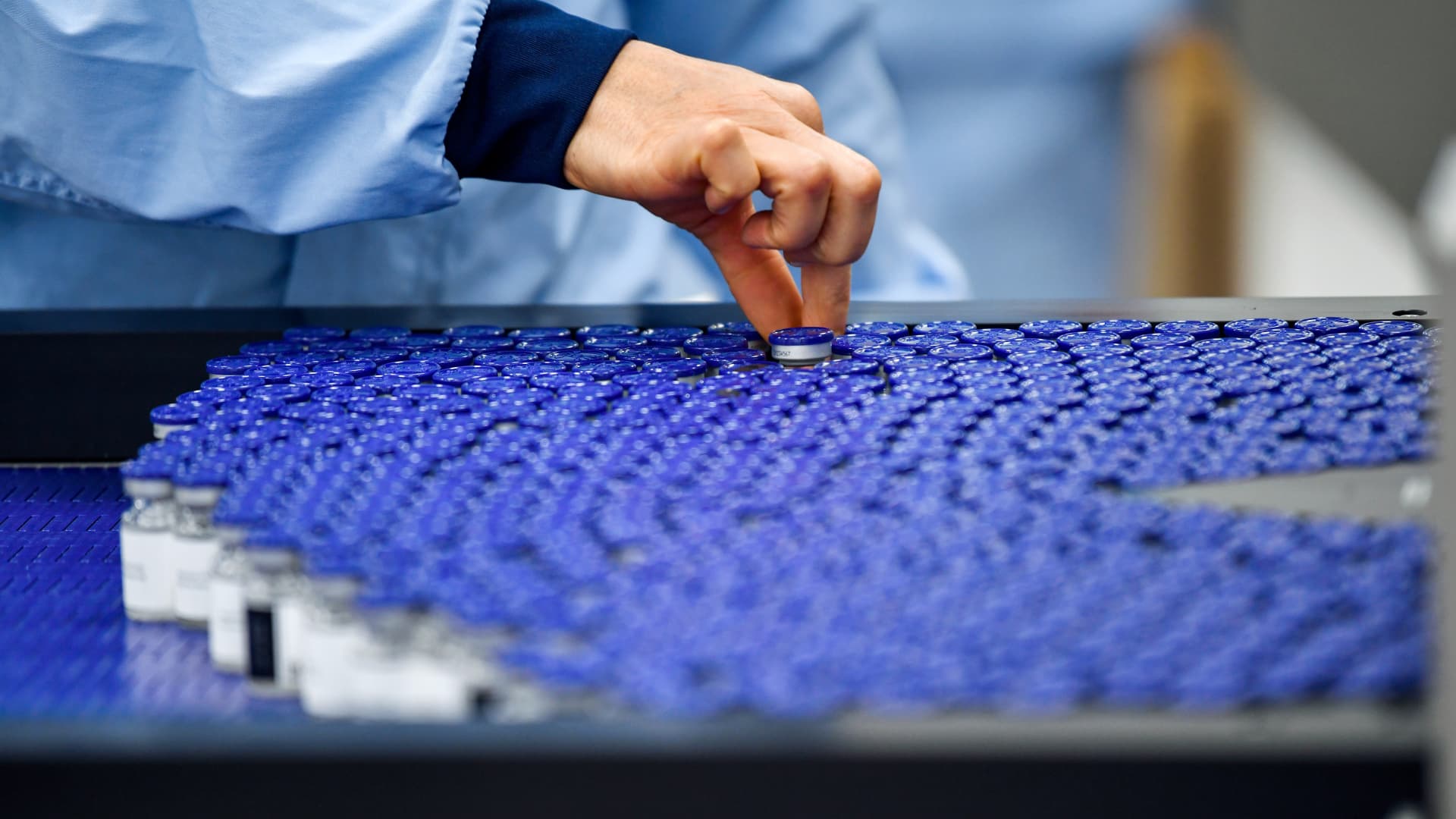

Rows of glass vials in a biologics laboratory in Sweden. Photographer: Mikael Sjoberg/Bloomberg

Bloomberg Artistic | Bloomberg Artistic Pictures | Getty Pictures

Firm: Catalent (CTLT)

Enterprise: Catalent develops and manufactures options for medication, protein-based biologics, cell and gene therapies, and shopper well being merchandise worldwide. The corporate operates by way of 4 segments. First, there’s Softgel and Oral Applied sciences, which offers formulation, improvement, and manufacturing companies for mushy capsules to be used in a spread of buyer merchandise. Biologics offers biologic cell-line, and it develops and manufactures cell remedy and viral-based gene remedy. This section additionally handles the formulation, improvement and manufacturing for parenteral dose varieties, together with vials and prefilled syringes. The Oral and Specialty Supply section affords formulation, improvement and manufacturing throughout a spread of applied sciences, together with built-in downstream medical improvement and business provide options. Lastly, the Scientific Provide Companies section affords manufacturing, packaging, storage, distribution and stock administration for medication and biologics, in addition to cell and gene therapies in medical trials.

Inventory Market Worth: $8.86B ($49.16 per share)

Activist: Elliott Funding Administration

Share Possession: n/a

Common Value: n/a

Activist Commentary: Elliott is a really profitable and astute activist investor, significantly within the expertise sector. Its group contains analysts from main tech personal fairness corporations, engineers, working companions – former expertise CEOs and COOs. When evaluating an funding, the agency additionally hires specialty and common administration consultants, professional value analysts and trade specialists. The agency typically watches firms for a few years earlier than investing and have an intensive secure of spectacular board candidates. Elliott has not disclosed its stake on this funding, however based mostly on the agency’s historical past, we might count on it to be roughly $1 billion.

What’s taking place?

On Aug. 29, Elliott and the corporate entered right into a cooperation settlement pursuant to which Catalent agreed to quickly enhance the scale of the board from 12 to 16 administrators and appoint Steven Barg (world head of engagement at Elliott), Frank D’Amelio (former CFO and EVP, world provide, of Pfizer), Stephanie Okey (former SVP, head of North America, uncommon ailments, and U.S. common supervisor, uncommon ailments at Genzyme) and Michelle Ryan (former treasurer of Johnson & Johnson). The corporate will scale back the scale of the board on the 2023 annual assembly; it agreed to appoint a slate of 12 candidates, together with the 4 new administrators. Catalent additionally agreed to determine a strategic and operational evaluation committee, charged with conducting a evaluation of the corporate’s enterprise, technique and operations, in addition to its capital allocation priorities. This committee will embrace new administrators Barg and Ryan. Additional, John Greisch (former president and CEO of Hill-Rom Holdings) has been appointed govt chair of the board and also will chair the newly fashioned committee. Elliott agreed to abide by sure customary voting and standstill provisions.

Behind the scenes

Catalent is an outsourced producer within the prescribed drugs trade. It is a secure enterprise in a rising trade working in an oligopoly. It is one of many three largest world contract improvement and manufacturing organizations, subsequent to Lonza and a division of Thermo Fisher. The corporate was at all times seen as a market chief, however in the midst of 2022 the tides started to show, largely resulting from two foremost components. First, Catalent was negatively affected by a Covid cliff: In the course of the pandemic, the federal government mandated that the corporate shut down a lot of its manufacturing and begin producing Covid vaccines. This manufacturing led to $1.5 billion in income that just lately went to zero. Second, Catalent had a number of self-inflicted wounds, together with an acquisition that didn’t pan out like they anticipated and operational and regulatory points. These are fixable points which have sunk the inventory from $142.35 in September 2021 to $48.82 this month, however they don’t essentially adversely have an effect on the long-term intrinsic worth of the corporate. That makes this example a wonderful alternative for an activist.

In its most simplistic type, there are two fundamental components to an activist marketing campaign: success within the activism (as an example, getting the corporate to undertake your agenda) and execution of the activist agenda. Elliott has already completed the previous, having entered into the cooperation settlement for 4 board seats. There’s additionally the institution of a strategic and operational evaluation committee and appointment of Greisch as govt chair of the board and as chair of the newly fashioned committee. Whereas this committee’s purview is enterprise, technique and operations, we count on it should put an emphasis on technique.

It is a very strategic asset, and there are more likely to be a number of acquirers. Actually, on Feb. 4, Bloomberg reported that fellow life sciences conglomerate Danaher had expressed curiosity in buying Catalent at a “important premium.” Catalent ended Feb. 3 at $56.05 per share, and the inventory popped almost 20% the next buying and selling session. In the end, a cope with Danaher by no means materialized. Moreover, firms like Merck may very well be concerned with shopping for the corporate or elements of it. One other chance is an acquisition by personal fairness, of which Elliott’s PE arm may very well be an social gathering. Whereas as an activist Elliott will do no matter it feels is important to boost shareholder worth, up to now the agency has made important use of the technique of providing to amass its portfolio firms as the very best catalyst to boost shareholder worth. We might not be stunned to see that occur right here. Catalent is the correct measurement for Elliott, which just lately partnered on buyout offers for Citrix Programs and Nielsen Holdings, every for roughly $16 billion. Elliott has additionally just lately proven curiosity on this trade, partnering with Affected person Sq. Capital and Veritas Capital to amass Syneos Well being (SYNH) for $7.1 billion. That acquisition is predicted to shut within the second half of 2023. Like Catalent, Syneos is an outsourced pharma options firm: It outsources R&D for pharmaceutical firms, whereas Catalent outsources manufacturing.

Elliott shortly received Catalent to pursue a strategic exploration agenda, which signifies to us that there was not a number of pushback by administration. We count on that this evaluation will conclude with a sale of the corporate. Nevertheless, it’s value noting that Catalent has a comparatively new CEO on the helm, Alessandro Maselli, who was promoted from president and COO in July 2022. Plenty of the operational points occurred throughout his watch. If this does flip from a strategic evaluation to an operational evaluation, there isn’t a assure that he retains his job.

Ken Squire is the founder and president of 13D Monitor, an institutional analysis service on shareholder activism, and the founder and portfolio supervisor of the 13D Activist Fund, a mutual fund that invests in a portfolio of activist 13D investments.