Robert Means/iStock Editorial by way of Getty Photographs

UBS on Monday stated it continued to see a difficult backdrop for the media and leisure sector in H2 2023, citing “sustained pressures” on tv, minimal direct-to-consumer (DTC) subscriber progress and the affect of sport rights inflation.

Sector leaders Netflix (NASDAQ:NFLX) and Disney (NYSE:DIS) of their current quarterly stories had contrasting fortunes when it comes to subscribers, with the previous’s quantity bettering sequentially and the latter seeing a 3rd straight quarterly decline.

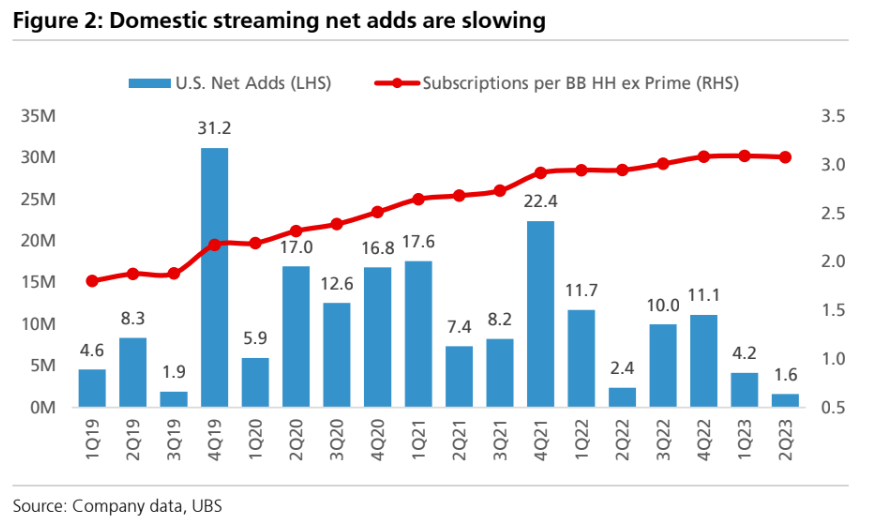

“DTC subscriber progress within the U.S. slowed dramatically in 2Q and studios answered with smaller content material budgets, impairment prices, value enhance bulletins and a larger concentrate on profitability,” UBS analyst John Hodulik stated in a analysis word.

“The large query is whether or not these platforms can nonetheless develop subs towards this backdrop as a result of value will increase and price slicing alone will not maintain EBITDA progress and platforms danger turning into profitless, no progress companies,” Hodulik added.

Netflix (NFLX) executives within the quarterly earnings name stated paid sharing was key to ramping up revenues this 12 months, whereas portray an image of an organization pivot going in response to plan. Disney (DIS) stated it might increase costs on its streaming providers.

“Subscriber progress within the U.S. has successfully floor to a halt and worldwide markets usually are not proving to be the fertile searching grounds the media firms envisioned when launching their DTC providers. We estimate the U.S. added <2M subscribers in 2Q, the bottom tally since we started monitoring the metric in 2017,” UBS’ Hodulik stated.

In response to Nielsen information on TV supply platforms, tv utilization bumped up solely barely in July throughout conventional TV’s down season. Nevertheless, streaming’s share of utilization climbed to a report excessive whilst stay TV continued a downdraft.

Weak Affiliate Traits

“Affiliate revenues are in clear decline with wire slicing solidly within the excessive single digit vary. New skinny/streaming bundles from Comcast (CMCSA) and Constitution (CHTR) might speed up these tendencies for many community teams,” UBS stated.

Sports activities affiliate revenues particularly is usually a key progress driver for media and leisure firms, with many venturing into streaming choices. Sinclair Broadcast Group (SBGI) has introduced the launch of such a service, whereas Amazon (AMZN) is reportedly planning a stand-alone app for watching sports activities.

Furthermore, Amazon (AMZN) has additionally been reportedly engaged in preliminary talks with Disney (DIS) over teaming up on a streaming providing of legacy sports-broadcaster ESPN.

“The larger situation is the growing availability of stay sports activities exterior of the standard bundle. Warner Bros. (WBD) introduced Max will carry its sports activities portfolio in October (for an up-charge) whereas sports activities is already a key part for Paramount+ (PARA) and Peacock (CMCSA). Fox (FOX) and ESPN don’t allow stay sports activities viewership exterior the bundle (for probably the most half) however this appears set to alter in 2025 and would possible take wire slicing to the subsequent stage,” UBS’ Hodulik stated.

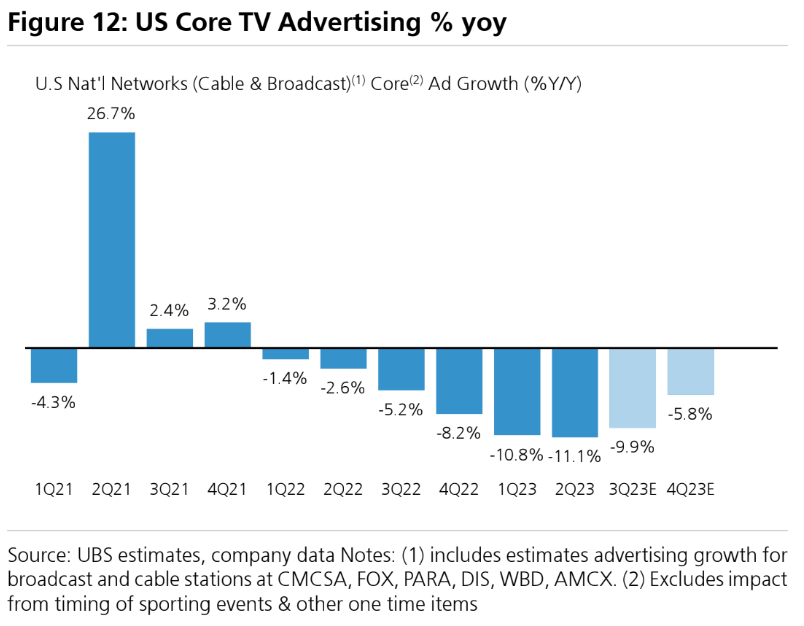

Promoting Stays Smooth

“Second quarter TV promoting tendencies had been tender regardless of relative stability within the broader financial system as a mixture of weak rankings and a steady scatter market saved ends in roughly the identical vary because the earlier 6 months,” UBS stated.

The promoting trade normally has seen a slight enchancment within the second quarter, particularly digital promoting. Fb-owner Meta (META) and Google-parent Alphabet (GOOG) (GOOGL) each reported sturdy will increase in promoting revenues of their current earnings stories. TV promoting, nevertheless, has remained subdued.

“Disney (DIS) had the most effective underlying tendencies at -8% in U.S. promoting (regardless of fewer NBA playoff video games) whereas Fox (FOX) was additionally forward of friends at -9% throughout TV and cable regardless of weaker rankings at FOX Information with the Tucker Carlson departure,” UBS’ Hodulik stated.

Sector shares: Netflix (NFLX), Walt Disney (DIS), Comcast (CMCSA), Constitution Communications (CHTR), Sinclair Broadcast Group (SBGI), Amazon (AMZN), Warner Bros. Discovery (WBD), Paramount (PARA), Fox (FOX), AMC Networks (AMCX), Endeavor Group (EDR), Apple (AAPL).