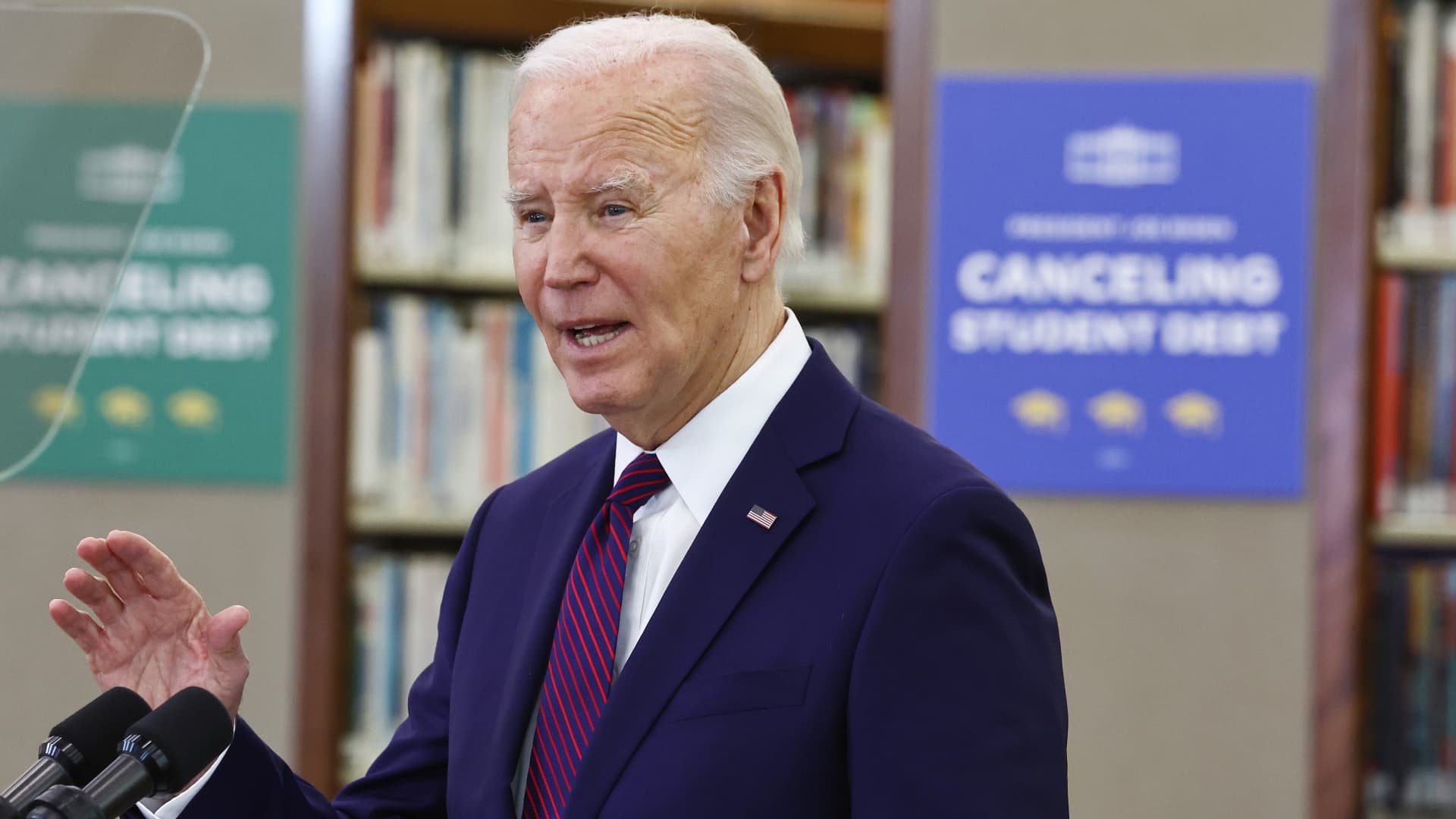

U.S. President Joe Biden delivers remarks on canceling scholar debt at Culver Metropolis Julian Dixon Library on February 21, 2024 in Culver Metropolis, California.

Mario Tama | Getty Pictures

A narrower assist bundle Biden hopes will survive

The president’s Plan B for scholar mortgage forgiveness will seemingly goal a number of teams of debtors, together with those that’ve been in reimbursement for many years and people who find themselves experiencing monetary hardship.

Instantly after the Supreme Court docket struck down Biden’s $400 billion scholar mortgage forgiveness plan final June, his administration started engaged on a revised help bundle.

The Biden administration believes its up to date plan will survive authorized challenges this time for a number of causes. One, it is narrower than its first try, which might have impacted as many as 40 million People.

“I feel it could be simpler to justify in entrance of a court docket that’s skeptical of broad authority,” mentioned Luke Herrine, an assistant professor of legislation on the College of Alabama, in an earlier interview with CNBC.

Scholar debt reduction activist rally in entrance of the U.S. Supreme Court docket on June 30, 2023 in Washington, DC. The Supreme Court docket caught down the Biden administration’s scholar debt forgiveness program in Biden v. Nebraska.

Kevin Dietsch | Getty Pictures

It’s also utilizing a distinct legislation — the Increased Schooling Act reasonably than the Heroes Act of 2003 — as its authorized justification.

The HEA was signed into legislation by President Lyndon B. Johnson in 1965, and permits the schooling secretary some authority to waive or launch debtors’ schooling debt.

The Heroes Act was handed within the aftermath of the 9/11 terrorist assaults, and grants the president broad energy to revise scholar mortgage applications throughout nationwide emergencies.

The conservative justices did not purchase that argument.

″’Can the Secretary use his powers to abolish $430 billion in scholar loans, fully canceling mortgage balances for 20 million debtors, as a pandemic winds all the way down to its finish?'” Chief Justice John Roberts wrote within the majority opinion for Biden v. Nebraska. “We will not imagine the reply could be sure.”

Lastly, the Biden administration has now turned to the rulemaking course of to ship its reduction. The president beforehand tried to cancel the debt via government motion.

As a part of the rulemaking course of, a group of negotiators met 4 occasions to attempt to set up the brand new parameters of the up to date coverage. The ultimate session concluded in February.

Primarily based on the timeline of regulatory adjustments, the proposal will seemingly develop into public inside weeks, Kantrowitz mentioned.

“Sometimes on the finish of the negotiated rulemaking, a month or so later you will have publication of the proposal,” he mentioned.

There’ll then be a public remark interval, which is prone to final for at the very least 30 days.