[ad_1]

pidjoe

Utility shares have been extraordinarily weak in 2023, partly as a result of we’ve seen an incredible bull market, but additionally as a result of they’re extremely delicate to rates of interest. We all know that defensive sectors like utilities underperform when fairness markets are doing effectively, and that has been the case once more in 2023. However what I see as altering for utilities is rates of interest, and certainly, we’ve already seen plenty of progress on that entrance in current months.

NextEra Power, Inc. (NYSE:NEE) is likely one of the largest gamers within the house, with a standard utility and a big renewables enterprise. The inventory was destroyed in September however has since rebounded massively, and to my eye, it appears just like the rally is probably going simply getting began. I’m beginning NextEra with a powerful purchase score; let’s dig in.

A powerful rally, however extra room to run

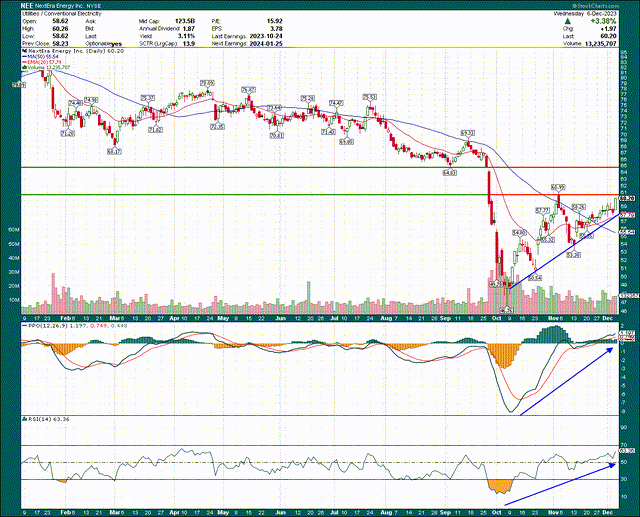

NextEra rapidly recovered from the waterfall decline it posted in September, after dropping help at $65. The last word backside was all the best way down at $46, and the inventory closed yesterday at $60. For a $120 billion utility inventory, that’s a large transfer.

StockCharts

I’ve famous resistance ranges on the chart, which I’ve plotted at $61 and $65, with these ranges being the relative excessive from November and that prior $65 degree from September. I consider NextEra will take these out; it’s a matter of whether or not it does so rapidly or not.

The PPO is rising sharply and is in optimistic territory, and the identical might be mentioned for the 14-day RSI. From a momentum perspective, NextEra appears very supportive of sustaining this bull run. On the draw back, the rising 20-day exponential shifting common and trendline help are in the identical space, so if the inventory loses these, it’s in all probability going to lead to an extended consolidation. Nonetheless, long-term buyers received’t care about that, and I feel danger is skewed to the upside into 2024.

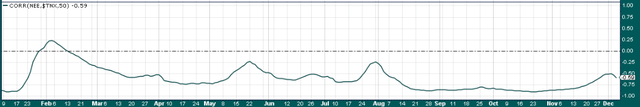

I discussed rates of interest above, and we all know that in current weeks, charges have plunged. Under is the correlation between the 10-year Treasury yield (US10Y) and NextEra’s share worth, and we will see they’re extraordinarily inverse to one another.

StockCharts

The correlation on a 50-day foundation is -0.59, which in plain phrases simply signifies that if charges go down, NextEra goes up. You may make your personal willpower in regards to the course of charges, however so long as charges don’t transfer again in direction of their highs, it’s open season for utility inventory bulls.

Fundamentals help extra beneficial properties forward

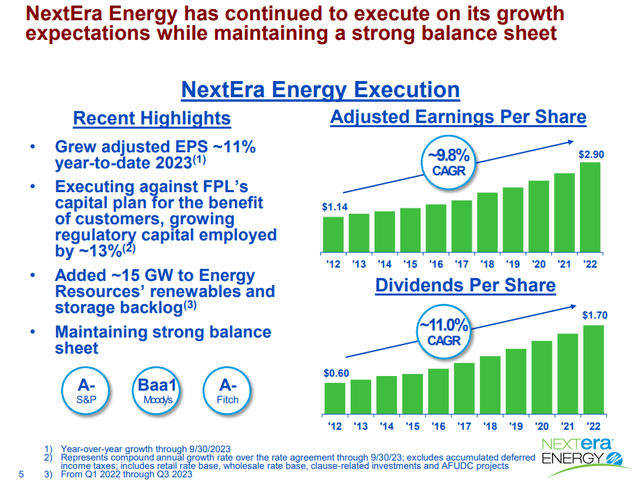

NextEra is likely one of the higher performing utilities over time, so it’s definitely no accident it has one of many bigger market caps within the house. The corporate’s potential to develop earnings constantly has been spectacular, and so far as administration is worried, the nice instances are set to proceed for years to return.

Investor presentation

It is a view into the previous for NextEra, and we’re taking a look at roughly 10% annualized EPS development along with 11% annualized dividend development. When you’re an revenue investor, that is about nearly as good because it will get; excessive charge of development in EPS and the dividend, and fairly regular as effectively. We don’t see 25% beneficial properties one 12 months and a ten% retracement the subsequent 12 months, we simply see a well-managed enterprise. It helps, after all, that utilities function what are basically monopolies of their service areas, however that’s why revenue buyers love utilities, proper?

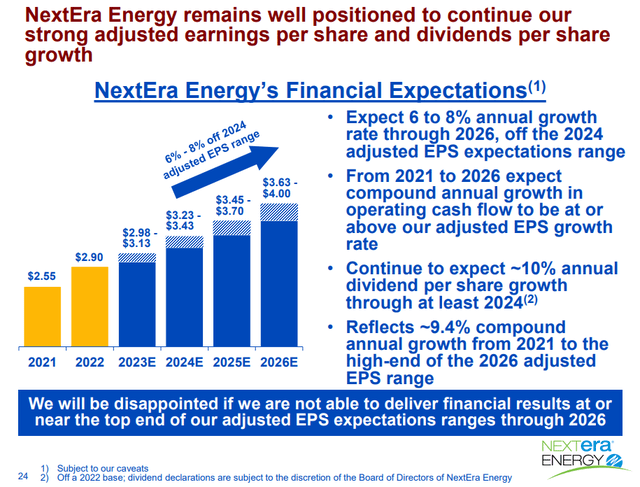

Trying ahead, we see the subsequent few years are anticipated to see 6% to eight% development in EPS, so barely off of historic ranges, however nonetheless fairly robust for a utility.

Investor presentation

The corporate is taking a look at $3.63 to $4.00 in adjusted EPS for 2026, and analysts are firmly on the higher finish of that vary with present expectations of $3.92. As well as, the dividend is anticipated to develop at 10% yearly, so for dividend buyers, NextEra provides a powerful present yield and terrific dividend development potential; what’s to not like?

The gorgeous factor a few utility enterprise is that outcomes are largely predictable, that means earnings volatility and earnings danger are minimal in comparison with most different companies. There’s some danger of working prices being greater than anticipated, or unexpected regulatory actions, however over time as we noticed above, this can be a very predictable enterprise. Buyers pay premiums for that predictability, however proper now NextEra is reasonable.

Low-cost regardless of the way you slice it

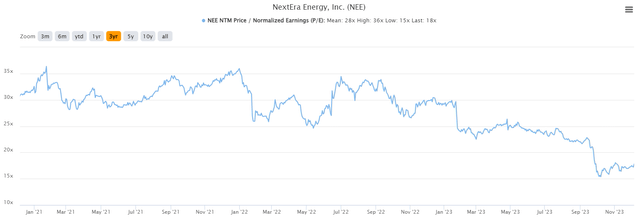

Let’s kick off the valuation dialogue with a take a look at the inventory’s ahead P/E ratio for the previous three years, which is exhibiting a really lengthy runway for shares if it could get well former valuation ranges.

TIKR

Shares are buying and selling at the moment at 18X ahead earnings, which is a ~35% low cost to its common valuation previously three years. Stated one other method, the inventory would wish to rise by greater than half with a purpose to get to its common valuation of the previous three years, all else equal. I’m not suggesting the inventory goes to rise by half in a single day, however what I’m suggesting is that the chance may be very firmly to the upside right here, not the opposite method round. That limits your draw back danger as a purchaser and will increase the probabilities you see worth appreciation.

One other strategy to worth a dividend inventory is thru the yield, as yields fall when a inventory is overvalued and rise when it’s low-cost.

In search of Alpha

NextEra’s yield may be very close to the highest of its 5-year vary proper now, having been greater solely after the September plunge earlier this 12 months. At a 3.1% yield and a ten% dividend development charge, NextEra is dividend royalty in the intervening time.

If we take all of this collectively, I see a enterprise with extraordinarily predictable earnings, robust dividend development, a effectively above common yield, and a pretty valuation. It’s my opinion we’ve already seen the lows, and that Subsequent Period goes rather a lot greater in 2024. When you’re searching for a value-oriented revenue inventory, NextEra may be the one for you.

[ad_2]

Source link