Sean Gallup

Funding thesis

Our present funding thesis is:

- Garmin Ltd. (NYSE:GRMN) is a high-quality enterprise, with deep experience in navigation and GPS, permitting the enterprise to develop a spread of market-leading merchandise.

- Income progress and margins are sturdy, though Garmin has confronted some erosion in current intervals. We suspect this can regularly subside over the approaching years.

- The excessive free money stream, lack of debt, and diversified income create an overarchingly engaging enterprise, with upside at its present value.

Firm description

Garmin is a Swiss firm that designs, manufactures, and sells wi-fi gadgets globally. They’ve segments devoted to health, out of doors actions, aviation, marine, and automotive.

Their merchandise vary from watches, trackers, and smartwatches to avionics options, marine electronics, and automobile navigation methods.

Share value

Garmin’s share value has carried out extraordinarily properly within the final decade, exceeding the returns of the S&P 500. This has been pushed by a gradual enchancment in monetary efficiency, in addition to a improvement of the corporate’s capabilities.

Monetary evaluation

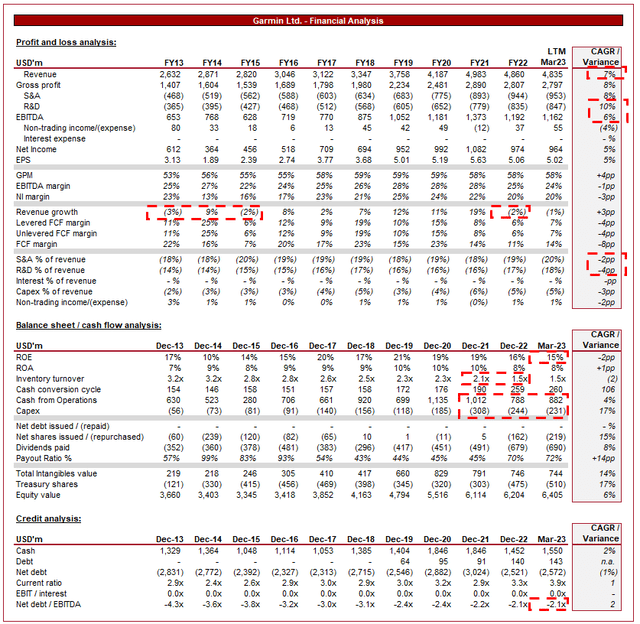

Garmin’s financials (TIKR Terminal)

Offered above is Garmin’s monetary efficiency for the final decade.

Income & Business Components

Garmin’s income has grown at a wholesome CAGR of seven%, with solely 3 fiscal years of unfavorable progress, 2 of which had been initially of the interval. This displays a profitable pivot by the enterprise towards wearable health expertise.

Enterprise Mannequin and Aggressive Positioning

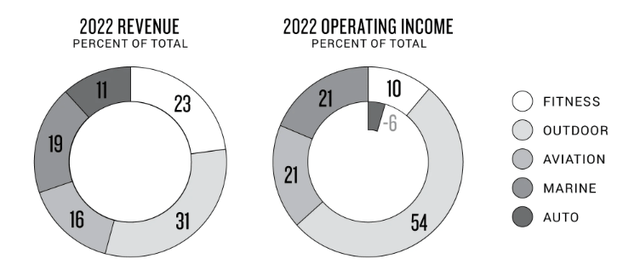

Garmin operates a extremely diversified enterprise, with no single phase comprising greater than 31% of its income.

Garmin’s segments present the next:

- Health phase – Garmin affords merchandise resembling working and multi-sport watches, biking gadgets, exercise trackers, and smartwatches.

- Out of doors phase – focuses on journey watches, out of doors handhelds, golf gadgets and apps, and canine monitoring and coaching gadgets.

- Aviation phase – Garmin designs, manufactures, and markets varied avionics options for plane.

- Marine phase – offers marine electronics.

- Auto phase – affords embedded area controllers and infotainment methods, private navigation gadgets, and cameras.

Income break up (Garmin)

Garmin’s focus revolves across the improvement of GPS/navigation options, searching for to use its experience within the expertise to create worthwhile merchandise for a variety of shoppers. This has been the unwavered focus of the enterprise for a number of many years, permitting Garmin to develop deep experience and a robust model. The corporate is thought for its high-quality and dependable merchandise.

The diversification of its goal market has been crucial to the continued success of the enterprise, and resilience in opposition to altering business dynamics. Garmin was a pacesetter within the “sat nav” business, which was subsequently made out of date by the event of smartphones. That might have been the top of the corporate had it not continued to develop its breadth of shoppers/merchandise.

Garmin has emphasised vertical integration as a part of its operational capabilities, together with in-house design, manufacturing, and distribution capabilities. This has contributed to lowered prices however importantly, illustrates a continued give attention to innovation and the pursuit of recent options.

Garmin’s aggressive place revolves round its sturdy model, broad product base (and mental property), scale, and experience. We imagine these elements present Garmin with a defensible place in its core markets.

Garmin’s Industries

In recent times, we’ve got seen a speedy enhance within the demand for wearable good gadgets, particularly smartwatches. This has been pushed by technological improvement creating the feasibility of the product, in addition to the event of smartphones to assist integration. Garmin has invested closely on this expertise, specializing in its core capabilities, and marrying it with premium parts to construct a spread of high-quality merchandise.

Not like others, Garmin’s focus has at all times been on the premium phase, guaranteeing its merchandise had the very best of what shoppers need, particularly reliability, battery life, and ruggedness. This has protected the enterprise in opposition to the current pattern of low cost wearables imported from the far east, considerably disrupting the “style smartwatch” phase.

Covid-19 and a larger consciousness of a wholesome life-style have contributed to a rising curiosity in out of doors leisure actions resembling mountain climbing, biking, and tenting. We imagine it is a pure tailwind that may assist the justification for an funding in wearable expertise, encouraging purchases.

Numerous Garmin merchandise goal the out of doors phase, though are centered totally on professionals. The method permits for the event of its model within the sticky phase of the market, though makes profitable over casuals tougher (justifying value).

The continued improvement of smartwatches by main cell producers resembling Apple (AAPL) and Google (GOOG) is a menace, however we imagine the inherent goal market is completely different. Garmin’s goal care extra about well being and GPS, whereas Apple’s market is targeted on eco-system integration. To not point out a Garmin measures its battery life in months however days. This mentioned, the hole is definitely closing. If Apple stays dedicated to the continued improvement of the Apple Watch Extremely, it may shortly change into a problem.

We count on the demand for smartwatches to proceed, as though purchases have been excessive lately, the extent of penetration in society stays low globally.

The Marine and Aviation industries signify resilient demand for Garmin. Garmin’s deep experience has allowed the enterprise to create market-leading assist options, supporting each corporates and shoppers. For example, Garmin acquired a number of provider awards (eighth consecutive yr) from Embraer (ERJ), the main aerospace enterprise. These are each industries that ought to proceed to develop properly over the long run, producing sustained demand for Garmin, as long as product improvement is maintained.

Many industries have skilled a shift towards subscription-based companies and cloud options, as a part of the general product package deal. The worth proposition for Garmin is straightforward, recurring income that may enhance periodically with value hikes. Throughout Garmin’s varied enterprise models, it has 13 subscriptions. We count on continued give attention to this income stream with a purpose to develop the worth proposition; nevertheless, the scope for upselling is seemingly excessive given the complexity of the companies supplied.

Rising markets, particularly in Asia, signify key progress markets, as continued financial improvement contributes to a rising center class. We imagine demand from these areas ought to assist the smartwatch phase, though Garmin should guarantee it develops its model accordingly.

Financial & Exterior Consideration

Present financial circumstances signify a key near-term threat to the enterprise. With excessive inflation and heightened charges, shoppers’ funds are being squeezed, contributing to lowered discretionary spending. Additional, throughout such occasions, even these not financially struggling are emotionally inspired to defer giant spending, awaiting an enchancment in circumstances.

Given the pricing of Garmin’s merchandise, we suspect the enterprise may face slowing demand, within the near-term, till circumstances start to normalize.

In the newest quarter, Garmin skilled a (2)% decline in gross sales, though the efficiency was pretty good in our view. 4 of its 5 BUs skilled double-digit progress, offset by a decline within the out of doors BU. This was as a result of a slowdown within the sale of journey watches YoY, which we suspect is proof of a slowdown. The resilience of different BUs is on full show, nevertheless, with aviation up 22% and Marine up 10%.

Margins

Garmin presently boasts a GPM of 58%, EBITDA of 24%, and a NIM of 20%. In the course of the historic interval, margins have remained comparatively flat, as GPM beneficial properties have been offset by elevated S&A spending.

The motion in margins is pushed by overarching operational elements, resembling scale economies and, extra just lately, inflationary pressures, in addition to a change in product combine.

Garmin’s enterprise models have various margins, contributing to a change based mostly on progress. As the next illustrates, wearables and Automotive are presently eroding the spectacular efficiency from the others.

| Q1 | OPM | Progress |

| Health | 4% | 11% |

| Out of doors | 23% | (27%) |

| Aviation | 27% | 22% |

| Marine | 26% |

10% |

| Auto OEM | (24)% |

11% |

We suspect margin enchancment ought to happen, as demand for Out of doors returns, supplemented by an enchancment in Auto OEM. This mentioned, Health will proceed to signify a downward stress on margins.

Stability sheet & Money Flows

Garmin’s stock turnover noticeably declined in FY22 and this has not been subsequently improved. This displays weaker demand for its product past Administration’s expectations, contributing to a drag on money.

This mentioned, Garmin’s money stream era has typically been extraordinarily sturdy and constant, permitting the enterprise to fund operations and distribution sustainably, with out using debt.

Garmin’s ND/EBITDA place is presently (2)x, offering the enterprise with scope for elevating if required. Administration ought to take into account whether or not M&A may complement its present technique, given the power.

Distributions within the final yr have come within the type of dividends and buybacks, though the sustainability of that is missing given the dimensions of the dividend funds. The common FCF within the final 3 years was ~$730m, which means additional dividend progress is feasible.

Business evaluation

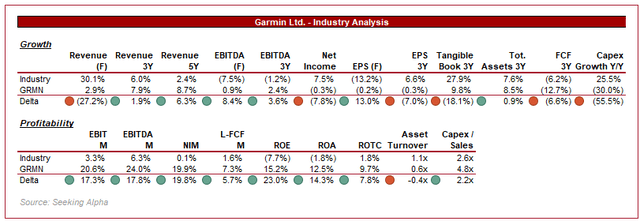

Client electronics (Searching for Alpha)

Offered above is a comparability of Garmin’s progress and profitability to the typical of its business, as outlined by Searching for Alpha (11 firms).

Garmin performs extremely properly on a relative foundation, producing superior margins and progress. The Client electronics business is notoriously extremely aggressive, firstly because of the bigger tech conglomerates working throughout a number of sub-sectors, and secondly because of the sensitivity of demand to financial circumstances.

Garmin’s superiority illustrates that it is without doubt one of the few that is ready to function on a standalone foundation and succeed. If something, this means the corporate is a improbable takeover goal, amongst a sea of underperformers.

Valuation

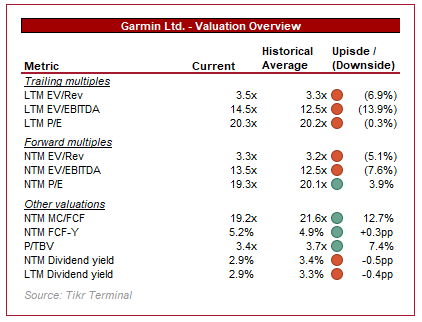

Valuation (TIKR Terminal)

Garmin is presently buying and selling at 15x LTM EBITDA and 14x NTM EBITDA. It is a premium to its 10Y historic common.

Our view is that Garmin justifies this present premium, primarily because of the following elements:

- Progress enchancment within the latter half of the final 10Y.

- Underlying sturdy margins that had been bettering and can doubtless proceed to take action.

- Spectacular FCF conversion, funding distributions, and progress funding.

- Constant dividend progress.

Key dangers with our thesis

The dangers to our present thesis are:

- Though we count on continued financial weak spot to weigh on the Health and Out of doors BUs, we’re not anticipating additional large-scale declines. A continuation may quickly deteriorate, resulting in a nasty yr. At the moment, Garmin expects to commerce flat / barely up, which we expect.

- Additional margin deterioration. We expect an enchancment over the following a number of years. Each bp of margin loss can be tough to win again.

Remaining ideas

Garmin is a strong enterprise working in a distinct segment specialty. It has utilized its core competencies to develop a set of merchandise in a spread of industries. This has created a sturdy enterprise, tethered to its extremely regarded model.

We anticipated a continuation of its present pattern, and at its present share value, we see additional worth. An attention-grabbing improvement can be if Garmin turns into a takeover goal. With its present margins, it will be accretive to most.