[ad_1]

Chesky_W/iStock by way of Getty Photos

Workhorse Group (NASDAQ:WKHS), an electrical van maker, is scheduled to announce This autumn earnings outcomes on Tuesday, Mar. 1, earlier than market open.

The consensus EPS estimate is -$0.15 and the consensus income estimate is $0.08M (-87.7% Y/Y).

Over the past 2 years, WKHS has crushed EPS estimates 38% of the time and income estimates 13% of the time.

Final month, WKHS appointed Robert Ginnan as CFO. The corporate had onboarded a brand new administration staff in Q3.

WKHS had reported Q3 income that missed Road estimates. Gross sales have been hit by the recall of WKHS’ C-1000 autos.

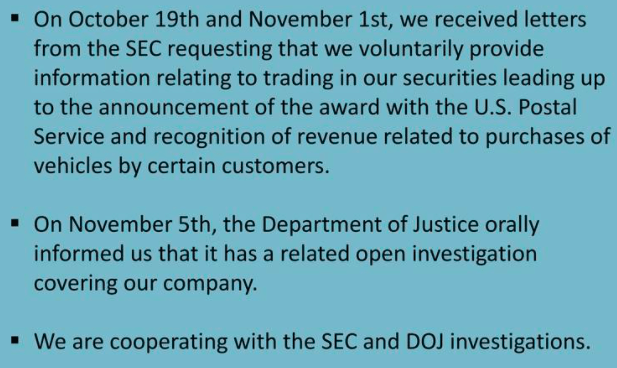

Final 12 months, Wall Road Journal reported that the Justice Dept. and SEC opened an investigation into WKHS. The corporate supplied the next updates in its Q3 post-earnings name:

WKHS inventory fell final week after the U.S. Postal Service confirmed a $6B order of gasoline-powered vans constructed by Oshkosh.

SA contributor Vince Martin final month famous that WKHS’ stability sheet has actual considerations, and competitors is getting stiffer. He stated 2022 can be a pivotal 12 months for WKHS and its new administration is maybe the largest cause to think about proudly owning WKHS inventory.

On common, Wall Road analysts have rated WKHS Purchase. As per SA’s Quant Score, WKHS is at excessive danger of performing badly as it’s overpriced and has decelerating momentum when in comparison with different client discretionary shares.

WKHS inventory sank 67.5% prior to now 6 months and ~84% during the last 1 12 months.

[ad_2]

Source link