Bet_Noire

As tensions within the Center East flare up but once more and as we enter election season, placing on some shorter-term tactical vitality trades on high of current oil and fuel investments makes some sense.

At the moment, vitality merchants are anticipating a squeeze in deliverable provides of oil and a pointy depletion of stock over the summer season. That is mirrored within the spot value and calendar spreads. Briefly, they’re anticipating larger oil costs into summer season.

In the present day, I talk about two methods to make use of Power Choose Sector SPDR® Fund ETF (NYSEARCA:XLE) to hedge an increase within the value of oil. If you don’t promote choices, I implore you to study, as it’s a great instrument for producing revenue and managing threat. All the time absolutely perceive the dangers of choices earlier than putting any trades.

First, let’s take a look at a few the key dangers for oil costs rising additional.

Center East Conflicts

Since October seventh, we now have been watching as Israel seeks a mixture of retribution and safety for its future. With an Israel bombing in Damascus that killed Iranian senior navy commanders, tensions have skyrocketed between the 2 nations. Israel has cancelled all navy leaves and gone to an much more heightened stage of readiness.

That is on high of the drone killing of a number of help employees prior to now week that grew the rift between President Biden and Prime Minister Netanyahu. The state of affairs in Gaza has develop into untenable regardless of Iran’s help of the terrorist PLO because of Netanyahu’s method to bombing and really discriminate sabotaging of help to Gazans.

Whereas Israel shouldn’t be a big oil producer, Iran is. And, Iran is supporting Houthis which might be attacking vessels within the Straits Of Hormuz. The potential for additional disruptions will increase if Israel and Iran come to blows, disrupting Iranian oil manufacturing.

Netanyahu may very effectively leverage threats to assault Iranian oil to extract concessions from the US. It is vitally doable that President Biden has had nearly sufficient of Netanyahu regardless of the robust help of Israel. So, the specter of Israeli and Iranian battle seems elevated with Netanyahu probably being intractable and Iran looking for retribution. That places Iranian oil provide to the world in danger.

OPEC And Politics

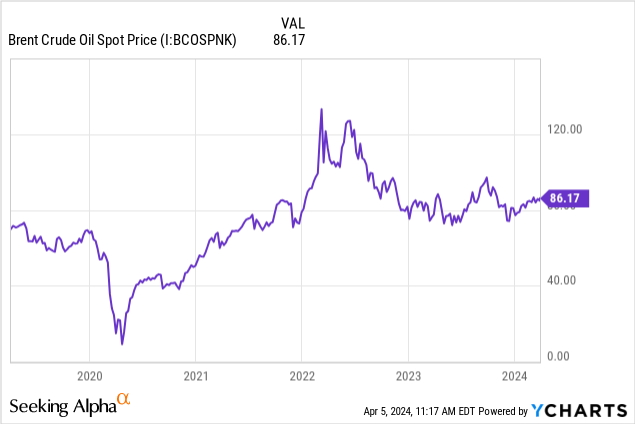

OPEC, led by Saudi Prince Mohammed bin Salman Al Saud, has been curbing oil manufacturing and exports since 2020 in an effort to get and preserve oil costs (CL1:COM) close to or above $80 per barrel. They’ve been largely profitable, with Brent Crude catching help the previous two years when it sinks under $80/b.

Brent Crude Value (YCharts)

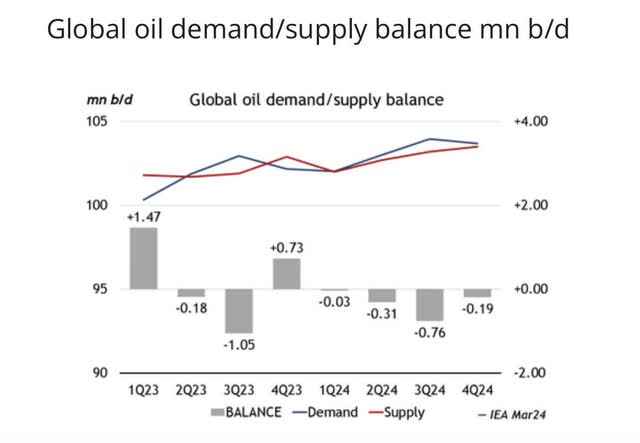

With oil demand and provide roughly in steadiness, owing to report U.S. manufacturing prior to now two years and nonetheless some world demand progress, Saudi supported manufacturing limitations have successfully held the road on oil costs.

International Oil Demand/Provide Stability (IEA)

Oil traditionally has had an outsize influence on inflation. That influence has typically dissipated for the reason that Monetary Disaster, excluding the post-Covid financial jumpstart, although.

An inexpensive worry is that Prince MBS may use oil to influence the U.S. election within the autumn, as costs on the pump have traditionally mattered in Presidential elections. Certainly, final week, OPEC determined to not improve manufacturing going into the U.S. driving season.

Purchase XLE For Potential Inflation Surge

The mix of battle and motivated OPEC strikes to maintain oil provide tight may result in larger oil costs and gasoline inflation. I believe now is an effective time so as to add short-term tactical investments to your longer-term vitality holdings.

We’ve got held sure vitality investments through the vitality transition which have included clear vitality, biofuels, oil and fuel shares. Listed below are three positions that I believe you may add to or add new for publicity for a possible rally in oil and oil-related shares. These are additionally a good hedge on an inflation uptick.

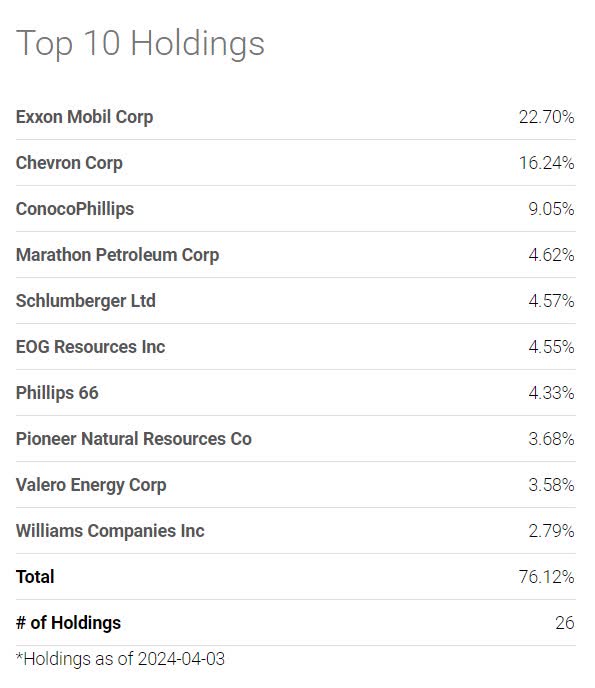

Power Choose Sector SPDR® Fund ETF is the best manner so as to add vitality publicity. Its 26 holdings embrace oil majors, midstream, and oil providers, in addition to, a number of bigger oil and fuel E&Ps.

XLE High 10 Holdings (In search of Alpha Premium)

Usually, the monetary energy of the businesses held within the high 10 are pretty to very robust, so, there’s not quite a lot of monetary threat past typical market fluctuations. The entire corporations have profitability scores of A- or higher by In search of Alpha’s Quant Issue Grades.

Valuation and progress grades will not be nice. Nevertheless, I imagine are underestimating the firmness of the sector because the vitality transition plods alongside. Value momentum was impartial to constructive and seems to have room to run. Earnings revisions, which have a verifiable correlation to future share costs, have been impartial to constructive.

Merely growing some publicity to XLE is the best and possibly least dangerous transfer for these wanting extra oil and oil trade publicity. It additionally provides important revenue potential on a value surge.

Promoting Money-Secured Places On XLE

One other method is to promote cash-secured places on XLE. By promoting cash-secured places, you may accumulate a premium and proceed to carry money in an interest-bearing cash market account.

Your threat is having to purchase XLE at your chosen strike value if the basket sinks in value. By promoting places versus shopping for XLE outright, you might be additionally giving up the appreciation potential on XLE above the premium collected.

I’m a prolific cash-secured put vendor and use promoting places to generate revenue whereas not taking everything of fairness threat. I recurrently shut my positions on value spikes within the underlying safety to take my earnings.

The commerce I like is promoting XLE August $100 cash-secured places for over $5. That could be a 5% premium revenue for about 4 months maintain time, throughout which you additionally accumulate your curiosity in your cash market account.

Your threat, with these places being barely in-the-money is that you find yourself proudly owning XLE on the $100 strike value. Your internet value, after all, can be $95, as you already pocketed the premium.

Usually, I don’t go 4 months out on possibility promoting, however on this case, I wish to catch the summer season drive season, the three potential Fed conferences the place they could lower rates of interest, and the additional time worth premium.

A Fed price lower is stimulative and may weaken the greenback a bit, which each help agency oil costs. We all know the dangers within the Center East and of politics.

If the value of XLE rises considerably previous $100 through the contract interval, then you should buy to shut the contract and pocket your positive factors whereas now not having the chance of getting to purchase XLE. Time worth begins to burn off with about 2-4 weeks left on the contract, so that could be a interval to watch the place carefully.

To take a bit much less threat, you may promote out of the cash places at decrease premiums if that fits your type and circumstances.

Investing Closing Ideas

Whether or not you purchase XLE outright or promote cash-secured places, you might be on the lookout for a value spike in XLE to take your earnings. Keep in mind, business merchants will transfer rapidly to take earnings which could have an inverse impact on costs earlier than you see the world change or alter.

As Don Rumsfeld mentioned, there are “identified knowns, identified unknowns, and unknown unknowns.” As such, I’m not positive there may be a good way to handicap a value spike, so, you simply have to observe and browse.

Ideally, the world turns into nicer, with the value of oil and oil shares roughly transferring in a correlated manner with the market. That will provide you with some historic comparisons on threat administration and asset allocation sizing.

XLE at present makes up about 3.9% of the S&P 500 (SP500). Traditionally, that has been round 10%. Whereas I have no idea if that might be achieved once more anytime quickly or ever, it does point out some room to run not less than for some time.

If it would not flip nicer within the coming months, then XLE appears a great hedge given the identified basket of dangers. If there’s a value spike, I might be ready for the day by day momentum to sluggish after which take my earnings.