[ad_1]

Friday Suggestions: The “Misplaced In Emotion” Version

♫Hit the beat now… ♫

Nice Ones, some guys will promise you an funding made in heaven, however I’m gonna persist with my weapons.

Like ready for that inventory decide that I is likely to be getting, my desires have simply begun…

Oh, child … Mr. Nice Stuff, am I a idiot ‘trigger I don’t know simply how you are feeling?

I see. I see.

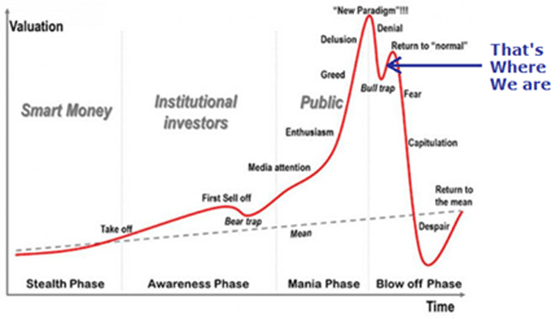

So, you too are misplaced in emotion after taking a look at Monday’s chart on investor sentiment.

That stated, I feel “misplaced” is a bit too form. Y’all are freaking buried in emotion, judging from the overflowing Nice Stuff inbox.

So, after all, in right this moment’s version of Friday Suggestions, we’re speaking concerning the investor sentiment cycle and the place we seem like proper now.

By no means heard of Friday Suggestions? For disgrace. It’s the day we reply your market rants, dive into your salacious inventory soliloquies and customarily allow you to Nice Ones run the present.

Wanna get in on the enjoyable subsequent week? Simply drop us a line at GreatStuffToday@BanyanHill.com.

Let’s kick issues off with this e-mail from Gary A.:

My cash is on this as being the place we’re at this time limit:

Thanks — Gary A.

No, thanks, Gary!

Thanks for studying and thanks for writing in. I imply, you even made me a pleasant little chart and saved me the difficulty of breaking out MS Paint once more.

Gary, you’ll be glad — or not so glad, I suppose — that your opinion jives with about 99% of everybody who wrote to us prior to now week.

I imply, there’s:

Undoubtedly a bull lure. — Ted B.

We’re in a bull’s lure cycle. — Rajesh S.

And, my private favourite:

I feel we’re on the rising a part of the curve between the “Bull lure” and “Return to regular”.

If I’m proper, and your chart is appropriate, we’re in for “One Hell of a multitude”

One different factor that might additionally deliver every part to a halt is that if our younger good friend Putin begins enjoying with tactical atomic weapons.

We will have to attend and see. — Bob H.

“One hell of a multitude” … Bob, you’ve a approach with phrases, my man.

Nice Ones, I’m not usually a broad market prognosticator. I choose to stay to the rivers and the lakes that I’m used to. However I simply can’t shake the sensation that there’s one thing occurring right here, and what it’s ain’t precisely clear.

If I needed to decide a facet right here, I’m siding with Gary, Bob, Ted, Rajesh and the plethora of different “bull lure” readers who wrote in.

I imply, we actually simply got here out of a large decade-plus bull rally off the 2009 market backside. Y’all Nice Ones who’ve been round for some time know that I used to be calling for a correction again in 2019 earlier than the pandemic hit.

I imagine that the pandemic, the financial stimulus and the Federal Reserve’s fast reversal on tightening financial coverage put that correction on maintain. However that maintain has to finish in the end, and that correction nonetheless must occur to blow off all the simple cash nonetheless flooding the system.

Are we about to see that correction? Effectively … “about to” is a bizarre factor on Wall Road. “About to” can imply tomorrow, subsequent week, subsequent month and even within the subsequent couple of years.

What’s extra, simply because one thing ought to occur or wants to occur, doesn’t imply it should once you anticipate it to. Bear in mind, the market can stay irrational longer than you may stay solvent.

So whereas I’m enormously inclined to imagine that we’re, the truth is, in a “bull lure” section, the size of that section stays a really huge query.

In reality, the market could be so loopy at instances that Nice One Earl G. is simply as more likely to be proper:

You ask, I reply. Proper now, we’re proper on the bear lure section. The market takes off in late spring of this yr and forgets to cease till the spring of 2027. THEN all hell breaks free, and the massive crash all of the pundits are speaking about now will truly occur.

The grinding rise is asset costs will likely be due extra to cash printing than financial growth, however hey, when bread is 100 {dollars} a loaf, it should really feel good to promote these Boeing shares for ten grand apiece.

The above isn’t just whistling Dixie. It’s based mostly on a really cautious have a look at the 240-year financial cycle, (plus different cycles too quite a few to say) which not plenty of people take note of. Extra’s the pity.

You possibly can bear in mind you heard it right here first.

I actually take pleasure in your work. — Earl G.

Admit it, Earl. You learn WallStreetBets on Reddit, don’t you?

I like your short-term optimism and I want I shared it.

However at the very least you acknowledge that ought to this insane bull market proceed after the pandemic pause, we’re taking a look at a doubtlessly very, very ugly 2027 when every part lastly involves a head.

And if Earl right here is true, buying and selling Boeing inventory for bread would be the least of our worries.

Personally, I feel we are able to get too caught up in investor sentiment and market cycles. Nobody goes to foretell the broad market’s whims.

Subsequently, maintain watch, since you have no idea the day or the hour when the grasp of the home will return.

Did you simply get Biblical? Dude, don’t deliver the wrath of God down in the marketplace, please!

Me? Wrath of God? By no means.

Anywho, I’m going to finish this matter with an e-mail from Nice One Dan G.:

The market is sort of a sailor on shore depart. He blew his money, awoke with a hangover and the conclusion that he won’t receives a commission for some time. So now he’s in deep despair identical to the DOW. The upside is that the good cash or the bar proprietor is sweeping up the ground and is aware of his cash is on the best way to the financial institution.

Personally I subscribe to Charles M.s methodology / philosophy of investing. Purchase it proper, maintain on tight and don’t panic if it drops one evening. With good analysis comes peace of thoughts that the Markets Manic conduct can have little to do with my long run investing success. (besides to recollect to purchase when everyone seems to be leaping ship on strong corporations.)

Greatest needs — Dan G.

Dan, my man, I like your plan.

No matter the place you suppose the market is when it comes to the funding cycle, you may’t go incorrect by following Charles Mizrahi’s funding philosophy. That philosophy revolves round doing all of your analysis, shopping for the appropriate inventory from a strong, outperforming firm and holding on to it for pricey life … even when the market $#!ts the mattress.

I’ve stated this a number of instances myself right here in these Nice digital pages. Purchase inventory in a strong firm with a strong marketing strategy in a rising market, and also you’ll by no means go incorrect.

Now, Charles and I could differ in opinion over what constitutes a “strong firm” — he tends to be much more conservative than I’m in the case of investing — however possibly all of us want that proper now, given how misplaced in emotion Wall Road is.

Am I a idiot? A minimum of my pals suppose so. Que será, que será.

Talking Of Charles Mizrahi … And Strong Firms:

We’ve informed you earlier than that the No. 1 downside stopping the mass adoption of electrical automobiles (EVs) is value. However for EVs, the tipping level — affordability — could lastly be arriving, due to a brand-new battery expertise.

Based on Charles, this beautiful new expertise is about to chop the price of EV batteries IN HALF … that means by subsequent yr, an EV is predicted to value the identical as a gas-powered automobile.

To find the corporate behind this new expertise, click on right here now.

Now let’s see what else is left within the tank — the Nice Stuff inbox!

Bear in mind to e-mail in when you’ve got extra to share about right this moment’s subjects … or in case you simply wish to rant into the void. We get plenty of that too.

Silver Greenback Pancake Good points

I’m invested in silver cash as properly since its cheaper to purchase in, now could be it higher to purchase an organization earlier than I purchase the alternate fund on silver just like the index. Which firm is greatest round?

Is China secure to purchase but?

— Mike S.

Hello ho, silver investor!

So that you wanna add somewhat metallic magic to your portfolio, eh? Word: I stated metallic magic, not “magic metallic” as a result of … properly, we’re not entering into that sorcery right this moment.

Anyway, silver ain’t attractive … but it surely’s strong.

And it’s shiny. Don’t neglect the shiny.

Uhh … certain. You could have your causes for investing in silver, I’ve mine. If we get a recession or market downturn, silver ought to do properly. It’d even fare higher than gold, since gold costs are already wanting toppy.

If we don’t get a recession or market downturn, then silver nonetheless has rising demand from the tech sector and EV makers. So reserving a portion of your portfolio for silver ETFs isn’t a foul thought to reap the benefits of silver costs.

Now, I wanna make it crystal clear: We’re speaking about metallic indexes right here … not mining corporations.

Until you’re 100% assured in a selected miner and its prospects (lol), sticking with metallic ETFs gives you the silver market publicity you search with out leaving you open to the dangers of, you understand, a miner going underneath.

I believed all miners do is go underground?

I … I’m not touching that one. As on your query on entering into Chinese language shares?

I’m not biting on Chinese language shares till I see some concrete settlement with the U.S. on reporting necessities to maintain the shares from delisting. If that makes me “late to the sport” concerning sure shares, so be it.

I’m not doing the FOMO on this one, plain and easy. However don’t fear, Mike. You’re not the one Nice One wanting wide-eyed at Chinese language shares proper now…

Do Nice Ones Dream Of Electrical Automobiles?

Why are you ignoring Nio, is it that unhealthy? It additionally jumped huge time yesterday so what’s the rating? Get pleasure from your ramblings.

— Bert Ok.

Thanks for writing in, Bert!

I’m simply as stunned as you that we haven’t hit up Nio (NYSE: NIO) since promoting it out of the Nice Stuff Picks Portfolio again on December 15.

But when something, it’s as a result of my ideas on Nio haven’t modified for the reason that finish of final yr.

I nonetheless like Nio inventory. I nonetheless suppose EVs — whether or not they’re totally electrical or hydrogen fuel-cell powered — are the way forward for the auto market.

And I nonetheless imagine Nio’s swappable batteries give it a aggressive edge over Tesla’s (Nasdaq: TSLA) present charging capabilities.

Heck, regardless of falling in need of its deliveries forecast, Nio nonetheless managed to beat Wall Road’s fourth-quarter gross sales estimate in its newest earnings report. (For what it’s value, deliveries have been additionally up 109% yr over yr.)

The issue isn’t Nio, Bert. It’s China.

See, although the Center Kingdom’s grasp, Xi Jinping, expressed a willingness to maintain U.S.-listed Chinese language corporations on American inventory exchanges … each nations nonetheless have completely different opinions in the case of information-sharing.

As I stated again in December:

If U.S. regulators can’t get the data they want from U.S.-listed Chinese language corporations, they’ll’t shield U.S. buyers. This lack of monetary data will outcome within the delisting of many Chinese language shares … doubtlessly together with Nio.

That’s the rationale we offered Nio out of the Nice Stuff Picks Portfolio — not due to stiff EV competitors, a disbelief within the firm’s EVs or another downside with Nio as a complete.

And whereas I discover Xi’s latest feedback encouraging … I’m nonetheless not shopping for into any Chinese language shares till I see some concrete settlement between the U.S. and China on reporting necessities, identical to I informed Mike up there.

However you do you, Bert. For those who’re a risk-taker and don’t thoughts playing on a possible delisting, Nio’s nonetheless an outstanding inventory regardless of its latest drop in share worth.

As for me? The China scenario’s simply too speculative proper now … and for that cause, I’m out.

Pssst: Collect ‘Spherical, Nice Ones

Don’t wish to depart the EV race fully? Now we have you lined!

Ian King believes this tiny firm might ship EV gross sales surging 1,400% over the following decade … and make early buyers huge positive aspects.

Higher but: As a Nevada-based firm, this inventory isn’t going through any delisting dilemmas like Nio … so you understand, bonus factors.

Click on right here for the complete story.

When you’re carried out checking that out, atone for all of the Nice Stuff you would possibly’ve missed on-line at GreatStuffToday.com!

Within the meantime, right here’s the place you will discover our different junk — erm, I imply the place you may try some extra Greatness:

Regards,

Joseph Hargett

Editor, Nice Stuff

[ad_2]

Source link