The home fairness markets have been in a corrective mode in latest weeks. However a great a part of the explanation for this may be attributed extra to the motion within the bond markets globally — particularly within the US. The Reserve Financial institution of India’s comparatively hawkish tackle inflation (and liquidity) within the latest coverage assembly — and geopolitical tensions following the Israel-Hamas battle — have added to the challenges.

These happenings spoilt an in any other case moderately rosy state of affairs for the debt markets until a month or so in the past, as GDP progress was good, inflation below management and the JP Morgan bond addition served as an icing.

Yields within the US treasuries have risen sharply over the previous few months, as have Indian G-Sec yields (authorities securities) throughout tenors over the previous 8-10 weeks.

What are the implications for mounted revenue buyers? Do excessive yields current a sexy entry level for the long run?

Learn on as we focus on the affect of three key developments — JP Morgan’s India bond addition, report US treasury yield scenario and RBI’s hawkish stance & spike in home yields — and current funding avenues you’ll be able to take into account to your portfolio.

JP Morgan’s bond addition

In the end, we had a world monetary service supplier, JP Morgan, asserting the addition of Indian Authorities Bonds (IGBs) into its Authorities Bond Index-Rising Markets (GBI-EM). The index may have solely these bonds which might be issued by the RBI and can be found below the totally accessible route — a channel to allow non-resident buyers to put money into Indian authorities securities.

First, the fundamental particulars. The addition will begin from June 2024 and proceed until March 2025. The weightage within the index will begin at 1 per cent in June 2024 and can improve by 1 proportion level until March 2025. Over the 10-month interval, IGBs may have a ten per cent weight within the bond index. on the fee of 1 per cent addition monthly

The eligibility set out is these IGBs with no less than $1 billion excellent and having a residual maturity of two.5 years, which implies solely bonds maturing after December 2026 are eligible.

Based mostly on these standards, 23 IGBs value about $330 billion are eligible for inclusion within the bond index. The JP Morgan bond index has about $213 billion dimension of funding in whole. India’s 10 per cent weight will imply about $21 billion of bonds could be included.

On a base of $330 billion, incremental influx of $21 billion from International Portfolio Traders (FPIs) is prone to have a constructive impact on bond costs and should decrease yields.

Provided that banks, insurance coverage firms and mutual funds are the primary patrons of Indian debt securities, a further purchaser within the type of FPIs could be welcome.

Additionally, if different index suppliers comparable to Bloomberg, S&P and FTSE discover benefit in including IGBs to their rising market indices, it could function a fillip to better FPI flows and deepening of bond markets.

Nevertheless, dig deeper and it could be that the bond inclusion is barely a marginal constructive.

First, the $21 billion influx talked about earlier is a one-time affair with the bond index inclusion over a 10-month window (June 2024 to March 2025) for the reason that weightage is capped at 10 per cent. Passive flows into the JP Morgan index would decide periodic rebalancing and lead to incremental inflows in addition to outflows.

Second, India’s whole G-Sec market is valued at $1.2 trillion at present. Subsequently, once we now take the $21 billion influx from FPIs in context, it could hardly transfer the needle on home bond yields.

Third, the yield hole between Indian G-Secs and US Treasuries throughout tenors is at historic lows (might be defined within the subsequent part). Given the slender hole and excessive yields within the US, FPIs are prone to favour investments within the latter, particularly because the foreign money issue could be out of the best way. Any critical widening of yield hole — which is sort of unlikely within the brief to medium time period — could convey incremental attraction to Indian bond markets for FPIs, extra so for these investing by way of the lively route. As no tax advantages have been prolonged, there is no such thing as a added incentive for a bond rush from FPIs.

India will borrow₹15-16 lakh crore or about $198 billion in FY24, and maybe greater quantities by way of FY25, including to the present pile of G-Secs. , So, the one-time influx, although anticipated to offer some push for mildly decrease yields, has restricted probability of making any critical structural long-term affect on yields for the foreseeable future.

In FY24 to this point, they’ve web purchased ₹31,934 crore of debt within the Indian markets. .

When seen in totality, whereas the bond index addition is certainly a constructive sentimental booster, any critical rally within the bond market (and appreciable yield discount) over the long run on the idea of this transfer alone, could not materialise that simply.

Roiled US debt markets

Because of the report inflation ranges in 2022 resulting from Covid provide chain disruptions, Russia-Ukraine conflict and straightforward liquidity, the Federal Reserve has elevated rates of interest by 525 foundation factors from near-zero ranges starting mid 2022. It additionally began the second part of quantitative tightening that ended a decade-long unfastened liquidity scenario (the primary part was stopped in 2019.) Since June 2022, the Federal Reserve has reportedly lowered its steadiness sheet by $1 trillion.

Within the present yr until September, the US funds deficit is $1.695 trillion, up 23 per cent over the earlier yr. And the federal government is reportedly asking for an additional $100 billion for the Russia-Ukraine and Israel-Hamas wars.

Inflation has cooled off steadily from 9.1 per cent in July 2022 to three.7 per cent by October 2023.

Although there are some conflicting indicators just like the tight labour market with very low employment and decelerating bank card spends, the final two quarters have seen the US financial system develop by 2 per cent and 4.9 per cent. Federal Reserve hopes for a slowing financial system — on the again of rate of interest hikes and steadiness sheet discount — to scale back client demand, cool off the labour market and thus convey inflation to 2 per cent ranges.

Thus, the Fed stays hawkish. So, yields of many tenors of US treasury securities have risen sharply over the previous few quarters .

Since 2021, US 10-year treasury bond yields have risen steadily and are at present at 4.86 per cent (October 26), up from 1.5 per cent ranges in October 2021.

The one-year treasury yield is at 5.44 per cent (October 26) per cent from 0.72 per cent in February 2022. Even 2-year and 5-year treasuries commerce at 5.05 per cent and 4.8 per cent, respectively. These have been ranges final seen in 2005-07.

The inverted yield curve the place short-term yields are decrease than these on longer-term treasuries normally suggests expectations of an financial slowdown.

However though there should be one other fee hike within the coming quarters, the final expectation is that yields are near the height because the rate of interest cycle could also be near the highest.

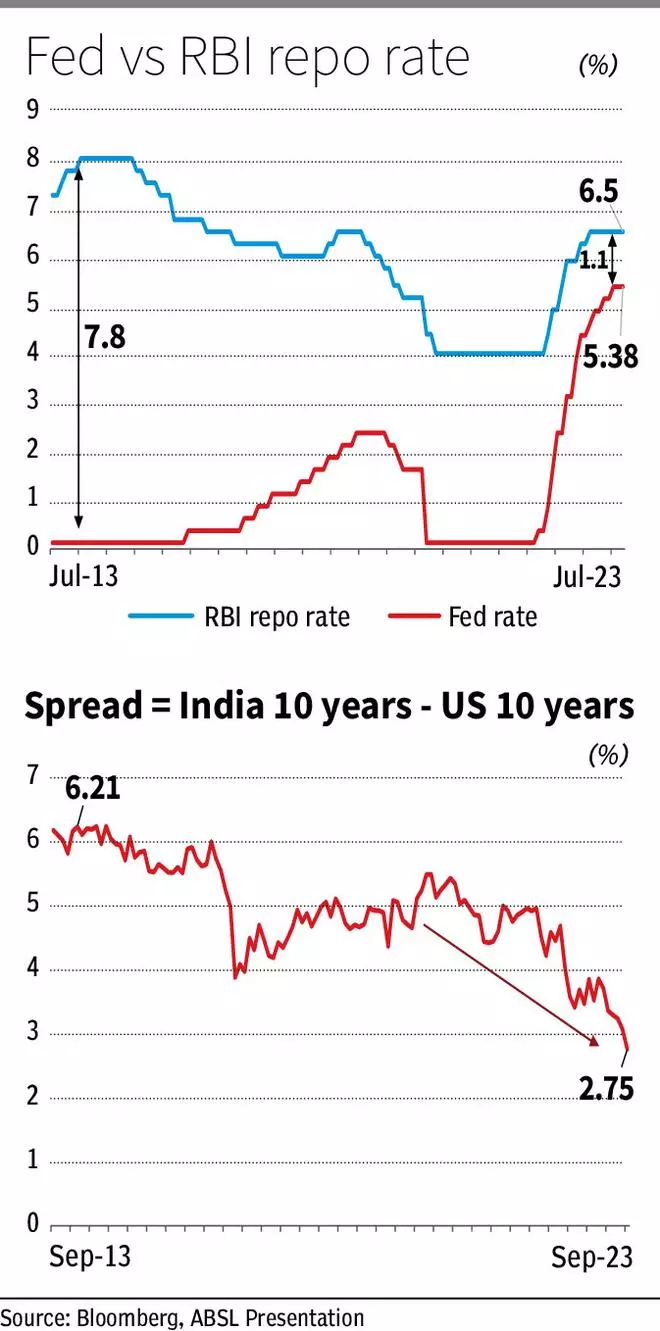

One key facet to notice is that the distinction in yields of Indian G-Secs and people of their US counterparts for related tenors has narrowed significantly.

The ten-year G-Sec yield and the 10-year US treasury yield are at 7.4 per cent and 4.86 per cent, respectively, or a spot of solely 254 foundation factors. For perspective, the hole was over 600 foundation factors in January 2014 and about 500 foundation factors in September 2020.

Even the rate of interest differential — repo fee minus the Fed funds fee — is barely about 110 foundation factors at present. It was 780 foundation factors in 2014.

Thus, there was better attraction in direction of US bonds in latest instances given the upper yields and safe-haven standing in a risky international financial atmosphere.

RBI stance and better yields in India

To make sure, the RBI final hiked the repo fee in February 2023 and has since maintained a pause within the subsequent 4 financial coverage conferences. India’s client worth inflation has been on a constantly downward trajectory over the previous one yr, barring the odd spike resulting from vegetable/meals worth rise.

From the highs of seven.43 per cent in March 2023 after the Silicon Valley Financial institution collapse and different banking troubles within the US, the 10-year Indian G-Sec fell to 7 per cent ranges in Might. Over the subsequent 4 months, the yield inched as much as 7.1 per cent.

Even RBI’s directive to banks for having greater incremental money reserve ratio (ICRR), in its August coverage, impacted the yield solely a wee bit, although the transfer sucked out ₹1 lakh crore liquidity from the system.

However the Central Financial institution’s persevering with hawkish stance on inflation, international yield spikes, geopolitical tensions and the indication within the October coverage assembly of conducting open market operations (OMO) to soak up extra liquidity despatched the 10-year yields north to nudge 7.4 per cent ranges.

From the center of September 2023, the liquidity within the monetary system slipped into the unfavorable territory from a surplus scenario. Studies counsel that liquidity was in deficit to the tune of ₹1 lakh crore lately. From sub 7 per cent ranges, the 182-day and 364-day T-bills now commerce at yields of seven.14 per cent and seven.16 per cent, respectively. Thus, the tight liquidity has pushed up yields within the system. The 5-year G-Sec yield can also be at 7.36 per cent, 20-25 foundation factors greater than what it was simply a few months in the past.

For perspective, the 10-year G-Sec had hit a closing excessive of seven.55 per cent in June 2022 as fee hikes simply began.

After a hike of 250 foundation factors over 2022-23, and as each wholesale and retail inflation are below management, the RBI could proceed to stay in pause mode. Although yields might improve a bit within the brief time period, rates of interest could nicely have touched their peak for the foreseeable future within the nation.

What ought to buyers do?

In gentle of the above discussions, there are a number of funding alternatives for buyers. The bond yield spike at two ends of the curve presents fascinating alternatives for mounted revenue buyers.

Quick time period: As talked about earlier, the short-term yields on 182-day and 364-day T-bills commerce at engaging ranges. Subsequently, mutual funds that put money into such securities could be gainful for buyers. Particularly, cash market funds put money into short-term securities.

Traders can take into account HDFC Cash Market, Aditya Birla Solar Life Cash Supervisor, Nippon India Cash Market and SBI Financial savings. These funds put money into a portfolio with common maturity of 5-6 months and carry yields to maturity of seven.4-7.5 per cent at present. Since taxation happens solely upon sale of models, buyers can plan accordingly and lock into these engaging yields.

Medium time period: For the medium time period, we would favor extremely rated non-convertible debentures (NCDs) that provide good yields for the 3-5 yr interval. Make sure that you make investments solely in AAA or AA rated NCDs and take into account A rated ones provided that there’s massive dependable conglomerate backing.

Since there aren’t any mutual fund or different avenues providing greater returns or yields within the 3-5-year tenor, NCDs could also be preferable.

At present, we now have Piramal Enterprises NCD open and yields north of 9 per cent can be found for buyers.

From the secondary markets, the NCDs of Aditya Birla Finance and Cholamandalam Finance provide yields of over 8 per cent for 3-5-years, although buying and selling is rare and volumes are low to this point, as seen from the exchanges.

These yields could be realised provided that held until maturity. Any sale accomplished earlier can alter the yields.

Preserve NCD exposures to 5-10 per cent of your total debt portfolio.

Long run: For buyers, particularly retirees, searching for common revenue and prepared to remain locked in for the long run, direct funding in G-Secs by way of the RBI’s retail direct platform could be a good possibility. The G-Secs maturing in 2037 could also be thought-about for a yield of seven.46 per cent, which is greater than what insurance coverage firms provide on annuities. The G-Sec maturing in 2033 with 7.26 per cent and buying and selling at a yield of seven.39 per cent is an alternative choice.

Goal maturity funds, though out of favour as a result of elimination indexation and tax advantages, can be helpful additions for goal-based investing.

The Bharat Bond ETF maturing in 2030 provides a yield to maturity of seven.66 per cent. It fees 6 foundation factors as bills. Edelweiss CRISIL IBX 50:50 Gilt Plus SDL April 2037 Index fund could be thought-about for an yield to maturity of seven.68 per cent (October 25). The fund has an expense ratio of 18 foundation factors. Put up-expenses yields might be a wee bit decrease.

One other avenue is gilt funds. ICICI Prudential Gilt, Kotak Gilt and SBI Magnum Gilt are appropriate decisions, given their sturdy observe efficiency report. The present yields to maturity of those funds go as much as 7.67 per cent and common maturities vary from 5-10 years (September factsheet information). Since g-secs have been beneficial, we’re avoiding fixed maturity 10-year gilt funds as yields could be decrease after fund fees.