HeliRy

Introduction

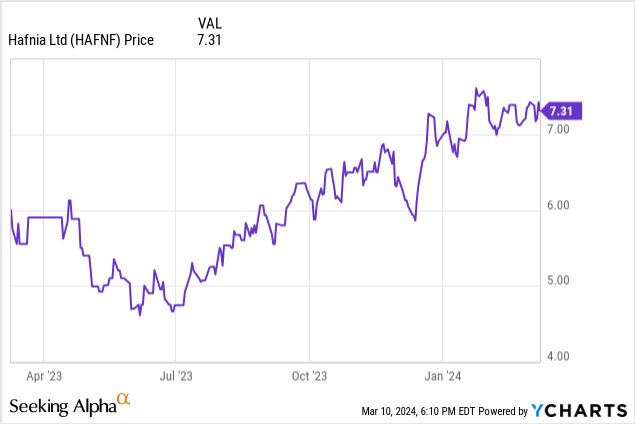

I beforehand coated Hafnia Restricted (OTCQX:HAFNF), again in September, once I wrote an article explaining my bullish view on the inventory. Since then, the shares have risen 15.12% to $7.31, and when together with the dividend provides a complete return of 18.63%, a tad above the 18.13% return of the S&P 500 (SPY). This outperformance in opposition to the S&P follows short-term catalysts and a stable set of outcomes for Hafnia.

Since writing my earlier article, the Panama Canal drought has continued to limit transport, and vital disruptions have occurred within the Crimson Sea because of Houthi assaults on transport. With Hafnia not too long ago reporting their newest quarterly outcomes, which proceed to point out power for the corporate, I believed it was a great time to look extra into the components that would drive progress within the share worth.

Disruption within the Crimson Sea

Since my earlier article, vital disruption has occurred within the Crimson Sea from Houthi assaults on business transport. This has resulted in lots of ships taking the choice route across the Cape of Good Hope to guard their crews and ships, but in addition because of considerably increased insurance coverage prices. This has resulted in for much longer distances needing to be coated which has elevated transport occasions from Asia to Europe by round 14 days.

At first look, this may increasingly seem detrimental to Hafnia; for much longer distances and time considerably improve gasoline prices; nonetheless, this fails to bear in mind the tight marketplace for tankers. This was highlighted in Hafnia’s This autumn 2023 Investor Presentation:

Looking forward to 2024, the short-term outlook reveals promise because of disruptions within the Crimson Sea prompting vessels to reroute onto longer voyages. This boosts demand for product tankers and will increase the space they journey, successfully decreasing tonnage provide availability.

A lift in demand mixed with a discount in provide inevitably results in increased costs which greater than cowl the elevated prices of rerouting. There may be motive to imagine transport charges may rise additional, with the diesel market in Europe exhibiting tightness, which mixed with refinery outages and imports from Russia restricted, means additional provide should be introduced in by sea. If there’s inadequate provide from America, then it should come from Asia by way of the longer voyage round Africa, additional decreasing the provision of obtainable Tankers.

Panama Canal Delays Stay

Delays in Panama Canal transits stay with solely 24 approved transits a day, far beneath the 36 usually approved transits. These delays are being pushed by droughts in Panama. Though wait occasions have diminished since my final replace, wait occasions are at the moment at 2 to 13 days relying on the vessel. Delays are set to stay till a minimum of the tip of the dry season in mid-2024. Because of this, some ships have been pressured to divert across the tip of South America, which, as defined within the earlier part, reduces obtainable transport provide, driving up transport charges.

With the potential of droughts within the area solely rising every year as a result of altering local weather, transit restrictions solely develop into extra possible. Though proposals have been put ahead to assist shift water into the canal to beat these issues, these will take years to design and construct.

This autumn Outcomes

On March fifth, Hafnia reported its outcomes for the fourth quarter. Income got here in at $472 million, a drop of 35% in opposition to the earlier yr, while earnings per share got here in at $0.34, in opposition to $0.54 a share the earlier yr. This drop might be attributed to decrease transport charges in the course of the quarter, with time constitution equal averaging $30,732 per day. For the total 2023 yr, internet earnings got here in at $793.2 million, barely forward of the $751.1 million reported for 2022.

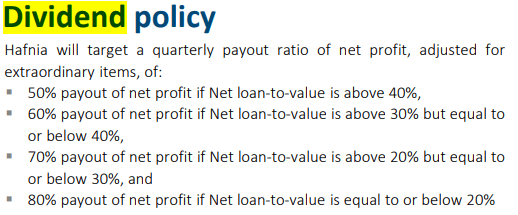

On the steadiness sheet facet, internet asset worth elevated to $7.70 per share and loan-to-value continued to fall, reaching 26.3%, in opposition to 37.2% a yr in the past. With Hafnia’s dividend payout ratio depending on loan-to-value, this drop resulted within the quarterly dividend being raised to 70% of internet revenue, leading to a dividend of $0.2431 per share.

Hafnia Dividend Coverage (Hafnia This autumn 2023 Outcomes Investor Presentation)

The corporate additionally reported that as of twenty eighth February, transport days for Q1 are 80% coated, at a median time constitution equal charge of $37,668, suggesting income ought to improve quarter-on-quarter.

General, Hafnia introduced one other stable quarterly set of outcomes, which underline its stable steadiness sheet and worthwhile enterprise mannequin.

Valuation

Because of the capital-intensive nature of their operations, transport corporations are sometimes valued based mostly on their internet asset worth and on an EV/EBITDA metric. Following the tip of the fourth quarter, Hafnia has a internet asset worth of $3.9 billion, or $7.7 a share. The shares at the moment commerce at $7.31, a reduction of 5% to the web asset worth. With opponents usually buying and selling at a premium to NAV, this means there could possibly be additional upside within the share worth.

The broader transport business trades at an EV/EBITDA ahead a number of of 5.55. Hafnia, nonetheless, trades solely at a a number of of 4.69. Given Hafnia’s robust steadiness sheet, with a loan-to-value ratio of solely 26.3%, and the constructive outlook for the sector Hafnia operates in, I imagine this low cost to friends is unjustified and helps the view that there’s potential for additional upside within the share worth.

Dangers

In my earlier article, I mentioned what I understand to be the three main dangers for Hafnia: business cyclicality, gasoline costs, and regulatory dangers. Amongst these, I deem the chance of upper gasoline costs, leading to elevated working bills, to be probably the most vital. Whereas there’s a risk that these heightened prices could possibly be transferred to prospects, thus aiding in mitigating this threat, particularly contemplating the restricted variety of vessels, it might wrestle to take action if vessel provide is ample.

One other threat value contemplating is the decision of occasions that help the constructive outlook, equivalent to Crimson Sea disruptions and Panama Canal delays. Ought to these points be resolved, decreasing journey distances, and eliminating the necessity for rerouting, tonnage provide availability may improve, thereby resulting in a decline in transport charges. The length of those occasions and whether or not they have already been factored into the share worth stays unsure.

Conclusion

Hafnia continues to stay a compelling funding alternative within the transport sector, with one other quarter of stable working outcomes. With a robust steadiness sheet and constructive outlook for the longer term, Hafnia appears to be like set to proceed creating worth for shareholders. With the shares persevering with to commerce beneath friends, I imagine there continues to be potential for additional upside within the coming years and proceed to carry.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.