Vertigo3d

Intro

Zeta World Holdings Corp. (NYSE:ZETA) is a younger software program outfit primarily based out of New York that gives firms (entrepreneurs) the instruments essential to each retain and develop their buyer bases considerably. That is achieved by way of Zeta’s sturdy AI platform the place entrepreneurs can considerably enhance their buyer & prospect streamlining processes which leads to much better focusing on and gross sales numbers general.

Suffice it to say, that with AI being the buzzword throughout an entire host of industries in current months, Zeta is clearly working in a high-growth area. As the knowledge age continues to achieve traction, Zeta’s prospects (entrepreneurs) know that their respective advertising and marketing campaigns should constantly endure a means of steady enchancment. Competitors is rife throughout all types of digital media (and can solely develop) which implies firms will proceed to shell out giant quantities of cash on their respective advertising and marketing budgets over time.

Subsequently (and herein lies the problem regarding Zeta’s success & longevity), Zeta’s AI know-how should frequently enhance to make sure it’s seen by its shoppers as ‘superior’ in comparison with the opposite advertising and marketing software program opponents on the market. The problem shouldn’t be whether or not Zeta’s AI providing turns into extra clever, because it undoubtedly will likely be resulting from new info & indicators having the ability to be screened at breakneck speeds. The problem is how briskly ZETA’s value-adding choices can enhance in comparison with its opponents.

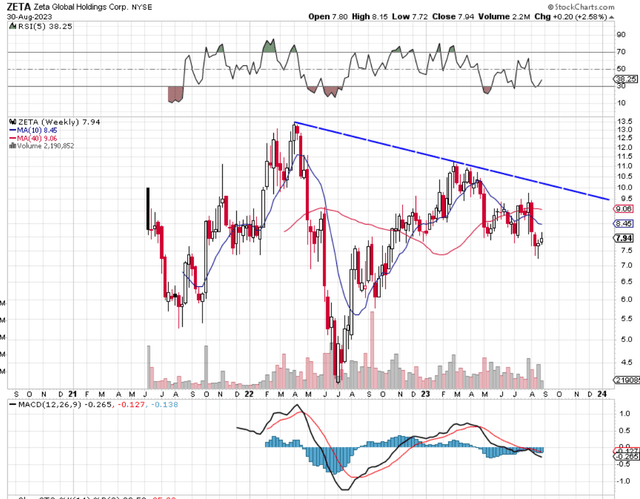

Technical Chart

From a technical standpoint, Zeta stays unproven as we see beneath. Within the firm’s quick life span to this point, we see that shares proceed to make intermediate decrease lows with the corporate’s 10-week transferring common ($8.45 per share) persevering with to path the corresponding 40-week common ($9.06) by a long way. Technically, we would want to see a bullish transferring common crossover, in addition to shares breaking out above that, downcycle intermediate pattern line (>$10 a share) in an effort to grow to be on the lengthy aspect on this play.

ZETA Intermediate Chart (Stockcharts.com)

Profitability V Progress

With respect to Zeta’s current second-quarter earnings name, the CFO pointed to the corporate’s quarterly earnings observe file, rising margins, and the elevating of full-year steerage. On the floor primarily based on these Q2 traits, one could imagine that profitability in Zeta has been bettering considerably on the agency however this may increasingly not essentially be the case as we see beneath.

Gross sales grew for instance by 24% organically to hit $172 million however this progress charge was virtually the identical rolling quarter progress charge the corporate reported in Q1. The CFO was additionally fast to level to the corporate’s adjusted EBITDA margin enlargement and constructive free money circulate of $13 million within the quarter.

When one will get previous the expansion metrics, nonetheless, the obtrusive profitability metric that continues to stay out like a sore thumb (and which is a very powerful metric from Wallstreet’s standpoint) is Zeta’s GAAP web earnings. Internet revenue within the quarter got here in damaging at -$52.2 million and regardless of displaying enchancment, clearly exhibits that Zeta stays a long way from reporting constructive bottom-line profitability.

Moreover, what buyers have to bear in mind right here is that constructive money circulate can basically be generated in a myriad of various methods. Subsequently, if certainly Zeta continues to generate sustained constructive free money circulate numbers (in a damaging earnings setting), we might warning buyers to see whether or not shares are being diluted or if shareholder fairness is being adversely affected over time. Keep in mind, a enterprise can develop a lot simpler when internally generated income are available to speculate.

Valuation

Subsequently, ZETA’s current worth is based on the expansion that’s anticipated of it going ahead. The variety of scaled prospects at Zeta continued to develop in Q2 however this pattern additionally shouldn’t be set in stone for the next purpose. Advertising and marketing all the time comes after product improvement inside firms and is invariably one of many first areas to be lower when income fall. The CFO alluded to this on the current Q2 earnings name when he said that the ‘insurance coverage’ vertical continued to return underneath strain resulting from above-average loss ratios going down in that area at current. Subsequently, though Zeta could also be properly diversified throughout an entire host of verticals that want its companies, the second any a type of sectors (Journey, Schooling, and so forth.) comes underneath strain, ZETA’s progress could undergo consequently.

Shares at current commerce with a ahead gross sales a number of of two.38 and a ahead guide a number of of seven.25. ZETA’s belongings specifically (sector guide a number of of 4.11) look costly particularly when one considers that goodwill and intangible belongings make up 46%+ of the corporate’s belongings. Subsequently, robust progress must proceed in Zeta in earnest.

Conclusion

To sum up, though ZETA continues to develop its gross sales and adjusted EBITDA numbers, the shortage of robust progress with respect to the corporate’s GAAP earnings is clearly demonstrated by the bearish pattern on the inventory’s intermediate technical chart. Buyers basically have to see greater than the current 20%+ top-line progress charge to basically transfer the needle right here. We sit up for continued protection.