[ad_1]

Shares of Lowe’s Firms, Inc. (NYSE: LOW) stayed inexperienced on Wednesday. The inventory has gained 13% year-to-date. The corporate reported its second quarter 2023 earnings outcomes a day in the past with the underside line exceeding expectations and the highest line matching estimates. Right here’s a take a look at how the house enchancment retailer fared in its most up-to-date quarter:

Gross sales and profitability

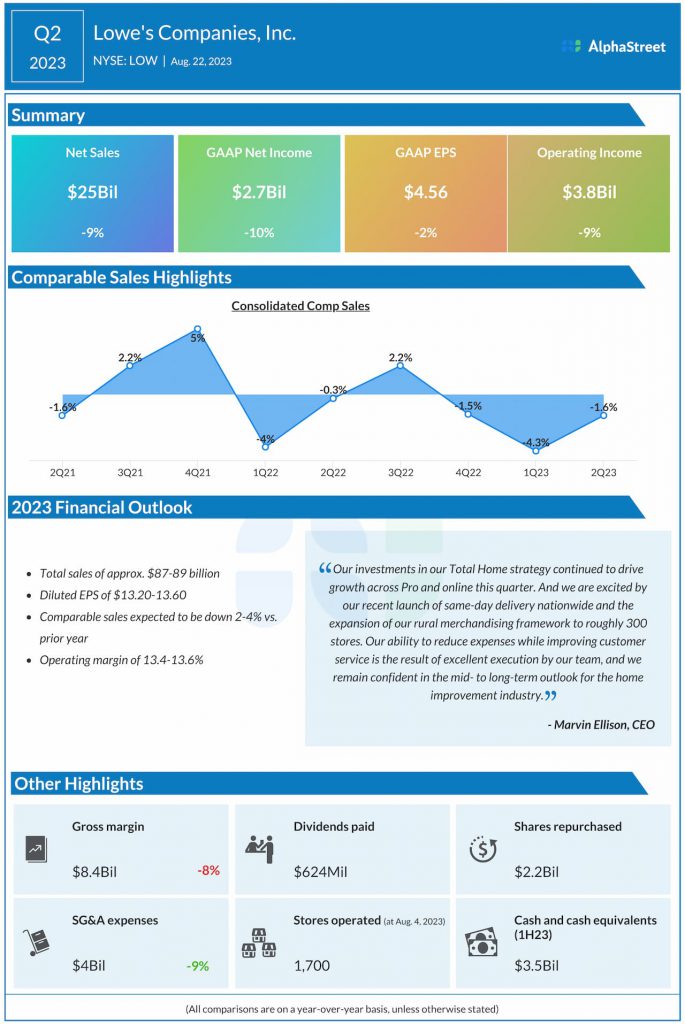

Within the second quarter of 2023, Lowe’s web gross sales decreased 9% to $25 billion versus the identical interval a 12 months in the past, however got here in step with estimates. Comparable gross sales fell 1.6% as the corporate confronted stress from decrease DIY discretionary demand and lumber deflation. These headwinds have been partly offset by a robust spring restoration and development in Professional and on-line. Internet earnings declined 10% to $2.7 billion whereas EPS dropped 2% to $4.56 in comparison with final 12 months. Regardless of the decline, EPS surpassed expectations.

Market developments

In Q2, Lowe’s noticed development in classes like plumbing, constructing supplies, paint, seasonal and outside residing, garden and backyard, and {hardware} because it captured spring gross sales and witnessed sturdy broad-based demand within the Professional class.

On its quarterly convention name, Lowe’s said that the 2 strongest demand drivers of its enterprise are actual disposable private earnings and residential value appreciation. Despite a slowdown, residence value appreciation stays 35% greater than pre-pandemic ranges. In the meantime, inflation and better rates of interest have put pressures on actual disposable earnings, which haven’t absolutely abated.

As a result of these elements, prospects proceed to be cautious with their spending, and are specializing in smaller restore and upkeep initiatives relatively than big-ticket discretionary purchases. The corporate stays optimistic on the truth that residence enchancment initiatives are sometimes postponed relatively than cancelled thereby hinting at possibilities of a restoration in demand.

The ageing housing inventory will even result in remodels and repairs and this, mixed with elements like millennial family formation, ageing in place, and distant work all give Lowe’s optimism on the mid to long-term outlook for the house enchancment business.

Outlook

Lowe’s expects web gross sales to vary between $87-89 billion for the complete 12 months of 2023. Comparable gross sales are anticipated to be down 2-4%, reflecting impacts from lumber deflation. The corporate expects energy to proceed in Professional and on-line whereas DIY discretionary purchases are anticipated to stay pressured. Adjusted EPS is anticipated to be $13.20-13.60 for the complete 12 months.

[ad_2]

Source link