Joe Raedle

Analysis Temporary

As a result of current recognition of my analysis articles protecting Canada-based banks & insurance coverage corporations, I made a decision to search for one other one which occurs to be a dividend gem.

Toronto-Dominion Financial institution (NYSE:TD), which I’ll simply check with as TD Financial institution, is a type of banks deemed globally systematically essential in response to the Monetary Stability Board in 2022, and although its guardian group is Canada-headquartered it additionally trades within the US on the NYSE and its US-based enterprise often known as “TD Financial institution” relies in New Jersey.

Although they aren’t on this month’s batch of financial institution earnings calls, as their subsequent quarterly earnings launch will not be till August twenty fourth, right this moment we are going to take a look at most up-to-date outcomes and forward of its subsequent earnings name attempt to decide of this can be a worth purchase or not.

My very own expertise with this financial institution goes again years in the past as a consumer on the now-defunct Commerce Financial institution in New Jersey, recognized for being open 7 days every week and for a free penny-arcade coin counting machine within the foyer, which I keep in mind properly. The financial institution chain was later acquired by TD Financial institution.

Some notables to say from this firm’s web site: TD Financial institution division whole belongings $422B, 9.9MM prospects, 2,700 ATMs, branches in 15 states and D.C.

Scores Methodology

Our objective is to seek out undervalued shares of corporations with stable monetary fundamentals, that pay aggressive dividend yields. Our key business focus is tech, financials, insurance coverage, innovation.

To simplify my ranking of an fairness, I’ve damaged it down into whether or not I might suggest or not suggest based mostly on these particular person components:

- Valuation vs Sector Common.

- Dividend Yield vs Sector Common.

- Constructive YoY Web Revenue Development.

- Capital & Liquidity Energy

- Inventory Worth vs 200 Day SMA.

If I like to recommend on all 5 classes, it’s a “robust purchase”, 4 classes is a “purchase”, 3 is a maintain, and fewer than that may be a promote ranking. Then I evaluate my ranking to the consensus rankings from Searching for Alpha & Wall Road.

Valuation vs Sector Common: Not Really helpful

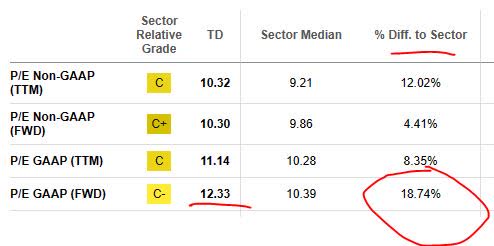

Let’s go into valuation first. As with my different articles, I’m utilizing the ahead P/E ratio and ahead P/B ratio, taken from Searching for Alpha knowledge. Then, I evaluate to the sector common. I’m not aware of which corporations this web site contains in its “sector common”, nevertheless.

From the information proven, the ahead P/E of 12.33 is sort of 19% above the sector common.

TD – P/E ratio (Searching for Alpha)

My goal vary is for the P/E to be at or beneath the sector common, or not more than 5% above it if the price-to-book can also be comparatively undervalued.

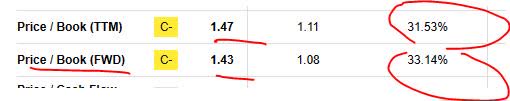

Looking, nevertheless, I see that the P/B is at 1.43, so that you’re paying nearly 1.5X e-book worth for this inventory, and that’s 33% above the sector common. Too excessive for my part. I’m searching for one thing nearer to a price-to-book of 1.0 or much less.

TD – P/B ratio (Searching for Alpha)

Based mostly on the information, I might not suggest this inventory within the class of valuation at the moment.

Dividend Yield vs Sector Common: Advocate

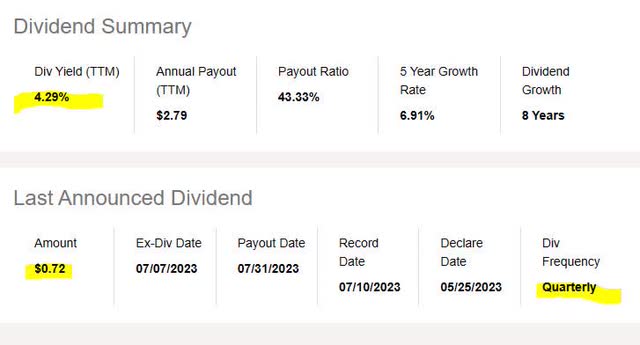

The subsequent query I ask is whether or not this inventory is correct for my readers who’re dividend-income traders like I’m. The reply is within the knowledge beneath, taking from Searching for Alpha official knowledge.

As of July 31, the trailing dividend yield is 4.29%, with a dividend of $0.72 per share, paid quarterly. In some financial institution & insurance coverage shares I lately researched, I’ve seen the yield wherever from 3% – 6%.

TD – dividend yield (Searching for Alpha)

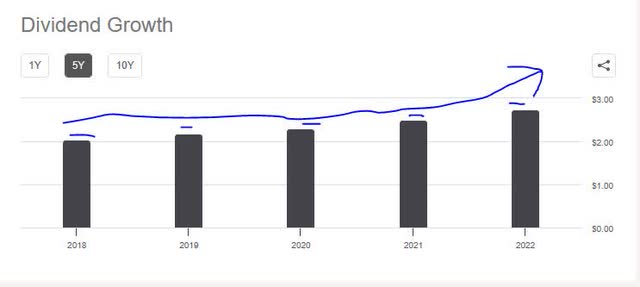

Additional, I just like the constructive dividend progress pattern within the final 5 years. For instance, it went from an annual dividend in 2018 of $2.04 to $2.74 in 2022, a rise of 34% in 5 years. It is a good signal {that a} financial institution is dedicated to returning capital again to shareholders and has the liquidity annually to take action, even whereas another corporations have decreased to chop again dividends, whereas some within the tech sector do not pay dividends in any respect.

TD – 5 12 months dividend progress (Searching for Alpha)

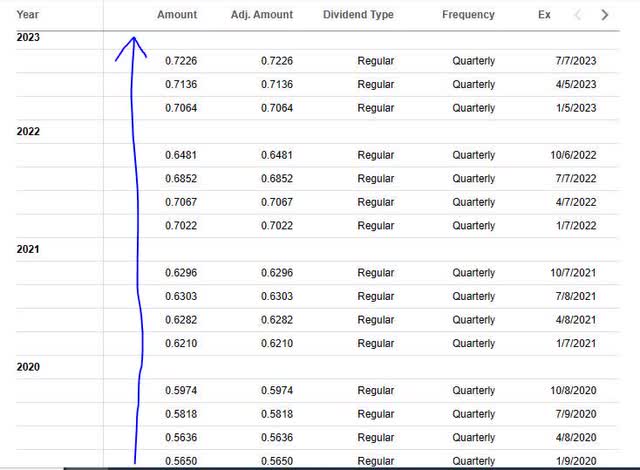

For August, I’m including one other metric to have a look at, and that’s frequency & stability of dividend funds. Because the desk beneath exhibits, this financial institution has made regular quarterly dividend funds within the final 4 years, with the quarterly fee typically rising in that point. One other constructive.

Although a few of my readers within the feedback have introduced up tax subjects with regards to dividends but in addition Canada-based shares, sadly as a matter of coverage I do not go into that realm in these articles and would relatively refer you to your tax skilled for that.

TD – dividend historical past of funds (Searching for Alpha)

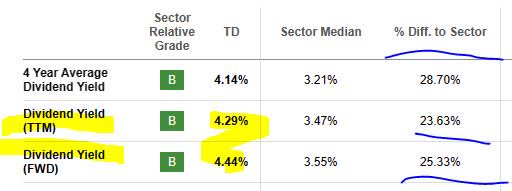

Lastly, the massive query is how the dividend yield for this inventory compares with that of its sector. The reply is within the desk beneath.

TD – dividend yield vs sector (Searching for Alpha)

Because the desk exhibits, each the trailing and ahead dividend yield is 23% to 26% above its sector common. That is spectacular. My goal is for a inventory’s yield to be not less than 5% -10% above sector common with the intention to be extremely aggressive on this class, so this one goes previous that focus on.

Therefore, based mostly on the proof given, I might suggest this inventory within the class of dividends.

Constructive YoY Web Revenue Development: Not Really helpful

At first look, the earnings assertion from the top of April after their final quarterly consequence appears disappointing, showing to have dropped YoY, together with the earnings per share. Additional, there is no such thing as a regular rising pattern in internet earnings during the last 12 months however relatively a lopsided pattern, with a peak final October.

TD – internet earnings and EPS YoY (Searching for Alpha)

On a constructive word, nevertheless, from the top-line it seems that internet curiosity earnings noticed a big YoY progress, as did non-interest earnings.

TD – internet curiosity earnings YoY (Searching for Alpha) TD – non curiosity earnings (Searching for Alpha)

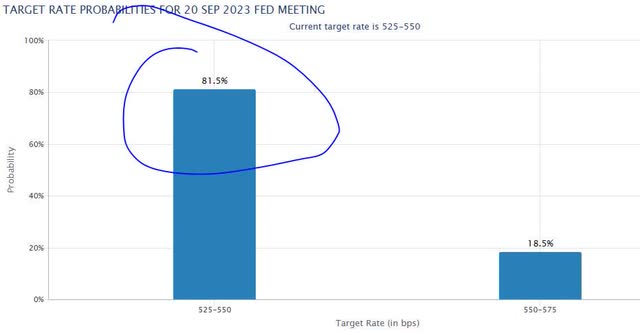

So far as curiosity earnings, contemplating that the Fed lately raised charges, the present sentiment is that these charges will maintain after the subsequent Fed assembly, so each are good for this financial institution I might say. Think about that rate-watching platform CME Fedwatch has already predicted an 82% likelihood that charges will maintain regular after the September assembly:

CME Fedwatch (CME)

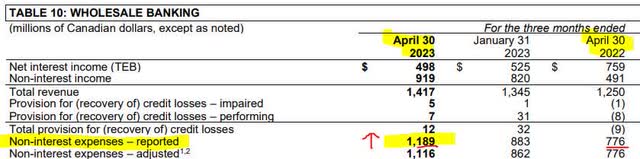

Additionally, when digging additional into what may have impacted earnings for the final quarter, the Wholesale Banking enterprise phase had acquired Cowen, which induced a one-time acquisition expense to be booked in that quarter.

In line with earnings commentary:

Reported non-interest bills for the quarter have been $1,189MM, a rise of $413MM, or 53%, in contrast with the second quarter final 12 months, reflecting TD Cowen and the related acquisition and integration-related prices.

Here’s what it seemed like within the YoY comparability for that enterprise phase:

TD – impression of Cowen acquisition (TD – quarterly presentation)

So, making an allowance for the one-time Cowen acquisition prices, and the truth that each curiosity earnings and non-interest earnings have proven YoY progress and the speed surroundings I believe will proceed to learn the financial institution, I’m satisfied the subsequent quarterly earnings name will see higher days with regards to internet earnings.

Nevertheless, in the intervening time it has not proven YoY progress as of the final outcomes, so for now I do not suggest this inventory on this class, since constructive developments in YoY earnings progress is certainly one of my ranking standards.

Capital & Liquidity: Advocate

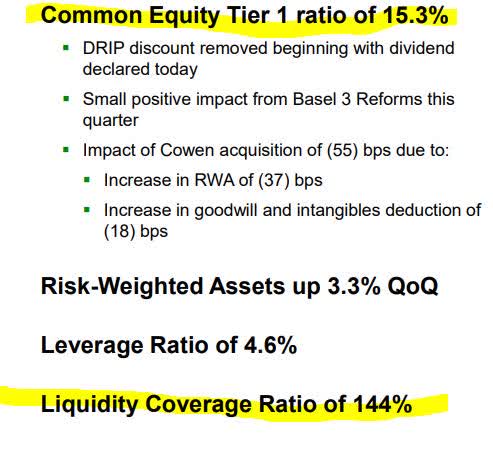

The next is a constructive signal of this financial institution’s capital power, getting my consideration with a CET1 of 15.3%, and an LCR of 144%:

TD- CET1 and LCR (TD – quarterly presentation)

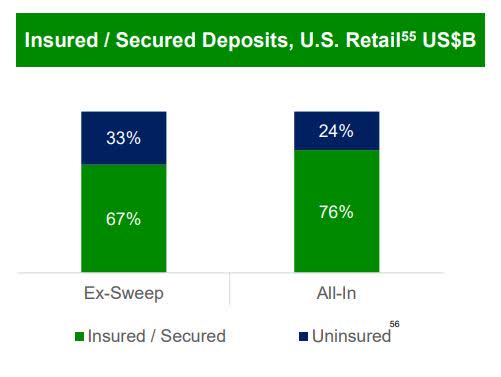

Additionally notable to say, since this spring we noticed a couple of regional financial institution failures within the US because of danger publicity to uninsured deposits, I wish to take a second to reassure readers that TD Financial institution’s US enterprise has at most 1/third or much less of deposits which can be “uninsured” deposits, as per the chart beneath, thereby I do not assume the financial institution’s liquidity can be impacted by some sudden “run” by uninsured depositors fleeing the financial institution.

TD – insured vs uninsured deposits (TD – quarterly presentation)

When wanting on the final quarterly stability sheet, this financial institution has a giant one, with over $5B in money & equivalents, $1.4T in whole belongings, $1.3T in whole liabilities, and $85.7B in constructive whole fairness.

I believe it is protected to say that I can suggest this inventory based mostly on its guardian firm’s capital & liquidity.

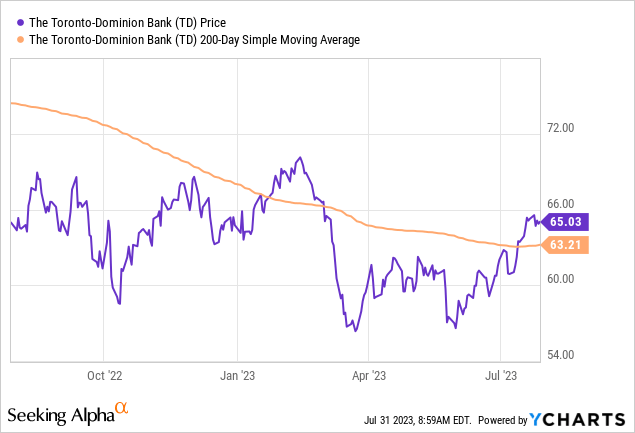

Inventory Worth vs 200 Day SMA: Advocate

As of the writing of this text, earlier than market open on Monday July thirty first the shares of TD Financial institution have been buying and selling at $65.03.

My investing thought, as in current articles is to trace the 200-day SMA and buying and selling inside a spread of 5% beneath and above that transferring common. On this case, with that transferring common being $63.21, I’m utilizing a buying and selling vary of $60.04 – $66.37.

Based mostly on that vary, the present share worth is inside shopping for vary, so I suggest it.

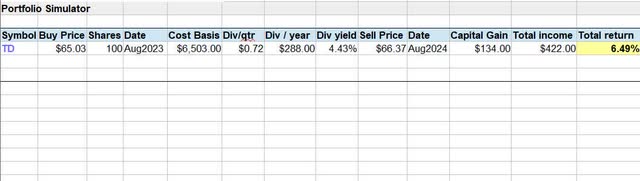

I’ve put collectively a fast spreadsheet beneath for example an instance commerce based mostly on my investing thought:

TD – portfolio simulator (Albert Anthony & Co)

On this simulated commerce, I’m shopping for 100 shares on the present trending worth of $65.03, holding for 1 12 months to get the complete 12 months dividend earnings and yield, and promoting at 5% above the present 200-day SMA, to realize a capital achieve. My whole simulated return on capital invested is 6.49%.

A danger to this concept is that after shopping for the shares, the transferring common turns downward for an prolonged interval, thereby inflicting unrealized losses on the portfolio.

In case you are questioning what buying and selling vary I might not suggest shopping for at, based mostly on this investing thought it might be a worth that’s over 5% above the SMA, so for instance a worth buying and selling at 10% above the SMA I’ll think about overpriced for a price shopping for alternative. Now, if it was out of the blue trending 10% beneath the 200-day SMA, it may nonetheless be a dip purchase alternative or maybe a price entice as properly.

This is the reason I take advantage of my 5-step holistic ranking strategy to any equities I price, to get the whole image relatively than simply taking a look at share worth.

Do share within the feedback part your ideas on recognizing worth traps with this inventory!

Scores Rating: Maintain/Impartial

Immediately, this inventory gained 3 of my 5 rankings classes, and earned a maintain /impartial ranking. That is not at all a “adverse” ranking, and in reality it’s in keeping with the consensus from the Searching for Alpha quant system. Nevertheless, it’s much less bullish than the consensus from Wall Road and Searching for Alpha analysts, as seen beneath.

Scores consensus (Searching for Alpha)

Dangers to My Outlook: Publicity to Workplace Property

A danger to my impartial / maintain sentiment on this inventory is a query different analysts and traders will ask, and that’s what publicity does their CRE portfolio should workplace property, the black sheep of the CRE portfolios recently it appears!

So, after some digging, here’s what I discovered..

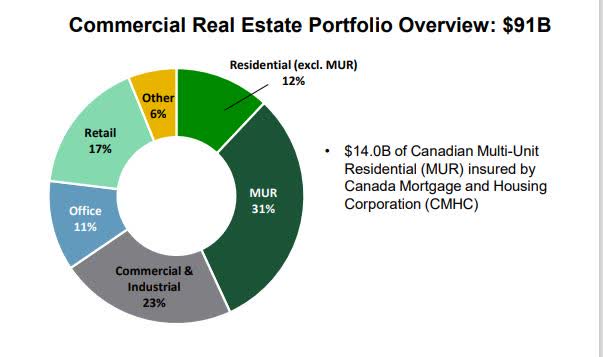

Seems, of their extremely diversified CRE portfolio, simply 11% is in workplace properties, because the chart beneath exhibits.

TD – CRE publicity (TD – quarterly presentation)

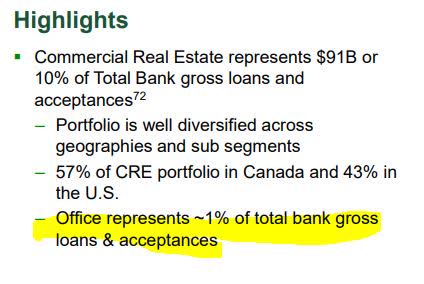

Additional, of the general mortgage e-book on the financial institution, it appears CRE is simply 10% of that, and the workplace phase is simply round 1%:

TD – CRE publicity – highlights (TD – quarterly presentation)

So, I’m not satisfied that this financial institution’s publicity to places of work is a serious danger, though it’s price keeping track of. The important thing knowledge level above to think about is that 31% of their CRE portfolio is tied up in multi-unit housing insured by the CMHC. That’s nearly a 3rd of the portfolio.

Evaluation Wrap Up

To wrap up right this moment’s evaluation, listed here are the important thing factors we mentioned.

Immediately I rated this inventory a maintain/impartial, in keeping with the Searching for Alpha quant system which additionally rated it a maintain.

Positives: dividend yield vs sector common, inventory worth vs 200-day SMA, capital & liquidity.

Headwinds: valuation too excessive vs sector common, internet earnings progress YoY was down.

The danger to workplace properties of their CRE portfolio was addressed.

In closing, I wish to reiterate that though my ranking is lukewarm on this inventory, it’s not a adverse reflection of this in any other case systemically vital and really giant banking big, however relatively a holistic view of many components collectively.

I anticipate the late August earnings name will present an enchancment in earnings per share, and for these “holding” this inventory at the moment and who purchased it earlier at a less expensive worth, I predict the subsequent constructive earnings name may result in some extra bullishness on the share worth. Once more, it is not going to have the Cowen acquisition price within the subsequent quarterly outcomes like within the final one.

Think about that three out of the final 4 quarters reported had beat earnings estimates, so I predict for Q3 we will see a possible earnings beat between $0.02 and $0.10.

TD – earnings beats (Searching for Alpha)