[ad_1]

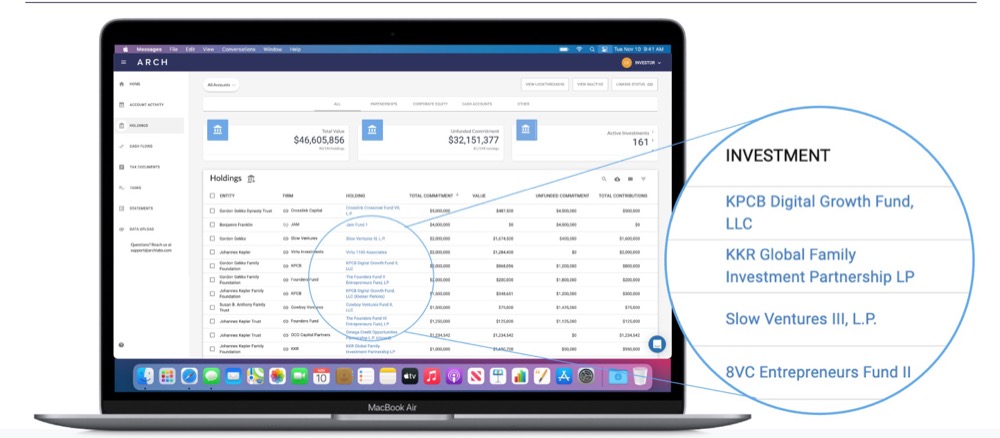

Managing the lifecycle of a non-public funding fund is a course of that’s rife with inefficiency. For advisors and buyers in these funds, aggregating data throughout all their various investments turns into an equally arduous job. Arch is a digital-first non-public funding administration platform that permits stakeholders to entry related particulars throughout their portfolio of different investments. The platform handles new funding alternatives, portfolio administration, capital calls, distributions, reporting, and investor updates by way of automation. Advisors and accountants now not have to entry fund admin portals however as an alternative will obtain polished reporting-ready knowledge straight from the platform which connects immediately with the again workplace of every non-public funding. Arch is at the moment being utilized by over 200 household workplaces, funding corporations, and establishments, monitoring over $60B in complete various investments.

AlleyWatch caught up with Arch CEO and Cofounder Ryan Eisenman to study extra in regards to the enterprise, the corporate’s strategic plans, newest spherical of funding, which brings the whole funding raised to $25.5M, and far, far more…

Who had been your buyers and the way a lot did you elevate?

Our $20M Sequence A funding spherical was led by Menlo Ventures, with participation from present buyers Craft Ventures and Quiet Capital, in addition to new buyers Carta, Citi Ventures, GPS Funding Companions, and Focus Monetary Companions.

Inform us in regards to the services or products that Arch presents.

Arch is a non-public funding administration platform modernizing Okay-1 assortment, automating operations, and simplifying reporting for monetary professionals. Our platform is client- and advisor-facing, aggregating knowledge and paperwork throughout each funding. This eliminates the necessity for customers to entry fund admin portals, and delivers reporting-ready knowledge on to buyers, accountants and advisors. We offer intuitive instruments for customers to overview and effectively handle updates inside their portfolios, together with new funding alternatives, capital calls, distributions and extra. Moreover, our platform collects and aggregates tax paperwork (comparable to Okay-1s) as they’re distributed, permitting customers to find these things from a centralized supply when tax season arrives.

What impressed the beginning of Arch? Arch was based in 2018 after a pre-seed-stage investor related me with two laptop scientists from MIT, Joel Stein and Jason Trigg. The investor had a non-public funding portfolio that was tough to handle, so he related the three of us to work on an answer. When offered with this chance, I remembered seeing my father, a monetary advisor, battle with related points round his shoppers’ non-public investments and determined to tackle the problem.

Arch was based in 2018 after a pre-seed-stage investor related me with two laptop scientists from MIT, Joel Stein and Jason Trigg. The investor had a non-public funding portfolio that was tough to handle, so he related the three of us to work on an answer. When offered with this chance, I remembered seeing my father, a monetary advisor, battle with related points round his shoppers’ non-public investments and determined to tackle the problem.

How is Arch completely different?

Arch meets the advanced wants of personal buyers, monetary advisors, banks, and establishments, equipping them with a platform to effectively handle and perceive their non-public investments. There are various platforms already on the market doing a few of this administrative work on behalf of advisors, nevertheless, these platforms automate these duties just for the asset managers on their platforms. We’ve got designed Arch to seize something with a normal associate or restricted associate construction, in addition to non-public corporations, immediately held actual property, and immediately held startup investments.

What market does Arch goal and the way large is it?

Arch targets advisors, accountants, and people who’re managing non-public market investments. With tens of trillions of {dollars} at the moment invested in various belongings, our platform can profit a big community of advisors and buyers.

What’s what you are promoting mannequin?

Arch is a B2B SaaS expertise firm that aggregates unstructured funding knowledge from numerous various investments right into a single digital platform, empowering buyers to know, analyze, and handle their various funding portfolio at scale.

How are you making ready for a possible financial slowdown?

We’re working Arch conservatively, sustaining a protracted runway, in order that we are able to thrive in any financial situation. That being stated, we’re bullish on the general market (and particularly bullish on New York). Arch has each a value financial savings facet to it (useful in a recessionary setting) in addition to an “allocate capital extra successfully” facet to it, which is very useful when LPs are actively investing.

What was the funding course of like?

We had been fortunate to obtain a pre-emptive provide for this spherical once we weren’t fundraising, which made our course of quicker than anticipated. We then had a pair weeks of conversations with potential buyers, a lot of which we knew coming into the method. We’re excited to associate with Menlo Ventures, who understood the Arch worth proposition rapidly, and likewise included a number of shoppers and strategics to spherical out our investor base.

What are the most important challenges that you simply confronted whereas elevating capital?

After we had been preempted, we didn’t have a deck or different key funding supplies able to share (as we weren’t but planning to fundraise), in order that was a little bit of a scramble. Folks discuss constructing the airplane as you’re flying. On this case, we had been constructing the deck as we had been pitching (which made for an exhausting however action-packed few weeks).

What components about what you are promoting led your buyers to jot down the verify?

Traders had been desirous to assist Arch due to the large drawback it solves for personal market investing, a rising sector of the business. Our resolution brings much-needed effectivity, pace and comfort to funding managers, excessive net-worth households, institutional buyers and tax advisors. With out Arch, wealth managers should log-in to tens, if not a whole lot, of third-party portals to drag down Okay-1s and monetary statements, manually monitor capital calls and distributions, and craft their very own experiences on every consumer’s non-public investments portfolio.

What are the milestones you intend to attain within the subsequent six months?

Over the subsequent six months, we’ll rent extra engineers and builders to facilitate the growth of our product roadmap. Moreover, we’ll purpose to construct a extra open structure for integrations with different advisor tech corporations and custodians. The objective is to launch an API to permit anybody to combine with Arch within the close to future.

What recommendation are you able to provide corporations in New York that would not have a recent injection of capital within the financial institution?

It’s at all times best to lift if you don’t have to, so the extra you may function leanly and let product/gross sales progress lead hiring (as an alternative of the opposite manner round), the extra you may management your personal future.

Three years in, we had been 5 folks, and have grown to 61 since then because the enterprise took off.

The place do you see the corporate going now over the close to time period?

Within the close to time period, we’ll additional the event of our product roadmap, which incorporates automating extra workflows for advisors, accountants and their shoppers; delivering elevated insights round an investor’s non-public markets portfolio; and constructing further instruments to cut back the danger of fraud towards buyers.

What’s your favourite fall vacation spot in and across the metropolis?

Mah Ze Dahr in Greenwich Village – sitting outdoors on a sunny fall day with a espresso and pastry.

You’re seconds away from signing up for the most well liked record in NYC Tech!

Enroll immediately

[ad_2]

Source link