bluecinema

Introduction

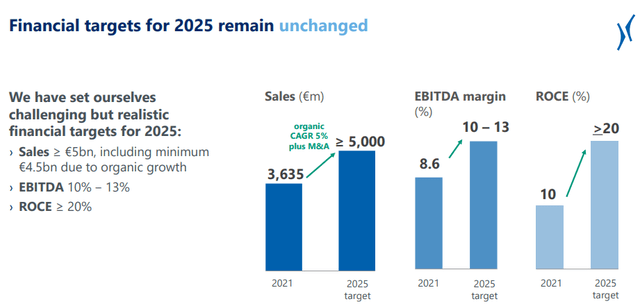

Krones (OTCPK:KRNNF) (OTCPK:KRNTY) is a German producer of machines used within the packaging and bottling sector. Its important specialty is to provide traces for filling aluminum beverage cans, glass bottles and plastic PET bottles. As it’s possible you’ll know, I’ve been bullish on the packaging sector as an entire, and I believe Krones stands to learn from the sluggish however constant demand improve within the packaging business. The corporate’s mid-term plans embody a better income and a considerably greater EBITDA margin by 2025, and the corporate appears to be nicely on its method to obtain its targets.

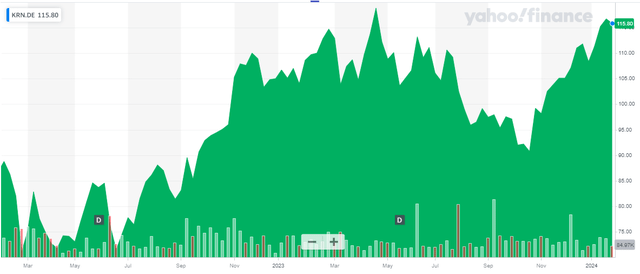

Yahoo Finance

Probably the most liquid itemizing to commerce in Krones’ inventory is its major itemizing on Deutsche Boerse the place it’s buying and selling with KRN as its ticker image. The typical every day quantity in Germany is roughly 28,000 shares, for a financial worth of in extra of 3M EUR per day. There are presently 31.6M shares excellent, leading to a market capitalization of three.67B EUR. As Krones had a web money place of 285M EUR on the finish of September, its enterprise worth is just below 3.4B EUR.

Slowly transferring towards its 2025 EBITDA margin objectives

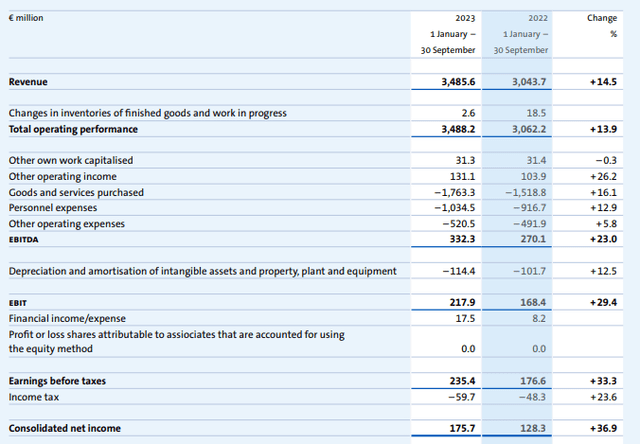

Within the first 9 months of 2023 (Krones nonetheless has to report its full-year outcomes), the corporate generated a complete income if 3.49B EUR, which is a 14.5% improve in comparison with the identical interval in 2022. Much more essential than the income improve is the EBITDA improve, as Krones was capable of increase its EBITDA by 23% to 332.3M EUR.

Krones Investor Relations

In the meantime, the depreciation and amortization bills elevated by simply 12.5% which certainly meant the EBIT expanded at a quicker tempo than the EBITDA, and with an EBIT results of 218M EUR in 9M 2023, Krones could be very comfortable. As the corporate has no debt, it is truly reporting a constructive curiosity revenue and this resulted in a pre-tax revenue of 235M EUR and a web revenue of just below 176M EUR, representing an EPS of 5.56 EUR per share.

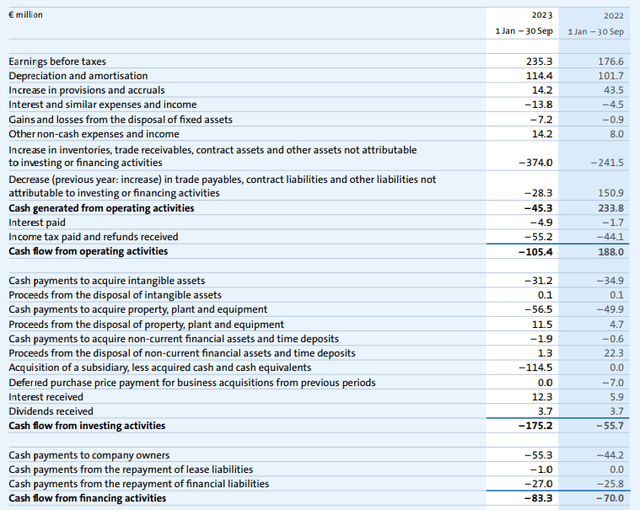

The EBITDA progress within the third quarter was somewhat bit extra subdued, however it nonetheless handsomely exceeded the income improve. It is also essential to appreciate the sturdy web revenue can also be transformed into actual money. Trying on the 9M 2023 money circulate assertion, the working money circulate was a unfavourable 105M EUR, however this included a 402M EUR funding within the working capital place. Excluding working capital adjustments, the reported working money circulate was roughly 297M EUR, and 293M EUR after deducting the right amount of taxes.

Krones Investor Relations

We additionally ought to nonetheless deduct the 1M EUR in lease funds, however it’s solely honest so as to add the 16M EUR in dividend and curiosity revenue again to the equation, leading to an adjusted working money circulate of 308M EUR Within the first 9 months of 2023.

With a complete capex of 88M EUR, the underlying free money circulate within the first 9 months of 2023 was roughly 220M EUR, or nearly 7 EUR per share.

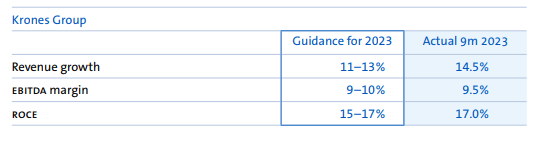

The corporate stays on observe to publish a 11-13% income progress versus 2022 whereas the EBITDA margin ought to are available between 9% and 10%.

Krones Investor Relations

That’s good to see, however I’m extra happy to see the corporate stays on observe to realize the 2025 mid-term targets it outlined throughout its 2022 capital markets day. The corporate had initially set a income goal of “in extra of 5B EUR” and I believe that concentrate on will already be reached in 2024. As such, I’ll anticipate a income of 5.25B EUR by 2025.

Krones Investor Relations

The corporate plans to generate an EBITDA margin of 10%-13% on that income. If I might use the midpoint of that steerage and apply an EBITDA margin of 11.5%, the attributable EBITDA in 2025 ought to be roughly 604M EUR.

We all know the depreciation and amortization bills might be roughly 160M EUR, and I’ll assume a web finance revenue of 15M EUR per yr (the online money place can have elevated by 2025, so I don’t assume I’m too optimistic right here). This can end in a pre-tax revenue of 460M EUR and a web revenue of 340M EUR, assuming a median tax charge of 26%. This may point out an EPS of round 11 EUR per share and I anticipate the free money circulate end result to be fairly comparable given the comparatively low capex and progress capex plans. This additionally implies that – barren of any sudden extra will increase in working capital necessities – the online money place will possible improve in the direction of 700M EUR by the tip of 2025.

Funding thesis

Based mostly on the steerage for 2023, the inventory is presently buying and selling at an EV/EBITDA ratio of roughly 8, which isn’t spectacularly low cost. Nevertheless, if I begin working the fashions utilizing the mid-term steerage, Krones is beginning to look fairly low cost. The enterprise worth might be simply 2.9B EUR whereas the EBITDA is anticipated to extend to only over 600M EUR, indicating the inventory is buying and selling at a ahead EV/EBITDA ratio of lower than 5 based mostly on the projections for 2025.

This, together with an anticipated P/E ratio of 10 and a free money circulate yield of roughly 10%, makes Krones fairly enticing on the present share value. I presently haven’t any place in Krones, however I could provoke a protracted place within the close to future.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.