Bet_Noire

All monetary numbers on this article are in Canadian {dollars} until famous in any other case. Please observe that oil and gasoline costs are all the time in US {dollars}.

Introduction

Two years in the past, I got here out as an enormous fan of Canadian power corporations, as the nation’s massive oil names, Canadian Pure (CNQ), Suncor (SU), and Cenovus Power (NYSE:CVE), have all the pieces I am in search of in oil corporations:

- Deep reserves, which lowers the dangers of “compelled” M&A to maintain manufacturing numbers regular.

- Environment friendly manufacturing supplies these corporations with low breakeven costs and elevated free money movement at elevated oil costs.

- A concentrate on shareholder distributions, as all three corporations are devoted to returning roughly all of their free money movement to shareholders (after reaching their goal leverage ratios).

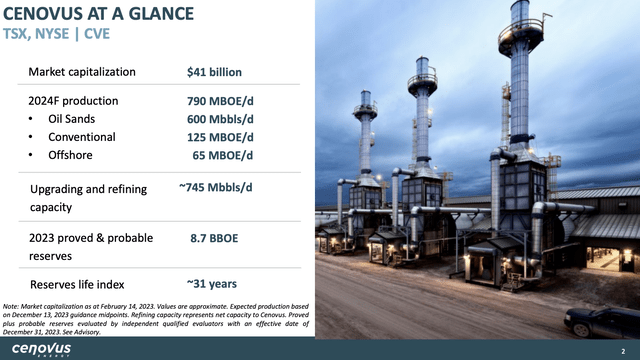

Because the title of this text suggests, it is about Cenovus Power, the third-largest Canadian oil and gasoline firm.

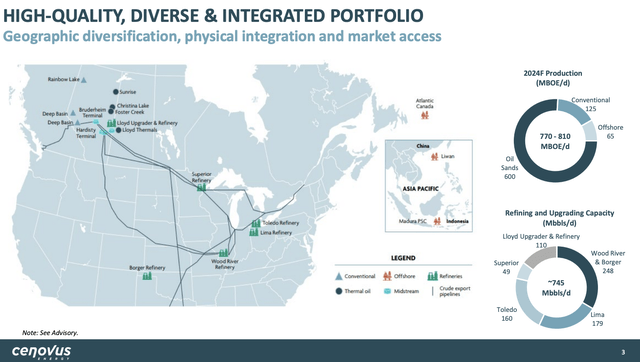

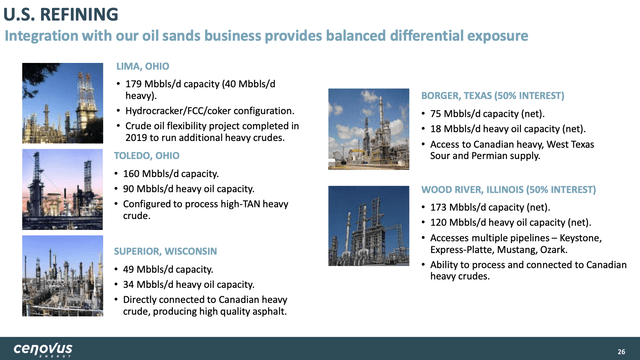

On this case, we’re coping with an built-in oil and gasoline firm, because it additionally owns substantial downstream belongings able to refining roughly 745 thousand barrels per day.

Cenovus Power

My most up-to-date article on this firm was written on November 6, titled “Canada’s Greatest – Cenovus Is A Considerably Undervalued Buyback Powerhouse.”

On this article, I am going to elaborate on this, utilizing the corporate’s just-released earnings and favorable developments within the North American oil and gasoline trade that would more and more favor Canadian gamers.

So, with all of this in thoughts, let’s get to it!

Between Headwinds And Tailwinds

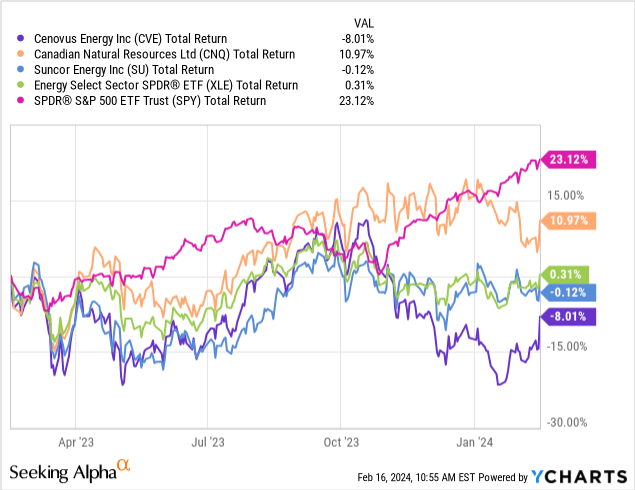

Over the previous twelve months, power hasn’t been the perfect place to be, because the Power Choose Sector ETF (XLE) returned simply 0.3%, lagging the S&P 500 by roughly 23 factors.

Poor financial development situations (at the least in cyclical industries), strain on Chinese language shoppers and building, recession dangers in Europe, and the truth that tech has been such an incredible place to be have triggered power to carry out poorly.

Nonetheless, Cenovus, which has been the worst performer amongst its friends, is doing somewhat nicely in terms of positioning its firm for development and its shareholders for larger distributions.

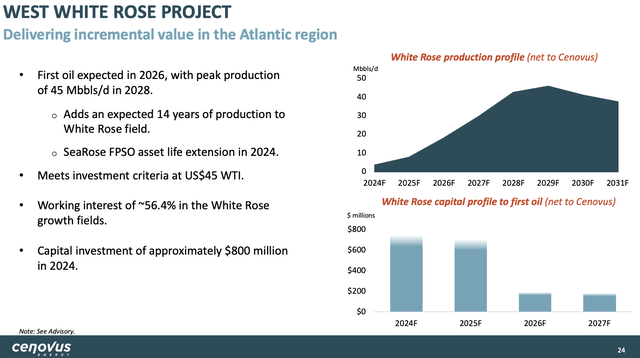

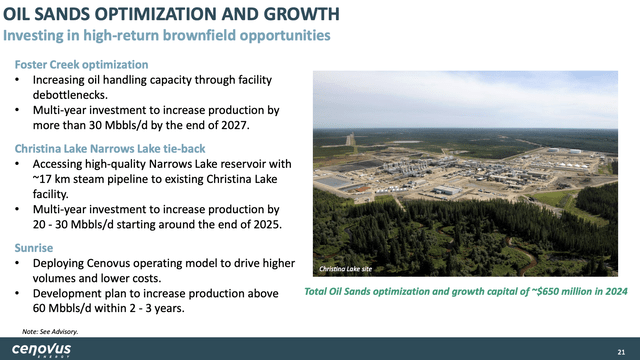

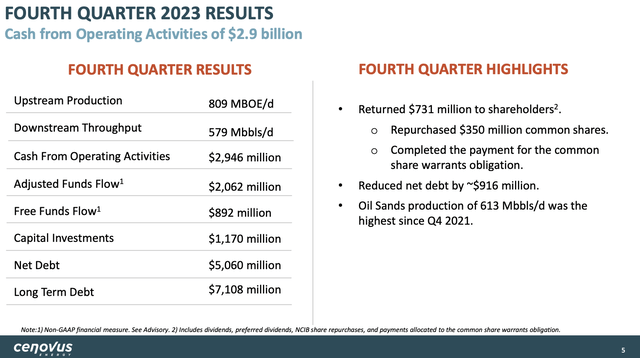

For instance, within the fourth quarter of 2023, Cenovus Power achieved vital operational milestones throughout its enterprise segments.

Notably, the corporate efficiently restarted two refineries and made substantial progress on the West White Rose challenge, reaching a completion charge of 75%.

Cenovus Power

As I mentioned within the introduction, CVE is rather more than an upstream enterprise, because it owns downstream (refining) belongings able to turning roughly 745 thousand barrels of oil into value-added merchandise.

Which means that an enormous a part of its 770 to 810 thousand barrels of oil equal (“BOE”) manufacturing in 2024E stays in its personal worth chain till it leaves within the type of a variety of refined merchandise.

Cenovus Power

With that in thoughts, Cenovus Power’s upstream enterprise (oil and gasoline manufacturing) demonstrated robust efficiency throughout the fourth quarter, with manufacturing reaching practically 810,000 barrels of oil per day.

This marked the best quarterly manufacturing for the 12 months and the second-highest within the firm’s historical past!

Keep in mind that this firm has no strain to restrict output, because it has confirmed and possible reserves of 8.7 billion barrels of OE, which is roughly 31 years’ price of manufacturing, one of many highest numbers in your complete trade.

In keeping with the corporate, this efficiency was pushed by strong operations on the oil sands belongings, notably Foster Creek, the place the ramp-up of latest sustaining pads contributed to elevated manufacturing ranges.

Moreover, the graduation of steaming at Dawn signaled the initiation of a multiyear growth plan aimed toward maximizing manufacturing volumes.

Cenovus Power

Nonetheless, regardless of these developments, the upstream enterprise confronted challenges associated to decrease crude costs and wider heavy oil differentials.

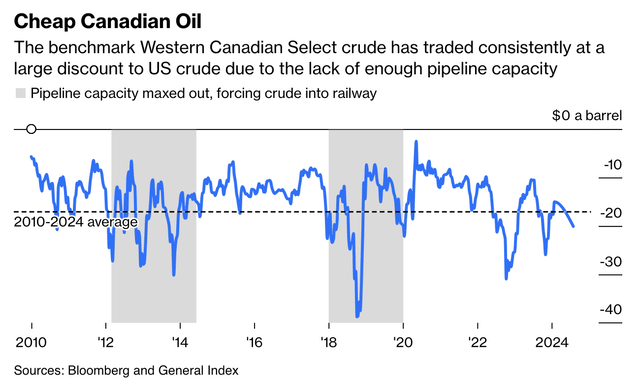

Talking of unfavorable Canadian oil differentials, these headwinds may quickly flip into tailwinds.

Earlier this month, Bloomberg’s Javier Blas wrote an article titled “The $10 Billion Mistake That Will Revive Canadian Oil.”

In keeping with him, after years of “ache,” Canada’s costly new TMX pipeline is anticipated to offer tailwinds for the trade.

I added emphasis to the quote beneath.

The bottleneck has price Canadian oil corporations billions of {dollars} in forgone income, delaying the trade’s development. With current pipelines full, any additional barrels have needed to transfer through pricey railway, miserable their worth. On the worst level in late 2018, Canadian crude bought at a reduction of $50 a barrel lower than American petroleum.

Bloomberg

Moreover:

The consensus is, that is going to pattern now towards minus $10 a barrel. Crucially, TMX most likely signifies that the differential will now not endure from its perennial blowouts, when it has widened to as a lot as minus $40 and even minus $50 a barrel.

Though we should always anticipate that persevering with output development in Alberta may lead to a widening unfold within the years forward if no new pipelines are permitted, we should always see rising tailwinds for Canada’s largest producers within the mid-term.

Going again to Cenovus, its downstream operations have been considerably of a combined bag within the fourth quarter.

Whereas the corporate’s operated refining companies continued to carry out nicely, challenges have been encountered in sure areas.

Canadian refining achieved a crude utilization charge of 91%, with the Lloydminster Upgrader demonstrating constant and robust efficiency.

Nonetheless, deliberate upkeep actions impacted throughput, notably on the Superior Refinery, the place efforts to enhance reliability have been ongoing.

Cenovus Power

The downstream enterprise confronted headwinds as a result of a weak Chicago crack crush setting, leading to a decline in refining margins and throughput.

In keeping with the corporate, the Chicago 3-2-1 crack unfold averaged US$13.24 per barrel, reflecting a major decline in comparison with the earlier quarter.

Shareholders Stay In A Nice Place

Regardless of short-term headwinds associated to decrease crude costs, unfavorable worth differentials, and crack unfold headwinds, the corporate delivered roughly $2.1 billion of adjusted funds movement within the fourth quarter.

The corporate additionally made vital progress in debt discount, with internet debt reducing by over $900 million from the third quarter.

Cenovus Power

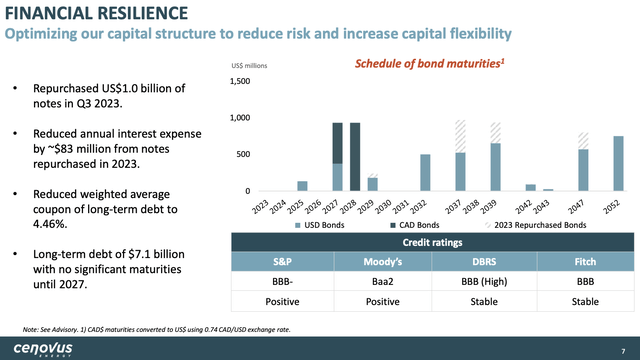

As we will see beneath, the corporate has an funding grade ranking of BBB- from Customary & Poor’s and a weighted common rate of interest on its long-term debt of 4.5%.

It has no main debt maturities till 2027, which buys the corporate a number of time on this unfavorable setting.

Cenovus Power

Moreover, Cenovus distributed over $700 million on to shareholders by way of dividends, share buybacks, and the ultimate cost of frequent share warrant obligations.

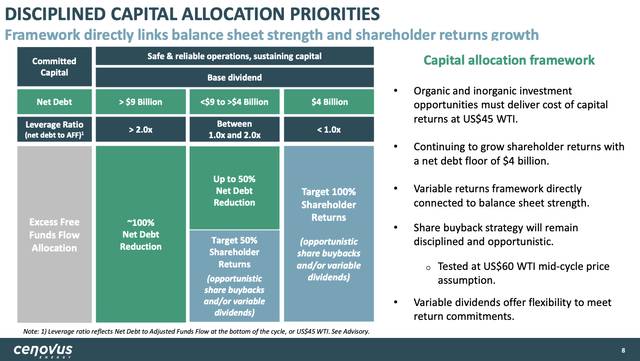

Waiting for 2024, the corporate stays targeted on reaching its $4 billion internet debt goal, advancing high-return development tasks within the upstream section, and enhancing the profitability of the downstream enterprise.

With regard to shareholder distributions, Cenovus is dedicated to returning extra free funds movement to shareholders and can present additional insights into its technique and plans at an upcoming Investor Day on March 5.

As soon as the corporate achieves its internet debt goal of $4 billion, it goals to return each penny of free money movement to shareholders, possible utilizing buybacks.

Cenovus Power

This bodes nicely for shareholders.

Why?

As a result of CVE is in a improbable place to spice up shareholder worth.

The corporate, which at present yields 2.6%, has a totally coated dividend and capital packages at US$45 WTI. This contains sustaining capital of $3 billion per 12 months.

Analysts anticipate that CVE will finish this 12 months with $3.7 billion in debt, which suggests it can possible hit its leverage goal within the second half of this 12 months.

Additionally it is anticipated to generate $5.0 billion in free money movement, possible adopted by $5.5 billion in 2025E free money movement.

These numbers translate to free money movement yields of 11.4% and 12.5%, respectively. That is primarily based on the corporate’s $44 billion market cap.

In different phrases, as soon as the corporate reaches its debt goal, that is the type of annual return traders can anticipate in a mid-cycle oil setting just like the one we’re at present witnessing.

As soon as oil begins a significant rally, which I anticipate to occur when international cyclical demand improves, we may see a lot larger free money movement potential.

Valuation

CVE isn’t solely in an incredible spot to reward shareholders, however it’s also very low-cost.

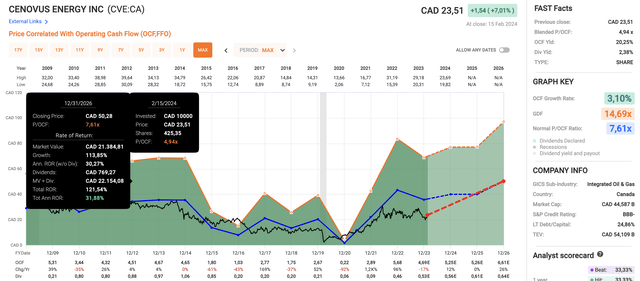

Utilizing the information within the chart beneath:

- CVE trades at a blended worth/OCF (working money movement) ratio of simply 4.9x, which is considerably beneath its long-term normalized a number of of seven.6x OCF.

- This 12 months, analysts anticipate OCF to rise by 10%, doubtlessly adopted by unchanged OCF in 2025 and 26% development in 2026.

- Whereas these numbers are clearly extremely depending on the value of oil, they point out that beneath present circumstances, the inventory has a good worth of $50 in Toronto. That is roughly twice its present worth.

FAST Graphs

Whereas I will not make the case that CVE will double in a single day, I actually like the chance/reward and can be a purchaser if I did not have a lot publicity in Canadian Pure already.

Additionally, my private choice is shopping for upstream and downstream as separate corporations, which is why I opted for Canadian Pure.

All issues thought-about, if I have been in search of extra diversified oil publicity, I’d be a purchaser of CVE – particularly if cyclical headwinds push the inventory down a bit extra.

Takeaway

Cenovus Power stands out within the power sector with its strategic concentrate on shareholder distributions, operational effectivity, and strong manufacturing capabilities.

Regardless of trade headwinds, together with decrease crude costs and unfavorable differentials, CVE’s built-in enterprise mannequin and robust steadiness sheet place it for development and worth creation.

With a dedication to debt discount and returning extra free money movement to shareholders, CVE affords a pretty funding alternative, particularly contemplating its efficiency relative to friends.

As the corporate progresses towards its debt goal and generates vital free money movement, traders can anticipate substantial returns, making CVE a compelling possibility for these in search of publicity to the Canadian power sector.

Professionals and Cons

Professionals:

- Shareholder-Pleasant Method: The corporate prioritizes returning extra money movement to shareholders by way of dividends and buybacks, enhancing investor returns.

- Undervalued: Buying and selling at a major low cost to its honest worth, CVE presents a pretty alternative for potential capital appreciation.

- Robust Fundamentals: With a concentrate on debt discount and maximizing free money movement, CVE is well-positioned to climate market volatility and ship long-term worth.

- Potential for Development: Because the power sector rebounds and oil costs recuperate, CVE’s strategic initiatives may drive future development and profitability.

Cons:

- Trade Challenges: CVE operates in a cyclical trade susceptible to fluctuations in commodity costs and market situations, which may impression monetary efficiency.

- Refining Margin Pressures: The downstream section faces challenges comparable to refining margin pressures, which may have an effect on total profitability.

- Threat of Regulatory Modifications: Regulatory modifications or environmental insurance policies may impression CVE’s operations and profitability, including to funding threat.