[ad_1]

By Graham Summers, MBA

Is that this the following black swan?

The industrial actual property market within the U.S. is about $20 trillion in measurement. This isn’t a small asset class. And due to the pandemic altering work habits, the Fed creating a large credit score bubble, and plenty of cities going gentle on crime, the collapse of economic actual property could very properly be the following black swan occasion.

In its easiest rendering, the issues dealing with industrial actual property are as follows:

1) Folks do NOT need to return to the workplace, even when the pandemic is over.

2) Valuations/ costs available in the market have been badly distorted by the Fed, each not directly through the huge credit score bubble the Fed created in 2020-2022, and immediately by the Fed providing to purchase industrial mortgage backed securities (the final level put a ground beneath this market).

3) Many massive cities have determined to go gentle on crime, leading to felony exercise skyrocketing. Because of this and heavy tax burdens, massive companies are shifting out of locations like Chicago, New York and the like.

It’s actually an ideal storm for the industrial actual property sector.

Oh… and lest we overlook, a lot of this asset class is financed by trillions of {dollars} value of debt. And that debt is now coming due.

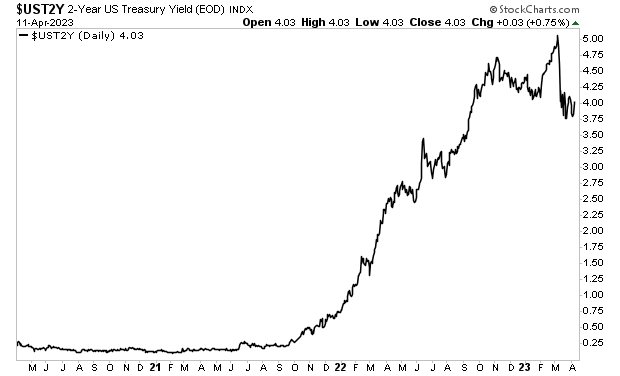

The New York Submit notes that $1.5 trillion value of economic actual property debt comes due by the tip of 2025. Keep in mind, charges have carried out this since a lot of this debt was issued:

So industrial actual property corporations will both have to pay this again (exhausting to think about given workplace vacancies) or roll the debt over at a lot increased rates of interest.

And final however not least… guess who loaned out all this debt to industrial actual property builders and landlords?

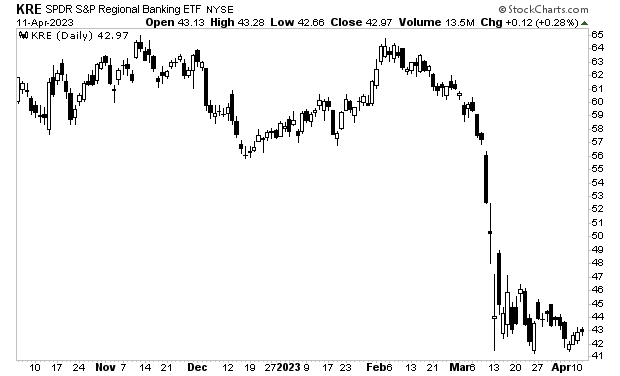

REGIONAL BANKS.

Maybe this is the reason the regional banking sector can’t rally regardless of the Fed gifting them tons of of billions of {dollars} value of low-cost credit score during the last month.

What does this imply?

A $20 trillion asset class is quick approaching its “2008” second.

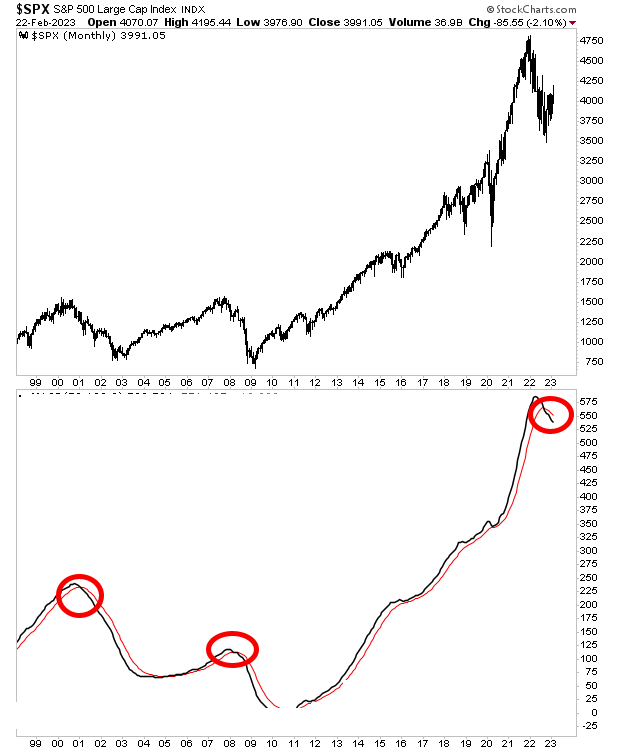

Certainly, our proprietary Crash sign has simply triggered its third confirmed sign within the final 25 years. The final two instances it signalled?

2000 and 2008.

[ad_2]

Source link