Ирина Мещерякова

Foreword

As complement to this text, please be aware that The Motley Idiot, which sourced this newest record, and SureDividend each replace their lists periodically.

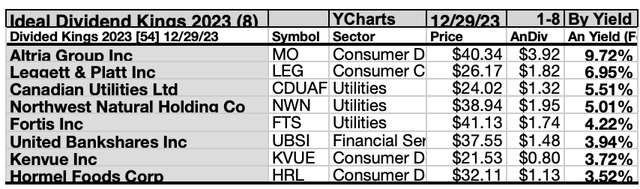

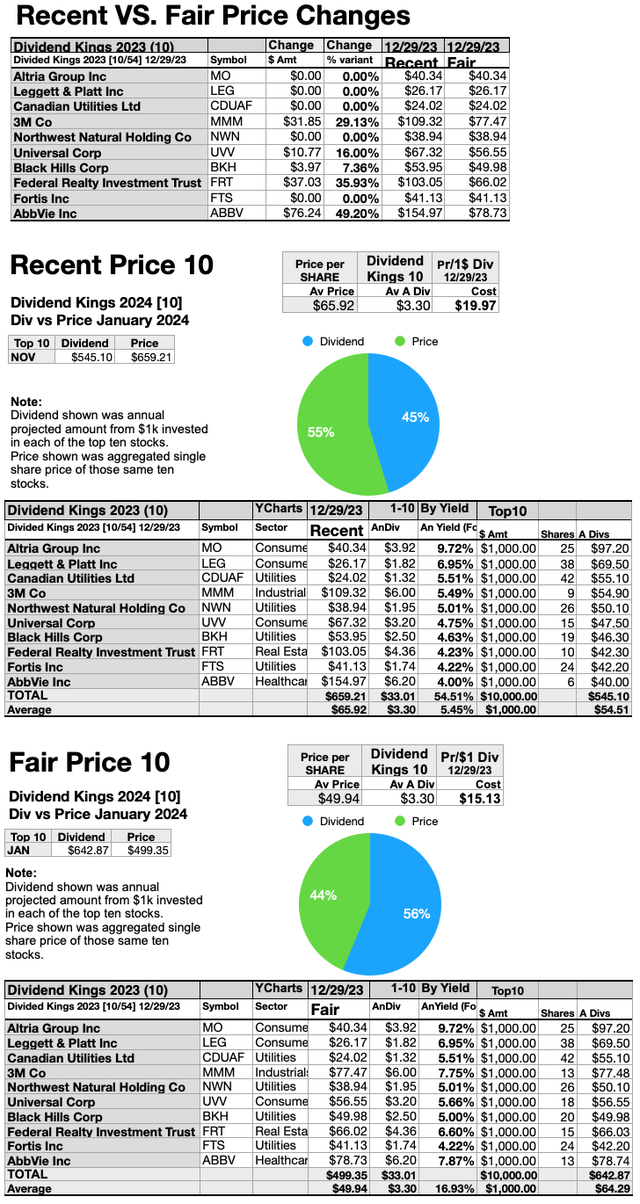

Whereas most of this assortment of 54 Kings is simply too expensive to justify their skinny dividends, 5 of the top-ten, by yield, and three extra exterior of the highest ten, reside as much as the best of providing annual dividends (from a $1K funding) exceeding their single share costs, and this month there are 4 extra to look at.

Within the present market adjustment, it’s now doable for these eight, Altria Group Inc. (MO), Leggett & Platt Inc. (LEG), Canadian Utilities Ltd (OTCPK:CDUAF), Northwest Pure Holding Co. (NWN), Fortis Inc. (FTS) (5 inside the highest ten), and United Banckshares Inc. (UBSI), Kenvue Inc. (KVUE), and Hormel Meals Corp. (HRL) (the three outsiders) to remain fair-priced with their annual-yield (from $1K invested) assembly or exceeding their single-share costs.

The 5 to look at are: Black Hills Corp. (BKH); Nationwide Gas Fuel (NFG); 3M Corp. (MMM); Federal Realty Funding Belief (FRT); Common Corp. (UVV).

BKH is $3.97 over-priced, UVV is $10.77 excessive, MMM is $31.85 obese, FRT must lose $37.03 in value to hitch the best eight.

As we weblog previous the three-year and three quarter mark of the 2020 Ides of March dip, the time to snap-up these eight lingering top-yield dividend King canine is at hand… except one other huge bearish drop in value looms forward. (At which era your technique could be so as to add to your place in any of these you then maintain.)

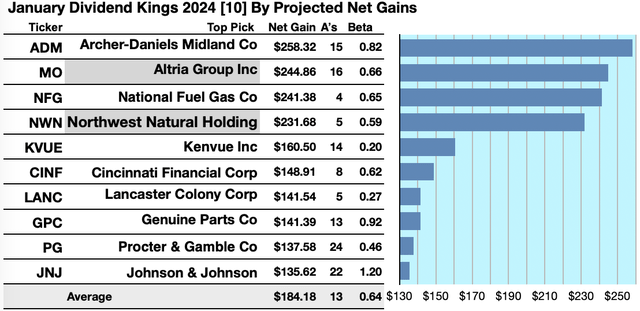

Actionable Conclusions (1-10): Analysts Predict 13.56% To 25.83% High-Ten Kingly Web Positive factors To January 2025

Two of the ten high Kings by yield have been verified as being among the many top-ten gainers for the approaching yr primarily based on analyst 1-year goal costs. (They’re tinted grey within the chart beneath.) Thus, this yield-based December 29 forecast for January Kings (as graded by Brokers) was 20% correct.

Estimated dividend returns from $1000 invested in every of those highest-yielding shares and their mixture one-year analyst median target-prices, as reported by YCharts, produced the next 2023-24 information factors. (Notice: target-prices from lone-analysts weren’t used.) Ten possible profit-generating trades projected to December, 2024 have been:

Supply: YCharts.com

Archer Daniels Midland Co. (ADM) was projected to web $258.32, primarily based on the median of goal value estimates from 15 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 18% lower than the market as an entire.

Altria Group Inc was projected to web $244.86, primarily based on dividends, plus the median of goal value estimates from 16 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 34% underneath the market as an entire.

Nationwide Gas Fuel Co. was projected to web $241.38 primarily based on dividends, plus the median of goal value estimates from 4 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 35% lower than the market as an entire.

Northwest Pure Holding Co. was projected to web $231.68, primarily based on a median of goal estimates from 5 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 41% lower than the market as an entire.

Kenvue Inc. was projected to web $160.50, primarily based on dividends, plus the median of goal value estimates from 14 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 80% lower than the market as an entire.

Cincinnati Monetary Corp. (CINF) was projected to web $148.91, primarily based on dividends, plus the median of goal value estimates from 8 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 38% lower than the market as an entire.

Lancaster Colony Corp. (LANC) netted $141.54 primarily based on a median goal value estimate from 5 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 83% lower than the market as an entire.

Real Components Co. (GPC) was projected to web $141.39 primarily based on the right track value estimates from 13 analysts, plus annual dividend, much less dealer charges. The Beta quantity confirmed this estimate is topic to danger/volatility 8% lower than the market as an entire.

Procter & Gamble Co. (PG) was projected to web $137.58, primarily based on the median of goal value estimates from 24 analysts, plus the estimated annual dividend, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 54% lower than the market as an entire.

Johnson & Johnson (JNJ) was projected to web $135.62, primarily based on the median of goal value estimates from 22 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 20% over the market as an entire.

The typical web achieve in dividend and value was estimated to be 18.42% on $10k invested as $1k in every of those ten shares. The typical Beta rating confirmed these estimates topic to danger/volatility 36% underneath the market as an entire.

Supply: Open supply canine artwork from dividenddogcatcher.com

The Dividend Canine Rule

Shares earned the “canine” moniker by exhibiting three traits: (1) paying dependable, repeating dividends, (2) their costs fell to the place (3) yield (dividend/value) grew larger than their friends. Thus, the best yielding shares in any assortment turned often known as “canine.” Extra exactly, these are, actually, greatest known as, “underdogs”, even when they’re “Kings.”

High 39 Dividend Kings By Dealer Targets

Sources: motleyfool.com/YCharts.com

This scale of broker-estimated upside (or draw back) for inventory costs offers a measure of market recognition. Notice: no dealer protection or single dealer protection produced a zero rating on the above scale. These dealer estimates will be seen because the emotional element (versus the strictly financial and goal dividend/value yield-driven report beneath). As famous above, these scores may be considered contrarian.

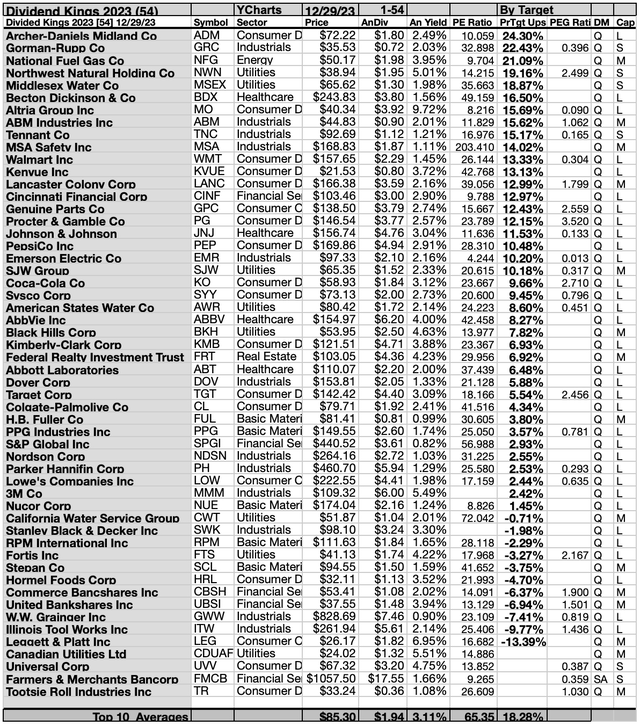

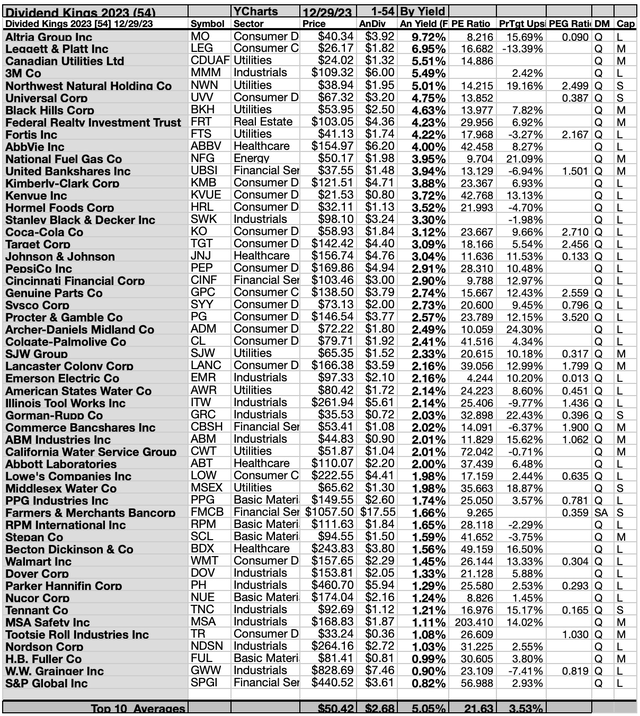

High 54 Dividend Kings By Yield

Supply: motleyfool.com/YCharts.com

Actionable Conclusions (11-20): Ten High Shares By Yield Are The January Canine Of The Dividend Kings

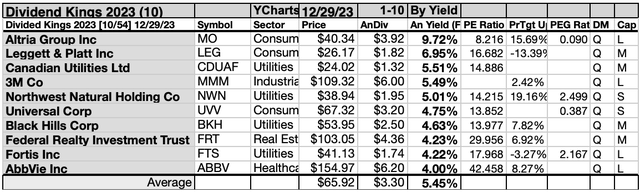

High ten Kings chosen 12/29/23 by yield represented six of 11 Morningstar sectors. In first place was Altria Group Inc. [1], the tops of two shopper defensive representatives within the high ten. The opposite positioned sixth, Common Corp [6]. Then, one shopper cyclical consultant took second place, Leggett & Platt Inc [2].

In third place, was the primary of 4 utilities, Canadian Utilities Ltd [3]. Thereafter, in fifth, seventh, and ninth locations, have been Northwest Pure Holding Co [5], Black Hills Corp [7], and Fortis Inc [9].

A lone industrials sector consultant positioned fourth, 3M Co [4]. Lastly, eighth place was claimed by the lone actual property consultant, Federal Realty Funding Belief [8], and tenth place went to the lone healthcare sector member, AbbVie Inc (ABBV) [10], to finish these January top-ten Kings, by yield.

Supply: YCharts.com

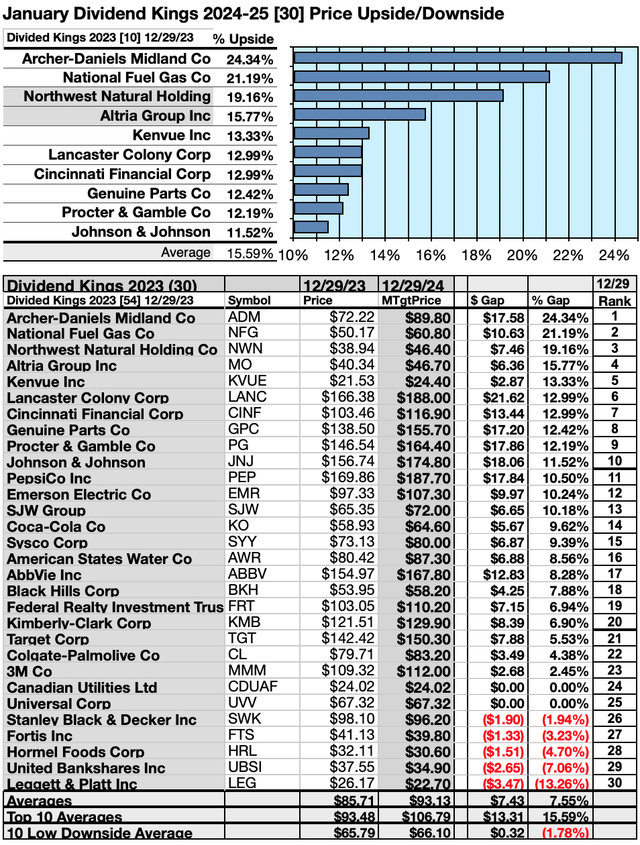

Actionable Conclusions: (21-30) High Ten Kings Confirmed 24.61% To 37.22% Upsides Into December 2023; (31) On The Draw back Have been Two At -3.61% & -5.05%

To quantify top-yield rankings, analyst median price-target estimates supplied a “market sentiment” gauge of upside potential. Added to the easy high-yield metrics, analyst median price-target-estimates turned one other instrument to dig-out bargains.

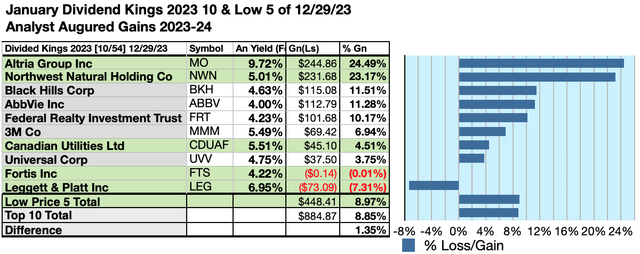

Analysts Estimated A 1.35% Benefit For five Highest Yield, Lowest Priced, of High-Ten Dividend Kings By January, 2025

Ten high Kings have been culled by yield for his or her month-to-month replace. Yield (dividend/value) outcomes verified by YCharts did the rating.

Supply: YCharts.com

As famous above, high ten Kings chosen 12/29/23 displaying the best dividend yields represented seven of 11 within the Morningstar sector scheme.

Actionable Conclusions: Analysts Estimated The 5 Lowest-Priced Of Ten Highest-Yield Dividend Kings (32) Delivering 8.97% Vs. (33) 8.85% Web Positive factors by All Ten by January, 2025

Supply: YCharts.com

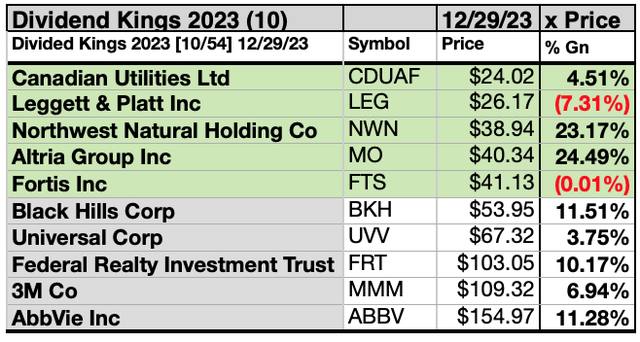

$5000 invested as $1k in every of the 5 lowest-priced shares within the high ten Dividend Kings kennel by yield have been predicted by analyst 1-year targets to ship 1.35% LESS achieve than $5,000 invested as $.5k in all ten. The fourth lowest-priced top-yield King inventory, Altria Group Inc, was projected to ship the perfect web achieve of 24.49%.

Supply: YCharts.com

The 5 lowest-priced top-yield Dividend Kings as of December 29 have been: Canadian Utilities Ltd; Leggett & Platt Inc; Northwest Pure Holding Co; Altria Group Inc; Fortis Inc, with costs starting from $24.02 to $41.13

The 5 higher-priced top-yield Dividend Kings by the December 29 accounting have been: Black Hills Corp; Common Corp; Federal Realty Funding Belief; 3M Co, and AbbVie Inc, whose costs ranged from $53.95 to $154.97.

This distinction between 5 low-priced dividend canine and the overall discipline of ten mirrored Michael B. O’Higgins’ “primary technique” for beating the Dow. The size of projected positive aspects primarily based on analyst targets added a singular aspect of “market sentiment” gauging upside potential. It supplied a here-and-now equal of ready a yr to search out out what would possibly occur available in the market. Warning is suggested, nevertheless, since analysts are traditionally solely 15% to 85% correct on the route of change and simply 0% to fifteen% correct on the diploma of change.

Afterword

If by some means you missed the suggestion of the seven shares ripe for choosing initially of the article, here’s a repeat of the record on the finish:

The next 8 (as of 12/29/23) realized the best of providing annual dividends from a $1K funding exceeding their single share costs: 5 of the top-ten, by yield, plus one out on these high ten, reside as much as the best of providing annual dividends (from a $1K funding) exceeding their single share costs, and there are 5 extra to look at.

Supply: YCharts.com

The 5 to look at are: Black Hills Corp; Nationwide Gas Fuel; 3M Corp; Federal Realty Funding Belief; Common Corp.

BKH is $3.97 over-priced, UVV is $10.77 excessive, MMM is $31.85 obese, FRT must lose $37.03 in value to hitch the best eight.

As we weblog previous the three-year and three quarter mark of the 2020 Ides of March dip, the time to snap-up these ten lingering top-yield dividend King canine is at hand… except one other huge bearish drop in value looms forward. (At which era your technique could be so as to add to your place in any of these you then maintain.)

Worth Drops or Dividend Will increase Might Get All Ten High Dividend Kings Again to “Honest Worth” Charges For Buyers

Supply: YCharts.com

Since 5 of the highest ten Dividend Okay&P shares are actually priced lower than the annual dividends paid out from a $1K funding, the highest chart beneath reveals the greenback and share variations between current and honest costs. Notice that 5 others are inside $1.21 to $59.71 of being there. The center chart compares the 5 beliefs with 5 at current costs. Honest pricing (when all ten high canine conform to the best) is displayed within the backside chart.

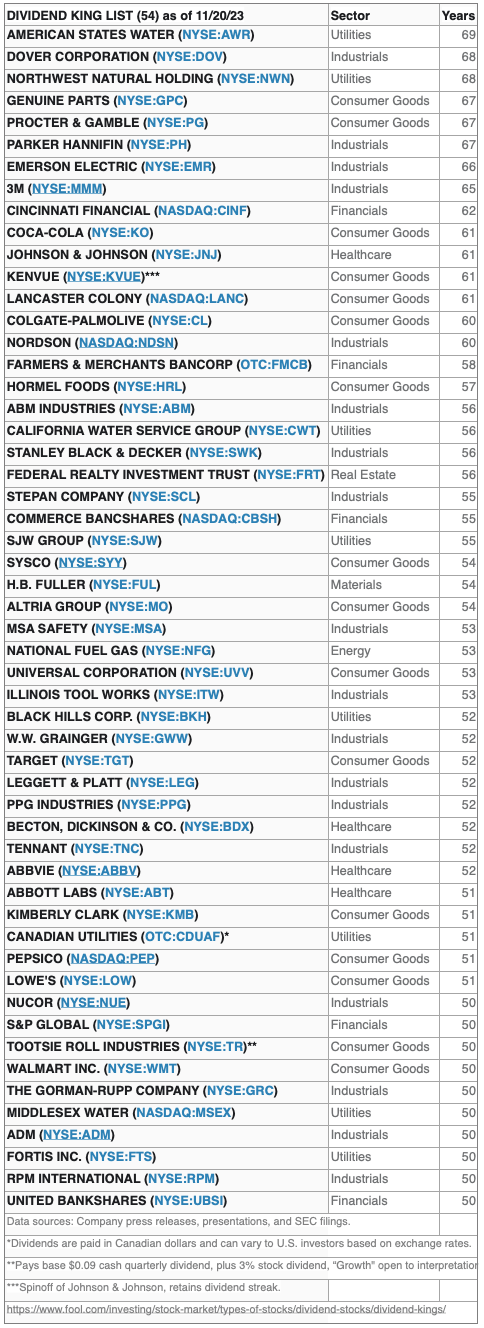

Jnuary Dividend Kings by Years Growing Dividends

Supply: Motleyfool.com

The online achieve/loss estimates above didn’t think about any international or home tax issues ensuing from distributions. Seek the advice of your tax advisor concerning the supply and penalties of “dividends” from any funding.

Shares listed above have been instructed solely as doable reference factors in your Dividend Aristocrats canine inventory buy or sale analysis course of. These weren’t suggestions.

Graphs and charts have been compiled by Rydlun & Co., LLC from information derived from www.indexarb.com; YCharts.com; Yahoo Finance – Inventory Market Reside, Quotes, Enterprise & Finance Information; analyst imply goal value by YCharts. Canine artwork: Open supply canine artwork from dividenddogcatcher.com.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.