Nikada

Once we converse of ETFs, frequent ones like SPDR S&P 500 ETF (NYSEARCA:SPY) and Vanguard 500 Index Fund ETF (NYSEARCA:VOO) come to thoughts. Investing in devices which observe the S&P 500 index is certainly the go-to for a lot of retail buyers immediately – and there is not any situation with that in any respect! That being mentioned, there are different ETFs out there which may additionally show to be worthwhile additions to your funding portfolio.

Schwab US Dividend Fairness ETF

The main target of this text can be Schwab US Dividend Fairness ETF (NYSEARCA:SCHD). I’ll go over the underlying index, the fund’s efficiency and likewise the portfolio breakdown of the fund, and at last decide if investing in SCHD ETF is a sound funding determination.

Underlying index

SCHD ETF tracks the Dow Jones US Dividend 100 index, which includes of 100 firms chosen for comparatively robust elementary efficiency and persistently excessive dividend payouts. The index is rebalanced yearly in March to make sure an appropriate number of firms and likewise an acceptable weight for every firm within the index.

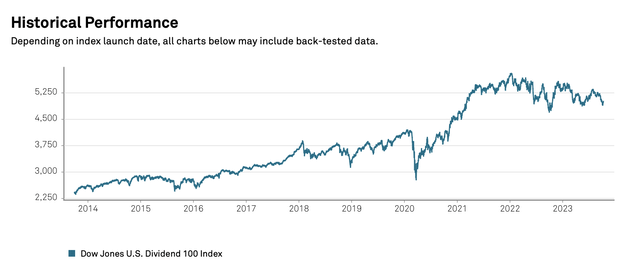

Historic efficiency of Dow Jones US Dividend 100 index (S&P International)

We see that the index itself has skilled robust development through the years, although there’s a vital dip between 2020 and 2021 – the precise interval the place the Covid-19 pandemic hit and harmed the enterprise of a number of firms worldwide. Nonetheless, the index has proven a powerful rebound, recovering to pre-Covid ranges in a couple of 12 months.

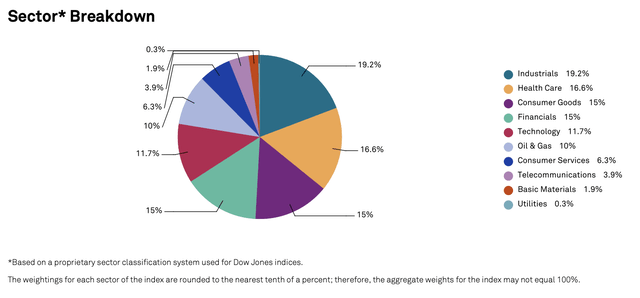

Sector Breakdown of Dow Jones US Dividend 100 index (S&P International)

Going over the sector breakdown of the index, we see that about 77.5% of the fund’s constituents are in industrials, healthcare, client items, financials and know-how. There may be affordable degree of diversification, with over 10% weightage in 6 totally different sectors, all of that are favourites amongst retail buyers.

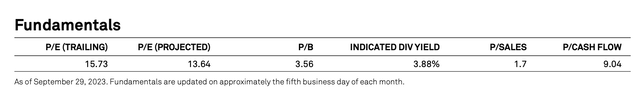

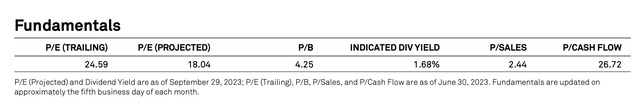

Fundamentals of Dow Jones US Dividend 100 index (S&P International) Fundamentals of S&P 500 Index (S&P International)

By way of relative valuation, I’ve pulled up the basics of Dow Jones US Dividend 100 index and the S&P 500 index. A have a look at the price-to-earnings, price-to-book, price-to-sales and price-to-cash stream reveals that the Dow Jones US Dividend 100 index may probably be at a extra engaging valuation in comparison with the S&P 500. We additionally notice that the indicated dividend yield of Dow Jones US Dividend 100 index, which is 3.88%, is greater than double that of the S&P 500’s, which stands at 1.68%.

Fund efficiency

Now that we all know a little bit extra in regards to the underlying index that SCHD ETF is monitoring, let’s go over the fund’s previous efficiency.

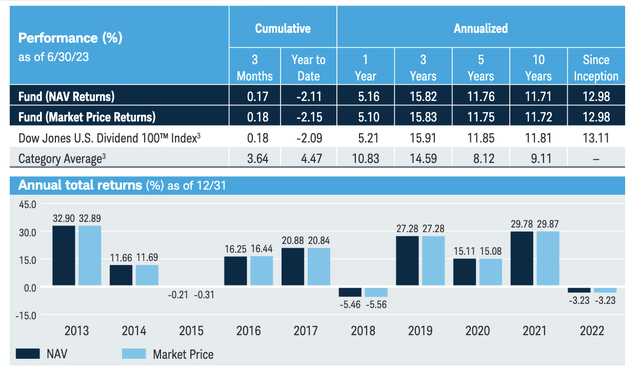

Historic returns of SCHD ETF (Charles Schwab Asset Administration)

Over the previous 10 years, the fund has carried out an annualized 11.72% return. Since inception, the fund has carried out an annualized 12.98%. We see that these metrics largely mirror the underlying index, which has annualized returns of 11.81% prior to now 10 years and 13.11% since inception. Evaluating the 10-year annualized return of SCHD ETF (11.72%) with the class common (9.11%), we see that SCHD ETF has outperformed the class common by 2.61% extra return. From the bar graphs that illustrate the annual whole returns of the fund, we see that previously 10 years, the fund has proven robust general development, attaining over 10% annual development in 7 of the previous 10 years. All in all, the fund’s efficiency has been stellar.

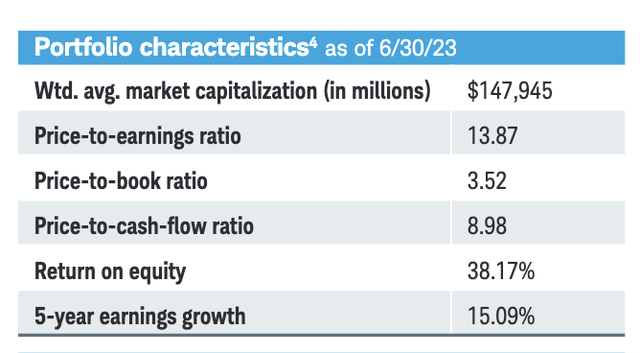

Portfolio traits of SCHD ETF (Charles Schwab Asset Administration)

We now go over the portfolio traits of SCHD ETF. The valuation metrics aren’t any shock – we have gone via the identical metrics for the ETF’s underlying index within the earlier a part of the article. Nevertheless, two issues that hooked me are the return on fairness of 38.17% and 5-years incomes development of 15.09%, each of that are robust indicators of profitability of the businesses within the ETF’s portfolio.

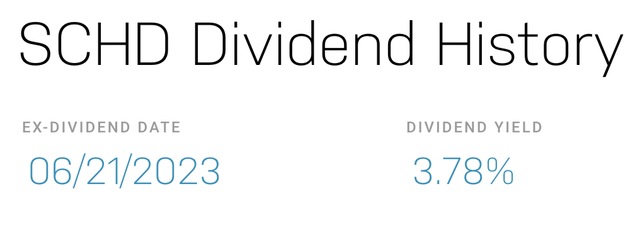

Dividend yield of SCHD ETF (Nasdaq)

We observe that SCHD ETF has a dividend yield of three.78%, and pays an annual dividend of about $2.66 a share. Now, that is on no account the very best dividend yield within the ETF market. ETFs like Advocate Rising Fee Hedge ETF (NYSEARCA:RRH) boast over 20% in dividend yield. Nevertheless, contemplating the consistency in returns of SCHD ETF’s portfolio, along with a dividend yield that’s greater than twice that of S&P 500 ETFs, SCHD ETF may show to be an honest dividend-generating ETF with steady capital appreciation.

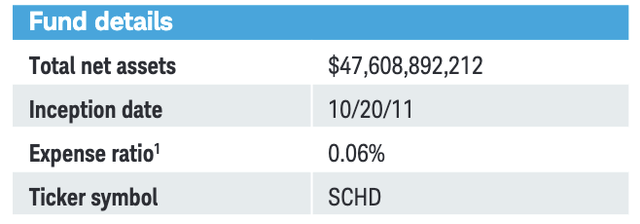

SCHD ETF Fund particulars (Charles Schwab Asset Administration)

Other than the massive quantity of web belongings, one other level to notice is the low expense ratio of 0.06%. This is a sign of environment friendly administration, as barely any working or administrative prices are deducted from the fund worth. Compared, different ETFs like ARK Innovation ETF (NYSEARCA:ARKK) have expense ratios of over 0.7%, which is greater than 10 instances than of SCHD ETF’s expense ratio. Now, this isn’t a affirmation that ARK Innovation ETF is a worse ETF than SCHD ETF, as there are numerous extra elements to consider earlier than making such a conclusion.

Portfolio breakdown

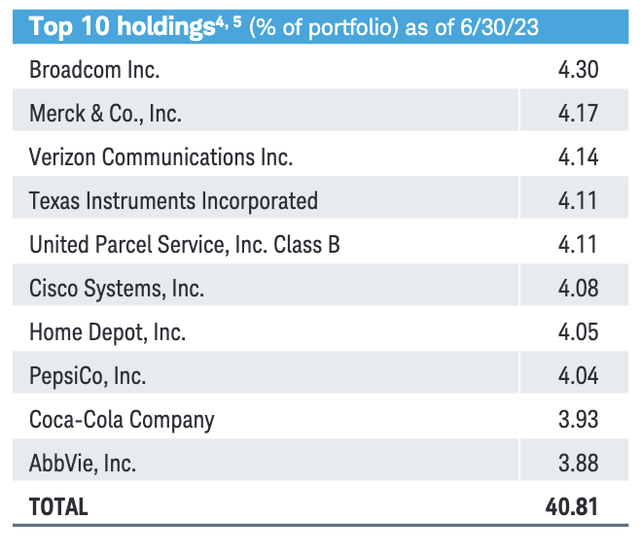

Let’s go excessive 10 holdings in SCHD ETF’s portfolio.

High 10 holdings in SCHD ETF’s portfolio (Charles Schwab Asset Administration)

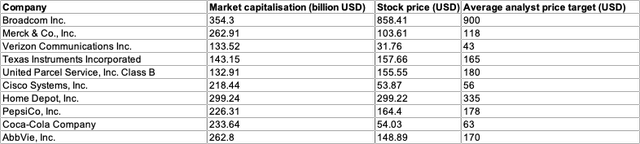

Market capitalisation, inventory worth and common analyst worth goal of every firm in SCHD ETF’s prime 10 holdings (Ready by creator)

We see that every firm in SCHD ETF’s prime 10 holdings is a big firm with tons of of billions of {dollars} in market capitalization. Particularly, the typical market capitalization of those firms on the time of writing is 226.72 billion USD – to place issues into perspective, that is bigger than the mixed market capitalization of Spotify (NYSE:SPOT) and Netflix (NASDAQ:NFLX). By way of valuation, we additionally observe that almost all of their inventory costs are beneath analyst worth targets. Now, this isn’t a name to motion to purchase all of those firm shares, as extra due diligence is required to find out a good valuation of those shares. Nevertheless, it’s a good indication that the businesses that make the majority of the ETF’s portfolio are at a snug valuation.

What ought to I take into account earlier than investing in SCHD ETF?

The most important factor to contemplate earlier than investing in ETFs which observe an underlying index, like SCHD ETF, is the market threat.

Market threat

This can be a frequent threat that’s current in all ETFs monitoring specific indices. We have to perceive that we’re investing in a diversified basket of shares. So, if we expertise lengthy intervals of market correction, it is doubtless that the ETFs in our portfolio can even see a tank in worth. Equally, when market sentiment is sweet and indices are up, the ETFs in our portfolio are more likely to see an increase in worth. All in all, market threat is certainly current when investing in SCHD ETF, and one ought to at all times take into account his or her threat tolerance earlier than investing on this ETF.

Funding determination

With all issues thought of, SCHD ETF is a perfect ETF so as to add into your portfolio for those who’re trying into diversified fairness investments that present first rate capital appreciation along with steady dividends. It isn’t going to double your cash in a 12 months, nevertheless it’s positively a very good decide for the long run.