[ad_1]

The S&P 500 (SP500) on Friday superior 0.21% for the week to shut at 4,604.37 factors, posting losses in three out of 5 classes. Its accompanying SPDR S&P 500 Belief ETF (NYSEARCA:SPY) added 0.24% for the week.

After a surprising November rally, markets took a little bit of a breather at first of this week, with the benchmark index posting a three-day dropping streak from Monday to Wednesday. The advance resumed on Thursday, as general sentiment has remained optimistic after favorable labor market information.

Jobs was the phrase for the week, because the market’s normal consensus that the Federal Reserve is completed climbing charges and might ship a delicate touchdown was strengthened by financial indicators that pointed to the gradual cooling within the labor market that the central financial institution needs to see.

Tuesday’s Job Openings and Labor Turnover Survey confirmed that job openings fell to their lowest degree since March 2021. ADP’s newest employment report on Wednesday indicated that the personal sector added lesser-than-expected jobs in November. On Thursday, the Division of Labor mentioned that the variety of Individuals submitting for preliminary jobless claims up to now week edged up.

Lastly on Friday, November nonfarm payrolls got here in higher-than-anticipated, although a lot of that rise was attributable to staff getting back from strikes. Nevertheless, the report did make market contributors take a beat and barely mood the speed cuts that they’ve aggressively priced in for as quickly as March 2024.

“At the moment was clearly a powerful jobs report. However needless to say what we’re actually seeing is a stabilizing labor market. Indicators of slowing final month, rebounding a bit this month: that is what a powerful however steady labor market appears to be like like,” Betsey Stevenson, former Chief Economist of the U.S. Division of Labor, mentioned on X (previously Twitter).

Merchants nonetheless broadly anticipate the Fed to carry charges regular at subsequent week’s financial coverage committee assembly. Shut consideration may even be paid to the central financial institution’s up to date dot plot of financial and price projections.

“The case for the Consumed maintain this assembly is easy: numerous Fed audio system throughout the spectrum have lately indicated their help of that stance. Since no person dissented in November it’s exhausting to see anybody dissenting subsequent week,” JPMorgan’s Michael Feroli mentioned in a preview notice.

“On the (publish resolution) press convention we expect (Fed chief) Powell will attempt to transfer the dialog away from the timing of the primary ease by noting that presently the Committee is just contemplating whether or not they need to keep on maintain or tighten coverage. We don’t assume the Chair might be extra emphatic than that, for instance by saying they’re not even speaking about speaking about easing, as past the following few months he received’t have sufficient readability to make a stronger assertion,” Feroli added.

Main commodities had been additionally in focus this week. Price minimize expectations have lured merchants again to the bullion, with gold costs (XAUUSD:CUR) hovering close to report ranges after hitting an all-time excessive of $2,111.39/oz final Sunday. In the meantime, WTI crude oil futures (CL1:COM) on Wednesday fell beneath $70 a barrel for the primary time since early July on issues surrounding oversupply and weak demand.

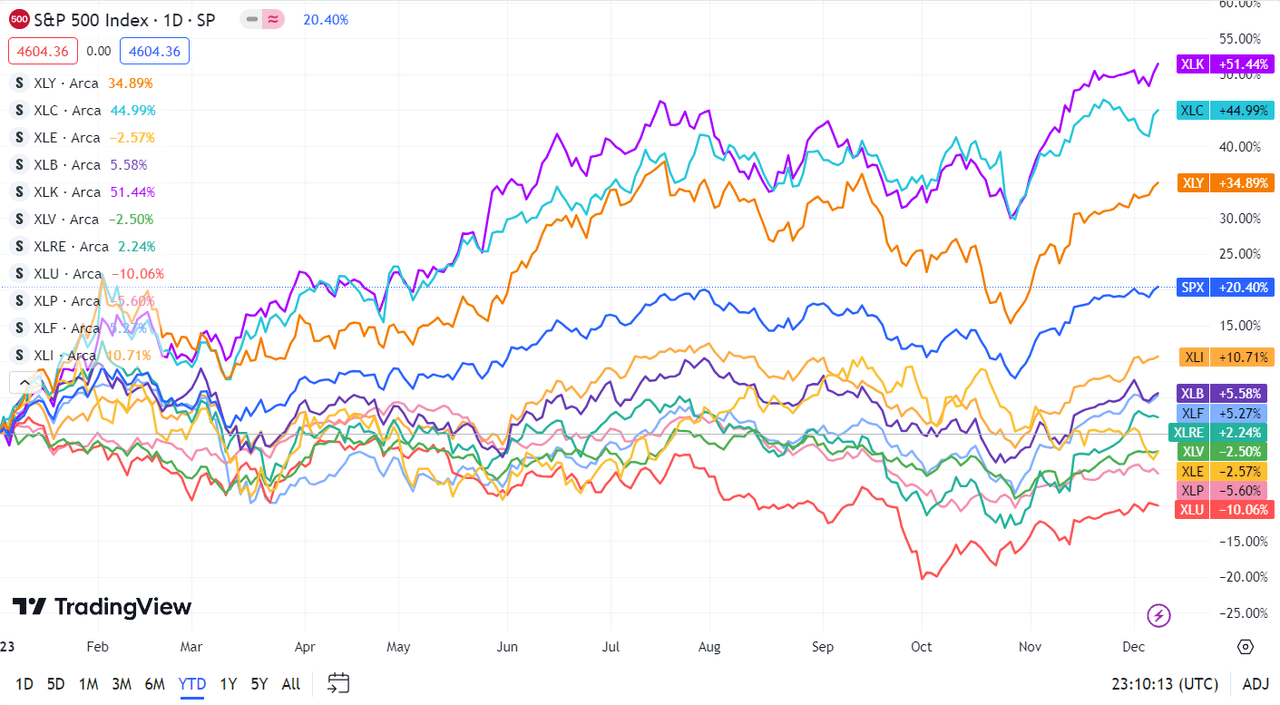

Turning to the weekly efficiency of the S&P 500 (SP500) sectors, six of the 11 ended within the inexperienced, led by Power as oil costs fell. Client Discretionary was the highest gainer. See beneath a breakdown of the efficiency of the sectors in addition to their accompanying SPDR Choose Sector ETFs from December 1 near December 8 shut:

#1: Communication Companies +1.40%, and the Communication Companies Choose Sector SPDR Fund (XLC) +0.82%.

#2: Client Discretionary +1.14%, and the Client Discretionary Choose Sector SPDR ETF (XLY) +1.23%.

#3: Info Know-how +0.74%, and the Know-how Choose Sector SPDR ETF (XLK) +0.58%.

#4: Industrials +0.21%, and the Industrial Choose Sector SPDR ETF (XLI) +0.20%.

#5: Well being Care +0.20%, and the Well being Care Choose Sector SPDR ETF (XLV) +0.18%.

#6: Financials -0.11%, and the Monetary Choose Sector SPDR ETF (XLF) -0.11%.

#7: Utilities -0.30%, and the Utilities Choose Sector SPDR ETF (XLU) -0.19%.

#8: Actual Property -0.40%, and the Actual Property Choose Sector SPDR ETF (XLRE) -0.29%.

#9: Client Staples -1.24%, and the Client Staples Choose Sector SPDR ETF (XLP) -1.18%.

#10: Supplies -1.72%, and the Supplies Choose Sector SPDR ETF (XLB) -1.70%.

#11: Power -3.28%, and the Power Choose Sector SPDR ETF (XLE) -3.28%.

Under is a chart of the 11 sectors’ YTD efficiency and the way they fared in opposition to the S&P 500 (SP500). For traders wanting into the way forward for what’s taking place, check out the In search of Alpha Catalyst Watch to see subsequent week’s breakdown of actionable occasions that stand out.

Extra on the markets

[ad_2]

Source link