Volatility is a given when placing your cash to work on Wall Avenue. Since this decade started, all three main inventory indexes have traded off bear and bull markets in successive years. Whereas most buyers are in all probability hoping for an finish to this sample in 2024, it however speaks to the unpredictable nature of shares over the quick time period.

Traditionally, when volatility and uncertainty crop up, skilled and retail buyers tend to hunt out firms which have constantly outperformed in just about any financial local weather. One excellent instance of that is buyers flocking to the FAANG shares for greater than a decade. However lately, it is shares enacting splits which were the cream of the crop.

A “inventory break up” is a purely beauty occasion that enables a publicly traded firm to change its share worth and excellent share rely. It is beauty within the sense {that a} inventory break up does not change an organization’s market cap or its working efficiency.

A forward-stock break up could make shares extra nominally reasonably priced for retail buyers who haven’t got entry to fractional-share purchases with their dealer. Conversely, reverse-stock splits are designed to extend an organization’s share worth to make sure continued itemizing on a serious inventory alternate. With few exceptions, buyers are inclined to deal with high-flying companies conducting forward-stock splits.

Almost a dozen high-profile firms have enacted ahead splits since mid-2021

Firms that enact ahead splits are normally extremely worthwhile and on the vanguard of the modern curve inside their respective industries.

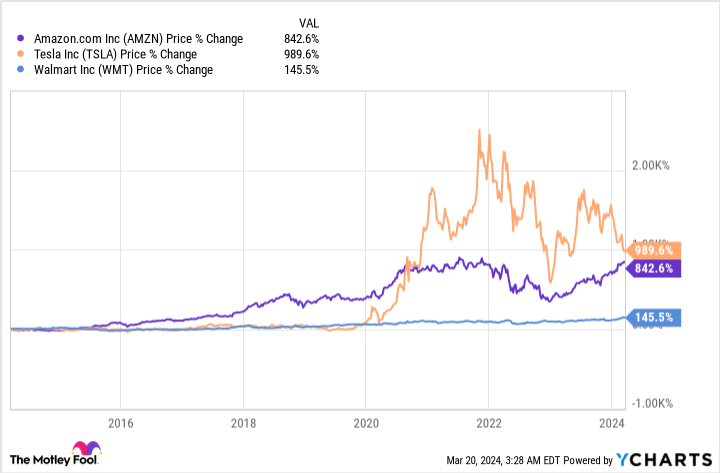

For the reason that midpoint of 2021, simply shy of a dozen high-profile firms have accomplished forward-stock splits, together with Amazon (NASDAQ: AMZN), Tesla (NASDAQ: TSLA), and Walmart (NYSE: WMT). Amazon and Tesla performed ahead splits of 20-for-1 and 3-for-1 in 2022, respectively, whereas Walmart’s 3-for-1 forward-stock break up went into impact final month.

The explanation these companies have outperformed is due to their well-defined aggressive benefits:

-

Amazon is an absolute juggernaut in e-commerce. The almost 38% share of U.S. on-line retail gross sales it accounted for in 2023 was almost six occasions greater than Walmart, its next-closest competitor. Amazon can be the father or mother of Amazon Internet Companies (AWS), the world’s main cloud infrastructure service platform.

-

Tesla is North America’s main electric-vehicle (EV) producer and the one pure-play EV maker that is producing a recurring revenue. Final yr, Tesla produced simply shy of 1.85 million EVs and can seemingly make a run at topping 2 million manufacturing automobiles this yr.

-

Walmart has been ready to make use of its dimension as a bonus. Shopping for merchandise in bulk helps to decrease per-unit prices, which supplies a aggressive edge on worth in comparison with most native shops and grocery chains. In the meantime, the vastness of its shops and direct-to-consumer web site encourages consumers to remain inside its ecosystem of services.

On Tuesday, March 19, one other top-notch firm introduced that it might becoming a member of this unique group of stock-split shares.

Meet Wall Avenue’s tasty new stock-split inventory

Following the closing bell on March 19, the board of administrators of fast-casual restaurant chain Chipotle Mexican Grill (NYSE: CMG) introduced a 50-for-1 inventory break up, which is likely one of the largest ahead splits within the historical past of the New York Inventory Alternate. Assuming the break up is given the inexperienced gentle by shareholders on the firm’s annual assembly in June, Chipotle will start buying and selling at a post-split worth on June 26, 2024.

Chipotle went public in January 2006 at an preliminary providing worth of $22 per share, however has by no means break up its inventory. Shares of the corporate neared the $3,000 mark shortly after the announcement. A 50-for-1 inventory break up would cut back Chipotle’s share worth to only shy of $60 per share, based mostly on the place it is buying and selling on the time of this writing.

Stated Chipotle’s chief monetary and administrative officer, Jack Hartung,

That is the primary inventory break up in Chipotle’s 30-year historical past, and we consider it will make our inventory extra accessible to staff in addition to a broader vary of buyers. This break up comes at a time when our inventory is experiencing an all-time excessive pushed by document revenues, earnings, and development.

Curiously, Chipotle’s need to make shares extra nominally reasonably priced for its staff echoes what Walmart mentioned when in late January when it introduced its 3-for-1 inventory break up.

Chipotle’s continued outperformance, which led to this monumental inventory break up, will be summed up by three catalysts: meals high quality, its menu, and innovation.

With regard to the previous, Chipotle has strived to make use of regionally sourced greens and responsibly raised meats. Simply as grocery shops benefited from the natural meals push 20 years in the past, Chipotle is having fun with distinctive pricing energy and elevated demand due to its use of contemporary components.

Secondly, Chipotle tends to maintain its menu comparatively small. A small menu makes meals preparation simpler on its employees, which might expedite service occasions. A restricted menu may also result in extra pleasure when new meals objects are launched.

Lastly, innovation has performed an essential function within the outperformance of Chipotle’s inventory. An ideal instance is the introduction of “Chipotlanes,” that are drive-thru lanes particularly designed for cellular orders. Administration has achieved an outstanding job of enhancing the working effectivity of its shops over time.

This skyrocketing synthetic intelligence (AI) inventory could break up its shares subsequent

With Walmart finishing its break up in late February and Chipotle Mexican Grill on observe to conduct its first-ever break up in late June, it is only a matter of time earlier than one other high-quality firm joins this unique membership of stock-split shares. Given the thrill surrounding synthetic intelligence (AI) in the mean time, the likeliest candidate to comply with in Chipotle’s footsteps is semiconductor firm Broadcom (NASDAQ: AVGO). Did you suppose I used to be going to say Nvidia?

Broadcom inventory ended the buying and selling session on March 19 at a whopping $1,238 per share. That is up greater than 1,800% over the trialing decade. Though Broadcom performed three inventory splits previous to be acquired by Avago in early 2016 (Avago selected to maintain the Broadcom identify), Avago had by no means introduced any inventory splits.

AI is a megatrend the likes of which we’ve not seen because the introduction of the web. Although estimates are in every single place, researchers at PwC launched a report final yr that recommended AI may add $15.7 trillion to international gross home product by 2030. That is music to the ears of Broadcom.

Broadcom’s working efficiency is liable to be fueled by its Jericho3-AI chip, which the corporate launched final spring. Jericho3 has the power to attach as much as 32,000 graphics processing items without delay in AI-accelerated information facilities. In different phrases, Broadcom boasts the vital infrastructure that’ll be wanted to assist generative AI options and enormous language mannequin coaching.

Along with its plain AI ties, Broadcom’s extremely worthwhile basis is its wi-fi chip section. It is a main supplier of 5G wi-fi chips utilized in next-generation smartphones. A gentle stream of shoppers upgrading their wi-fi gadgets to reap the benefits of quicker obtain speeds has led to a wholesome backlog of orders for Broadcom.

Though Avago’s administration crew has by no means pulled the set off on a inventory break up, a share worth north of $1,200 could be the catalyst wanted to make the corporate’s inventory extra nominally reasonably priced for on a regular basis buyers.

Do you have to make investments $1,000 in Chipotle Mexican Grill proper now?

Before you purchase inventory in Chipotle Mexican Grill, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Chipotle Mexican Grill wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 20, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Sean Williams has positions in Amazon. The Motley Idiot has positions in and recommends Amazon, Chipotle Mexican Grill, Nvidia, Tesla, and Walmart. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.

Meet Wall Avenue’s Latest Inventory-Cut up Inventory, Alongside With the Synthetic Intelligence (AI) Inventory Likeliest to Comply with in Its Footsteps was initially revealed by The Motley Idiot