matdesign24

The market turmoil continues in 2023 as a result of rates of interest have headed greater. The U.S. Federal Reserve has aggressively moved to comprise and decrease inflation by draining liquidity and elevating the Federal Funds charge. Consequently, short-term and long-term Treasury yields have soared.

One consequence of the Fed’s motion is dividend yields have climbed, particularly in curiosity rate-sensitive industries. For instance, in combination, utility shares are buying and selling on the lowest valuation and highest yields in a few years. Financial institution shares are additionally sporting elevated dividend yields. Granted, a few of these shares carry dangers due to trade or company-specific points. However high quality firms exist.

As well as, dividend development and earnings buyers can discover high-yield shares with cheap valuation. We focus on three undervalued high-yield shares which are additionally dividend development shares for long-term earnings.

Standards for Choice

To select the three shares, we require particular standards to be met. The bullets under define what we want in using a inventory screener within the Portfolio Perception software.

- A minimal dividend yield of seven%.

- No less than 5 years of dividend development for Dividend Challenger standing.

- A payout ratio of no more than 65%.

- Undervaluation primarily based on historic price-to-earnings [P/E] ratio.

The end result was 18 shares. We focus on three firms from completely different industries.

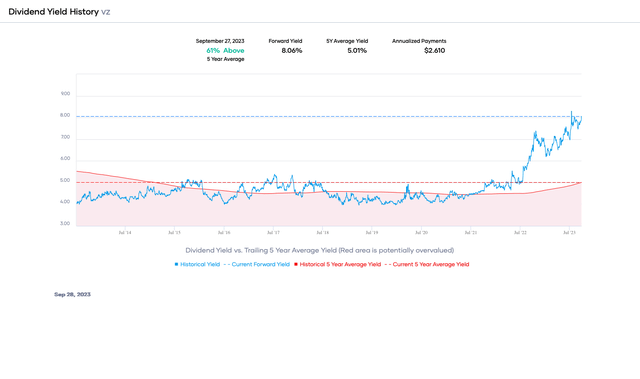

Verizon Communications

Verizon Communications (VZ) is within the bargain-basement bin. The corporate has struggled with poor ends in its retail mobile enterprise. Internet subscriber development was damaging due to poor operational execution and competitors from T-Cellular (TMUS) and AT&T (T). Additionally, capital spending was elevated due to the 5G rollout, impacting profitability.

The CEO made some adjustments, changing the top of the Client Group twice in a single yr. Whether or not the patron mobile numbers reverse their losses over time is but to be decided, nevertheless it reveals year-over-year enchancment. Additionally, when mixed with enterprise mobile development, Verizon has internet additions.

He additionally lowered capital spending. The transfer to decrease capital spending has improved working and free money stream. Complete debt remains to be elevated, however internet debt is decrease.

Within the meantime, Verizon carries an 8%+ dividend yield, the very best in a decade. Furthermore, the speed was elevated for the nineteenth consecutive yr this month. This Dividend Contender’s excessive yield comes with a non-GAAP payout ratio of 53%. The credit standing businesses give Verizon a BBB+ /Baa1, a lower-medium funding grade, offering confidence concerning the stability sheet.

Verizon is undervalued buying and selling at a price-to-earnings ratio of solely ~6.9X, appreciably lower than the vary over the previous decade. We view Verizon as a long-term purchase.

Portfolio Perception

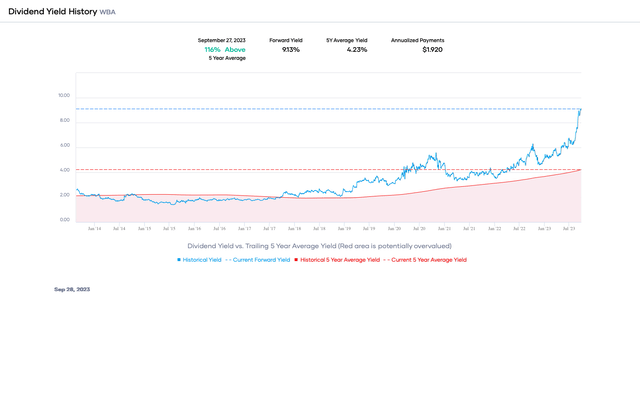

Washington Belief Bancorp

Washington Belief Bancorp (WASH) is a regional financial institution whose share worth and valuation have plummeted whereas its yield has climbed to above 8%. The financial institution doesn’t have the identical publicity to cryptocurrencies and riskier property that affected a number of regional banks earlier this yr.

The over 200-year-old financial institution operates in Rhode Island, Connecticut, and Massachusetts. It has 26 branches in Rhode Island, seven residential mortgage places of work, 4 industrial lending places of work, and 5 wealth administration places of work. Investing on this financial institution is a play on the New England financial system, which is doing nicely in comparison with the remainder of the USA. The unemployment charge for Rhode Island is 2.7%, for Massachusetts is 2.6%, and Connecticut is 3.6%, all under the nationwide common.

That mentioned, regional banks have publicity to industrial lending like actual property and industrial & industrial [C&I]. A priority is that industrial loans could also be underneath strain as a result of the rates of interest will reset greater. Nonetheless, most loans have a set time period adopted by a reset after a couple of years, that means the chance will influence solely a small proportion of loans yearly.

The opposite important threat is workplace portfolios, which face troublesome occasions as a result of hybrid work reduces earnings. Nonetheless, Washington Belief solely has ~$306 million of publicity out of a $5.4 billion whole mortgage portfolio or 5.7%. Subsequent, the typical loan-to-value is 50%, whereas the debt-service cowl ratio is 1.4+, and $0 non-performing loans. The underside line is Washington Belief doesn’t have the identical publicity as different regional banks.

Since buyers have been indiscriminately promoting all regional financial institution shares, it has made bargains of some. Washington Belief now yields about 8.3% with a payout ratio of 65%. The financial institution has raised the dividend for 13 consecutive years and paid a constant dividend for over a century.

Moreover, the earnings a number of is barely 10.6X, decrease than the 10-year vary. We view this financial institution as a long-term purchase.

Portfolio Perception

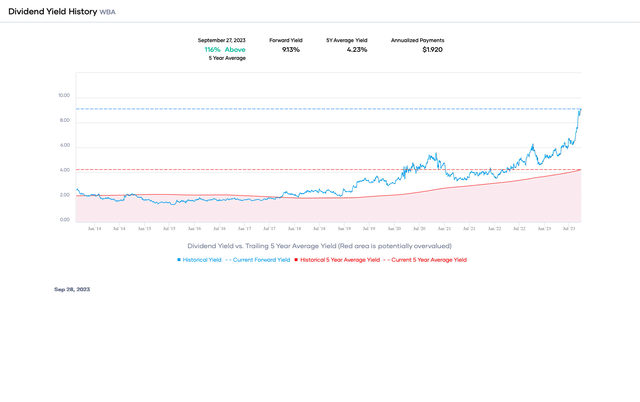

Walgreens Boots Alliance

The third inventory on this checklist is Walgreens Boots Alliance (WBA), the large pharmacy retailer. The corporate has been troublesome to carry due to a declining share worth since 2015, after the merger of Walgreens and Boots. The third quarter of fiscal yr 2023 noticed decrease steering, and subsequently, the CEO and CFO resigned, additional pressuring the share worth.

Though the corporate is seemingly in a rut, it is likely one of the two market leaders in pharmacy retail nationwide. Walgreens Boots additionally has a robust presence in the UK. Moreover, the corporate is increasing from its core retail into healthcare for development, leveraging the shops as the middle. Alongside these strains, Walgreens Boots is rising VillageMD (major care), CareCentrix (post-acute care), Shields Well being Options (specialty pharmacy), and Walgreens Well being.

On the plus aspect, pharmacy gross sales are rising on greater prescription volumes, and Boots is gaining market share. Retail gross sales for Boots are additionally climbing however are weaker for the U.S. shops. However, the agency has some challenges. First, though rising quickly, the U.S. Healthcare phase has but to be worthwhile. Subsequent, margins are underneath strain globally due to inflation, rising wages, decrease COVID-19 vaccine demand, and weak client sentiment.

Lastly, Walgreens Boots has a posh footprint. Nonetheless, the agency is promoting its AmerisourceBergen stake, exited Choice Care Well being, offered its stake in Guangzhou Prescription drugs, and introduced the sale of retail pharmacies in Chile. The corporate makes use of the proceeds to put money into the enterprise, strategic M&A, pay down debt, and dividend and share repurchases.

The corporate has a storied historical past as a dividend development inventory with a 48-year streak and 91 years of by no means lacking a fee. The agency is a Dividend Aristocrat and can most likely turn into a Dividend King. The ahead dividend yield is 9%+, supported by a average payout ratio of roughly 47%. Nonetheless, debt is greater due to M&A and working lease obligations on the stability sheet. The leverage ratio is about 2.0X, together with solely short-term, present, long-term, and long-term debt.

Walgreens Boots is in a weaker place than a couple of years in the past, and rather a lot has to do with complexity, technique, and extra debt. Nonetheless, slimming the company construction and cost-cutting initiatives ought to assist margins and profitability. Within the meantime, the inventory is undervalued at a P/E ratio of solely ~5.2X, and buyers are paid to attend.

Portfolio Perception