gorodenkoff/iStock by way of Getty Photos

For the month of February, hedge funds outpaced the efficiency of main indices, rising 0.3%, in response to the PivotalPath Composite Index, whereas the S&P 500 dropped 3.0% and the Nasdaq slid 3.4% in the identical month.

Preqin is seeing robust hedge fund returns as nicely. Its All-Methods Hedge Fund benchmark returned 3.43% in February, constructing on January’s 2.03% acquire and bringing the 12-month return to nearly 26%.

The composite 12-month beta to the S&P by means of February was 0.16, information supplier PivotalPath mentioned.

By technique, managed futures and international macro led all methods in February, producing 2.2% and 1.3% respectively. The fairness sector turned within the worst efficiency, largely from losses within the expertise, media, and telecom and healthcare sub-strategies.

Smaller funds appeared to have an edge on bigger funds final month, with the $500M-$1B AUM corporations clocking in the most effective positive aspects, up 0.45%. Funds with greater than $5B in AUM slipped 0.8% in the identical month.

The worth-over-growth shift continued to achieve traction in February, with the PivotalPath proprietary Cyclical Sectors Basket outperforming the Development Sector Basket by 4.2%.

“Multi-strategy, Managed Futures, International Macro, and Credit score had been optimistic for the month and proceed to generate high of sophistication alpha,” the agency mentioned. “Commodities, particularly oil, reached contemporary highs not seen in a decade which, together with continued volatility, benefited International Macro and Managed Futures funds who caught the appropriate facet of the commerce.”

As well as, the hedge fund area has been attracting extra gamers. Quant applied sciences supplier SigTech mentioned new fund launches stay robust, with nearly 2,000 new funds per yr, on common, since 2019. Of the 5,500 new hedge funds began since 2019, 70% are based mostly within the U.S., 9% within the U.Okay. and 5.2% in China.

“The strong degree of recent hedge fund launches displays a sustained robust demand from buyers for modern and uncorrelated funding methods to fulfill return expectations in an more and more difficult market atmosphere,” mentioned Daniel Leveau, vice chairman, Investor Options, at SigTech.

Crypto is gaining traction as a hedge fund technique. In 2021, some 171 crypto hedge funds had been launched bringing the technique’s whole to 774. Of these, 80% are domiciled within the U.S.

Observe that some extra conventional funding corporations are forming companies that give buyers entry to hedge-fund-like methods. Living proof: Constancy Funding has began a liquid alternate options unit.

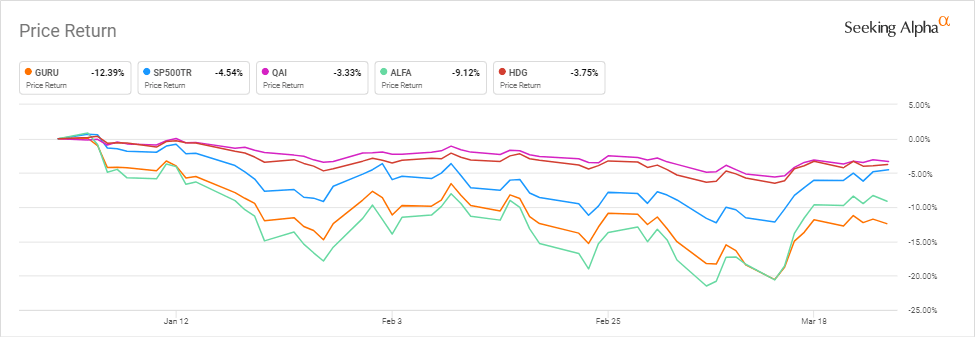

Check out the YTD efficiency of ETFs supposed to imitate hedge-fund efficiency: GURU, ALFA, QAI, HDG.