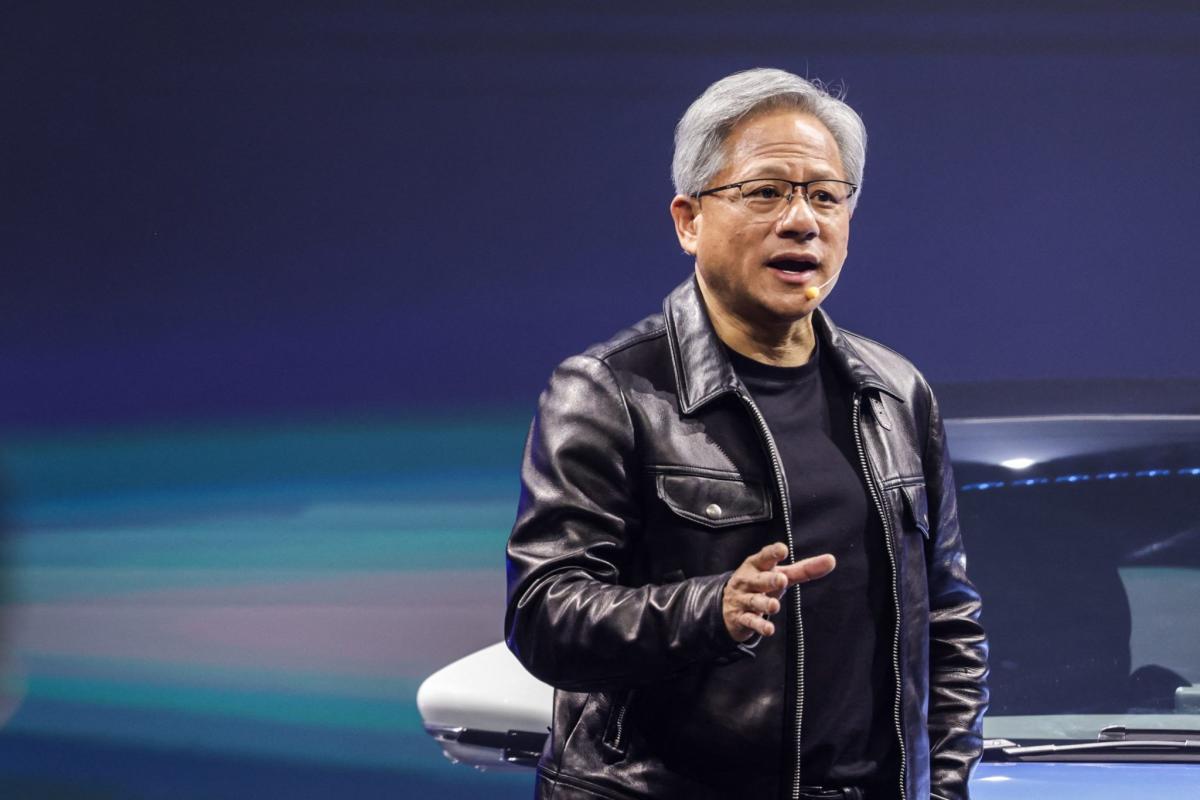

Nvidia is on a tear. It is usually, in accordance with its billionaire CEO Jensen Huang, in peril.

The semiconductor maker, whose processors are utilized in gaming, knowledge facilities, and autonomous automobiles, performs a key function within the artificial-intelligence growth that has rejuvenated Silicon Valley. Tech giants compete to purchase up its costly AI chips. This 12 months it joined the choose group of firms with a market cap of $1 trillion extra.

However “there aren’t any firms which are assured survival,” Huang warned Thursday on the Harvard Enterprise Assessment’s Way forward for Enterprise occasion.

Nvidia in its 30-year historical past has confronted a number of existential threats, which helps clarify why Huang just lately instructed the Acquired podcast that “no person of their proper thoughts” would begin an organization. For instance, it virtually went bankrupt in 1995 after its first chip, the NV1, failed to draw prospects. It needed to lay off half its staff earlier than the success of its third chip, the RIVA 128, saved it just a few years later.

“We get pleasure from constructing the corporate from the bottom up and having not-exaggerated circumstances of practically going out of enterprise a handful of occasions,” Huang stated this week, as Observer reported. “We don’t must faux the corporate is at all times in peril. The corporate is at all times in peril, and we really feel it.”

However Huang thinks it’s essential to keep away from getting too harassed about it.

“I believe the corporate residing someplace between aspiration and desperation is loads higher than both [being] at all times optimistic or at all times pessimistic,” he famous.

One problem the Santa Clara, Calif.-based chipmaker now faces is the tightening of U.S. guidelines on tech exports to China. That might end in Nvidia dropping billions of {dollars} after canceling deliberate deliveries to Chinese language firms.

“The restriction is a functionality restriction,” Huang stated. “It’s not an absolute restriction…The very first thing we have to do is to adjust to the regulation and perceive what the boundaries are and, to one of the best of our skill, supply merchandise that may nonetheless be aggressive.”

However attempting to promote chips with decreased capabilities in China leaves Nvidia extra uncovered to competitors from native rivals. “It’s not straightforward, and rivals are shifting shortly,” Huang stated. “It’s like the rest that you just gotta keep alert and do one of the best you possibly can.”

In the meantime regardless of Nvidia blowing previous expectations in latest quarters, many analysts warn that competitors from rival AMD and others is certain to accentuate. Amongst them is David Coach, chief of analysis agency New Constructs.

“The remainder of the world received’t simply roll over and allow them to dominate AI,” Coach instructed Fortune in August. “They’re going through the identical curse as Tesla. Nvidia benefited like Tesla from being first to market. However when Tesla acquired worthwhile, a great deal of rivals entered the EV house, reducing its margins and slowing gross sales. The identical will occur for Nvidia.”

Huang instructed Acquired that he’s learn the enterprise books by former Intel CEO Andrew Grove, calling them “actually good.” Amongst these is Solely the Paranoid Survive.

Huang appears to have taken it to coronary heart.

“Should you don’t suppose you’re in peril,” he stated this week, “that’s most likely as a result of you will have your head within the sand.”

This story was initially featured on Fortune.com