The S&P 500 (SP500) on Thursday fell 1.77% for the month of August to shut at 4,507.54 factors. Its accompanying SPDR S&P 500 Belief ETF (NYSEARCA:SPY) retreated 1.63% for the month.

The benchmark index’s efficiency for August is barely the second damaging month general this 12 months, after February. August was actually a story of two halves, with markets retreating till the center of the month earlier than erasing a few of these losses over the ultimate two weeks.

After a blistering rally this 12 months that has seen the S&P 500 (SP500) advance almost 20% up until July, optimistic sentiment took a major hit within the first week of August, mainly as a result of a shock downgrade of the USA’ long-term credit standing by Fitch. A conservative forecast from iPhone-maker Apple (AAPL) together with a rise within the dimension of debt gross sales introduced by the U.S. Treasury additionally weighed on equities.

The pullback in markets continued over the second week of August, as know-how shares prolonged their decline and key inflation reviews despatched blended indicators. The patron worth index report for July confirmed that the headline and core determine remained unchanged from June. Nonetheless, the producer worth index report confirmed an increase in each figures from the earlier month. The contrasting information led to buyers to marvel over the Federal Reserve’s subsequent transfer when it comes to financial coverage.

Markets had been additionally beneath strain as a result of an intensifying sell-off in bonds, each within the U.S. and throughout the globe. Treasury auctions particularly had been within the highlight within the second week of August, with the auctions seen as a check of better provide in the marketplace after the federal government boosted its funding targets so as to add $19B in new money raised.

The third week of August was particularly robust, with the S&P 500 (SP500) falling over 2%. A continued sell-off in bonds stored dragging on equities, together with a deteriorating financial image in China, one other warning from scores company Fitch, sizzling retail gross sales information, a largely hawkish message from the most recent Federal Reserve minutes and a blended efficiency from retail giants Walmart (WMT), Goal (TGT) and House Depot (HD).

Issues started to take a flip within the fourth week of this month. In what was the principle occasion of that week, Fed chief Jerome Powell gave a speech on the Jackson Gap Symposium that was intently watched for clues concerning the central financial institution’s future financial coverage actions. Issues over larger rates of interest for longer had been tempered after Powell largely caught to a “no surprises” message of data-dependency with a bias in the direction of hikes. Moreover, a surge in shares of chip large Nvidia (NVDA) to a document excessive after one other blowout quarter and steerage helped know-how shares rebound.

The ultimate week of this month has seen market beneficial properties as a result of tender financial information on the labor market together with a downward revision to U.S. Q2 GDP development. Moreover, a key inflation gauge most well-liked by the Fed has held regular on a M/M foundation. The weak financial indicators have strengthened bets that the central financial institution would be capable to maintain off on charge hikes.

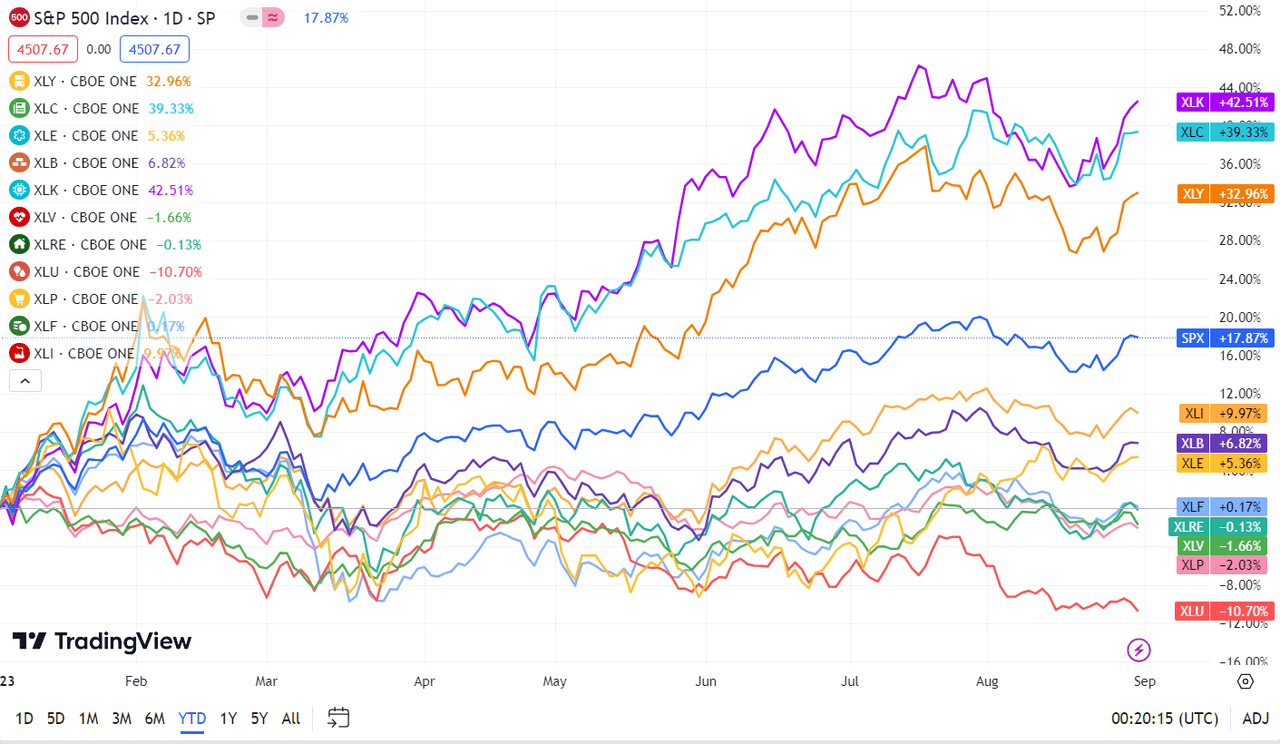

Turning to the month-to-month efficiency of the S&P 500 (SP500) sectors, except for Power, all 11 sectors ended within the crimson. Utilities noticed an outsized lack of greater than 6%, whereas Know-how closed out the month with a fall of about 1.5%. See beneath a breakdown of the efficiency of the sectors in addition to their accompanying SPDR Choose Sector ETFs from July 31 near August 31 shut:

#1: Power +1.27%, and the Power Choose Sector SPDR ETF (XLE) +1.65%.

#2: Communication Providers -0.40%, and the Communication Providers Choose Sector SPDR Fund (XLC) -1.54%.

#3: Well being Care -0.80%, and the Well being Care Choose Sector SPDR ETF (XLV) -0.70%.

#4: Shopper Discretionary -1.30%, and the Shopper Discretionary Choose Sector SPDR ETF (XLY) -1.74%.

#5: Info Know-how -1.45%, and the Know-how Choose Sector SPDR ETF (XLK) -1.51%.

#6: Industrials -2.26%, and the Industrial Choose Sector SPDR ETF (XLI) -1.98%.

#7: Financials -2.86%, and the Monetary Choose Sector SPDR ETF (XLF) -2.69%.

#8: Actual Property -3.04%, and the Actual Property Choose Sector SPDR ETF (XLRE) -3.06%.

#9: Supplies -3.46%, and the Supplies Choose Sector SPDR ETF (XLB) -3.30%.

#10: Shopper Staples -3.82%, and the Shopper Staples Choose Sector SPDR ETF (XLP) -3.95%.

#11: Utilities -6.72%, and the Utilities Choose Sector SPDR ETF (XLU) -6.13%.

Beneath is a chart of the 11 sectors’ YTD efficiency and the way they fared in opposition to the S&P 500 (SP500).