VV Pictures

Citigroup Inc.’s (NYSE:C) newest proxy assertion is out, and so is its ultimate “organizational simplification” progress replace; each provided very optimistic insights into the financial institution’s turnaround progress forward of Q1 2024 earnings this week (anticipated premarket Friday, April twelfth). The underside line, in my opinion, is that, as I outlined in my prior C protection (see Citigroup: Make investments Alongside Buffett In This Turnaround Story), this time could also be effectively and actually totally different. The truth that present CEO Jane Fraser has truly accomplished “organizational” simplification after just a few months is a working example, bucking Citi’s monitor document of poor execution underneath its prior management groups. From right here, senior administration’s compensation coverage (linked to return on tangible frequent fairness (“ROTCE”) and tangible ebook worth development) ought to hold pursuits well-aligned with shareholders; the newest tranche (linked to inventory efficiency) is especially fascinating as Citi clears most of its one-off prices and frees up extra capital.

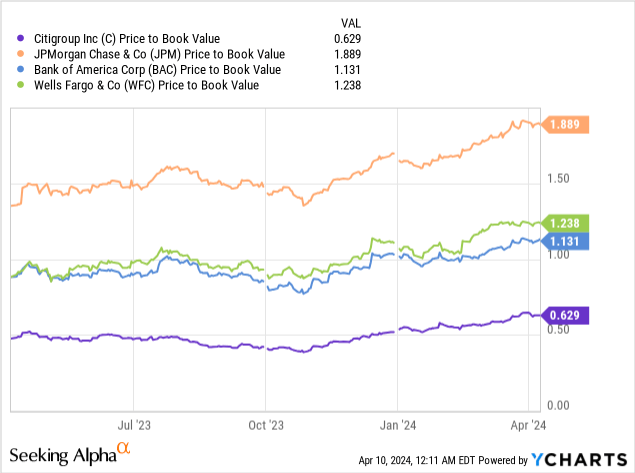

Whereas this week’s Q1 earnings report is likely to be too quickly for any significant catalysts, I do count on extra optimistic information on the “self-help” story, notably coming off a really stable proxy/Board letter replace. It is value noting that Citi ranks very extremely as effectively on Looking for Alpha’s momentum scorecard. In any case, expectations stay very low on the present low cost to ebook (as mirrored within the P/B part of SA’s valuation scorecard) and thus, traders prepared to underwrite administration getting wherever close to its 10% return on tangible frequent fairness goal stand to be well-rewarded.

Whereas the U.S.-listed C stays the perfect “no-frills” method to achieve publicity, smaller traders shifting much less quantity may take into account the FX-hedged, Canadian depositary receipts (NEOE:CITI:CA), which generally provide a slight low cost to the U.S.-listed underlying.

Places and Takes from the Transformation Information Move

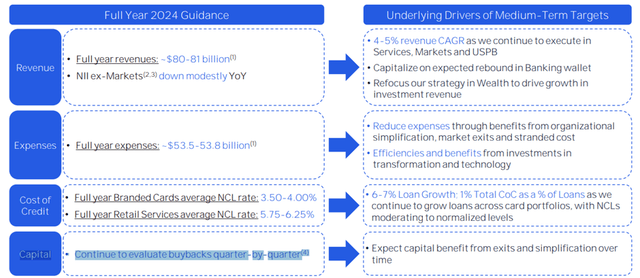

Citi is now at an fascinating level in its transformation, having accomplished its “organizational simplification” efforts this month. This yr’s proxy submitting, launched on March 19, provided a well timed recap of administration’s progress, noting “structural adjustments” to reorganize the group round 5 “core” companies that can now report on to the CEO – Providers, Markets, Banking (institutional companies like funding banking and company lending), Wealth, and US Private Banking (retail companies and playing cards). This implies a lot much less “duplicative governance,” with the one different reporting line for these core segments being a centralized “consumer group” led by new Chief Shopper Officer David Livingstone (ex-Europe/Center East/Africa head).

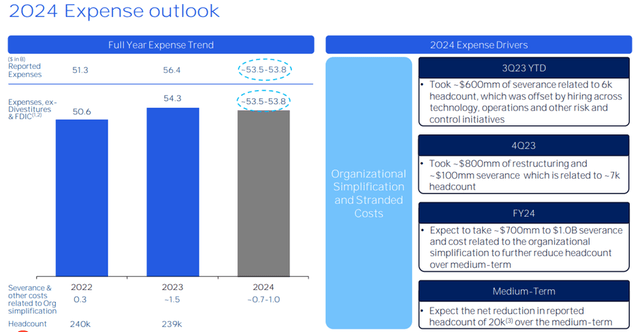

Clearing the organizational hurdle additionally means administration can flip its focus to accelerating expense levers elsewhere, together with taking out extra “stranded prices” (one other key a part of Citi’s $2.0-2.5bn midterm expense saving goal), to realize its guided 2024 expense run-rate of $53.5-53.8bn. Tech effectivity features may also be value watching out for, given Citi has already retired 390 legacy know-how functions (6% of the full as of 2023) and might be on monitor for extra features (probably AI-enabled) into the midterm. The excellent news is that Citi in all probability would not have to ship on all counts; the inventory’s steep 40% low cost to ebook (far beneath different systemically necessary banking teams) means the expense lever alone stays an underappreciated one, regardless of the group’s turnaround progress up to now.

Citigroup

Within the close to time period, although, it is value preserving in thoughts that whereas Citi is previous the worst of its restructuring, administration’s expense information implies a nonetheless hefty $700mn-$1bn from severance and headcount reductions this yr. The tempo of simplification thus far may additionally pull ahead some expense gadgets, which alongside FDIC particular evaluation prices (“annual charge of 13.4 foundation factors starting with the primary quarterly evaluation interval of 2024”), means Q1 will in all probability be one other messy quarter.

The important thing needle-mover, in my opinion, would be the forward-looking information; the present low bar means any reiteration of Citi’s price financial savings and 11-12% ROTCE targets will give the market added confidence in underwriting a unique transformation end result this time round.

Paving the Means for a Potential Buyback Shock

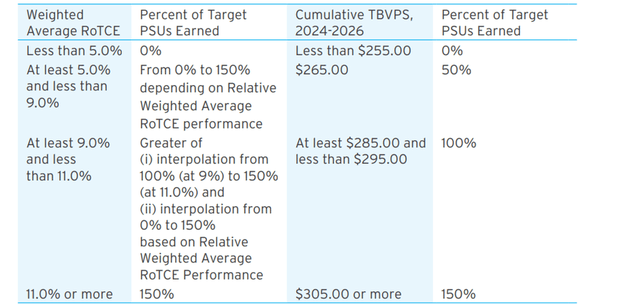

Apart from the extra elementary cost-cutting and simplification points of Citi’s transformation to this point, the 2024 proxy additionally highlighted an fascinating inventory value efficiency hyperlink for the third tranche (i.e., the newest efficiency interval) of administration’s “transformation bonus program.” As this system’s announcement date will function the beginning base, administration’s incentive is thus to get the inventory value above $70.37 (as of Oct 25-29, 2021). Additionally, value noting is that this inventory goal goes each methods – outperforming will increase the award worth above the goal, whereas value underperformance “may additionally lower” the worth of administration’s award.

To be clear, the important thing incentive stays rising the tangible ebook and optimizing returns. Particularly, attending to a weighted common Sep 11% ROTCE on a rising tangible fairness base by means of 2026 stays the important thing efficiency goal. Nonetheless, Charlie Munger’s quip, “present me the inducement, I will present you the result,” rings true right here, and I would not be shocked if administration begins factoring in inventory efficiency much more closely on this ultimate stretch.

Citigroup

In mild of the inventory efficiency incentive, one lever I might look out for is buybacks, as much more capital might be freed up within the probably situation that we see a watered-down “Basel Endgame” for the large banks. Additionally within the pipeline is the itemizing of Citi’s Mexico shopper enterprise, Citibanamex (a part of Citi’s fourteen “non-core” companies being exited), a transaction that might fetch fairly a bit extra capital than many count on (observe Citi final turned down a $7bn provide) given the favorable Mexican inventory market backdrop. The group has guided to a 2025 itemizing for now, however given the inventory efficiency stipulations in administration’s newest compensation tranche, I would not be shocked to see some optimistic updates on the itemizing timeline or the dimensions of a possible elevate. Q1 is likely to be too quickly for a buyback replace (at present being evaluated “quarter-by-quarter”), although the upcoming ‘Providers’ investor day in June, which coincides with stress check outcomes, may spring some upside surprises.

Citigroup

Turnaround Traction Creates a Compelling Setup into Earnings Season

Citigroup inventory has been on a tear these days, but when current updates are something to go by, this “self-help” story stays an underappreciated one. Heading into its Q1 replace later this week, count on extra traction on the turnaround, notably on the expense facet. Additionally, value watching out for will likely be any share buyback updates – if not in Q1, then probably later this yr, with Citi poised to see much more capital freed up post-exits and in mild of administration’s inventory performance-linked compensation construction within the present transformation section. Internet-net, the present ebook/tangible ebook low cost means the market remains to be fairly skeptical, so even incremental visibility into the ROTCE enchancment path may re-rate Citigroup Inc. inventory lots larger.