pwmotion/iStock by way of Getty Photos

San Gimignano and the Center Ages

Midway between Florence and Siena lies the small, fortified city of San Gimignano. Within the collective creativeness, San Gimignano is recognized with the very thought of the Center Ages. Certainly, over the centuries, the traditional village has miraculously preserved its unmistakable Thirteenth-century city and architectural physiognomy. Such was given to it when it was an essential buying and selling middle alongside the Through Francigena, the good European medieval artery that led pilgrims to Rome.

Its widespread wealth is evidenced by the flourishing of towers, symbols of the affluence of the native service provider class, which nonetheless tower over the encircling countryside. In Dante’s time, town had greater than seventy towers (of which solely fourteen stay), protected by a legislation forbidding their demolition until extra stunning ones had been to be constructed. The tower thus represented a show of status for rich households, who might flaunt their financial energy in a contest to claim the prevalence of their lineage.

Towers and Closed-Finish Funds

The historical past of mankind is peppered with “contests” to claim one’s status, expertise and authority via the development of fabric works, the accomplishment of memorable feats or the administration of financial assets. Funding homes don’t escape this dynamic both, regularly providing new services and products, searching for to safe ever bigger slices of the market.

In San Gimignano, towers had been being constructed. Within the monetary world, funding funds are being launched. On this article, I’ll deal solely with Closed-Finish Funds, which signify the core of my earnings portfolio. The variety of CEFs at present on the U.S. market is 440, hovering via the monetary sky, each performing as a spokesperson for the technique and administration philosophy of the homes that launched them.

However are we positive they’re at all times profitable methods? I analyzed all of the funds, one after the other, and the outcome total just isn’t fairly encouraging. Let’s examine why.

Is It Price Investing in CEFs?

The reply is sure, however on the situation of creating sensible selections, deciding on the funds that, though two tough years like 2022 and 2023, have maintained their worth over time. That’s, whose NAV exhibits a constructive pattern since inception. The evaluation performed at present due to this fact acquires higher relevance, given the efficiency of the markets within the current previous.

With a purpose to make investments consciously, it due to this fact seems essential to keep away from these CEFs that present a relentless lack of wealth. This loss is just partially offset by double-digit distributions on which the person on the road sometimes focuses. After all this contains, at instances, yours really, who just isn’t exempt from blunders like most buyers, to the extent that even my CEF portfolio, created throughout 2020, exhibits solely partially optimum selections on this respect. Let he who’s with out sin solid the primary stone…

Based mostly on the record printed by the positioning StockMarketMBA.com Dwelling (which, nonetheless, is now not maintained), I extrapolated 440 CEFs at present lively on the U.S. market and analyzed them, one after the other, specializing in their Internet Asset Worth % change since inception, utilizing the YCharts platform.

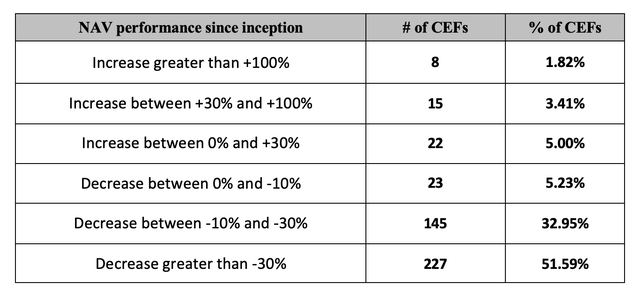

I divided all CEFs into six teams. That is the ultimate outcome, up to date to October 11, 2023:

Creator

Word: Because it has taken me just a few days to investigate all of the 440 CEFs, it might be that within the meantime some funds have modified their efficiency, transferring from one group to a different. Some may additionally have modified their efficiency from destructive to constructive, thus remaining excluded from that record.

As will be seen from this abstract desk, as many as 395 CEFs, i.e., about 90 % of all these at present in the marketplace at present, present a NAV that has misplaced worth since inception. After all, throughout this time there have been month-to-month or quarterly distributions which have affected the Whole Return of every safety. I’ve restricted myself right here to analyzing the sheer change in NAV, with out taking into consideration both the cashflow generated by every fund or any reinvestment of dividends.

In observe, if on the time of their launch an investor had bought any of the 395 CEFs which have decreased in worth by merely cashing within the dividends since then, at present he would have much less invested capital than he had initially. It’s because many of those shares have seen their NAV drop, in some circumstances by as a lot as 70, 80 or 90 %. (Since I’m Italian, tax issues associated to the comfort of any loss-making transactions underneath U.S. taxation are past the scope of my evaluation.)

Sure, with Due Warning

As I mentioned, the reply as as to whether it’s price investing in CEFs is sure, so long as one seems to be for high quality. That’s, deciding on these funds which have elevated the worth of their property over time, financing their distributions with out depleting capital. Due to this fact, on this method making a twin supply of wealth: capital development and dividends collected.

A virtuous circle, nonetheless, that impacts lower than 10 % of the CEFs at present in the marketplace, since 7 out of 45 funds with constructive NAVs don’t pay dividends. So the vary of funding choices for to those that observe a dividend technique whereas additionally aiming for capital development is additional diminished.

The periodic distributions of those 38 CEFs range in each quantity and frequency, as does, in fact, the appreciation of NAV from fund to fund. However, the message to be emphasised is that each one 38 funds examined have over time (albeit, in some circumstances, by a small quantity) elevated the face worth of the preliminary capital, the place bought at launch, in addition to, in fact, paying dividends. A few of them have carried out way more, displaying NAV development even reaching double or triple digits.

A curious side that emerged throughout this evaluation is that the overwhelming majority of those funds quote at a reduction, in lots of circumstances even within the double digits. In observe, one should purchase on the flea market funds which have confirmed they will create worth over time. Evidently, for mysterious causes, worth creation doesn’t appear to have a lot enchantment to the person on the road, versus juicy distributions.

Let’s take a look at the efficiency of those 38 CEFs intimately, grouped by frequency of distributions.

8 CEFs with Annual Distributions

Of the 38 dividend-paying CEFs with constructive NAV since launch, 8 have distributions concentrated primarily within the year-end installment (represented largely by capital features, and due to this fact variable from 12 months to 12 months) though a few of them pay quarterly or semiannual interim funds. In some circumstances, these are historic funds, having been launched final century, however they nonetheless get pleasure from glorious well being, as will be seen from the graphs.

I’m not personally considering any such CEF due to the extreme dilution of their distributions over time. This prevents me from framing them correctly inside the context of my earnings portfolio.

In any case, that is the record:

- Adams Diversified Fairness Fund (ADX)

- Central Securities Company (CET)

- European Fairness Fund (EEA)

- Templeton Rising Markets Fund (EMF)

- Normal American Buyers Firm (GAM)

- Eagle Capital Development Fund (GRF)

- Morgan Stanley India Funding Fund (IIF)

- Adams Pure Assets Fund (PEO)

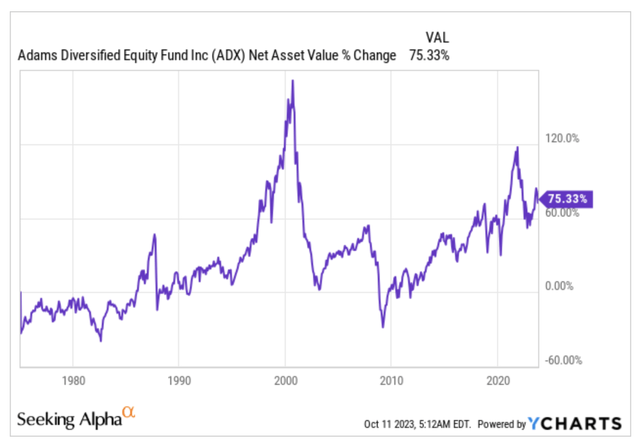

Adams Diversified Fairness Fund

ADX (YCharts)

Morningstar Class: Massive Mix

Market Worth: $2.0 Bil

Whole Leverage Ratio: 0.00%

Final Precise Disc/Prem: -15.05%

Whole Dist. Fee: 1.19% (quarterly, plus year-end distribution)

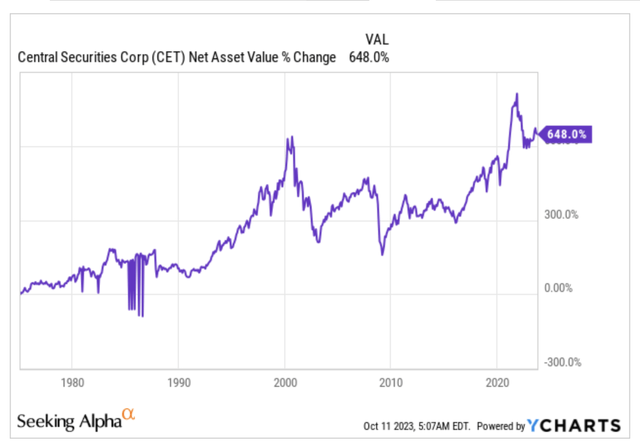

Central Securities Company

CET (YCharts)

Morningstar Class: Massive Mix

Market Worth: $1.0 Bil

Whole Leverage Ratio: 0.32%

Final Precise Disc/Prem: -17.50%

Whole Dist. Fee: 1.11% (semi-annual, plus year-end distribution)

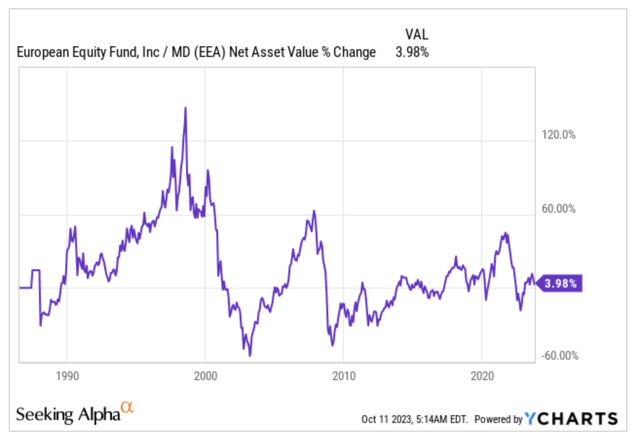

European Fairness Fund

EEA (YCharts)

Morningstar Class: Europe Inventory

Market Worth: $55 Mil

Whole Leverage Ratio: 2.38%

Final Precise Disc/Prem: -17.44%

Whole Dist. Fee: 0.81% (semi-annual, plus year-end distribution)

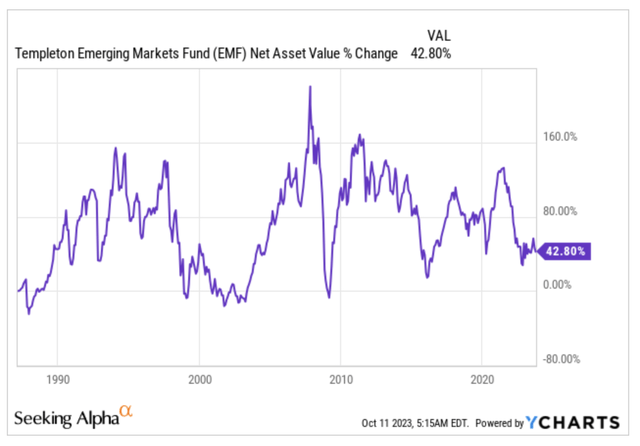

Templeton Rising Markets Fund

EMF (YCharts)

Morningstar Class: Diversified Rising Mkts

Market Worth: $177.1 Mil

Whole Leverage Ratio: 4.57%

Final Precise Disc/Prem: -15.14%

Whole Dist. Fee: 10.02% (2022 year-end distribution)

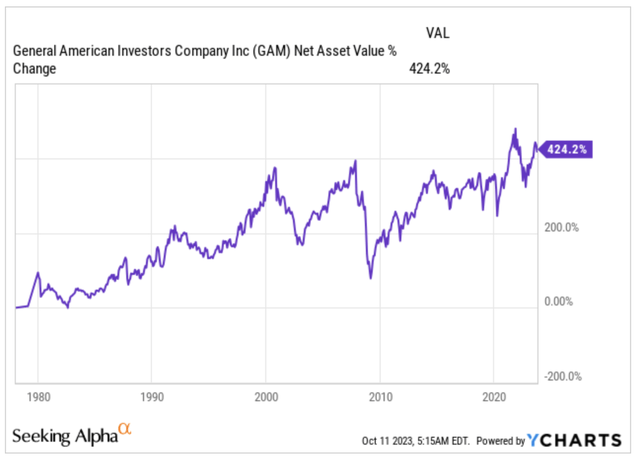

Normal American Buyers Firm

GAM (YCharts)

Morningstar Class: Massive Mix

Market Worth: $987.4 Mil

Whole Leverage Ratio: 13.75%

Final Precise Disc/Prem: -17.17%

Whole Dist. Fee: 2.41% (semi-annual, plus year-end distribution)

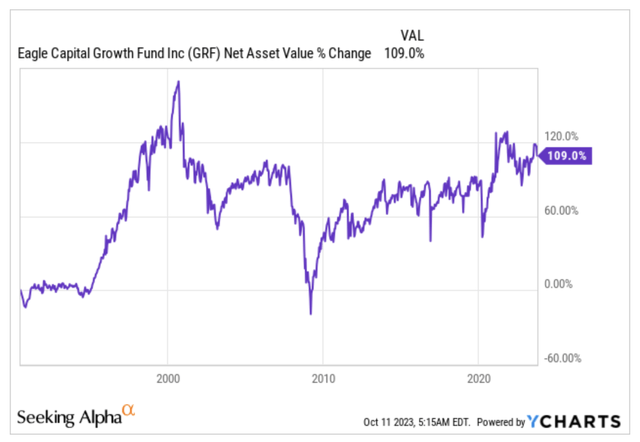

Eagle Capital Development Fund

GRF (YCharts)

Morningstar Class: Massive Mix

Market Worth: $33.4 Mil

Whole Leverage Ratio: –

Final Precise Disc/Prem: -18.65%

Whole Dist. Fee: 4.39% (2022 year-end distribution)

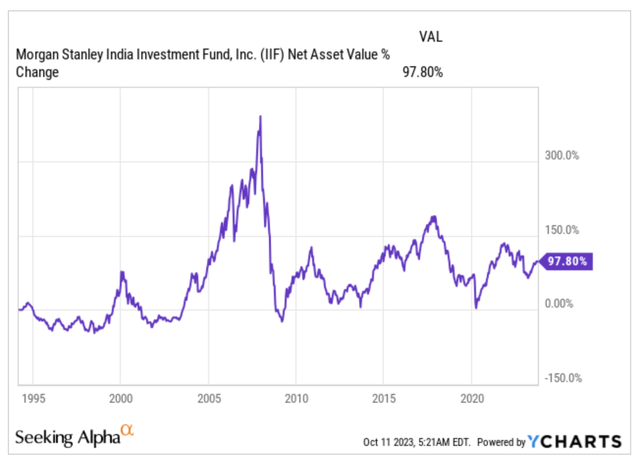

Morgan Stanley India Funding Fund

IIF (YCharts)

Morningstar Class: India Fairness Mix

Market Worth: $226.2 Mil

Whole Leverage Ratio: –

Final Precise Disc/Prem: -19.70%

Whole Dist. Fee: 17.86% (2022 year-end distribution)

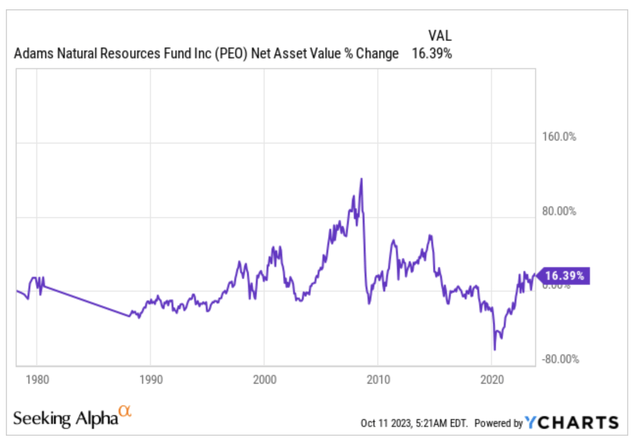

Adams Pure Assets Fund

PEO (YCharts)

Morningstar Class: Fairness Vitality

Market Worth: $551.0 Mil

Whole Leverage Ratio: 0.70%

Final Precise Disc/Prem: -16.34%

Whole Dist. Fee: 1.82% (quarterly, plus year-end distribution)

18 CEFs with Quarterly Distributions

Eighteen, alternatively, are the quarterly distribution CEFs with a constructive NAV since launch, that are a really fascinating class though the frequency of fee is in fact deferred over time in comparison with month-to-month distribution.

Personally, I’ve by no means most well-liked them over CEFs with month-to-month distribution, all in all mistaken, as a result of after shopping for some shares with quarterly frequency I noticed how way more enjoyable the method is in these circumstances, in comparison with the psychological stress given by the month-to-month renewal of distribution declarations. Who is aware of why, however I think about their managers are much less pressed by deadlines and have extra time to assume: foolish particulars, I admit, however nuances also can have their weight.

That is the record:

- ClearBridge MLP and Midstream Fund (CEM)

- Sprott Focus Belief (FUND)

- Gabelli International Small & Mid Cap Worth Belief (GGZ)

- Gabelli Healthcare & WellnessRx Belief (GRX)

- Tekla Healthcare Buyers (HQH)

- Tekla Life Sciences Buyers (HQL)

- The India Fund (IFN)

- Barings Company Buyers (MCI)

- Barings Participation Buyers (MPV)

- Mexico Fund (MXF)

- PIMCO Vitality & Tactical Credit score Alternatives (NRGX)

- Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX)

- Royce Micro-Cap Belief (RMT)

- Royce Worth Belief (RVT)

- SRH Whole Return Fund (STEW)

- Columbia Seligman Premium Expertise Development Fund (STK)

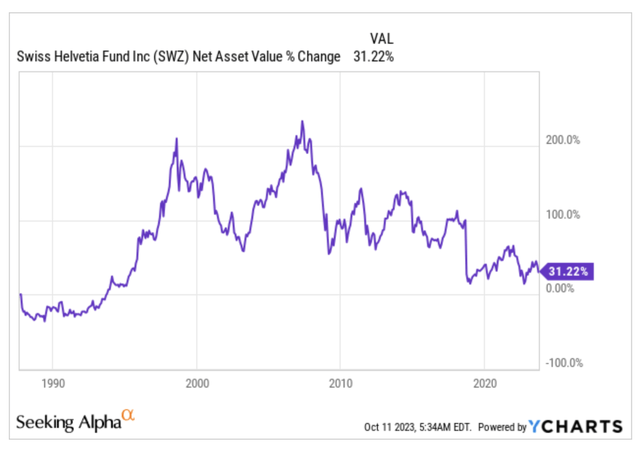

- Swiss Helvetia Fund (SWZ)

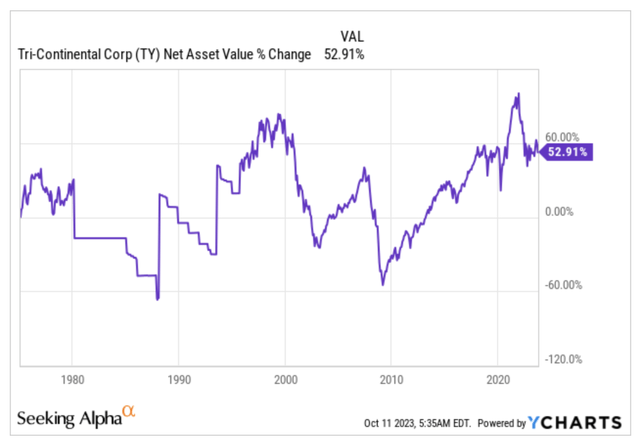

- Tri-Continental Company (TY)

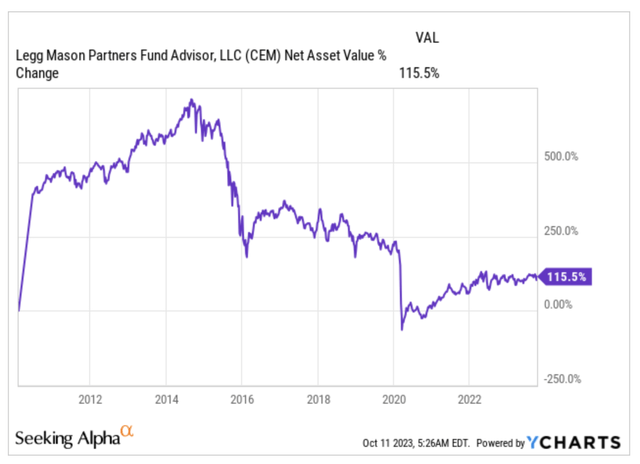

ClearBridge MLP and Midstream Fund

CEM (YCharts)

Morningstar Class: Vitality Restricted Partnership

Market Worth: $476.3 Mil

Whole Leverage Ratio: 31.35%

Final Precise Disc/Prem: -14.75%

Whole Dist. Fee: 8.60%

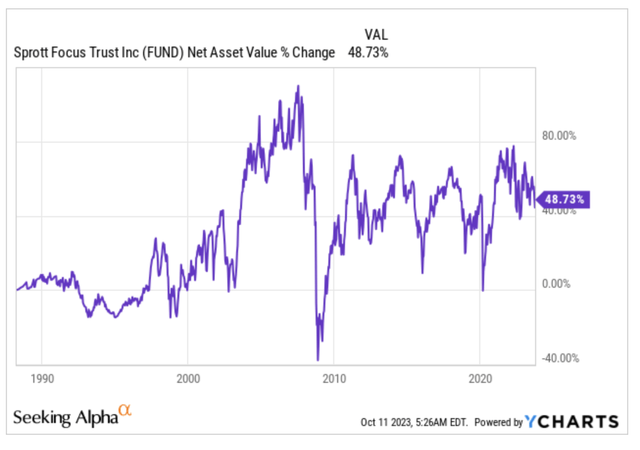

Sprott Focus Belief

FUND (YCharts)

Morningstar Class: Mid-Cap Worth

Market Worth: $218.2 Mil

Whole Leverage Ratio: 0.00%

Final Precise Disc/Prem: -9.21%

Whole Dist. Fee: 6.74%

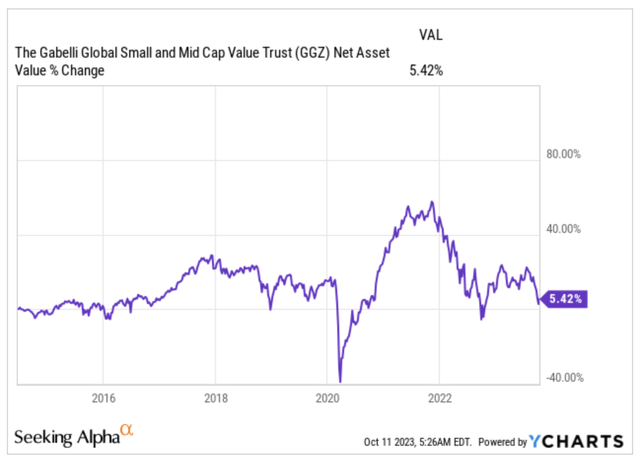

Gabelli International Small & Mid Cap Worth Belief

GGZ (YCharts)

Morningstar Class: International Small/Mid Inventory

Market Worth: $87.7 Mil

Whole Leverage Ratio: 22.97%

Final Precise Disc/Prem: -18.31%

Whole Dist. Fee: 6.29%

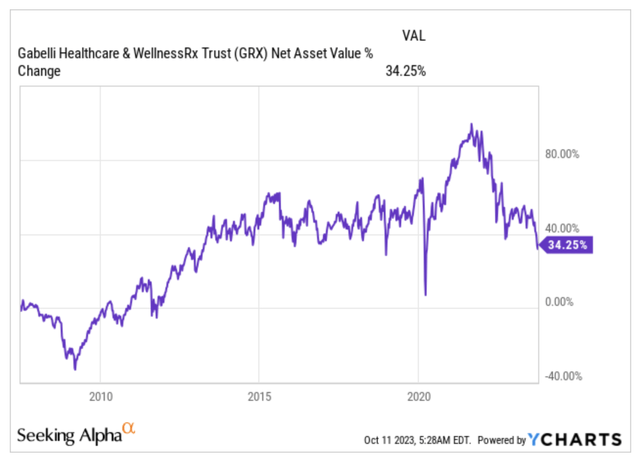

Gabelli Healthcare & WellnessRx Belief

GRX (YCharts)

Morningstar Class: Well being

Market Worth: $138.1 Mil

Whole Leverage Ratio: 27.22%

Final Precise Disc/Prem: -19.22%

Whole Dist. Fee: 7.25%

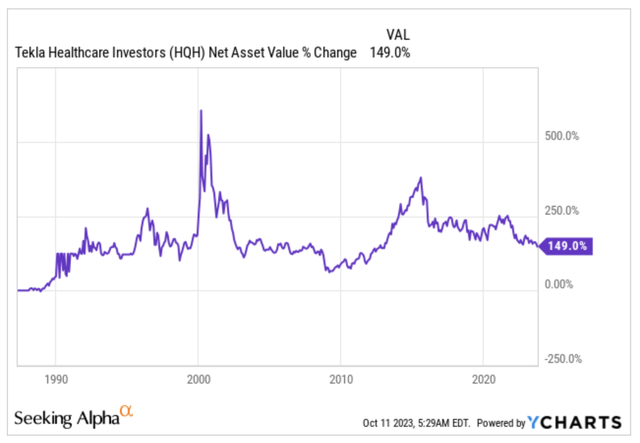

Tekla Healthcare Buyers

HQH (YCharts)

Morningstar Class: Well being

Market Worth: $765.4 Mil

Whole Leverage Ratio: 1.11%

Final Precise Disc/Prem: -17.40%

Whole Dist. Fee: 10.34%

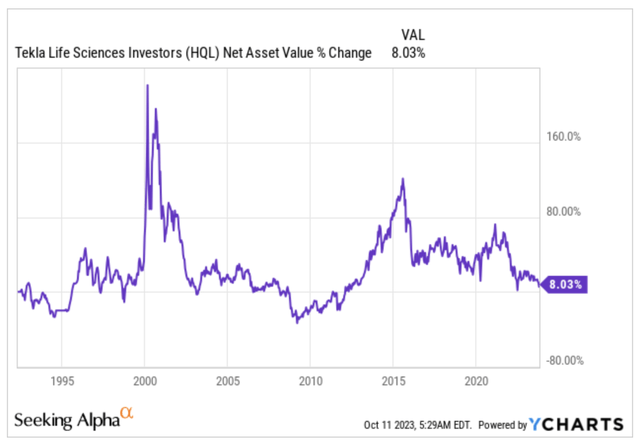

Tekla Life Sciences Buyers

HQL (YCharts)

Morningstar Class: Well being

Market Worth: $328.7 Mil

Whole Leverage Ratio: 2.28%

Final Precise Disc/Prem: -17.87%

Whole Dist. Fee: 10.43%

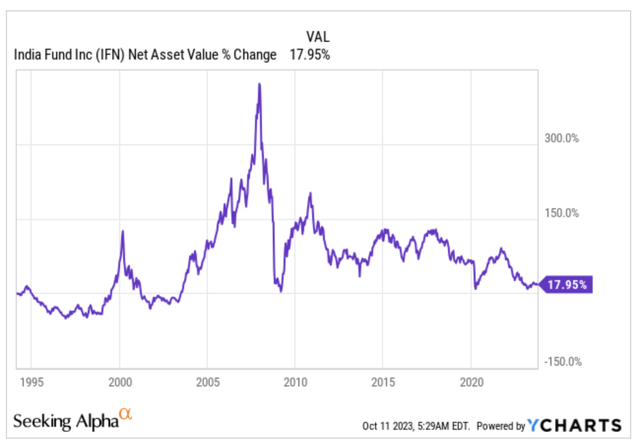

The India Fund

IFN (YCharts)

Morningstar Class: India Fairness

Market Worth: $515.8 Mil

Whole Leverage Ratio: 0.28%

Final Precise Disc/Prem: 4.12%

Whole Dist. Fee: 9.55%

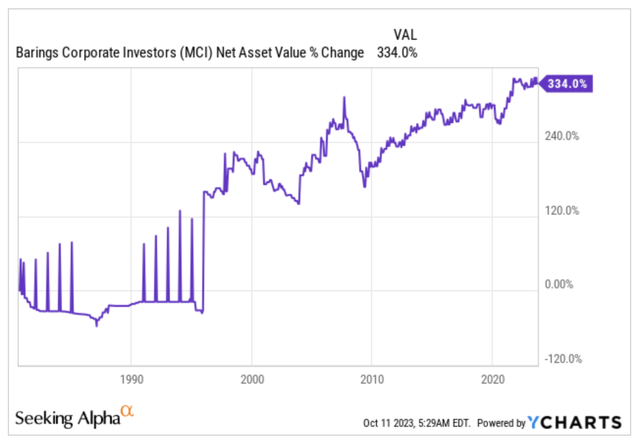

Barings Company Buyers

MCI (YCharts)

Morningstar Class: Excessive Yield Bond

Market Worth: $318.7 Mil

Whole Leverage Ratio: 10.64%

Final Precise Disc/Prem: -5.13%

Whole Dist. Fee: 9.41%

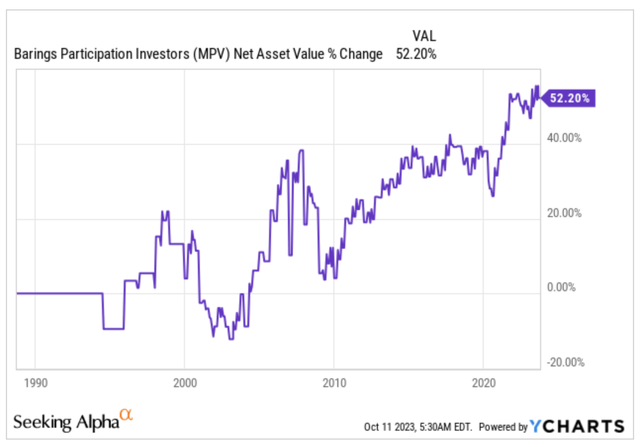

Barings Participation Buyers

MPV (YCharts)

Morningstar Class: Excessive Yield Bond

Market Worth: $142.1 Mil

Whole Leverage Ratio: 11.76%

Final Precise Disc/Prem: -11.96%

Whole Dist. Fee: 10.15%

Mexico Fund

MXF (YCharts)

Morningstar Class: Miscellaneous Area

Market Worth: $235.9 Mil

Whole Leverage Ratio: –

Final Precise Disc/Prem: -19.14%

Whole Dist. Fee: 5.09%

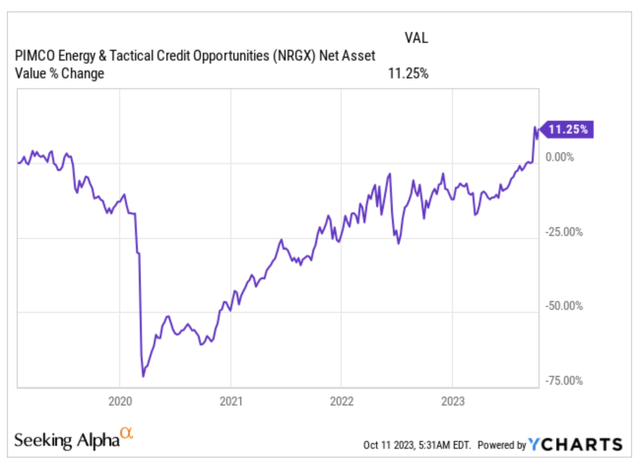

PIMCO Vitality & Tactical Credit score Alternatives

NRGX (YCharts)

Morningstar Class: Vitality Restricted Partnership

Market Worth: $844.1 Mil

Whole Leverage Ratio: 13.22%

Final Precise Disc/Prem: -15.49%

Whole Dist. Fee: 4.66%

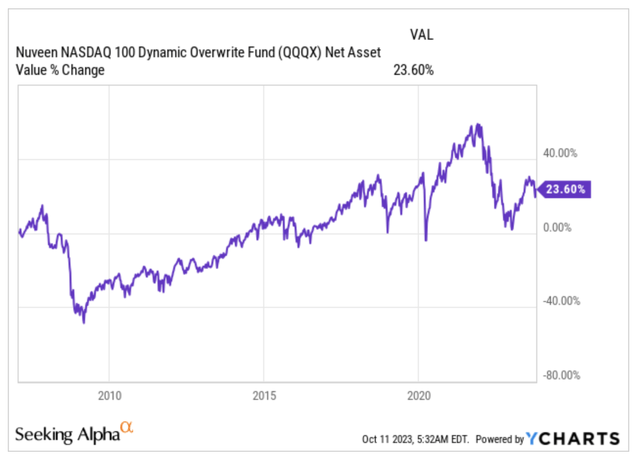

Nuveen Nasdaq 100 Dynamic Overwrite Fund

QQQX (YCharts)

Morningstar Class: By-product Revenue

Market Worth: $1.1 Bil

Whole Leverage Ratio: –

Final Precise Disc/Prem: -5.28%

Whole Dist. Fee: 7.49%

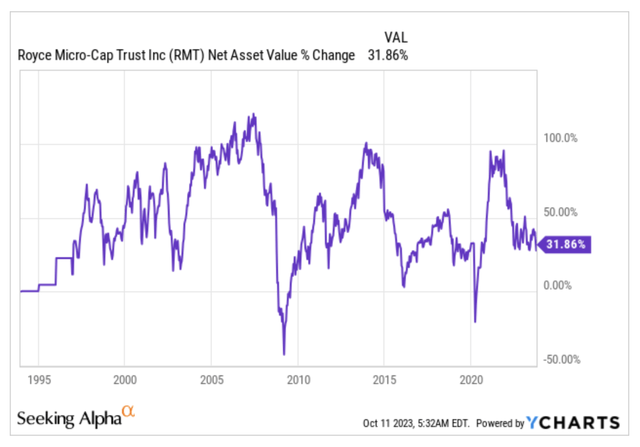

Royce Micro-Cap Belief

RMT (YCharts)

Morningstar Class: Small Mix

Market Worth: $395.9 Mil

Whole Leverage Ratio: 4.61%

Final Precise Disc/Prem: -13.03%

Whole Dist. Fee: 8.35%

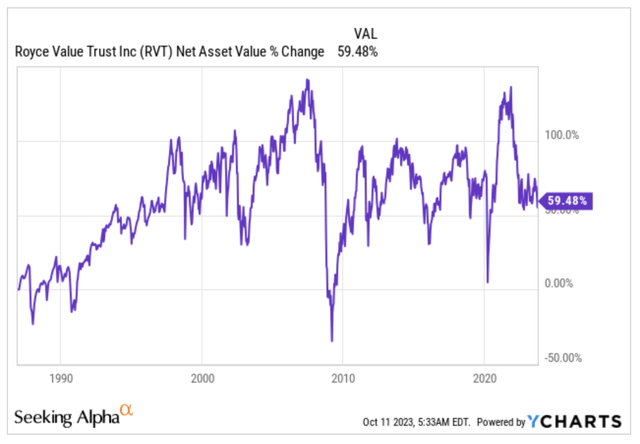

Royce Worth Belief

RVT (YCharts)

Morningstar Class: Small Mix

Market Worth: $1.4 Bil

Whole Leverage Ratio: 2.11%

Final Precise Disc/Prem: -13.40%

Whole Dist. Fee: 8.25%

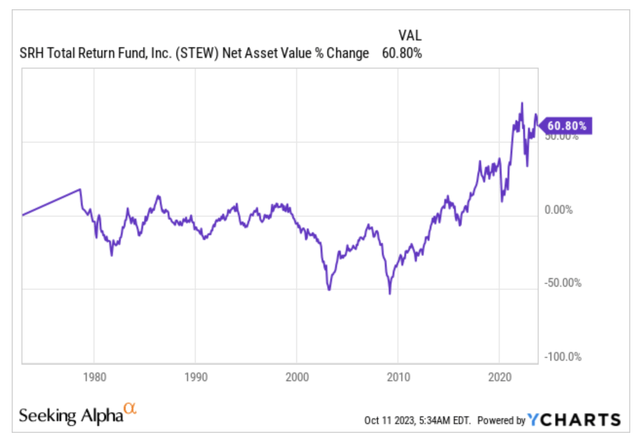

SRH Whole Return Fund

STEW (YCharts)

Morningstar Class: Monetary

Market Worth: $1.3 Bil

Whole Leverage Ratio: 12.56%

Final Precise Disc/Prem: -18.99%

Whole Dist. Fee: 3.86%

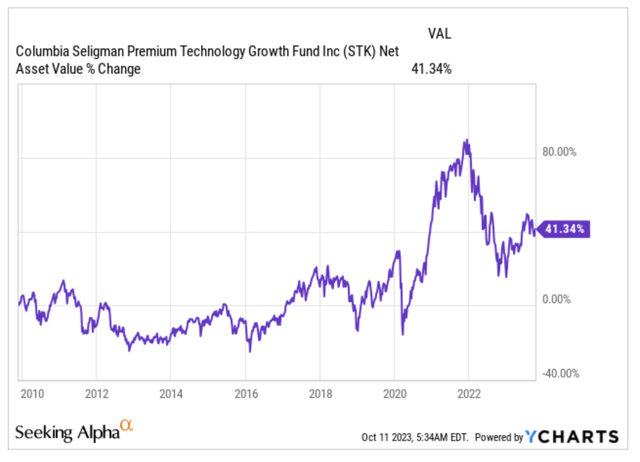

Columbia Seligman Premium Expertise Development Fund

STK (YCharts)

Morningstar Class: Expertise

Market Worth: $454.4 Mil

Whole Leverage Ratio: –

Final Precise Disc/Prem: 1.62%

Whole Dist. Fee: 6.71%

Swiss Helvetia Fund

SWZ (YCharts)

Morningstar Class: Miscellaneous Area

Market Worth: $98.3 Mil

Whole Leverage Ratio: –

Final Precise Disc/Prem: -16.72%

Whole Dist. Fee: 6.49%

Tri-Continental Company

TY (YCharts)

Morningstar Class: Reasonably Aggressive Allocation

Market Worth: $1.4 Bil

Whole Leverage Ratio: 2.27%

Final Precise Disc/Prem: -11.89%

Whole Dist. Fee: 3.91%

12 CEFs with Month-to-month Distributions

Lastly, twelve are the month-to-month distribution CEFs with constructive NAV since launch, which fall into my favourite class as an investor considering dividends due to the consistency of their payouts, though as I discussed I’ve lately opened as much as quarterly distributions, which I’ve begun to get pleasure from with equal satisfaction.

That is the record:

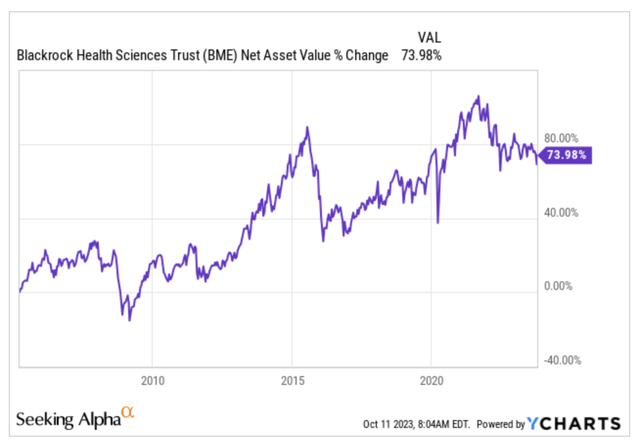

- BlackRock Well being Sciences Belief (BME)

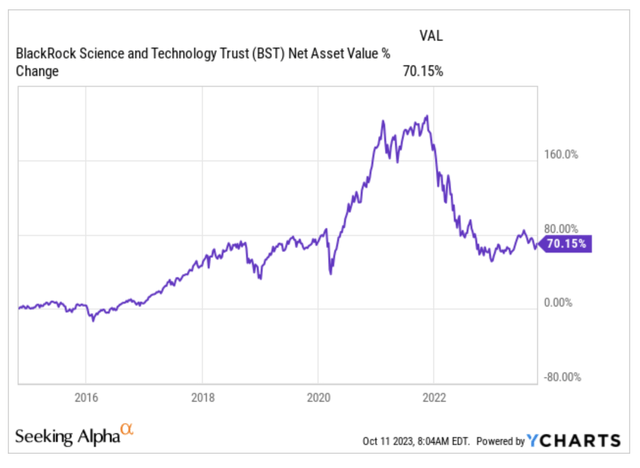

- BlackRock Science and Expertise Belief (BST)

- BlackRock Science and Expertise Belief II (BSTZ)

- BlackRock Utilities Infrastructure & Energy Alternatives Belief (BUI)

- Eaton Vance Tax-Adv. International Dividend Opps (ETO)

- Eaton Vance Tax-Adv. Dividend Revenue (EVT)

- Gabelli Dividend & Revenue Belief (GDV)

- Nuveen AMT-Free Municipal Worth Fund (NUW)

- Supply Capital (SOR)

- Tekla Healthcare Alternatives Fund (THQ)

- Cohen & Steers Infrastructure Fund (UTF)

- Reaves Utility Revenue Fund (UTG)

Blackrock Well being Sciences Belief

BME (YCharts)

Morningstar Class: Well being

Market Worth: $536.1 Mil

Whole Leverage Ratio: 0.46%

Final Precise Disc/Prem: -5.76%

Whole Dist. Fee: 6.65%

BlackRock Science and Expertise Belief

BST (YCharts)

Morningstar Class: Expertise

Market Worth: $1.1 Bil

Whole Leverage Ratio: 0.23%

Final Precise Disc/Prem: 0.28%

Whole Dist. Fee: 9.18%

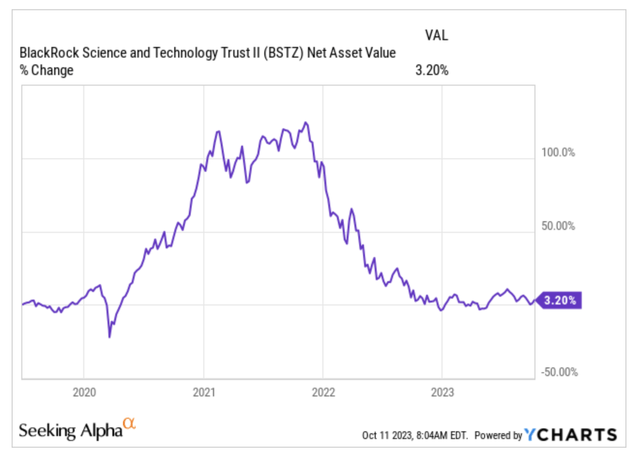

BlackRock Science and Expertise Belief II

BSTZ (YCharts)

Morningstar Class: Expertise

Market Worth: $1.2 Bil

Whole Leverage Ratio: 0.16%

Final Precise Disc/Prem: -21.76%

Whole Dist. Fee: 7.69%

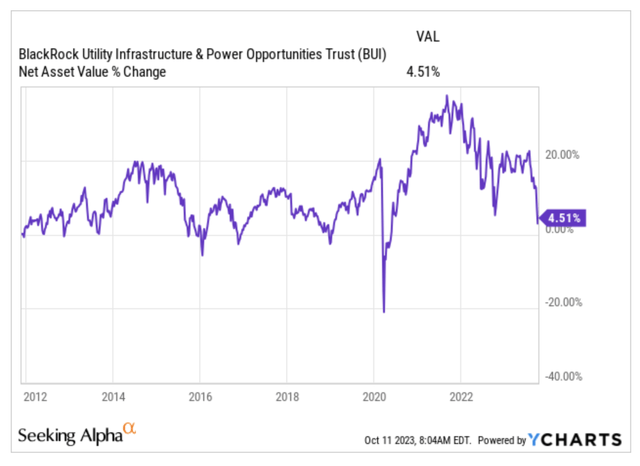

BlackRock Utilities Infrastructure & Energy Alternatives Belief

BUI (YCharts)

Morningstar Class: Utilities

Market Worth: $458.8 Mil

Whole Leverage Ratio: 0.55%

Final Precise Disc/Prem: 0.84%

Whole Dist. Fee: 7.10%

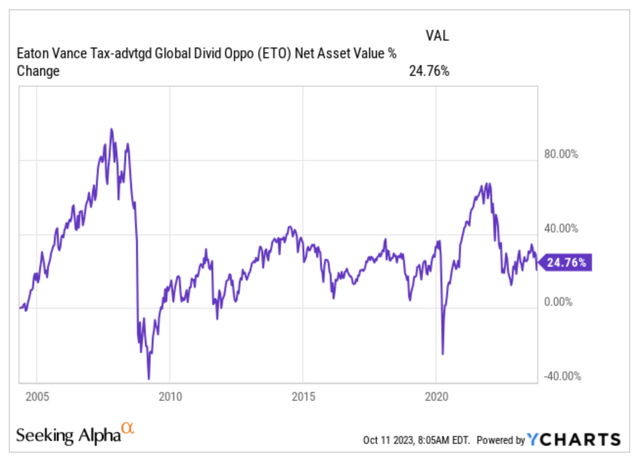

Eaton Vance Tax-Adv. International Dividend Opps

ETO (YCharts)

Morningstar Class: International Allocation

Market Worth: $349.9 Mil

Whole Leverage Ratio: 20.89%

Final Precise Disc/Prem: -10.29%

Whole Dist. Fee: 7.72%

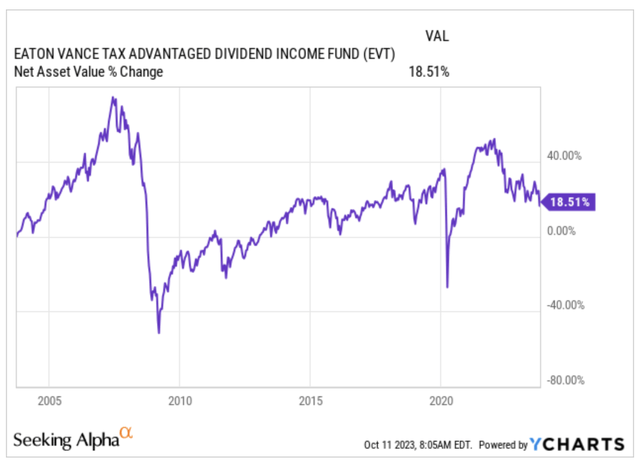

Eaton Vance Tax-Adv. Dividend Revenue

EVT (YCharts)

Morningstar Class: Reasonably Aggressive Allocation

Market Worth: $1.5 Bil

Whole Leverage Ratio: 21.11%

Final Precise Disc/Prem: -8.43%

Whole Dist. Fee: 8.70%

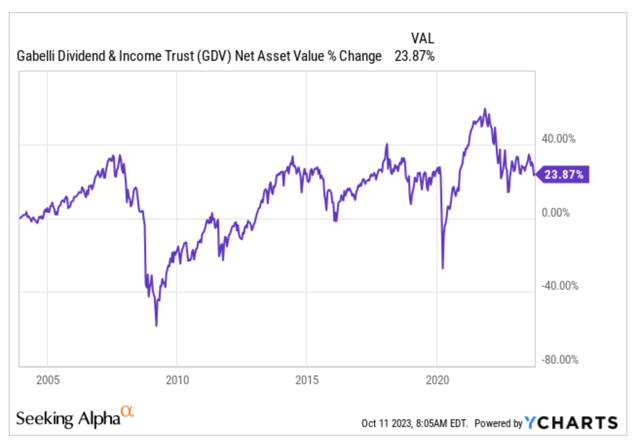

Gabelli Dividend & Revenue Belief

GDV (YCharts)

Morningstar Class: Massive Mix

Market Worth: $1.7 Bil

Whole Leverage Ratio: 14.15%

Final Precise Disc/Prem: -17.08%

Whole Dist. Fee: 6.81%

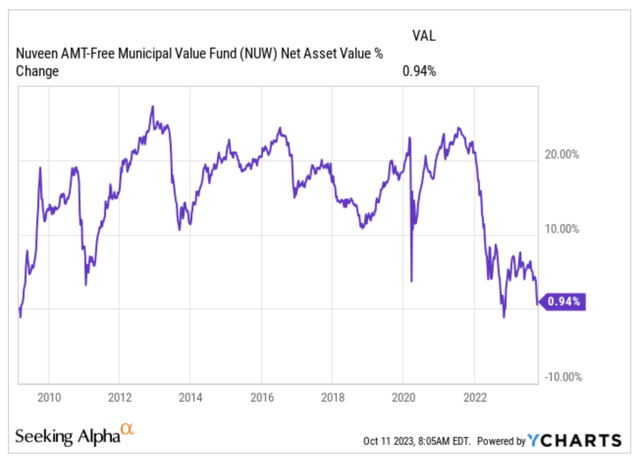

Nuveen AMT-Free Municipal Worth Fund

NUW (YCharts)

Morningstar Class: Muni Nationwide Lengthy

Market Worth: $232.3 Mil

Whole Leverage Ratio: 0.76%

Final Precise Disc/Prem: -10.76%

Whole Dist. Fee: 3.94%

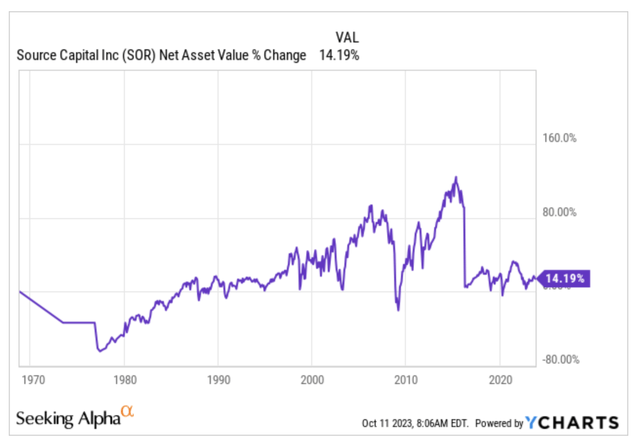

Supply Capital

SOR (YCharts)

Morningstar Class: Average Allocation

Market Worth: $319.9 Mil

Whole Leverage Ratio: –

Final Precise Disc/Prem: -8.67%

Whole Dist. Fee: 6.40%

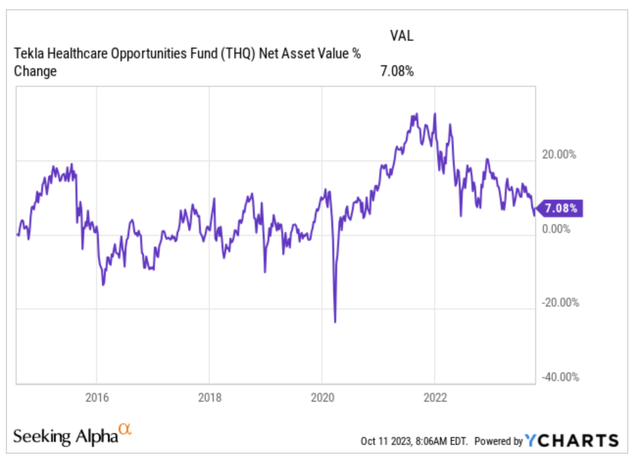

Tekla Healthcare Alternatives Fund

THQ (YCharts)

Morningstar Class: Well being

Market Worth: $690.2 Mil

Whole Leverage Ratio: 21.34%

Final Precise Disc/Prem: -16.76%

Whole Dist. Fee: 8.09%

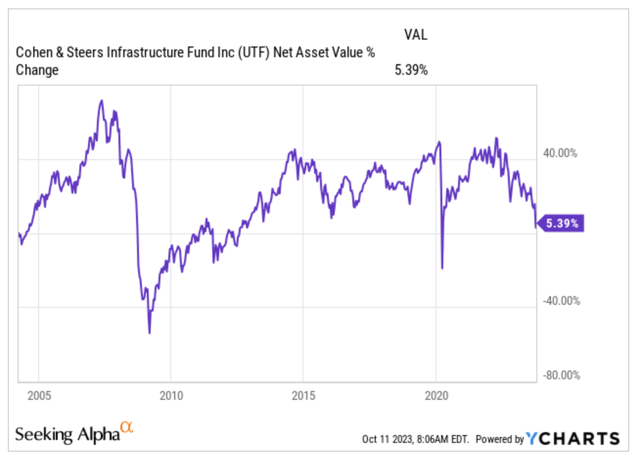

Cohen & Steers Infrastructure Fund

UTF (YCharts)

Morningstar Class: Infrastructure

Market Worth: $1.9 Bil

Whole Leverage Ratio: 32.86%

Final Precise Disc/Prem: -3.02%

Whole Dist. Fee: 9.50%

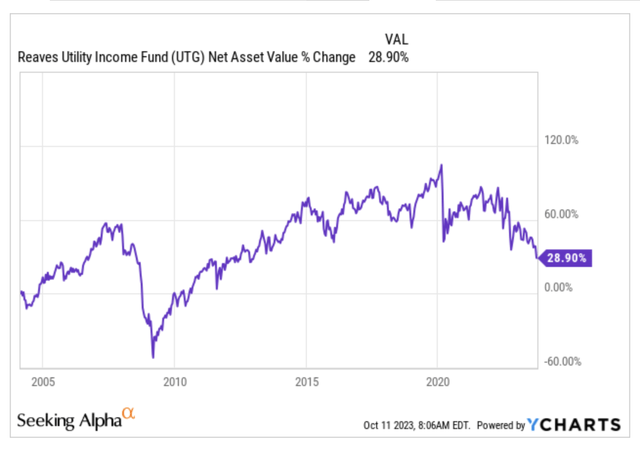

Reaves Utility Revenue Fund

UTG (YCharts)

Morningstar Class: Utilities

Market Worth: $1.8 Bil

Whole Leverage Ratio: 22.00%

Final Precise Disc/Prem: 0.00%

Whole Dist. Fee: 9.24%

Summing Up…

As now we have seen, as of October 11, 2023, there have been solely 38 dividend-paying CEFs with constructive NAV since launch out of a complete of 440 at present in the marketplace. Lower than 10%, on which the eye of the long-term investor who goals to get pleasure from a gentle money stream with an eye fixed on capital appreciation ought to rightly focus.

As is well-known, the tide lifts all boats, however it’s at instances like these that Warren Buffett’s proverbial metaphor about who’s swimming bare is affirmed. If historical past issues, now that the tide has receded, I feel these 38 CEFs might be a speculation price contemplating, since their administration over time has been capable of create worth in addition to present a gentle stream of dividends.

In different phrases, given a selection between a fund that has been steadily declining since launch and one with a constructive NAV efficiency, I imagine it’s extra prudent to lean towards the latter. Particularly if in the long term I’ve a higher prospect of preserving (and even rising) the preliminary capital invested whereas pocketing or reinvesting its distributions.

After all, a lot is dependent upon if you purchase a safety inside every enterprise cycle, however figuring out that these CEFs have elevated in worth over time is already a consolation in a panorama filled with funds which have burned via capital since launch. A few of these 38 CEFs (BST, ETO, EVT, RVT, UTF, UTG) are additionally current in my earnings portfolio. Though on the time I created it, lots of the different funds that comprise it had been displaying a constructive NAV since launch, which have been depleting throughout this newest disaster.

Of the greater than seventy towers in-built San Gimignano in medieval instances, solely fourteen have been preserved, both as a result of they had been extra stable or due to a sequence of circumstances that spared them over the centuries. Evidently, they’d one thing additional that made them survive, identical to the 38 CEFs which have a constructive NAV at present in comparison with once they had been launched.

And it’s not solely a matter of luck.

Editor’s Word: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.