[ad_1]

gorodenkoff

Introduction

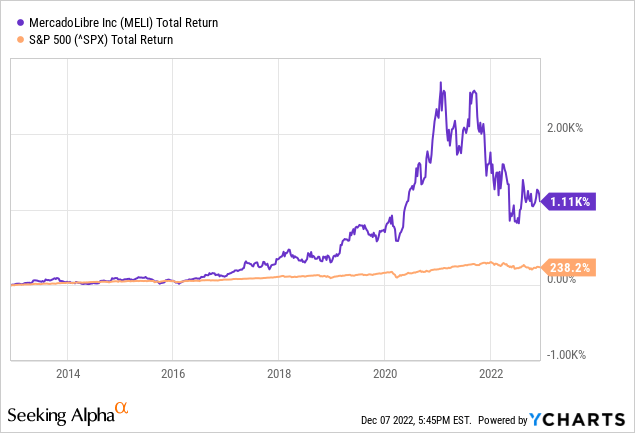

MercadoLibre (NASDAQ:MELI) was a well-liked inventory because the corona disaster. The corona measures compelled bodily shops to shut, giving an additional enhance to on-line purchasing. Favorable for MercadoLibre, as it’s the largest e-commerce platform in Latin America.

The inventory worth was on a robust rise over the previous 10 years, however has been experiencing a correction since 2021. Nonetheless, the inventory return may be very excessive with as a lot as 28% on common per yr. The latest decline makes it attention-grabbing to take a more in-depth take a look at the inventory.

Behind the robust progress figures lies appreciable threat. Buyers ought to concentrate on the danger they’re taking after they put money into MercadoLibre. The danger-reward ratio is now favorably skewed towards the reward a part of the equation. The inventory is assigned a purchase ranking with a high-risk warning.

Firm Overview

MercadoLibre is Latin America’s largest e-commerce platform, with greater than 140 million lively customers and 1 million lively sellers as of the tip of 2021 in 18 international locations. Along with its e-commerce platform, the corporate has complementary companies akin to Mercado Envios (delivery options), Mercado Pago (cost supplier), Mercado Libre Adverts (adverts) and Mercado Retailers (turnkey e-commerce shops), and others. It generates income from charges, advert royalties, cost processing, insertion charges, subscription charges and curiosity earnings from loans to customers and small companies.

Income up 61% YoY

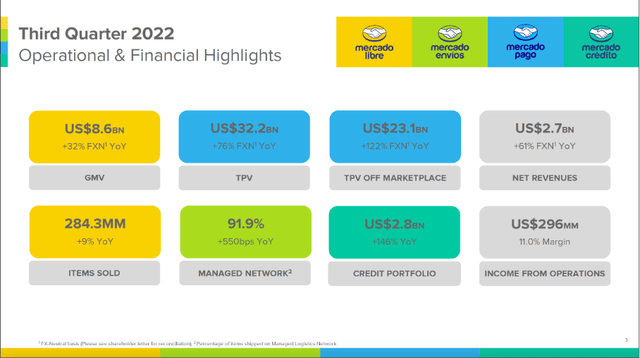

Operational & Monetary Highlights (3Q22 MELI Investor Presentation)

Third quarter outcomes have been robust, with income up 61% year-on-year on a forex-neutral foundation. The working margin for the quarter was unprecedented at 11%. All segments carried out strongly, however the FinTech enterprise (Mercado Pago) noticed income decline attributable to a larger mixture of bigger retailers in whole cost quantity.

Mercado Libre grew strongly as product sales quantity elevated 32% year-on-year and 9% extra objects have been offered on the platform. The corporate gained important market share in Brazil and extra distinctive consumers from Mexico bought objects on the platform.

Mercado Envios noticed the share of things shipped enhance to 91.9% by means of its Managed Logistics Community.

Mercado Pago is its FinTech enterprise, which elevated its whole cost quantity by 76% to $32.2 billion. Mercado Pago exceeded 40 million distinctive lively customers for the primary time, with all geographic segments contributing to this progress.

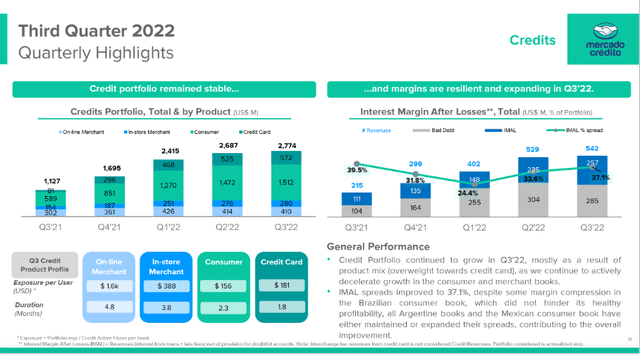

Mercado Credito is the credit score enterprise, whose portfolio elevated to $2.8 billion. Though there’s a important quantity of “unhealthy debt” on the books, credit score exercise stays strong, because the curiosity margin after losses (IMAL) was 37% within the third quarter of 2002.

Though the corporate confirmed robust earnings and progress numbers, there have been a couple of metrics that I discovered dangerous. Within the portfolio, the variety of greater than 90 days late elevated from 18.2% final quarter to 23.9% this quarter. Buyers ought to keep watch over these numbers to evaluate the monetary power of customers on the platform and Mercado Credito’s profitability. The rise of greater than 90 days in arrears is because of unhealthy money owed remaining on the books. The availability for uncertain accounts falls to 10.3% from 11.3% final quarter because of the slowdown in functions and unchanged provisioning guidelines. Mercado speaks of a difficult macro surroundings, however provisions for present loans remained steady.

Mercado Credito Quarterly Highlights (3Q22 MELI Investor Presentation)

Though the corporate is rising strongly, buyers ought to be conscious that Mercado is a inventory with important dangers. Nevertheless, Mercado supplies clear metrics in its earnings report back to assess these dangers. The rise in cost delays of greater than 90 days, the decrease allowance for uncertain accounts and the point out of elevated macroeconomic dangers are important dangers. For the reason that firm operates primarily in Latin America, some international locations in Latin America are in monetary misery, akin to Argentina (inflation price = 88%). Buyers ought to monitor macroeconomic developments in these international locations and settle for the danger related to an funding in Mercado.

The excessive risk-reward profile is now favorably skewed towards the reward a part of the equation, because the inventory’s valuation is traditionally low.

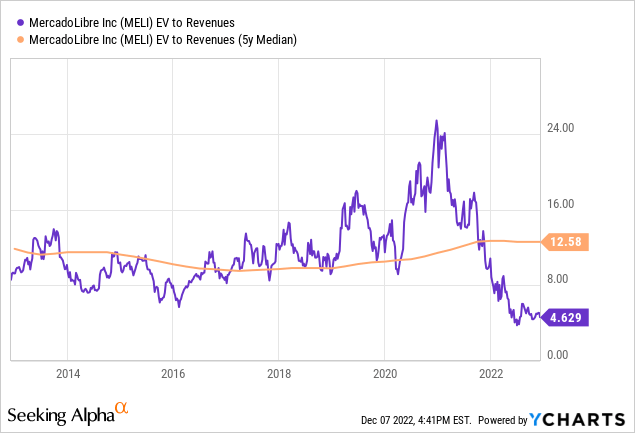

Inventory Valuation Is Traditionally Low

MercadoLibre is a progress inventory; earnings should not but important to correctly chart the inventory’s valuation. With an working margin of 11.0% within the third quarter of 2022, it’s extra worthwhile than Amazon (AMZN); Amazon’s working margin is 2.7%. Nevertheless, that is evaluating apples to oranges.

To chart inventory valuation, I take the ratio of EV to income. EBIT and FCF fluctuate extensively, so these don’t give a transparent image of its valuation. Gross sales are rising steadily, so the EV to gross sales ratio is a better option.

Because the chart reveals, the EV to income ratio may be very low, each under the five-year common and the ratio is traditionally low over the previous 5 years. Whereas the typical EV to income ratio quotes 12.6, the present ratio of 4.6 may be very favorable.

Nevertheless, this doesn’t imply that the valuation of the inventory is definitely favorable. For this, I analysis earnings per share for the subsequent few years and depend on analysts who’ve carried out intensive analysis on this.

14 analysts revised earnings estimates upward, whereas 1 analyst revised earnings estimates downward. On common, 10 analysts count on earnings per share on the finish of fiscal yr 2024 to be round $22.35 per share, representing common annual progress of 59%. Solely two analysts count on earnings per share of $32.86 for fiscal yr 2025 (progress of 47%). The projected PE ratio for fiscal yr 2025 is 26. With anticipated annual earnings progress of about 50%, and along with the favorable EV to income ratio, I recommend that the inventory is favorably valued.

The robust progress prospects, aggressive benefit in Latin America, and low-cost valuation make this inventory price shopping for.

Key Takeaway

- MercadoLibre is Latin America’s largest e-commerce platform, with greater than 140 million lively customers and 1 million lively sellers as of the tip of 2021 in 18 international locations.

- Third quarter outcomes have been robust, with web earnings up 61% year-on-year on a forex-neutral foundation. The working margin for the quarter was unprecedented at 11%.

- Within the portfolio, the variety of greater than 90 days late elevated from 18.2% final quarter to 23.9% this quarter.

- The rise of greater than 90 days in arrears is because of unhealthy money owed remaining on the books. The availability for uncertain accounts falls to 10.3% from 11.3% final quarter because of the slowdown in functions and unchanged provisioning guidelines.

- Mercado speaks of a difficult macro surroundings, however provisions for present loans remained steady.

- The excessive risk-reward profile is now favorably skewed towards the reward a part of the equation, because the inventory’s valuation is traditionally low.

- Whereas the typical EV to income ratio quotes 12.6, the present ratio of 4.6 may be very favorable.

- On common, 10 analysts count on earnings per share on the finish of fiscal yr 2024 to be round $22.35 per share, representing common annual progress of 59%.

- The projected PE ratio for fiscal yr 2025 is 26. With anticipated annual earnings progress of about 50%, and along with the favorable EV to income ratio, I recommend that the inventory is favorably valued.

[ad_2]

Source link