Competitors

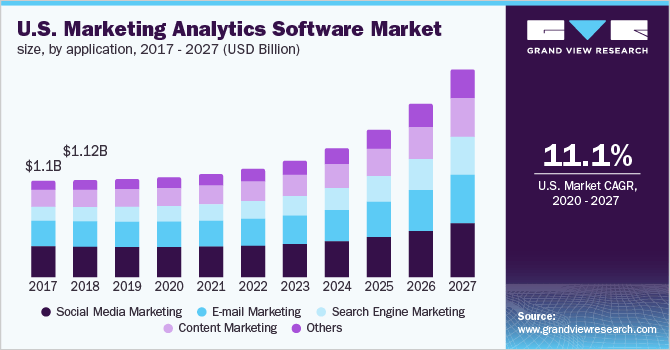

In keeping with a 2020 market analysis report by Grand View Analysis, the worldwide digital advertising and marketing analytics software program market was an estimated $2.7 billion in 2019 and is anticipated to succeed in $8.1 billion by 2027.

This represents a really sturdy forecast CAGR of 14.8% from 2020 to 2027.

The primary drivers for this anticipated development are adoption by corporations throughout nearly all business verticals to extra successfully perceive purchaser behaviors and to enhance their on-line advertising and marketing campaigns.

Additionally, beneath is a historic and projected future development trajectory for digital advertising and marketing analytics software program in the USA:

U.S. Advertising and marketing Analytics Software program Market (Grand View Analysis)

The agency sees competitors within the following business classes:

-

search engine marketing

-

SEM

-

Digital PR

-

Content material Advertising and marketing

-

Social Media Administration

-

Aggressive Intelligence

SEMR’s Latest Monetary Tendencies

-

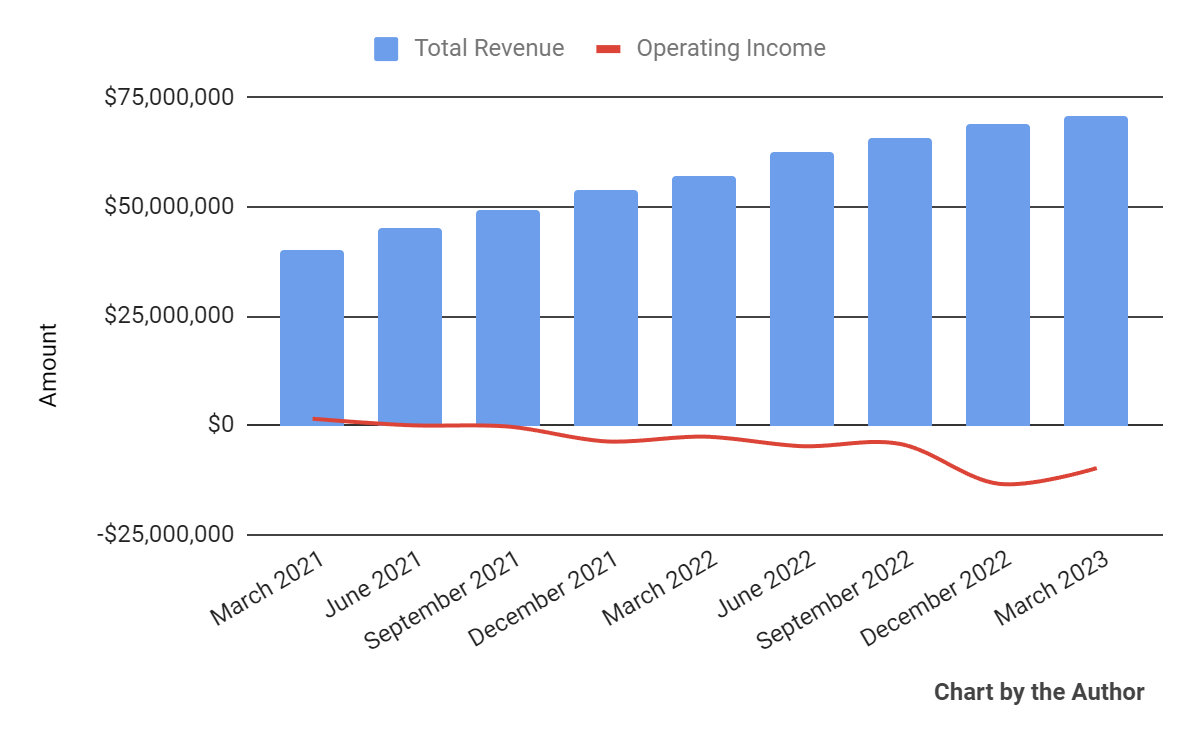

Complete income by quarter has risen; Working losses have lessened in the newest quarter:

Complete Income and Working Earnings (Looking for Alpha)

-

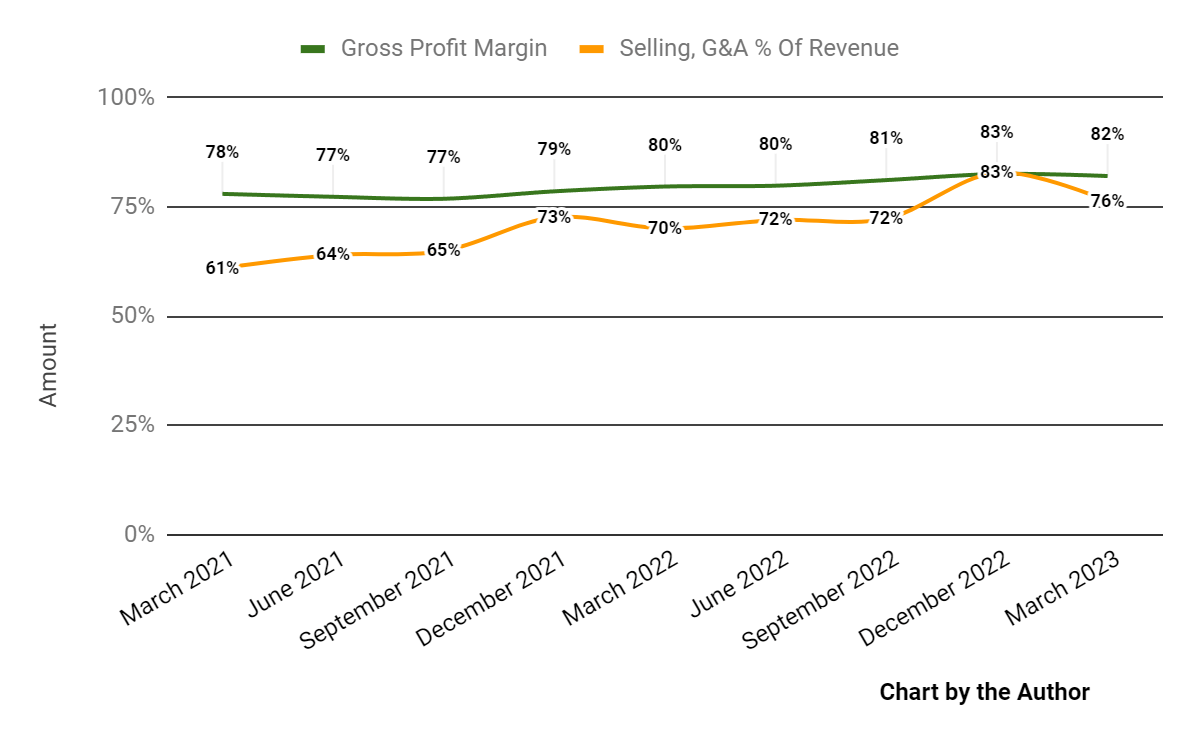

Gross revenue margin by quarter has continued to rise YoY; Promoting, G&A bills as a share of complete income by quarter have additionally trended increased in latest quarters, though Q1 2023’s determine represented a sequential drop:

Gross Revenue Margin and Promoting, G&A % Of Income (Looking for Alpha)

-

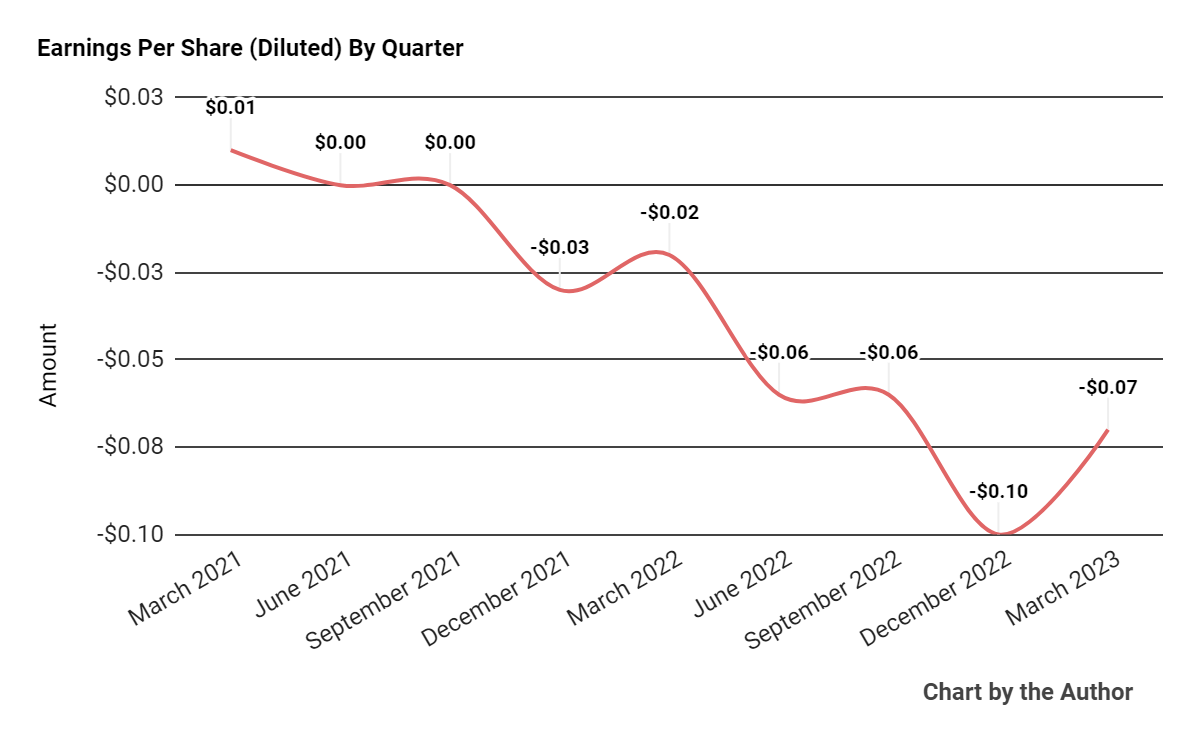

Earnings per share (Diluted), whereas nonetheless materially unfavorable, have improved sequentially:

Earnings Per Share (Looking for Alpha)

(All information within the above charts is GAAP)

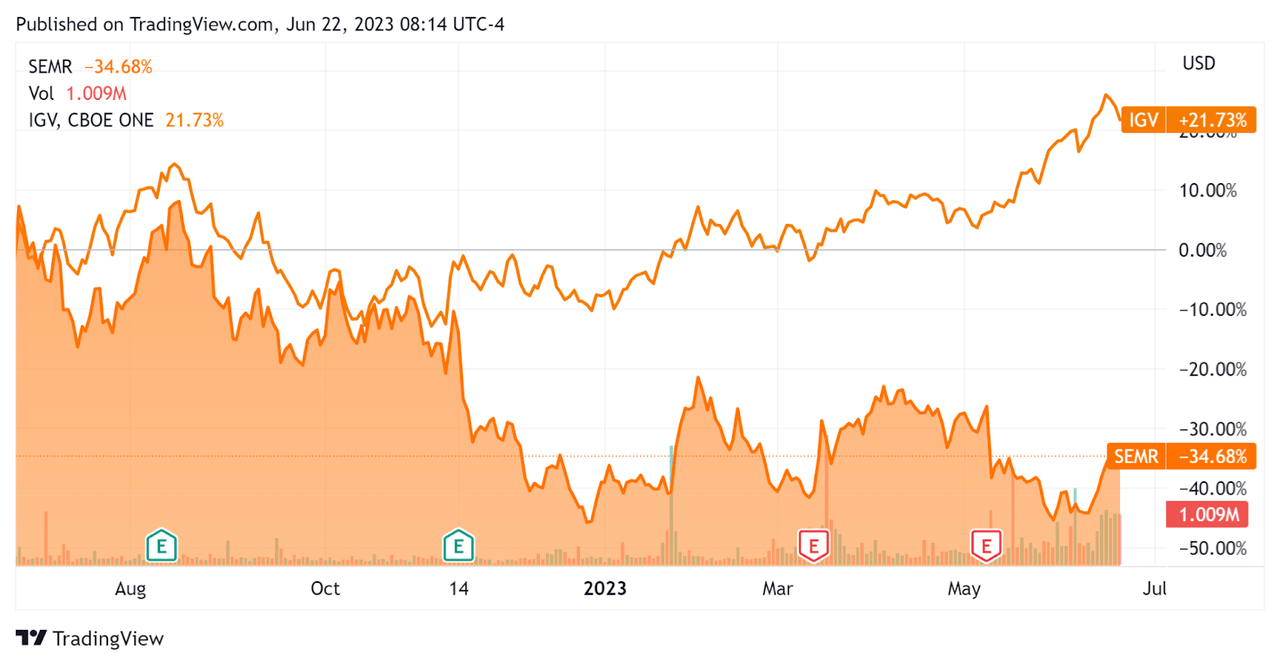

Up to now 12 months, SEMR’s inventory worth has fallen 34.68% whereas the iShares Expanded Know-how-Software program ETF (IGV) jumped 21.73%, because the chart signifies beneath:

52-Week Inventory Value Comparability (Looking for Alpha)

For the stability sheet, the agency ended the quarter with $232.3 million in money, equivalents and short-term investments and no debt.

Over the trailing twelve months, free money used was $25.4 million, throughout which capital expenditures have been $4.1 million. The corporate paid $9.3 million in stock-based compensation within the final 4 quarters, the best trailing twelve-month end result up to now eleven quarters.

Valuation And Different Metrics For SEMR

Under is a desk of related capitalization and valuation figures for the corporate:

|

Measure [TTM] |

Quantity |

|

Enterprise Worth / Gross sales |

3.9 |

|

Enterprise Worth / EBITDA |

NM |

|

Value / Gross sales |

4.7 |

|

Income Development Charge |

30.7% |

|

Web Earnings Margin |

-15.4% |

|

EBITDA % |

-9.8% |

|

Web Debt To Annual EBITDA |

8.9 |

|

Market Capitalization |

$1,280,000,000 |

|

Enterprise Worth |

$1,060,000,000 |

|

Working Money Circulation |

-$21,260,000 |

|

Earnings Per Share (Totally Diluted) |

-$0.29 |

(Supply – Looking for Alpha)

The Rule of 40 is a software program business rule of thumb that claims that so long as the mixed income development charge and EBITDA share charge equal or exceed 40%, the agency is on a suitable development/EBITDA trajectory.

SEMR’s most up-to-date Rule of 40 calculation was 20.9% as of Q1 2023’s outcomes, so the agency’s outcomes on this regard have worsened since its This autumn 2022 report (27.8%), per the desk beneath:

|

Rule of 40 Efficiency |

This autumn 2022 |

Q1 2023 |

|

Income Development % |

35.3% |

30.7% |

|

EBITDA % |

-7.5% |

-9.8% |

|

Complete |

27.8% |

20.9% |

(Supply – Looking for Alpha)

Commentary On SEMR

In its final earnings name (Supply – Looking for Alpha), protecting Q1 2023’s outcomes, administration highlighted file internet new buyer additions and reaching the milestone of 100,000 paying clients in 150 international locations for the primary time.

Management additionally famous that over 20% of the agency’s clients buy multiple product from the corporate. This means SEMR has extra potential upside by focusing additional on its cross-selling efforts.

Notably, administration mentioned that ‘as a share of income, we plan to spend much less on gross sales and advertising and marketing in comparison with the prior 12 months.’ It is going to be fascinating to see how negatively this impacts income development vs. decreasing working losses.

Administration is working to include the newest AI applied sciences into its programs. The agency has a number of years of expertise with a few of its higher-end merchandise however is increasing AI integration with a wider set of features and is seeing rising utilization in consequence.

The corporate’s internet greenback retention charge was 116%, indicating strong product/market match and fairly good gross sales & advertising and marketing effectivity.

Complete income for Q1 2023 rose 24.2% YoY whereas gross revenue margin elevated by 2.4 share factors.

SG&A bills as a share of income elevated by 6.3 share factors, a unfavorable sign indicating decrease effectivity in producing incremental income and working loss elevated sharply year-over-year.

Wanting forward, for full-year 2023, administration reiterated its earlier steerage indicating 21% income development over 2022 on the midpoint of the vary.

If the agency achieves this development charge, it is going to be notably lower than 2022’s development of 35% over 2021, indicating meaningfully slowing topline income development forward.

The corporate’s monetary place is robust, with ample liquidity and no debt, however materials money burn that administration will wish to scale back sooner or later.

SEMR’s Rule of 40 efficiency has been worsening sequentially, dropping to twenty.9% in the newest quarter.

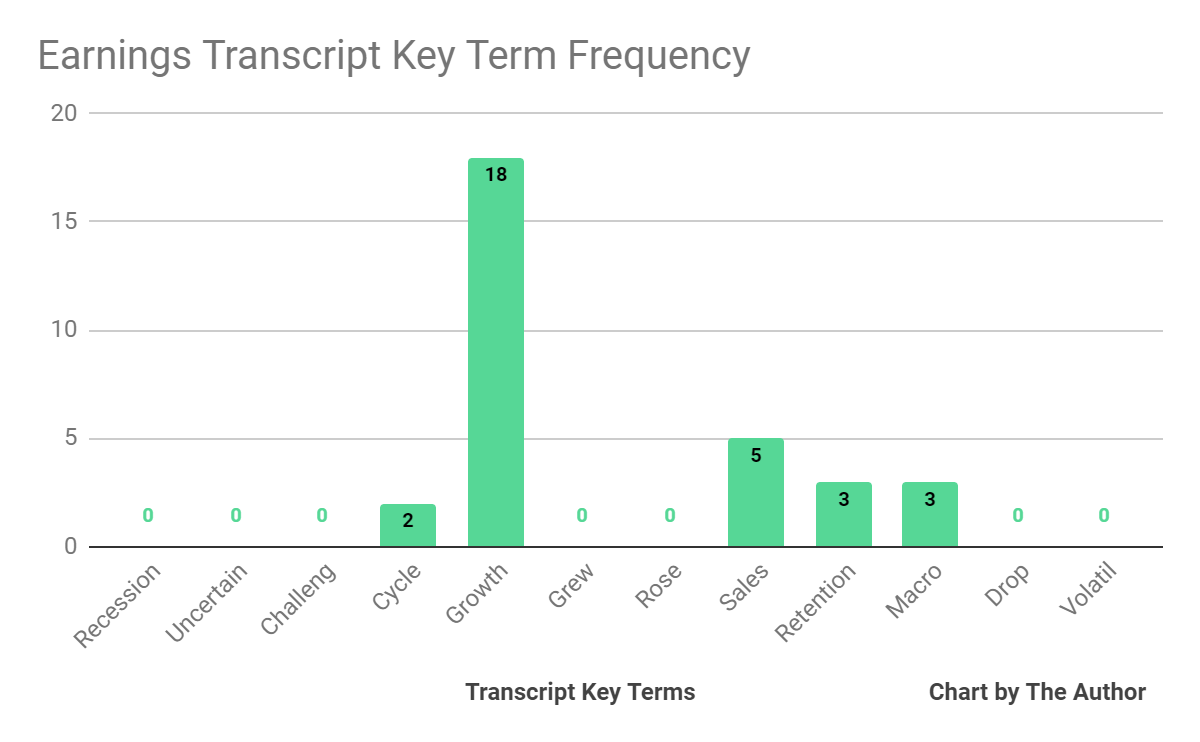

From administration’s most up-to-date earnings name, I ready a chart exhibiting the frequency of key phrases talked about (or not) within the name, as proven beneath:

Earnings Transcript Key Phrases Frequency (Looking for Alpha)

I’m most within the frequency of probably unfavorable phrases, so administration or analyst questions cited ‘Macro’ thrice.

On this case, ‘Macro’ referred to macro tendencies throughout the business and never unfavorable macroeconomic surroundings mentions. The corporate sees ‘elevated and sustained demand, notably registration trials’, so it doesn’t look like experiencing top-of-the-funnel slackening.

Analysts questioned firm management about tendencies within the business, together with vendor consolidation, which administration confirmed is a ‘massive pattern’.

With downward macroeconomic pressures together with administration showing to prioritize decreased working spending and guiding to decrease topline income development, I’m Impartial [Hold] on Semrush for the close to time period.