Who doesn’t love a discount? Shopping for high quality for a low worth is likely one of the thrills of the market system – and that applies to inventory markets as nicely. The trick is realizing which rock-bottom shares are the best ones to purchase.

Loads of shares are priced low, and bargain-hunting traders want to search out those whose fundamentals are sound. The sheer quantity of shares, and the reams of knowledge they produce, makes that troublesome – however Wall Road analysts make their dwelling by taking deep dives behind the scenes of the inventory market, and their suggestions are at all times price a learn.

Utilizing the analyst critiques as a information and backing them up with the newest knowledge from TipRanks, we’ve picked out two shares that ought to entice the curiosity of bargain-minded traders. Each shares maintain ‘Robust Purchase’ scores from the analysts, and each are exhibiting important losses over the previous yr, on the order of fifty% or extra. Let’s take a better look.

ADTRAN, Inc. (ADTN)

Let’s begin with ADTRAN, an organization primarily based in Alabama that provides ‘open, disaggregated networking and communications options’ on a worldwide scale. ADTRAN’s product vary encompasses voice, knowledge, video, and web communications options, all adaptable to current community infrastructures. Collaborating with service suppliers worldwide, the corporate facilitates scalable administration of companies, linking people, places, and gadgets.

ADTRAN maintains places of work within the UK, Europe, the Center East, and Australia, catering to thousands and thousands of consumers in governmental and personal sectors. The corporate’s portfolio covers community infrastructure, fiber entry, aggregation, open optical networking, residential and enterprise options, cloud software program, in addition to companies and assist.

Shares in ADTRAN are down 59% to date this yr, with a collection of disappointing earnings outcomes not serving to its case, as occurred within the not too long ago launched Q2 print. The 2Q23 numbers confirmed a prime line of $327.4 million, for a 90% y/y improve – however lacking the forecast by $2.3 million. Trying forward, ADTRAN anticipates 3Q23 income to vary between $275 million and $305 million, which lags behind the consensus estimate of $352.5 million.

This international telecom agency has caught the eye of Rosenblatt’s 5-star analyst Mike Genovese, who defends the corporate, and factors out in his current be aware a number of the reason why traders ought to take into account proudly owning the inventory. Laying out the case, Genovese writes: “1) The inventory is cheap at beneath 0.5x EV-to-2024 gross sales. 2) The corporate has gained extra Huawei alternative enterprise than every other (six EMEA Tier 1 wins) and the income development from these wins remains to be forward. 3) We anticipate 2024 to be an excellent yr, and suppose Adtran will probably develop revenues by double-digits. 4) Trade comps, and stock correction pressures, ought to develop into a lot simpler in 4Q23, in comparison with 3Q23, and proceed to enhance in early 2024. In different phrases, we predict 3Q23 is the underside for the trade.”

Monitoring ahead from these feedback, Genovese charges ADTN shares as a Purchase, and his worth goal, of $11, implies a one-year upside potential of ~44%. (To observe Genovese’s observe file, click on right here)

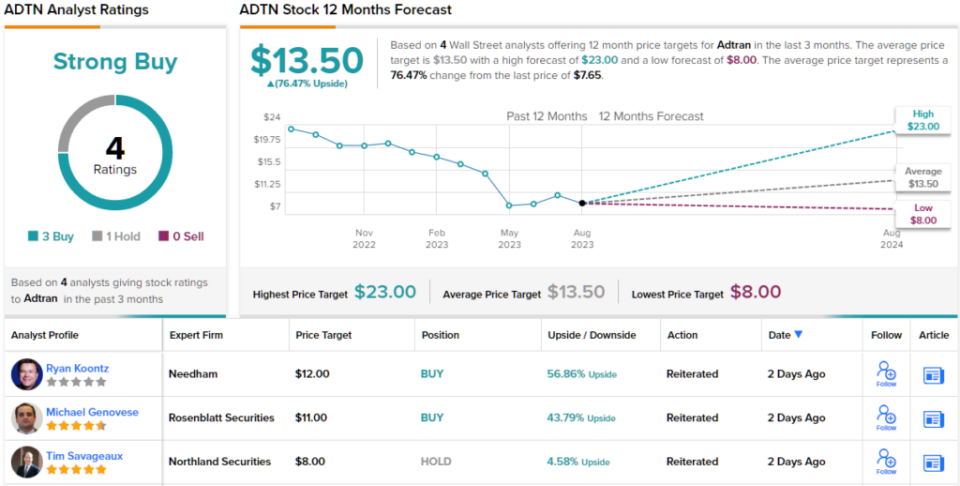

General, there are 4 current analyst critiques on ADTN shares, breaking down 3 to 1 favoring Buys over Holds, to make the Robust Purchase consensus ranking. The shares have a present buying and selling worth of $7.65, and the $13.50 common worth goal suggests the inventory will acquire ~76% within the subsequent 12 months. As an added bonus, ADTRAN pays a ahead annual dividend yield of 4.7%. (See ADTRAN inventory forecast)

IGM Biosciences (IGMS)

The second beaten-down inventory we’re taking a look at is a biomedical analysis agency, IGM Biosciences. This firm is working within the subject of antibody medicines, utilizing IgM antibodies as the start line in its growth therapeutic brokers designed to surpass the shortcomings of current IgG antibody medicines. The corporate has used IgM know-how to create a number of ‘tremendous antibodies,’ that are forming the bottom of a brand new class of superior drug candidates.

IGM has put collectively a proprietary pipeline with seven energetic analysis tracks. Of those, one remains to be in preclinical growth, however the different six have moved to Part 1 medical trials. These pipeline analysis tracks embody each monotherapy and mixture remedy applications, and goal quite a lot of cancers. The main drug candidate, aplitabart, is the topic of three trials, together with different anti-cancer medication, towards colorectal most cancers, acute myeloid leukemia, and stable tumors.

IGM reported a number of constructive steps in its pipeline applications. Distinguished amongst these was the rehash of constructive medical knowledge from the Part 1 trial of aplitabart + Folfiri within the remedy of colorectal most cancers. The corporate reported that 51 sufferers on the drug mixture confirmed ‘promising exercise by way of progression-free survival.’

Moreover, the corporate’s drug candidate imvotamab, a possible remedy for autoimmune illnesses, obtained FDA clearance for 2 Part 1b medical trials. The primary will goal extreme systemic lupus erythematosus (SLE) whereas the second will deal with extreme rheumatoid arthritis (RA). Each trials are anticipated to provoke throughout 3Q23.

Nonetheless, regardless of all this exercise, shares in IGMS are down 54% to date this yr. That brings the value down, and Stifel analyst Stephen Willey sees that as a shopping for alternative. In his feedback, the 5-star analyst notes the continuing progress of aplitabart, earlier than coming to a bullish conclusion:

“We proceed to imagine the biology of concurrently modulating extrinsic/intrinsic apoptosis signaling pathways has much-broader functions past mCRC and Aplitabart stays the centerpiece of our longer-term estimates/valuation… We imagine administration’s disclosure of incremental affected person efficacy/security knowledge from the single-arm, dose-expansion cohorts evaluating the mixture of Aplitabart 3mg/kg + FOLFIRI ± bevacizumab (Bev) in largely 3L+ mCRC sufferers is directionally-positive and further-confirms our confidence within the underlying organic speculation (simultaneous extrinsic/intrinsic apoptosis pathway modulation) and longer-term path ahead.”

“A number of extra disclosures/updates anticipated from this growth program by YE23 now present vital near-term catalysts for what we imagine stays an undervalued/underappreciated inventory,” Willey summed up.

To this finish, Willey charges IGMS shares as a Purchase, and his goal worth of $26 reveals his confidence in a strong 230% acquire within the coming yr. (To observe Willey’s observe file, click on right here)

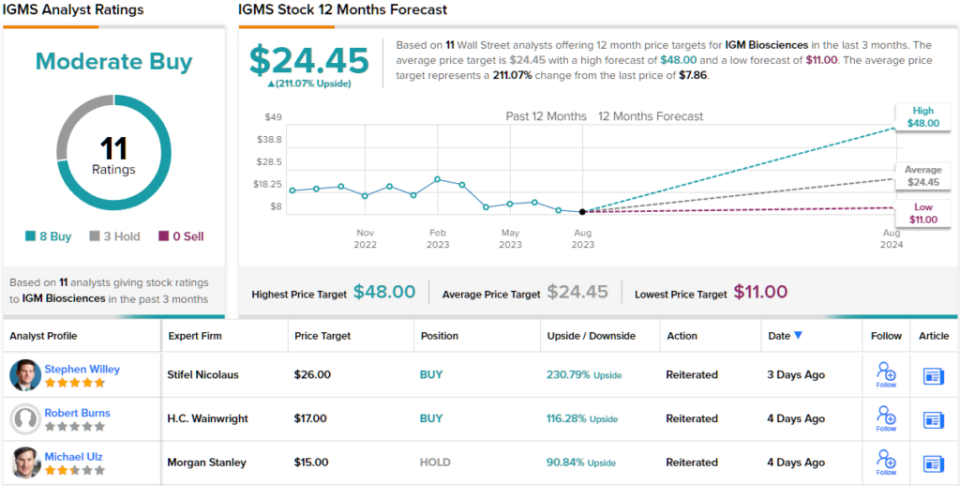

General, IGM’s 11 current analyst critiques, together with 8 Buys to three Holds, assist the inventory’s Purchase ranking, whereas the common worth goal of $24.45 and buying and selling worth of $7.86 mix to recommend a 211% upside potential on the one-year horizon. (See IGM inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally vital to do your individual evaluation earlier than making any funding.