sandsun

Secure Bulkers Inc. (NYSE:SB) or “Secure Bulkers” is a number one dry bulk shipper targeted on the bigger, gearless vessel courses. Whereas the corporate is included beneath the legal guidelines of the Marshall Islands, its principal govt workplace is situated in Monaco.

Secure Bulkers is successfully managed by CEO and Chairman Polys Haji-Ioannou, a Cypriot billionaire and delivery magnate.

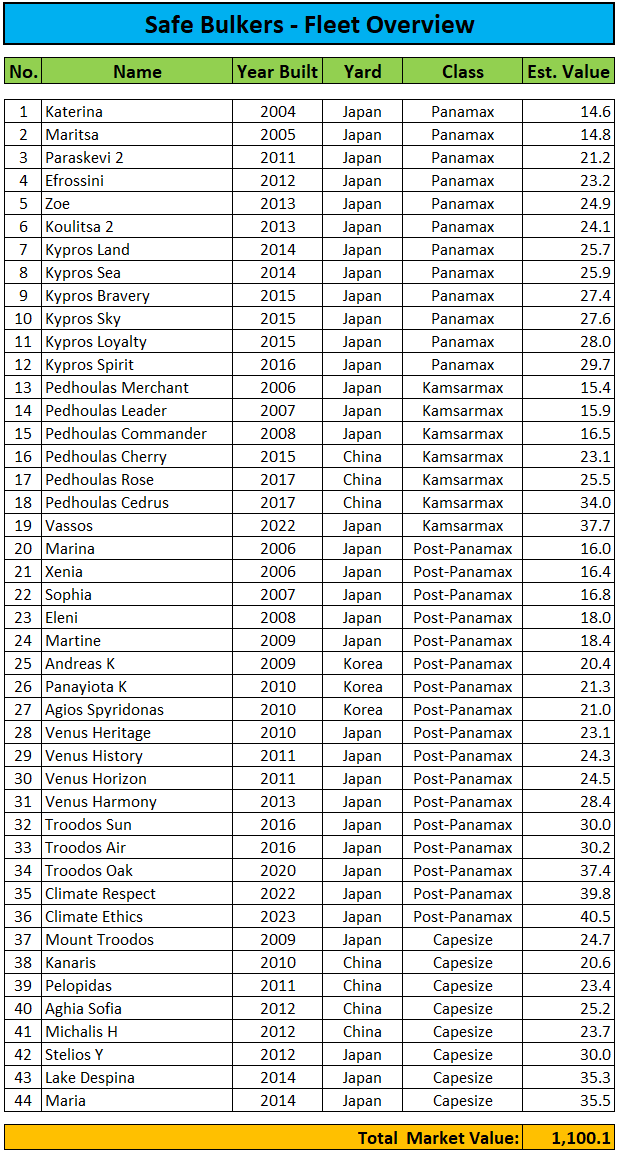

As of Could 5, the corporate commanded a fleet of 44 vessels, consisting of 12 Panamax, 7 Kamsarmax, 17 Publish-Panamax and eight Capesize dry bulk carriers with a median age of 10.8 years and an estimated market worth of $1.1 billion:

Regulatory Filings / MarineTraffic.com

Please be aware that my market worth estimate above may be too conservative as scrubber fittings not at all times appear to be adequately mirrored within the numbers offered by MarineTraffic.com.

As well as, Secure Bulkers has dedicated to an intensive newbuild program of 12 vessels designed to fulfill the Worldwide Maritime Group’s (“IMO”) laws associated to the discount of GHG and NOx emissions of which three have already been delivered. Remaining capital expenditures beneath the newbuild program quantity to $243.1 million.

As of Could 5, 2023, the corporate had an orderbook of 9 newbuilds (8x Kamsarmax, 1x Publish-Panamax), with 4 scheduled deliveries in 2023, three in 2024 and two within the first half of 2025.

As well as, Secure Bulkers has been investing greater than $80 million to retrofit roughly 50% of its fleet with exhaust gasoline cleansing techniques, generally known as “scrubbers”.

Secure Bulkers employs its fleet on a mixture of spot and interval timer charters with a median remaining constitution period of 0.9 years.

Like many Greece- and Cyprus based mostly delivery firms, Secure Bulkers’ fleet is managed by non-public entities affiliated with the controlling shareholder thus leading to potential conflicts of curiosity as additionally acknowledged in Secure Bulkers’ annual report on kind 20-F:

Our chief govt officer, Polys Haji-Ioannou, controls each of our Managers. Polys Haji-Ioannou, immediately and thru entities managed by him, owns roughly 40.70% of our excellent Frequent Inventory as of February 24, 2023. These relationships might create conflicts of curiosity between us, on the one hand, and our Managers, however. These conflicts could come up in reference to the chartering, buy, sale and operation of the vessels in our fleet versus vessels owned or chartered-in by different firms affiliated with our Managers or our chief govt officer.

That stated, in distinction to a lot of Greece- or Cyprus-based delivery firms, Secure Bulkers has not been partaking in dilutive fairness gross sales properly under internet asset worth (“NAV”). The truth is, the corporate has been lively repurchasing its personal shares in current quarters up to date traders on its progress in final month’s Q1/2023 report:

In June 2022, the Firm approved a program beneath which it could infrequently sooner or later buy as much as 5,000,000 shares of its frequent inventory. In March 2023, the Firm approved the rise of the share repurchase to a complete of as much as 10,000,000 shares of its frequent inventory. As of Could 5, 2023, roughly 83% of this system, or 8,312,259 shares of frequent inventory, had been repurchased and cancelled.

As well as, Secure Bulkers stays dedicated to paying a set quarterly money dividend of $0.05 per frequent share which is well-covered by money flows from working actions.

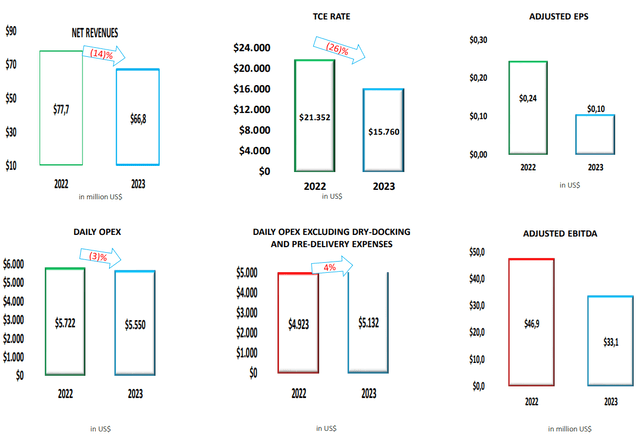

Final month, the corporate reported seasonally weak first quarter outcomes however nonetheless managed to generate $32.7 million in money from working actions.

Firm Presentation

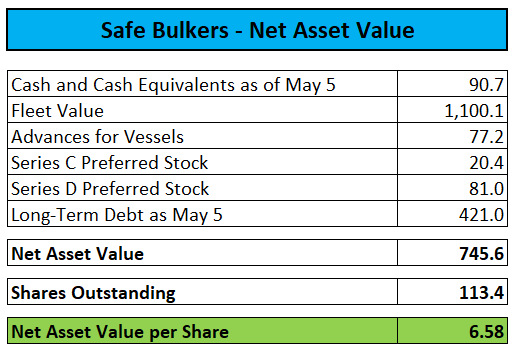

As of Could 5, the corporate had money and money equivalents of $90.7 million and complete long-term debt of $421.0 million.

After giving consideration to an mixture $267.2 million in undrawn borrowing capability beneath the corporate’s credit score amenities, complete liquidity amounted to $357.9 million.

As well as, Secure Bulkers has issued two sequence of most popular inventory (NYSE:SB.PC and NYSE:SB.PD) with an mixture liquidation desire of $101.4 million. Each the Collection C and D Most well-liked Shares presently provide a really protected 8% annual yield.

Valuation-wise, the corporate is buying and selling at a steep low cost to internet asset worth possible resulting from perceived subpar company governance and abusive capital raises to the detriment of frequent shareholders employed by a lot of smaller friends:

Regulatory Filings, MarineTraffic.com

However no less than when judging by Secure Bulkers’ plan of action in recent times, there seems to be little motive to fret for frequent shareholders as the corporate shouldn’t be solely paying a set quarterly money dividend of $0.05 per share but in addition stays dedicated to repurchasing frequent shares at prevailing costs.

With liquidity greater than enough to cope with the remaining capital expenditures beneath the corporate’s newbuild program and respectable money generated from operations even in a moderately weak constitution fee setting, I do not suppose a 50%+ low cost to estimated NAV ought to be warranted.

Backside Line

Other than some basic company governance considerations associated to the truth that the corporate stays successfully managed by its Chairman and CEO, there’s so much to love about Secure Bulkers.

Given ample liquidity, comparatively low leverage, a well-covered quarterly money dividend and ongoing share buybacks together with a 50% low cost to estimated internet asset worth, traders ought to take into account initiating or including to present positions in Secure Bulkers.